Global PV Modules Market - Key Trends & Drivers Summarized

Why Are PV Modules Central to the Global Clean Energy Transition?

Photovoltaic (PV) modules, the core units of solar energy conversion systems, have become pivotal in global decarbonization and renewable energy strategies. As the world shifts away from fossil fuels toward sustainable sources, solar PV stands out for its scalability, modularity, and rapidly declining cost per watt. PV modules transform sunlight into direct current electricity using semiconducting materials, typically crystalline silicon (mono- and polycrystalline) or thin-film technologies such as cadmium telluride (CdTe) and copper indium gallium selenide (CIGS). Their versatility allows deployment in diverse settings-from residential rooftops and utility-scale solar farms to mobile off-grid installations and building-integrated photovoltaics (BIPV).Solar PV's appeal is underpinned by multiple factors: the rising price of fossil fuels, increasingly stringent emission norms, and global commitments to net-zero targets. Technological maturity and a steadily improving manufacturing ecosystem have further enabled module price reductions, driving broader adoption across emerging economies. Governments are supporting this trend through tax credits, feed-in tariffs, auction mechanisms, and solar mandates. Whether powering remote agricultural pumps in India or smart grids in California, PV modules are now at the forefront of reshaping the global energy mix.

How Are Technology Advancements Revolutionizing Module Efficiency and Cost Performance?

PV module technology is undergoing rapid transformation aimed at increasing efficiency, lowering degradation rates, and enhancing lifecycle economics. One of the most significant innovations is the widespread adoption of Passivated Emitter and Rear Cell (PERC) technology in monocrystalline silicon modules, boosting efficiency beyond 22%. Even more advanced are TopCon and Heterojunction (HJT) cells, which deliver higher bifaciality and reduced thermal loss-key advantages for utility-scale projects in hot climates.Bifacial modules, which absorb sunlight from both front and rear sides, are increasingly being paired with single-axis trackers, increasing energy yield by 10-30%. Glass-glass module architecture enhances durability and reduces microcracking. Transparent conductive back sheets and busbarless designs are improving light capture and reducing cell shading losses.

Thin-film technologies are also regaining attention, particularly CdTe modules produced by First Solar, which offer excellent performance in high-temperature, diffused light conditions. Furthermore, perovskite solar cells, while still in R&D and pilot stages, are showing promise for future commercialization due to their ultra-thin profiles and potential to exceed 30% efficiency in tandem configurations. These improvements in design, material science, and process optimization are continuously enhancing the price-performance ratio of PV modules, making them competitive even without subsidies.

Which Markets and Applications Are Catalyzing Large-Scale Deployment?

Utility-scale solar farms remain the largest and fastest-growing segment for PV module deployment. Large national and transnational projects-such as India's PM-KUSUM scheme or Saudi Arabia's NEOM-are driving demand for high-output, low-cost modules. These installations typically use mono PERC or bifacial modules, emphasizing efficiency, land utilization, and energy yield.Rooftop solar is gaining traction across residential, commercial, and industrial buildings. The growth is especially visible in regions with high electricity tariffs and net metering policies. Commercial and industrial (C&I) solar is accelerating as corporates pledge carbon neutrality and seek to lock in long-term energy cost savings.

Emerging applications are also expanding the market footprint. Building-integrated photovoltaics (BIPV), agrivoltaics, and floating solar installations are being deployed to overcome space constraints and reduce land-use conflicts. Off-grid systems using portable PV modules are improving energy access in sub-Saharan Africa and Southeast Asia. Additionally, the integration of PV modules into electric vehicle charging stations, smart homes, and energy storage systems is reinforcing their role in distributed energy systems.

What Is Driving Growth in the Global PV Modules Market?

The growth in the global PV modules market is driven by aggressive climate policies, sustained declines in module pricing, and technological evolution improving energy yield and ROI. Countries are setting ambitious solar capacity targets in line with Paris Agreement commitments. For instance, the EU aims to install over 600 GW of solar by 2030, while China plans to reach over 1,200 GW by the same year. This provides a massive runway for PV module demand.Economies of scale and innovation in manufacturing have pushed module costs below $0.25/W for leading players, unlocking parity with grid electricity in many regions. Trade liberalization, improved solar financing, and solar leasing models are removing barriers to access. Local manufacturing incentives and anti-dumping measures are also boosting domestic industries in India, the U.S., and Southeast Asia.

