Global Fortified Edible Oils Market - Key Trends & Drivers Summarized

Why Are Edible Oils Being Fortified and What Public Health Goals Are Involved?

Fortified edible oils are cooking oils enriched with essential micronutrients such as vitamin A, vitamin D, and sometimes iron. These fortified products are designed to address nutritional deficiencies in populations with limited access to diversified diets. Governments and public health agencies have adopted oil fortification as a practical intervention due to the widespread use of edible oils in daily cooking across cultures and regions. This approach supports large-scale delivery of essential nutrients without requiring changes in consumer behavior.Vitamin A deficiency, which can cause vision problems and immune dysfunction, is a primary target of edible oil fortification programs. In some regions, vitamin D is also added to improve bone health and combat rickets. Fortified oils are particularly important in low-income settings where undernutrition and food insecurity limit access to nutrient-rich foods. By delivering vitamins through a widely consumed medium, edible oil fortification helps improve baseline nutrition across all demographic groups, including children, women, and the elderly.

How Are Fortification Methods and Oil Processing Standards Evolving?

Modern fortification techniques involve the stable blending of micronutrient premixes into oils during the refining process. Heat-stable formulations are used to preserve vitamin potency throughout cooking cycles. Manufacturers ensure uniform distribution of nutrients and maintain organoleptic properties such as taste, color, and shelf life. Fortification is applied to commonly consumed oils including soybean, sunflower, canola, and palm oil. Cold-pressed oils are less frequently fortified due to technical limitations in nutrient stability.Quality control measures are implemented during production to meet regulatory and nutritional standards. Many producers now operate under government-mandated fortification policies, particularly in countries where edible oil is used as a vehicle for public health intervention. In addition, voluntary fortification by private brands is increasing in premium markets where consumers actively seek nutrient-enriched cooking oils. Packaging formats are being updated with clear labeling to communicate nutrient content and storage instructions, helping build consumer trust in fortified products.

Where Is Adoption Increasing and Which Segments Are Driving Growth?

Widespread adoption of fortified edible oils is taking place in regions with high incidence of micronutrient deficiencies, particularly South Asia, Sub-Saharan Africa, and Southeast Asia. Government programs, often supported by international development organizations, have made fortification mandatory for edible oils sold in public markets or distributed through welfare schemes. Urban and peri-urban consumers are increasingly purchasing fortified oils in packaged formats due to growing awareness of basic nutritional needs.In developed countries, fortified edible oils are being marketed through health food stores, supermarkets, and online channels as part of wellness-oriented diets. Households with children and elderly members are key adopters, often opting for fortified oils to complement vitamin supplementation. Food manufacturers also use fortified oils in the preparation of processed and ready-to-eat meals, expanding the reach of nutritional interventions through commercial food products. These dynamics are supporting both public-sector mandates and private-sector innovation in the fortified oil segment.

What Is Driving Growth in the Fortified Edible Oils Market?

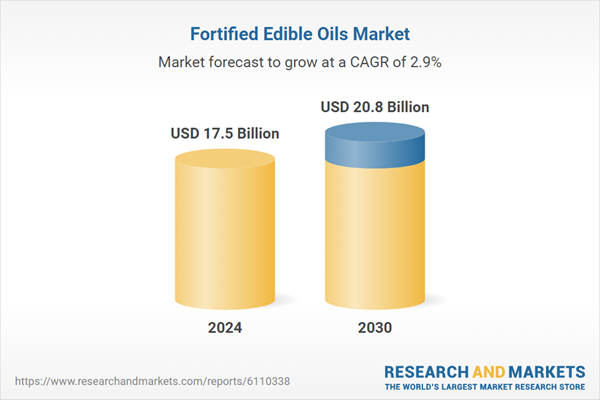

Growth in the fortified edible oils market is driven by several factors related to public health policy, micronutrient intervention strategies, and consumer health trends. Mandatory and voluntary fortification programs are expanding to address widespread vitamin A and D deficiencies in low- and middle-income countries. Advances in heat-stable micronutrient formulations and processing compatibility are enabling efficient and uniform nutrient delivery across oil types. Growth is also supported by rising consumer awareness of nutrition, health-focused product labeling, and increased use of fortified oils in school feeding and maternal health programs. As both institutional and retail distribution channels scale up, fortified edible oils are expected to remain a key platform for addressing basic nutritional gaps across population groups.Scope of the Report

The report analyzes the Fortified Edible Oils market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below:- Segments: Product Type (Palm Oil, Soybean Oil, Sunflower Oil, Olive Oil, Rice Bran Oil, Other Oils); Micronutrient (Vitamin A, Vitamin D, Vitamin E, Other Micronutrients); Distribution Channel (Supermarkets / Hypermarkets, Specialty Stores, Online Distribution Channel, Other Distribution Channels).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Palm Oil segment, which is expected to reach US$5.5 Billion by 2030 with a CAGR of a 4.3%. The Soybean Oil segment is also set to grow at 1.7% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $4.8 Billion in 2024, and China, forecasted to grow at an impressive 5.7% CAGR to reach $4.1 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Fortified Edible Oils Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Fortified Edible Oils Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Fortified Edible Oils Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AAK AB, Adani Wilmar Limited, Allanasons Private Limited, Archer Daniels Midland Company (ADM), BASF SE and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 33 companies featured in this Fortified Edible Oils market report include:

- AAK AB

- Adani Wilmar Limited

- Allanasons Private Limited

- Archer Daniels Midland Company (ADM)

- BASF SE

- Bunge Limited

- Cargill, Incorporated

- Conagra Brands, Inc.

- King Rice Oil Group

- Lam Soon Group

- Liberty Oil Mills Ltd.

- Nestlé S.A.

- Ruchi Soya Industries Ltd.

- Samarth Oil Refinery

- Wilmar International Limited

- Borges International Group

- Conagra Brands, Inc.

- Kings Rice Oil (redundant - omit)

- Tata Chemicals Limited

- Unilever PLC

- Sime Darby Plantation Berhad

- Olam International

- Golden Agri-Resources Ltd

- Nisshin OilliO Group, Ltd.

- Agropur Cooperative

- PT Musim Mas

- United Plantations Berhad

- Mazola Oils

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025 (E), competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AAK AB

- Adani Wilmar Limited

- Allanasons Private Limited

- Archer Daniels Midland Company (ADM)

- BASF SE

- Bunge Limited

- Cargill, Incorporated

- Conagra Brands, Inc.

- King Rice Oil Group

- Lam Soon Group

- Liberty Oil Mills Ltd.

- Nestlé S.A.

- Ruchi Soya Industries Ltd.

- Samarth Oil Refinery

- Wilmar International Limited

- Borges International Group

- Conagra Brands, Inc.

- Kings Rice Oil (redundant - omit)

- Tata Chemicals Limited

- Unilever PLC

- Sime Darby Plantation Berhad

- Olam International

- Golden Agri-Resources Ltd

- Nisshin OilliO Group, Ltd.

- Agropur Cooperative

- PT Musim Mas

- United Plantations Berhad

- Mazola Oils

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 381 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 17.5 Billion |

| Forecasted Market Value ( USD | $ 20.8 Billion |

| Compound Annual Growth Rate | 2.9% |

| Regions Covered | Global |