Global Coherent Optical Equipment Market - Key Trends & Drivers Summarized

Why Is Coherent Optical Equipment Central to the Next Generation of High-Speed Networks?

Coherent optical equipment has emerged as the cornerstone of high-capacity, long-distance data transmission, powering the backbone of modern internet infrastructure. With the explosion of data traffic driven by cloud computing, video streaming, 5G deployment, and enterprise digitization, network operators are under intense pressure to expand bandwidth while maintaining signal integrity and energy efficiency. Coherent optics utilize advanced modulation formats, high-speed digital signal processing, and sophisticated forward error correction techniques to transmit data over fiber-optic cables at speeds exceeding 100 Gbps per wavelength. Unlike traditional direct-detection optical systems, coherent systems enable better spectral efficiency, longer reach, and higher tolerance to signal degradation, making them ideal for metro, regional, and long-haul network applications. These technologies are essential for hyperscale data centers, internet exchange points, and submarine cable systems that require scalable, flexible, and robust transmission solutions. The growing demand for real-time applications, such as online gaming, video conferencing, and remote work, further reinforces the need for ultra-fast, low-latency optical transport solutions. As more organizations migrate to cloud-first environments, coherent optics are becoming indispensable in ensuring seamless connectivity between geographically dispersed data centers. Equipment vendors are continuously innovating to develop smaller, more power-efficient coherent transceivers, enabling easier integration into existing hardware and reducing operational costs. Additionally, the adoption of open optical architectures and software-defined networking is enhancing the interoperability and programmability of coherent systems, making them more adaptable to evolving network requirements. This strategic importance places coherent optical equipment at the forefront of global network transformation efforts.What Factors Are Influencing the Evolution and Adoption of Coherent Optical Technologies?

The evolution and growing adoption of coherent optical equipment are shaped by a combination of technological advancements, economic pressures, and network architecture changes. One of the key drivers is the need for higher bandwidth density and spectral efficiency, which is being achieved through advanced modulation techniques like quadrature amplitude modulation (QAM) and polarization division multiplexing. These methods enable the transmission of more data per wavelength, thus maximizing the capacity of existing fiber infrastructure. In parallel, developments in digital signal processing and ASIC design are enhancing the performance and energy efficiency of coherent transceivers, making them suitable for both long-haul and shorter metro applications. Network operators are also facing mounting cost pressures to deliver more capacity without significantly expanding their physical infrastructure. Coherent optics help address this by enabling the reuse of existing fiber lines and reducing the need for signal regeneration points. The shift toward disaggregated and software-defined networks is another major influence, as it encourages the decoupling of hardware and software layers, fostering vendor diversity and faster innovation cycles. Furthermore, the standardization efforts by industry bodies and the rise of open line systems are reducing vendor lock-in and promoting interoperability across network layers. Environmental concerns are also playing a role, with coherent equipment increasingly designed to consume less power and occupy less space, aligning with sustainability goals. The rollout of 5G and edge computing infrastructures demands more agile and high-capacity transport solutions, further solidifying the role of coherent optics in modern network planning. These factors, when combined, are not only driving widespread adoption but also redefining how network scalability and efficiency are approached.How Are Vendors and Operators Innovating to Meet Rising Network Performance Demands?

The coherent optical equipment market is experiencing a wave of innovation as vendors and network operators collaborate to develop solutions that meet the growing demand for higher speed, better efficiency, and greater flexibility. Vendors are pushing the boundaries of transmission rates, with commercial solutions now offering 400G, 600G, and even 800G coherent capabilities over a single wavelength. These higher-speed systems are enabled by advancements in photonic integration, high-performance DSPs, and power-optimized optical modules. The development of pluggable coherent optics, such as CFP2-DCO and QSFP-DD modules, is transforming the network equipment landscape by allowing greater scalability and modularity in both core and access networks. Operators are adopting these solutions to minimize capital expenditures, reduce power consumption, and streamline network upgrades without requiring a complete hardware overhaul. Simultaneously, the deployment of coherent optics in data center interconnect (DCI) applications is accelerating, as operators seek to build high-throughput, low-latency links between facilities. Innovations in line systems, including advanced ROADMs (reconfigurable optical add-drop multiplexers) and optical performance monitoring tools, are enabling dynamic traffic management and faster fault recovery. Network automation and AI-driven management platforms are being integrated with coherent systems to enable predictive maintenance, automated provisioning, and real-time optimization. Additionally, the adoption of programmable optics is giving operators the ability to tune performance parameters such as modulation format and baud rate, offering adaptability in the face of varying traffic loads and network conditions. These technological leaps are not only improving cost efficiency and network reliability but also future-proofing infrastructures to handle the ever-growing demands of digital communication.What Are the Key Market Drivers Behind the Expansion of Coherent Optical Equipment Worldwide?

