Global Alcoholic Beverage E-Commerce Market - Key Trends & Drivers Summarized

Why Is Alcoholic Beverage E-Commerce Reshaping Consumer Behavior and Retail Models?

The rise of alcoholic beverage e-commerce is dramatically reshaping how consumers purchase and interact with alcohol brands, transforming traditional retail dynamics into a more digitized, personalized, and accessible experience. With the convergence of convenience, technology, and shifting consumer expectations, online alcohol sales have grown from a niche offering into a mainstream channel. Consumers now expect to browse, compare, and order their preferred wines, spirits, beers, and craft beverages from the comfort of their homes, often with the added benefit of home delivery, subscription models, or curated tasting experiences. This shift is especially pronounced among younger, tech-savvy demographics who prioritize digital convenience and value the ability to explore unique, artisanal, or international brands that may not be readily available in local stores. Platforms offering detailed product descriptions, customer reviews, pairing recommendations, and sommelier insights have further enriched the decision-making process online. E-commerce also supports direct-to-consumer (DTC) sales models, allowing producers and craft distilleries to bypass intermediaries and build stronger relationships with their customer base. This is crucial for smaller or boutique producers who rely on storytelling and niche appeal to capture market share. For consumers, digital access removes geographical and logistical limitations, opening up a global marketplace for alcoholic beverages. The COVID-19 pandemic accelerated these behaviors, with lockdowns and social distancing fueling online alcohol purchases, and many of these habits have persisted beyond the pandemic. As e-commerce becomes a core part of the alcoholic beverage industry, brands and retailers are adapting their marketing, logistics, and compliance strategies to cater to a more informed and digitally connected customer base.How Are Platforms and Technologies Driving Innovation in Online Alcohol Sales?

The expansion of alcoholic beverage e-commerce is being propelled by significant innovation in digital platforms, logistics infrastructure, and data-driven marketing tools. Sophisticated e-commerce websites and mobile applications now offer intuitive user interfaces, AI-powered recommendation engines, and advanced search functionalities that make shopping more engaging and efficient. Machine learning algorithms analyze browsing and purchase history to suggest new products tailored to individual tastes, creating a personalized shopping experience that mimics the guidance one might receive in a specialty liquor store. Virtual tastings, augmented reality labels, and livestreamed product launches are also being used to create immersive brand experiences online. At the logistical level, technology has enabled more precise inventory tracking, age verification systems, and delivery optimization to ensure regulatory compliance and timely order fulfillment. Many platforms now integrate with third-party delivery services or operate through last-mile logistics providers who specialize in alcohol transport, offering same-day or next-day delivery in many urban markets. Subscription models and build-your-box features are becoming more popular, giving consumers the opportunity to regularly explore new products with minimal effort. In terms of back-end technology, cloud-based enterprise solutions are helping alcohol producers and retailers manage online orders, customer databases, marketing campaigns, and legal compliance across multiple jurisdictions. Payment platforms have also adapted, offering secure transactions while ensuring the buyer meets age restrictions. Collectively, these technologies are not only facilitating smoother transactions but also enhancing customer loyalty through convenience, personalization, and unique digital experiences. As technology continues to evolve, alcoholic beverage e-commerce will only become more interactive and efficient, and get seamlessly integrated into consumers’ lifestyles.How Do Regulations and Regional Markets Shape the Growth of Online Alcohol Sales?

The growth of alcoholic beverage e-commerce is significantly influenced by a complex web of local, national, and international regulations that vary widely across markets. In some countries, strict government control over alcohol distribution limits or outright prohibits online sales, while in others, regulatory reforms have created pathways for e-commerce to flourish under controlled conditions. For example, the United States has a highly fragmented system governed by state-level laws, requiring businesses to navigate varying rules around licensing, age verification, shipping restrictions, and taxation. Meanwhile, countries like the United Kingdom, Australia, and Germany have more mature and liberal regulatory frameworks, enabling a robust online market supported by efficient delivery networks and clear consumer protections. In rapidly developing regions such as Southeast Asia, Latin America, and parts of Africa, e-commerce platforms are emerging alongside regulatory updates, often pushed by demand from urban, middle-class consumers. Governments in these regions are gradually relaxing restrictions in response to economic incentives, including tax revenue and support for small producers. However, compliance remains a major challenge in the global landscape. Platforms must implement sophisticated age verification technologies, work with certified delivery partners, and adhere to advertising guidelines that prevent underage exposure. Labeling laws, duty calculations, and cross-border shipping regulations add further complexity. As global trade becomes more digitized, many governments are beginning to standardize rules or create digital frameworks to facilitate the safe and legal online sale of alcohol. For e-commerce operators and producers, understanding and adapting to regional legal nuances is crucial for scaling operations, building trust with regulators, and ensuring long-term sustainability in a rapidly growing but tightly controlled market.What Is Driving the Continued Expansion of the Alcoholic Beverage E-Commerce Market?

