Global Capital Exchange Ecosystems Market - Key Trends & Drivers Summarized

What Are Capital Exchange Ecosystems and Why Are They Reshaping Global Financial Networks?

Capital exchange ecosystems represent the intricate, technology-enabled networks that facilitate the movement, deployment, and exchange of financial capital across a variety of stakeholders including investors, institutions, enterprises, governments, and regulators. These ecosystems are not limited to traditional stock or bond markets but encompass a broader web of platforms such as venture capital hubs, crowdfunding sites, decentralized finance (DeFi) networks, sovereign wealth investment programs, and fintech-based trading exchanges. They serve as the infrastructure through which capital is allocated efficiently, enabling liquidity, pricing transparency, and access to funding for both private and public entities. Unlike linear capital flows of the past, these modern ecosystems operate through multi-directional, real-time exchanges of data and money, creating dynamic, interlinked financial environments. The expansion of digital infrastructure and the rise of digital assets have significantly broadened the scope of participation, lowering entry barriers for retail investors while offering sophisticated tools for institutional players. These systems are redefining the way companies raise capital, how assets are valued, and how risks are distributed across markets. In emerging economies, capital exchange ecosystems are playing a transformative role by democratizing access to capital and enabling micro-investments, often powered by mobile technology. In established economies, they are driving efficiency in asset allocation, shortening transaction times, and creating new investment classes. As capital exchange systems evolve, they are not only reshaping financial inclusion and innovation but also becoming essential instruments for economic resilience and long-term growth.How Is Technology Revolutionizing the Functionality and Reach of Capital Exchange Ecosystems?

The advancement of digital technologies has profoundly reshaped capital exchange ecosystems, making them faster, more transparent, and increasingly decentralized. Blockchain and distributed ledger technologies are leading this transformation by enabling secure, real-time transactions without the need for centralized intermediaries. Smart contracts are automating complex financial agreements, allowing for programmable capital flows that are self-executing and tamper-proof. Artificial intelligence and machine learning are enhancing the ability of platforms to analyze investment patterns, assess risks, and offer personalized financial recommendations, thereby improving decision-making for investors and managers alike. Cloud computing and big data analytics provide the backbone for scalable and responsive trading environments, supporting high-frequency transactions and real-time market monitoring. These technologies are not just limited to digital-native platforms but are also being adopted by traditional stock exchanges and investment firms looking to remain competitive. Application programming interfaces (APIs) are enabling seamless integration between various components of the ecosystem, from payment processors and banks to compliance software and investor dashboards. Cybersecurity tools are also becoming more sophisticated to address the rising risk of financial fraud and data breaches in a highly interconnected system. Furthermore, tokenization of assets is emerging as a major trend, allowing for fractional ownership of everything from real estate and artworks to intellectual property and carbon credits. These innovations are broadening the types of capital that can be exchanged and the participants who can engage in the process. As a result, technology is not merely supporting capital exchange ecosystems but is becoming the engine driving their evolution, scope, and inclusivity.What Regional and Sectoral Developments Are Shaping the Dynamics of Capital Exchange Ecosystems Globally?

Capital exchange ecosystems are being shaped by diverse regional priorities and sector-specific requirements, leading to a highly fragmented yet globally interconnected marketplace. In North America, particularly the United States, the dominance of venture capital networks, robust stock exchanges, and a mature regulatory environment has fostered a high level of ecosystem sophistication. Silicon Valley remains a hub of innovation in capital flows, from IPOs to crypto-finance. In Europe, a strong push for regulatory harmonization through frameworks such as MiFID II and the Digital Finance Strategy is enabling cross-border investment and financial innovation across member states. The rise of green finance and ESG (Environmental, Social, and Governance) metrics is further influencing capital allocation patterns, especially in Western Europe and Scandinavia. In Asia-Pacific, countries like China, Singapore, and India are leading in the deployment of digital financial infrastructure, with mobile-first ecosystems and fintech-driven platforms serving both urban and rural populations. China's experimentation with central bank digital currencies (CBDCs) and its tightly managed yet massive capital markets create a unique hybrid ecosystem. Meanwhile, India’s UPI-based digital payment backbone is facilitating grassroots investment opportunities that feed into broader capital markets. In Africa and Latin America, inclusive finance and micro-capital exchange platforms are gaining traction, particularly in sectors like agriculture, clean energy, and education, where traditional capital structures are limited or absent. Sectorally, the tech, real estate, and renewable energy sectors are the largest beneficiaries of dynamic capital exchange ecosystems, driven by high return potential and investor interest. These regional and sectoral differences not only diversify global capital markets but also illustrate how local context shapes the design, accessibility, and resilience of capital exchange systems.What Key Forces Are Driving the Global Expansion of Capital Exchange Ecosystems?

