Global Out-Of-Home Coffee Market - Key Trends & Drivers Summarized

Why Is Coffee Consumption Outside the Home Accelerating Across Demographics?

Out-of-home coffee consumption-including cafes, quick-service restaurants (QSRs), hotels, office buildings, convenience stores, and mobile carts-has become a defining feature of urban lifestyle and social interaction. As global coffee culture matures and consumers seek specialty brews, artisanal roasting, and personalized coffee experiences, demand for premium and customized coffee beverages outside the home is rising steadily. This growth is supported by rising disposable incomes, lifestyle changes, urbanization, and the increasing tendency to blend work, leisure, and consumption in public or semi-public settings.Millennials and Gen Z consumers are primary drivers of this segment, with preferences leaning toward cafe ambiance, beverage experimentation, and on-the-go convenience. The growth of co-working spaces and remote working models has further entrenched cafes and coffee chains as extensions of the workspace. Simultaneously, the popularity of cold brews, nitro coffee, oat milk lattes, and single-origin espresso variants reflects a shift from standardized offerings toward personalized, ethically sourced, and sensory-rich coffee experiences.

Technological advancements in point-of-sale (POS) systems, mobile ordering, and contactless payment are enabling faster service, order customization, and loyalty program integration-making out-of-home coffee more seamless and rewarding. Digital menus, app-based subscriptions, and targeted promotions are helping brands create sticky customer engagement strategies. The result is a diversified market spanning luxury cafes, drive-thru kiosks, convenience store counters, and self-serve coffee machines across workplaces and public areas.

How Are Business Models and Formats Evolving in the OOH Coffee Ecosystem?

The out-of-home coffee segment is no longer dominated solely by large cafe chains. The landscape now includes independent specialty cafes, in-store coffee counters in grocery stores, airport lounges, food trucks, and vending machine operators-all targeting different price points, tastes, and service speed expectations. While international brands like Starbucks, Costa Coffee, Tim Hortons, and Dunkin’ continue to expand globally through franchise and corporate-owned formats, local roasteries and boutique cafes are thriving on unique blends, Instagrammable spaces, and community engagement.Workplace coffee culture is evolving, with employers investing in premium coffee stations, automated espresso machines, and barista-style experiences to boost employee satisfaction and productivity. Hotels, gas stations, and convenience stores are also recognizing the revenue potential of quality coffee programs. Automatic bean-to-cup machines, now equipped with IoT monitoring and cashless interfaces, are making it viable to offer cafe-grade beverages in unattended formats.

Sustainability is becoming a core theme in OOH coffee operations. Brands are rethinking packaging (compostable cups, edible stirrers), sourcing (Rainforest Alliance and Fair Trade beans), and waste (used grounds recycling for cosmetics or compost). Circular economy models are emerging, especially among third-wave coffee brands that focus on traceability and social equity across the bean-to-cup journey. This aligns well with consumer values and influences brand preference in competitive retail environments.

Which Regional Markets and Consumer Segments Are Driving Growth Dynamics?

North America leads the global out-of-home coffee market in both consumption volume and brand diversity. The U.S. and Canada have well-developed cafe chains, strong drive-thru cultures, and rapidly growing specialty coffee communities. Urban centers like New York, Seattle, Toronto, and Vancouver continue to see innovation in brew techniques, alternative milk offerings, and artisanal flavor pairings. The rising number of suburban commuters and remote workers contributes to demand across diverse retail formats.Europe remains an epicenter of cafe culture, with Italy, France, Germany, and the UK at the forefront. While traditional espresso bars maintain their appeal, there is rising adoption of Nordic-style brews, third-wave micro-roasters, and cross-cultural fusions such as Turkish-style or Vietnamese drip coffees. Premiumization is visible across both Western and Eastern Europe, with experiential formats like cafe-bookstores, co-working cafes, and wellness-themed coffee shops on the rise.

Asia-Pacific is emerging as a powerhouse of growth, driven by urban youth, rising cafe penetration, and changing social norms around public consumption. China’s expanding middle class and South Korea’s trend-focused coffee market are driving double-digit growth in cafe launches and specialty offerings. India, Southeast Asia, and Australia are showing rapid format innovation, with cafes attached to fashion stores, libraries, and coworking spaces. The appeal of coffee as a lifestyle beverage rather than a functional stimulant is reshaping consumer behavior in these markets.

What Are the Primary Drivers Reshaping the Out-Of-Home Coffee Industry?