Furthermore, lifecycle costs are declining due to longer warranties, lower degradation rates, and better performance guarantees. This makes solar PV an attractive asset class for institutional investors and project developers. As innovation continues in materials, system design, and performance optimization, PV modules will remain a cornerstone technology in the transition to a cleaner, more resilient global energy future.

Scope of the Report

The report analyzes the PV Modules market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below:- Segments: Product (Monocrystalline, Polycrystalline, Cadmium Telluride, Amorphous Silicon, Copper Indium Gallium Diselenide); Technology (Thin Film Technology, Crystalline Silicon Technology); Connectivity (On-Grid Connectivity, Off-Grid Connectivity, Mounting Connectivity, Ground Mounted Connectivity, Roof Top Connectivity); End-Use (Residential End-Use, Commercial End-Use, Utility End-Use).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Monocrystalline segment, which is expected to reach US$148.1 Billion by 2030 with a CAGR of a 8.4%. The Polycrystalline segment is also set to grow at 4.7% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $57.3 Billion in 2024, and China, forecasted to grow at an impressive 11.3% CAGR to reach $67.0 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global PV Modules Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global PV Modules Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global PV Modules Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AE Solar GmbH, Canadian Solar Inc., First Solar, Inc., GCL System Integration, Hanwha Q CELLS Co., Ltd. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this PV Modules market report include:

- AE Solar GmbH

- Canadian Solar Inc.

- First Solar, Inc.

- GCL System Integration

- Hanwha Q CELLS Co., Ltd.

- JA Solar Technology Co., Ltd.

- JinkoSolar Holding Co., Ltd.

- LONGi Green Energy Technology

- Meyer Burger Technology AG

- Mission Solar Energy

- Panasonic Corporation

- REC Group

- ReneSola Ltd.

- Risen Energy Co., Ltd.

- Seraphim Solar System Co., Ltd

- Sharp Corporation

- Solaria Corporation

- SunPower Corporation

- Trina Solar Limited

- Vikram Solar Limited

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025 (E), competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AE Solar GmbH

- Canadian Solar Inc.

- First Solar, Inc.

- GCL System Integration

- Hanwha Q CELLS Co., Ltd.

- JA Solar Technology Co., Ltd.

- JinkoSolar Holding Co., Ltd.

- LONGi Green Energy Technology

- Meyer Burger Technology AG

- Mission Solar Energy

- Panasonic Corporation

- REC Group

- ReneSola Ltd.

- Risen Energy Co., Ltd.

- Seraphim Solar System Co., Ltd

- Sharp Corporation

- Solaria Corporation

- SunPower Corporation

- Trina Solar Limited

- Vikram Solar Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 480 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

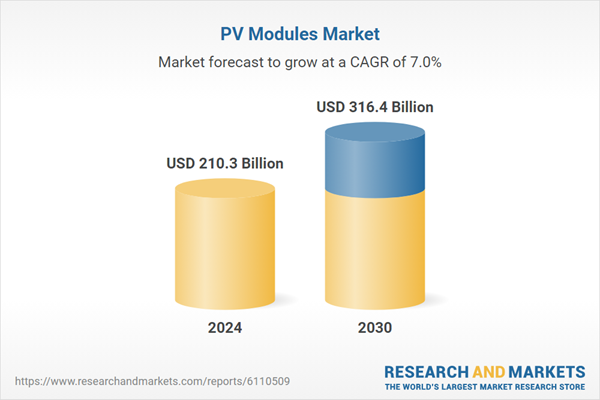

| Estimated Market Value ( USD | $ 210.3 Billion |

| Forecasted Market Value ( USD | $ 316.4 Billion |

| Compound Annual Growth Rate | 7.0% |

| Regions Covered | Global |