The growth in capital exchange ecosystems is driven by a convergence of economic, technological, regulatory, and social factors that reflect the changing dynamics of how capital is generated, distributed, and utilized. A major driver is the global proliferation of digital finance and the increasing comfort of both institutional and retail investors with technology-enabled investment platforms. This has allowed for greater financial participation across income levels and geographies, accelerating the decentralization of capital markets. Regulatory reforms in many jurisdictions are supporting this shift by creating sandboxes, updating securities laws, and enabling new asset classes such as digital tokens and green bonds. Another critical driver is the rise of alternative financing models such as crowdfunding, peer-to-peer lending, and initial coin offerings, which provide startups and small enterprises with access to capital that traditional banks may not offer. Institutional investors are also diversifying portfolios by participating in these non-traditional ecosystems, attracted by the prospects of higher returns and early access to innovation. The increasing integration of ESG criteria into investment strategies is shifting capital toward sustainable and socially responsible projects, reinforcing the value-driven nature of modern exchange systems. Global economic uncertainty and inflationary pressures are pushing investors to seek diversified and resilient investment channels, fueling interest in tokenized assets and cross-border opportunities. Additionally, the global shift toward data-driven decision-making is empowering platforms to deliver tailored investment options, making capital exchanges more efficient and targeted. Together, these forces are creating a more inclusive, agile, and intelligent capital marketplace, positioning capital exchange ecosystems as a central pillar in the future of global finance.Scope of the Report

The report analyzes the Capital Exchange Ecosystems market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below:- Segments: Market Composition (Primary Market, Secondary Market); Capital Market (Stocks Capital Market, Bonds Capital Market); Stock Type (Common & Preferred Stock, Growth Stock, Value Stock, Defensive Stock); Bond Type (Government Bond, Corporate Bond, Municipal Bond, Mortgage Bond, Other Bond Types).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Primary Market segment, which is expected to reach US$837.1 Billion by 2030 with a CAGR of a 3.3%. The Secondary Market segment is also set to grow at 5.3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $279.8 Billion in 2024, and China, forecasted to grow at an impressive 7.2% CAGR to reach $261.2 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Capital Exchange Ecosystems Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Capital Exchange Ecosystems Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Capital Exchange Ecosystems Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Australian Securities Exchange (ASX), BSE Ltd. (Bombay Stock Exchange), Cboe Global Markets, Chicago Mercantile Exchange (CME Group), Depository Trust & Clearing Corporation (DTCC) and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 39 companies featured in this Capital Exchange Ecosystems market report include:

- Australian Securities Exchange (ASX)

- BSE Ltd. (Bombay Stock Exchange)

- Cboe Global Markets

- Chicago Mercantile Exchange (CME Group)

- Depository Trust & Clearing Corporation (DTCC)

- Euroclear

- Euronext Group

- Hong Kong Exchanges & Clearing Ltd.

- Intercontinental Exchange, Inc. (ICE)

- Japan Exchange Group (JPX)

- London Stock Exchange Group plc (LSEG)

- MarketAxess

- Nasdaq, Inc.

- National Stock Exchange (Nigeria)

- National Stock Exchange of India Ltd.

- New York Stock Exchange (NYSE)

- Saudi Exchange (Tadawul)

- Shanghai Stock Exchange (SSE)

- SIX Swiss Exchange

- Toronto Stock Exchange (TSX)

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025 (E), competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Australian Securities Exchange (ASX)

- BSE Ltd. (Bombay Stock Exchange)

- Cboe Global Markets

- Chicago Mercantile Exchange (CME Group)

- Depository Trust & Clearing Corporation (DTCC)

- Euroclear

- Euronext Group

- Hong Kong Exchanges & Clearing Ltd.

- Intercontinental Exchange, Inc. (ICE)

- Japan Exchange Group (JPX)

- London Stock Exchange Group plc (LSEG)

- MarketAxess

- Nasdaq, Inc.

- National Stock Exchange (Nigeria)

- National Stock Exchange of India Ltd.

- New York Stock Exchange (NYSE)

- Saudi Exchange (Tadawul)

- Shanghai Stock Exchange (SSE)

- SIX Swiss Exchange

- Toronto Stock Exchange (TSX)

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 471 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

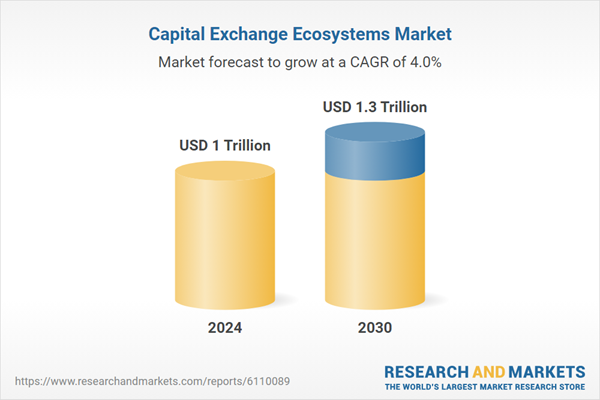

| Estimated Market Value ( USD | $ 1 Trillion |

| Forecasted Market Value ( USD | $ 1.3 Trillion |

| Compound Annual Growth Rate | 4.0% |

| Regions Covered | Global |