The growth in the alcoholic beverage e-commerce market is driven by several converging forces including changing consumer habits, technological advancements, demographic shifts, supply chain improvements, and evolving legal frameworks. One of the most important drivers is the rise of digital-native consumers who value convenience, personalization, and access to global brands without leaving home. The COVID-19 pandemic further catalyzed this shift, not only increasing short-term demand but also permanently altering consumer expectations around the accessibility and delivery of alcohol. Urbanization and rising disposable incomes, especially in emerging economies, are also contributing to increased online spending on premium and craft alcohol products. Brands are responding by expanding their digital presence, launching DTC channels, and investing in e-commerce marketing strategies that include influencer partnerships, social media campaigns, and content-driven engagement. Additionally, improvements in cold chain logistics, age verification software, and last-mile delivery are making it easier and more secure to sell alcohol online, even in jurisdictions with tight regulatory oversight. E-commerce also offers unparalleled market intelligence through customer data analytics, enabling brands to fine-tune their offerings, launch limited-edition products, and anticipate market trends with greater precision. Investment activity in alcohol tech startups and digital platforms is surging, providing capital and innovation to scale infrastructure and improve customer experiences. Governments are increasingly recognizing the potential of this channel to generate tax revenue and support small producers, leading to more permissive regulatory shifts in various regions. As these factors align, alcoholic beverage e-commerce is evolving from a supplemental sales channel into a primary mode of engagement, poised for sustained global growth and deepening its role in the future of beverage retail.Scope of the Report

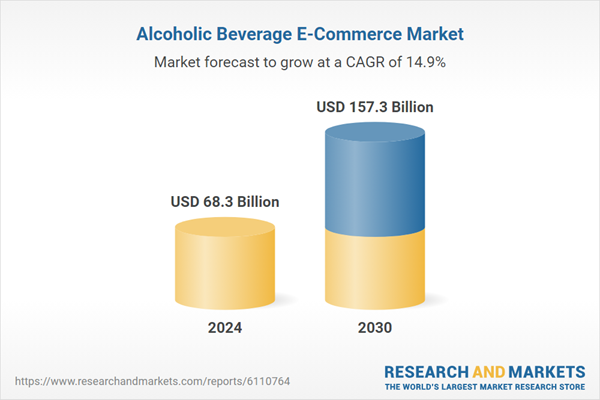

The report analyzes the Alcoholic Beverage E-Commerce market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below:- Segments: Alcohol Type (Wine & Champagne, Spirits, Beer, Other Alcohol Types); Price Point (Economy, Mid-Point, Luxury); Distribution Channel (Online Groceries, Online Distribution Channel, Licensed Specialty Retailers, Direct-to-Consumer Distribution Channel).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Wine & Champagne segment, which is expected to reach US$80.5 Billion by 2030 with a CAGR of a 16.8%. The Spirits segment is also set to grow at 11.0% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $18.6 Billion in 2024, and China, forecasted to grow at an impressive 20.1% CAGR to reach $34.5 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Alcoholic Beverage E-Commerce Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Alcoholic Beverage E-Commerce Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Alcoholic Beverage E-Commerce Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Ambev (Zé Delivery), Anheuser-Busch InBev, Boxed, Campari Group, Diageo and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 44 companies featured in this Alcoholic Beverage E-Commerce market report include:

- Ambev (Zé Delivery)

- Anheuser-Busch InBev

- Boxed

- Campari Group

- Diageo

- Drizly

- FreshDirect

- Gopuff (goBooze)

- Heineken

- Majestic Wine

- Minibar Delivery

- NakedWines.com

- Pernod Ricard

- ReserveBar

- Saucey

- Shipt (Alcohol)

- Tippsy (Sake)

- Tavour

- Winc

- Wine.com

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025 (E), competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Ambev (Zé Delivery)

- Anheuser-Busch InBev

- Boxed

- Campari Group

- Diageo

- Drizly

- FreshDirect

- Gopuff (goBooze)

- Heineken

- Majestic Wine

- Minibar Delivery

- NakedWines.com

- Pernod Ricard

- ReserveBar

- Saucey

- Shipt (Alcohol)

- Tippsy (Sake)

- Tavour

- Winc

- Wine.com

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 383 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 68.3 Billion |

| Forecasted Market Value ( USD | $ 157.3 Billion |

| Compound Annual Growth Rate | 14.9% |

| Regions Covered | Global |