Global Recombinant Vaccines Market - Key Trends & Drivers Summarized

How Are Recombinant Technologies Redefining Vaccine Development and Delivery?

Recombinant vaccine platforms have revolutionized the global immunization landscape by enabling the production of highly specific, stable, and safe vaccine antigens using genetic engineering. Unlike traditional inactivated or live-attenuated vaccines, recombinant vaccines rely on the expression of select antigens in host cells such as yeast, bacteria, or mammalian systems, minimizing the risk of pathogen reactivation or contamination. This technology is increasingly adopted for diseases where traditional vaccines have failed to deliver long-term efficacy or safety, including HPV, hepatitis B, and shingles. Moreover, the flexibility of recombinant platforms allows for rapid response to emerging pathogens, making them vital in pandemic preparedness and outbreak containment strategies.The post-COVID era has ushered in an acceleration of interest in recombinant DNA technologies, particularly in mRNA-compatible constructs and virus-like particles (VLPs) that mimic native viruses without carrying genetic material. Global public health initiatives are prioritizing the development of thermostable, needle-free, and adjuvant-enhanced recombinant formulations to boost vaccine access and coverage in low-resource settings. In parallel, recombinant vaccines are becoming central to personalized immunization strategies, especially in oncology and allergen desensitization, where antigen specificity and immune modulation are paramount. As R&D pipelines expand, recombinant vaccine development is expected to increasingly dominate the prophylactic and therapeutic vaccine landscape.

Which Disease Segments and Target Populations Are Driving Adoption?

The strongest momentum for recombinant vaccines is being observed in hepatitis, human papillomavirus (HPV), respiratory syncytial virus (RSV), and influenza segments. Widespread adoption of recombinant hepatitis B vaccines in national immunization programs, especially in Southeast Asia and Sub-Saharan Africa, has significantly reduced chronic infections and associated liver cancers. The inclusion of HPV vaccines in school-based programs is propelling recombinant vaccine usage among adolescents and young adults. Additionally, RSV vaccine rollouts for older adults and pregnant women-especially with the introduction of recombinant formulations-highlight the growing importance of life-course immunization approaches.Pediatric populations, immunocompromised individuals, and geriatrics are emerging as high-priority targets for recombinant vaccine delivery. These groups benefit from recombinant formulations due to their superior safety profiles and reduced risk of adverse events. Furthermore, oncology vaccines leveraging recombinant tumor-associated antigens are under rapid clinical development, signaling a shift toward therapeutic applications. Public-private partnerships, GAVI support, and WHO prequalification are catalyzing recombinant vaccine inclusion in routine immunization schedules in developing countries. As global vaccination strategies evolve beyond childhood focus, recombinant vaccines are poised to address broader public health goals, including antimicrobial resistance reduction and cancer prevention.

What Are the Key Supply Chain and Regulatory Enablers?

Manufacturing scalability and process control are essential to the success of recombinant vaccine commercialization. Unlike traditional egg-based methods, recombinant platforms offer more predictable yields, reduced production timelines, and enhanced biosafety. Leading manufacturers are investing in single-use bioreactor systems, automated purification processes, and cold chain innovations to support global distribution. Additionally, the modular nature of recombinant vaccine production allows for multi-pathogen platforms that can be swiftly adapted to new disease targets, supporting resilience in future health crises.From a regulatory standpoint, recombinant vaccines are benefitting from accelerated pathways in the U.S. FDA, EMA, and global regulatory bodies that prioritize high-need immunization products. The inclusion of recombinant vaccines in WHO’s emergency use listings, alongside expedited national licensing, is paving the way for rapid deployment during outbreaks. Moreover, pharmacovigilance frameworks and real-world evidence from post-marketing surveillance are continuously reinforcing the safety and efficacy profiles of recombinant products. Partnerships with contract development and manufacturing organizations (CDMOs) are further helping biotech innovators bridge capability gaps and scale recombinant vaccine production to meet growing global demand.

What Is Fueling the Sustained Growth of This Market?

