These advancements allow producers to meet diverse consumer expectations, further fueling market expansion by enabling the development of highly specialized flour products tailored to specific dietary preferences, health needs, and cultural trends. As consumers increasingly demand transparency, functionality, and clean-label ingredients, manufacturers are leveraging these innovations to create flours with enhanced nutritional value, better digestibility, and improved shelf life. The ability to customize flour formulations - whether gluten-free, low-carb, protein-rich, or allergen-friendly - empowers brands to cater to niche markets while broadening their overall consumer base. In turn, this strategic alignment with evolving food trends supports both premium product positioning and mass-market scalability, reinforcing the momentum of the global functional flour industry.

The cereals & grains segment is forecasted to reach USD 87.1 billion by 2034, expanding at a CAGR of 5.4%. Its strong market presence is supported by widespread incorporation in everyday products like bread, breakfast cereals, snack bars, and ready-to-eat foods. A surge in consumer preference for better-for-you options - especially gluten-free, whole-grain, and high-fiber formulations - is fueling this segment’s growth. As health and wellness trends continue to shape eating habits globally, this segment remains a staple in both developed and emerging markets. Despite this momentum, fluctuating raw material prices, transportation costs, and occasional supply chain interruptions pose ongoing risks. To counteract these challenges, producers are focusing on increasing the nutritional density of cereal-based flours by fortifying them with added fiber, vitamins, and minerals to appeal to health-conscious buyers.

In 2024, protein-enriched flours segment held 30.5% share. This segment is projected to grow at a CAGR of 5.2% through 2034, driven by surging demand for protein-rich diets, which are widely associated with improved physical performance, muscle health, satiety, and weight management. Heightened consumer awareness of the negative impacts of protein deficiency, especially among older adults and specific demographic groups, is intensifying interest in functional flours with added protein. In response, manufacturers are developing innovative offerings using plant-based proteins like lentils, peas, and soy to support growing vegetarian and vegan populations, while also catering to consumers with dairy or soy allergies.

North America Functional Flours Market held a 33.9% share in 2024. The region’s leading share is largely attributed to rising awareness around dietary customization, with consumers actively seeking flours suited for gluten intolerance, celiac disease, and other lifestyle-based eating patterns. This demand is driving the production and consumption of flours derived from nutrient-dense sources like chickpeas, quinoa, and brown rice. The strong presence of established industry players, who are consistently expanding their product portfolios through innovation and product diversification, is further supporting market growth.

Major players in the market include Roquette Frères, Ingredion Incorporated, Archer Daniels Midland Company (ADM), SunOpta Inc., and Associated British Foods plc. Top companies in the functional flour space are focusing on diversification, health-driven innovation, and supply chain robustness. They are expanding their product ranges to include plant-based protein flours and alternative grains. Heavy investment in R&D is enabling the development of custom-tailored flour blends that support blood sugar control, gut health, or high-protein diets. Strategic alliances with bakery and food manufacturers are improving product penetration and end-use compatibility. These players are strengthening global supply chains through sourcing partnerships and storage infrastructure to hedge against raw material price fluctuations.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

- Cargill, Incorporated

- Archer Daniels Midland Company (ADM)

- Associated British Foods plc

- General Mills, Inc.

- Ingredion Incorporated

- Roquette Frères

- Tate & Lyle PLC

- SunOpta Inc.

- The Scoular Company

- Agrana Beteiligungs-AG

- Limagrain

- Bunge Limited

- The Andersons, Inc.

- Grain Millers, Inc.

- Hodgson Mill, Inc.

- Lifeway Foods, Inc.

- Manildra Group

- Unicorn Grain Specialties

- Bluebird Grain Farms

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 225 |

| Published | June 2025 |

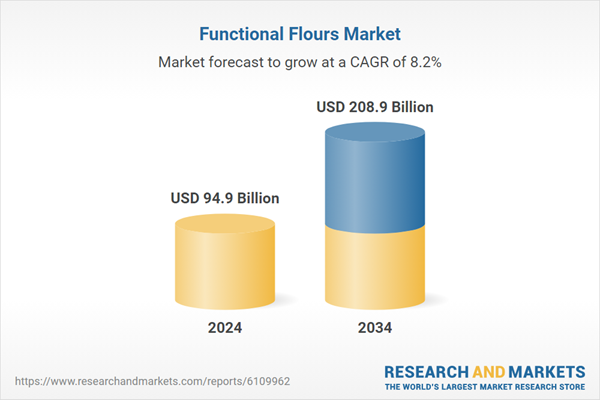

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 94.9 Billion |

| Forecasted Market Value ( USD | $ 208.9 Billion |

| Compound Annual Growth Rate | 8.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 19 |