The growth in the global out-of-home coffee market is driven by evolving consumer preferences, premiumization of beverage offerings, expansion of service formats, and increasing integration of technology in ordering and personalization. As coffee becomes a cultural anchor and social facilitator, the demand for unique, high-quality, and customizable experiences outside the home is accelerating across both developed and emerging economies.Convenience remains a key growth lever-whether through self-serve kiosks at gas stations, barista robots in airports, or app-driven ordering for curbside pickup. Consumers expect consistency, speed, and personalization in every interaction. Meanwhile, health-conscious behaviors are influencing menus with lower-caffeine, non-dairy, and sugar-free variants, opening up new subsegments within the OOH market.

Brand strategies are evolving to emphasize community-building, sustainability credentials, and value-added partnerships. For instance, many chains are collaborating with artists, influencers, or local chefs to offer curated experiences that transcend basic coffee delivery. Global players like Starbucks and Costa are investing in AI-enabled demand forecasting, zero-waste stores, and energy-efficient brewing equipment to align with ESG goals.

With ongoing innovations in service design, automation, flavor exploration, and sustainability, the out-of-home coffee market continues to be a hotbed of consumer-centric transformation-offering ample growth opportunities for both global giants and niche disruptors in an increasingly caffeinated world.

Scope of the Report

The report analyzes the Out-of-Home Coffee market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below:- Segments: Category (Regular Coffee, Gourmet / Specialty Coffee).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Regular Coffee segment, which is expected to reach US$32.1 Billion by 2030 with a CAGR of a 3.3%. The Gourmet / Specialty Coffee segment is also set to grow at 1.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $10.4 Billion in 2024, and China, forecasted to grow at an impressive 5.5% CAGR to reach $8.8 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Out-of-Home Coffee Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Out-of-Home Coffee Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Out-of-Home Coffee Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Alsea S.A.B. de C.V., AmRest Holdings SE, Blue Bottle Coffee Company, Caribou Coffee Company, Costa Coffee and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Out-of-Home Coffee market report include:

- Alsea S.A.B. de C.V.

- AmRest Holdings SE

- Blue Bottle Coffee Company

- Caribou Coffee Company

- Costa Coffee

- Dunkin' (Inspire Brands)

- Ediya Co., Ltd.

- Gloria Jean's Coffees

- Greggs plc

- JDE Peet's N.V.

- Keurig Dr Pepper Inc.

- Luckin Coffee Inc.

- Massimo Zanetti Beverage Group

- McCafé (McDonald's)

- Nestlé Professional (Nestlé S.A.)

- Peet's Coffee

- Starbucks Corporation

- The Coffee Bean & Tea Leaf

- Tim Hortons Inc.

- Tully's Coffee

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025 (E), competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Alsea S.A.B. de C.V.

- AmRest Holdings SE

- Blue Bottle Coffee Company

- Caribou Coffee Company

- Costa Coffee

- Dunkin' (Inspire Brands)

- Ediya Co., Ltd.

- Gloria Jean's Coffees

- Greggs plc

- JDE Peet's N.V.

- Keurig Dr Pepper Inc.

- Luckin Coffee Inc.

- Massimo Zanetti Beverage Group

- McCafé (McDonald's)

- Nestlé Professional (Nestlé S.A.)

- Peet's Coffee

- Starbucks Corporation

- The Coffee Bean & Tea Leaf

- Tim Hortons Inc.

- Tully's Coffee

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

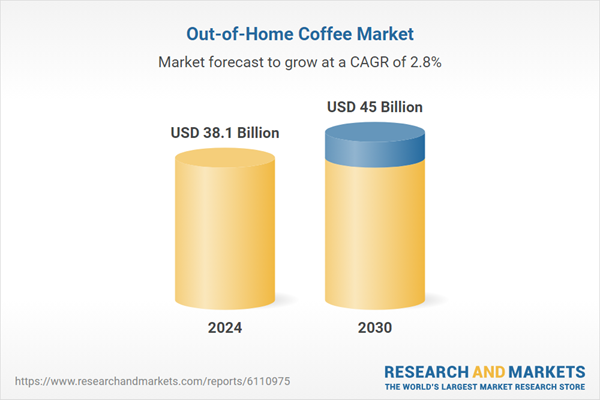

| Estimated Market Value ( USD | $ 38.1 Billion |

| Forecasted Market Value ( USD | $ 45 Billion |

| Compound Annual Growth Rate | 2.8% |

| Regions Covered | Global |