The growth in the recombinant vaccines market is driven by several factors, most notably the increasing global focus on precision immunization, the expansion of life-course vaccination strategies, and the rising incidence of vaccine-preventable diseases. As healthcare systems seek to improve the efficacy, safety, and accessibility of immunization programs, recombinant technologies offer a scientifically validated and commercially scalable solution. The shift toward universal vaccination across all age groups, combined with governmental and donor agency support, is accelerating demand in both routine and outbreak response settings.Technological innovation is also a major growth catalyst. Advancements in recombinant protein expression, nanoparticle delivery systems, and thermostabilization techniques are extending the reach of vaccines to rural and underserved areas. Continued investment in next-generation adjuvants and mucosal delivery methods is further enhancing the immunogenicity and patient acceptability of recombinant vaccines. Furthermore, the success of COVID-19 mRNA vaccines has increased global trust in recombinant platforms and validated their potential in combating emerging infectious diseases and cancer.

As pharmaceutical companies prioritize sustainable vaccine production and equitable access, recombinant vaccine technologies are becoming the backbone of future-ready immunization ecosystems. Market expansion is expected to intensify with new indications, broader regulatory support, and rising healthcare investments across middle-income nations.

Scope of the Report

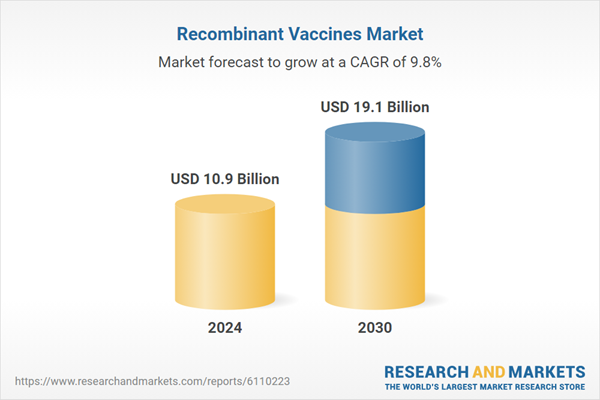

The report analyzes the Recombinant Vaccines market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below:- Segments: Vaccine Type (Subunit Recombinant Vaccines, Attenuated Recombinant Vaccines, Vector Recombinant Vaccines); Disease (Pneumococcal Disease, Cancer Disease, Hepatitis B Disease, Influenza Disease, DPT Disease, Other Diseases); Distribution Channel (Hospital & Retail Pharmacies, Government Suppliers Distribution Channel).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Subunit Recombinant Vaccines segment, which is expected to reach US$10.6 Billion by 2030 with a CAGR of a 8.3%. The Attenuated Recombinant Vaccines segment is also set to grow at 12.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $3.0 Billion in 2024, and China, forecasted to grow at an impressive 13.2% CAGR to reach $3.8 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Recombinant Vaccines Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Recombinant Vaccines Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Recombinant Vaccines Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AbbVie Inc., AstraZeneca plc, Bavarian Nordic, Bharat Biotech, Clover Biopharmaceuticals and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 44 companies featured in this Recombinant Vaccines market report include:

- AbbVie Inc.

- AstraZeneca plc

- Bavarian Nordic

- Bharat Biotech

- Clover Biopharmaceuticals

- CSL Limited

- Dynavax Technologies Corporation

- Emergent BioSolutions

- GlaxoSmithKline plc (GSK)

- Green Cross Corporation (GC Biopharma)

- Johnson & Johnson

- Merck & Co., Inc.

- Mitsubishi Tanabe Pharma Corporation

- Novartis AG

- Panacea Biotec

- Pfizer Inc.

- Sanofi S.A.

- Serum Institute of India Pvt. Ltd.

- Takeda Pharmaceutical Company Limited

- Vaxart, Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025 (E), competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AbbVie Inc.

- AstraZeneca plc

- Bavarian Nordic

- Bharat Biotech

- Clover Biopharmaceuticals

- CSL Limited

- Dynavax Technologies Corporation

- Emergent BioSolutions

- GlaxoSmithKline plc (GSK)

- Green Cross Corporation (GC Biopharma)

- Johnson & Johnson

- Merck & Co., Inc.

- Mitsubishi Tanabe Pharma Corporation

- Novartis AG

- Panacea Biotec

- Pfizer Inc.

- Sanofi S.A.

- Serum Institute of India Pvt. Ltd.

- Takeda Pharmaceutical Company Limited

- Vaxart, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 383 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 10.9 Billion |

| Forecasted Market Value ( USD | $ 19.1 Billion |

| Compound Annual Growth Rate | 9.8% |

| Regions Covered | Global |