Offshore drilling generates a variety of waste streams, including drilling fluids, drill cuttings, and produced water, all of which require proper containment, treatment, and disposal to prevent environmental contamination. In response, companies are investing heavily in technologies specifically designed to handle these materials in offshore environments. This includes solutions that support closed-loop systems and zero-discharge operations, especially in ecologically sensitive offshore areas. Regulatory agencies across multiple regions are reinforcing compliance measures, compelling drilling companies to adopt advanced waste handling practices and maintain higher environmental standards. As a result, the demand for offshore waste management services has surged, reflecting a broader industry shift toward responsible and sustainable operations.

The market has also seen notable advancements in technology, with innovations focused on improving efficiency, reducing emissions, and minimizing marine pollution. Operators are increasingly implementing integrated waste management systems that offer real-time data tracking and automation to ensure optimal performance and compliance. These digital solutions provide insights into waste composition and treatment outcomes, enabling quicker decision-making and improved cost control. The integration of these technologies is transforming waste management practices by streamlining operations and reducing reliance on manual oversight.

Among the key service segments, treatment and disposal accounted for the largest share of the market in 2024, commanding approximately 58% of the overall revenue. This segment includes a wide array of treatment methods such as thermal processing, chemical neutralization, solidification, and biological treatment. The growing preference for eco-friendly and low-emission treatment solutions is reshaping service offerings, with companies moving away from conventional practices and focusing on reducing long-term environmental liabilities. Offshore operators are particularly inclined toward in-situ treatment options that allow waste to be processed on-site, cutting down the need for extensive transport and minimizing environmental risk.

The market in the United States has shown significant momentum, with the offshore drilling waste management sector valued at USD 230 million in 2022, USD 250 million in 2023, and USD 280 million in 2024. This growth is fueled by a combination of factors, including the enforcement of rigorous environmental policies, expansion in offshore drilling projects, and a growing industry-wide focus on sustainability. The rise in waste generation due to increased drilling intensity has led to greater demand for advanced waste processing and containment solutions. With regulatory authorities stepping up oversight and refining technical standards, operators are being pushed to upgrade existing systems and adopt safer, more effective methods for waste handling.

The competitive landscape of the offshore drilling waste management market is shaped by a mix of multinational corporations and regional players. In 2024, the top five companies - Baker Hughes, Halliburton, Weatherford, SLB, and TWMA - together held over 30% of the global market share. These companies have cemented their positions through a combination of comprehensive service portfolios, global operational capabilities, and technological innovation. Their ability to deliver end-to-end waste management solutions - from waste containment to treatment, transportation, and final disposal - gives them a distinct edge in servicing complex offshore projects. Alongside the major players, a network of established regional firms and niche local service providers adds to the competitive intensity, encouraging continuous advancements in technology and operational best practices.

Strategically, leading companies are prioritizing service integration and digital transformation to enhance efficiency and compliance. By offering complete waste management ecosystems under a single service umbrella, they are simplifying vendor coordination for offshore clients while optimizing performance and reducing operational costs. These players are also adopting real-time monitoring systems and data analytics to improve the traceability of waste handling processes and drive better decision-making across project lifecycles. As the market evolves, such innovations are likely to become essential for maintaining competitiveness and meeting rising regulatory and sustainability expectations.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

- Augean

- Baker Hughes Company

- CLEAN HARBORS, Inc.

- Derrick Corporation

- Geminor

- GN Solids Control

- Halliburton

- Imdex Limited

- Newpark Drilling Fluids LLC

- NOV

- Ridgeline Canada Inc.

- Secure Energy Services

- SELECT WATER SOLUTIONS

- SLB

- Soli-Bond, Inc.

- TWMA

- Weatherford

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 128 |

| Published | June 2025 |

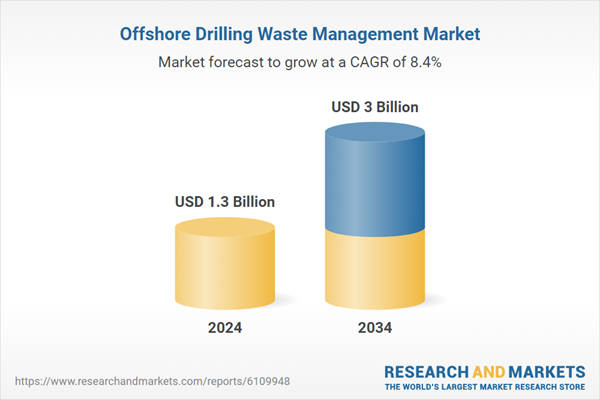

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 1.3 Billion |

| Forecasted Market Value ( USD | $ 3 Billion |

| Compound Annual Growth Rate | 8.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 17 |