Moreover, the advancement of innovative treatment options, including bioengineered skin substitutes, scaffolds, and growth factor-based therapies, supports further market growth. Increased healthcare funding, growing awareness of advanced treatment benefits, and supportive reimbursement policies all contribute to sustaining and accelerating demand for dermal regeneration products globally.

Dermal regeneration involves reconstructive processes designed to restore skin integrity using various approaches such as dermal substitutes, scaffolds, and cellular, or acellular matrices. These products are specifically engineered to aid in healing chronic wounds, burns, traumatic injuries, and reconstructive surgeries by promoting tissue integration, revascularization, and effective wound closure.

In 2024, the skin substitutes segment led the market with a valuation of USD 597.3 million and is expected to reach USD 1.2 billion by 2034, growing at a CAGR of 7.5%. This segment comprises both synthetic and biological skin substitutes. Their broad application in managing chronic wounds, burns, and surgical wounds enhances healing outcomes by reducing infection risk and scarring compared to conventional grafts. Clinicians favor these substitutes for their effectiveness in treating complex conditions like diabetic foot ulcers and extensive burn injuries. The segment’s growth is further supported by increasing FDA approvals, strong clinical evidence, and well-established reimbursement frameworks, especially in developed regions.

The chronic wounds segment captured the largest market share of 39.5% in 2024 and is forecasted to maintain strong growth throughout the forecast period. This segment includes diabetic foot ulcers, venous leg ulcers, and pressure ulcers. Traditional wound healing methods often face challenges, particularly in diabetic patients, which escalates the demand for innovative skin substitutes and regenerative therapies. Managing chronic wounds requires prolonged and comprehensive care, significantly affecting healthcare costs and patient quality of life. Consequently, advanced dermal regeneration products offer better therapeutic outcomes, reducing hospitalization time and complications.

U.S. Dermal Regeneration Market generated USD 404 million in 2024 and is anticipated to grow at a CAGR of 7.2% from 2025 through 2034. The U.S. maintains its leadership position due to its advanced healthcare infrastructure, high rates of chronic wound incidence, and substantial investments in regenerative medicine research. The country widely adopts sophisticated biosynthetic matrices, cellular therapies, and scaffolds, making it a global front-runner in dermal regeneration. Innovative products like specialized skin substitutes with FDA clearance are propelling market momentum.

Leading companies in the Dermal Regeneration Industry include MiMedx, Integra LifeSciences, Avita Medical, Gunze, Smith & Nephew, Organogenesis, PolyNovo, RTI Surgical, BioTissue, Extremity Care, Kerecis (Coloplast), MedSkin Solutions Dr. Suwelack, Stryker, Zimmer Biomet, and Tissue Regenix. To solidify their market presence, companies in the dermal regeneration sector are focusing heavily on research and development to innovate more effective, biocompatible, and easy-to-use products tailored to complex wound types. Many are investing in developing next-generation skin substitutes and scaffold technologies with improved integration and healing properties. Strategic collaborations and partnerships with healthcare providers and research institutions enable faster clinical adoption and expanded geographic reach. Firms also prioritize regulatory approvals and reimbursement negotiations to ensure market access.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

- Anika Therapeutics

- Avita Medical

- BioTissue

- Extrimity Care

- Gunze

- Integra Lifesciences

- Kerecis (Coloplast)

- MedSkin Solutions Dr. Suwelack

- MiMedx

- Organogenesis

- PolyNovo

- RTI Surgical

- Smith & Nephew

- Stryker

- Tissue Regenix

- Zimmer Biomet

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 140 |

| Published | June 2025 |

| Forecast Period | 2024 - 2034 |

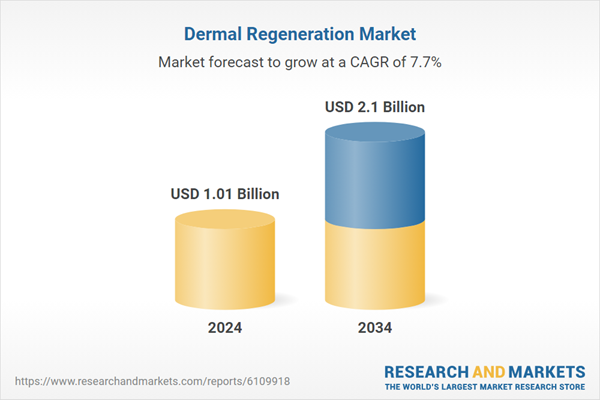

| Estimated Market Value ( USD | $ 1.01 Billion |

| Forecasted Market Value ( USD | $ 2.1 Billion |

| Compound Annual Growth Rate | 7.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 16 |