The growth in the coherent optical equipment market is driven by a range of factors rooted in infrastructure modernization, digital transformation, data consumption trends, and the evolution of connectivity technologies. The exponential rise in data traffic, fueled by cloud services, IoT proliferation, and mobile data usage, is compelling service providers and enterprises to upgrade their optical transport layers with solutions that support ultra-high bandwidth and extended reach. The global rollout of 5G networks is creating a surge in demand for backhaul and fronthaul capacity, which coherent optics can deliver efficiently and at scale. Edge computing initiatives, which bring data processing closer to the user, are creating a decentralized network landscape that requires fast, high-capacity links between edge nodes and core data centers. Data center operators, especially hyperscalers, are investing in coherent technologies to support massive interconnect requirements and to ensure seamless multi-cloud and hybrid cloud integration. The need to enhance network resiliency and minimize latency is further motivating investments in coherent solutions that offer programmable control and robust error correction capabilities. On the enterprise side, increasing reliance on real-time applications, high-definition video conferencing, and big data analytics is pushing the demand for scalable, low-latency optical connections. Governments and public sector agencies are also driving investment in fiber infrastructure to support digital inclusion initiatives, with coherent optics playing a key role in delivering high-capacity links to underserved regions. Additionally, the cost-per-bit advantage of coherent systems, along with energy efficiency improvements, makes them an attractive option for long-term network expansion. These diverse and converging factors are creating strong momentum for the global adoption of coherent optical equipment as a foundational technology in the next generation of digital infrastructure.Scope of the Report

The report analyzes the Coherent Optical Equipment market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below:- Segments: Component (Laser Component, DSP Component, Transmitter Component, Receiver Component, Modulator Component); Equipment (Modules / Chips Equipment, Optical Amplifiers Equipment, Optical Switches Equipment, Wavelength-Division Multiplexer Equipment, Other Equipment); Application (OEM Application, Networking Application, Data Center Application, Other Applications); End-User (Industrial End-User, Public Sector End-User, Service Provider End-User, Other End-Users).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Laser Component segment, which is expected to reach US$12.7 Billion by 2030 with a CAGR of a 5.5%. The DSP Component segment is also set to grow at 7.2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $5.8 Billion in 2024, and China, forecasted to grow at an impressive 10.3% CAGR to reach $6.4 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Coherent Optical Equipment Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Coherent Optical Equipment Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Coherent Optical Equipment Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ADVA Optical Networking, Alaxala Networks, Broadcom Inc., Ciena Corporation, Cisco Systems, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 44 companies featured in this Coherent Optical Equipment market report include:

- ADVA Optical Networking

- Alaxala Networks

- Broadcom Inc.

- Ciena Corporation

- Cisco Systems, Inc.

- Coriant (now part of Infinera)

- Eoptolink Technology

- FiberHome Technologies

- Fujitsu Limited

- Huawei Technologies Co., Ltd.

- II-VI Incorporated (now Coherent Corp.)

- Infinera Corporation

- Juniper Networks

- Lumentum Holdings Inc.

- NEC Corporation

- Nokia Corporation

- NTT Electronics Corporation

- Padtec Holding S.A.

- ZTE Corporation

- ZTE Trunking Technology Corp.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025 (E), competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ADVA Optical Networking

- Alaxala Networks

- Broadcom Inc.

- Ciena Corporation

- Cisco Systems, Inc.

- Coriant (now part of Infinera)

- Eoptolink Technology

- FiberHome Technologies

- Fujitsu Limited

- Huawei Technologies Co., Ltd.

- II-VI Incorporated (now Coherent Corp.)

- Infinera Corporation

- Juniper Networks

- Lumentum Holdings Inc.

- NEC Corporation

- Nokia Corporation

- NTT Electronics Corporation

- Padtec Holding S.A.

- ZTE Corporation

- ZTE Trunking Technology Corp.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 491 |

| Published | February 2026 |

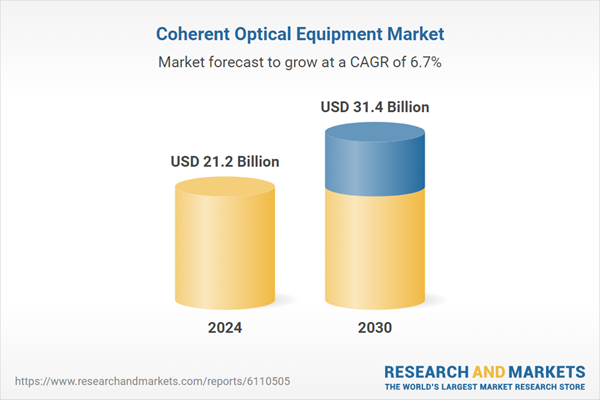

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 21.2 Billion |

| Forecasted Market Value ( USD | $ 31.4 Billion |

| Compound Annual Growth Rate | 6.7% |

| Regions Covered | Global |