The Global Organic Feed Market Study provides a comprehensive analysis of the organic feed industry, tailored for industry experts seeking actionable insights into market trends, opportunities, and competitive dynamics. This study examines the market’s structure, key drivers, and emerging developments, offering a detailed perspective on the global organic feed landscape. By analyzing market segmentation, technological advancements, and regional trends, the Global Organic Feed Market Study equips stakeholders with the knowledge to navigate this rapidly evolving sector.

Market Overview and Scope

The organic feed market is witnessing robust growth, driven by increasing consumer demand for organic meat, dairy, and poultry products. The Global Organic Feed Market Study defines organic feed as animal feed produced without synthetic pesticides, fertilizers, or genetically modified organisms, adhering to stringent organic certification standards. The study covers various feed types (fodder, forage, compound feed), raw materials (cereals, grains, oilseeds, pulses), forms (liquid, dry), livestock categories (ruminants, swine, poultry, aquatic animals), and distribution channels (direct/bulk supply, retail, online). Geographically, it spans North America, South America, Europe, Middle East and Africa, and Asia Pacific, providing a granular analysis of regional market dynamics.Business and Technological Landscape

The Global Organic Feed Market Study identifies key market drivers, such as rising consumer awareness of sustainable farming practices and stringent regulations promoting organic agriculture. However, challenges like high production costs and supply chain complexities are also explored. Opportunities lie in expanding online distribution channels and adopting innovative feed processing technologies. The study includes a Porter’s Five Forces analysis to evaluate competitive intensity and an industry value chain analysis to highlight critical stages from raw material sourcing to distribution. Technological advancements, such as precision fermentation and plant-based feed additives, are also examined to provide insights into future market directions.Competitive Environment and Analysis

In the Global Organic Feed Market Study, the competitive environment is thoroughly assessed, focusing on major players and their strategic initiatives. The study highlights recent developments from key market players, such as Cargill, Incorporated and ADM, which have significantly shaped the competitive landscape. Cargill recently expanded its organic feed portfolio by launching a new line of non-GMO, soy-based compound feeds tailored for poultry and ruminants. This move aligns with growing demand for traceable, sustainable feed options and strengthens Cargill’s position in North America and Europe. Similarly, ADM has invested heavily in organic grain processing facilities, enhancing its supply chain capabilities to meet rising demand for organic cereals and oilseeds. These facilities incorporate advanced milling technologies to improve feed quality and consistency, giving ADM a competitive edge in the Asia Pacific and European markets.The Global Organic Feed Market Study also examines strategic collaborations and acquisitions. For instance, Aller Aqua Group has partnered with regional organic feed suppliers in the Middle East to expand its distribution network for organic aquatic feed, capitalizing on the region’s growing aquaculture sector. Additionally, Scratch and Peck Feeds has focused on direct-to-consumer models, leveraging online platforms to reach small-scale organic farmers in North America. These developments underscore the competitive strategies of differentiation and market expansion. The study further includes a market share analysis, competitive dashboard, and details on mergers, acquisitions, and agreements to provide a holistic view of the competitive dynamics.

Regional and Segmental Insights

The Global Organic Feed Market Study offers in-depth segmentation analysis across types, raw materials, forms, livestock, and distribution channels. For example, compound feed dominates due to its nutritional balance, while cereals and grains, particularly wheat and maize, lead the raw material segment. The study also highlights regional variations, with Europe holding a significant market share due to stringent organic regulations and consumer preferences. In contrast, Asia Pacific is emerging as a high-growth region, driven by increasing organic livestock production in China and India.Key Benefits of this Report:

- Insightful Analysis: Gain detailed market insights covering major as well as emerging geographical regions, focusing on customer segments, government policies and socio-economic factors, consumer preferences, industry verticals, and other sub-segments.

- Competitive Landscape: Understand the strategic maneuvers employed by key players globally to understand possible market penetration with the correct strategy.

- Market Drivers & Future Trends: Explore the dynamic factors and pivotal market trends and how they will shape future market developments.

- Actionable Recommendations: Utilize the insights to exercise strategic decisions to uncover new business streams and revenues in a dynamic environment.

- Caters to a Wide Audience: Beneficial and cost-effective for startups, research institutions, consultants, SMEs, and large enterprises.

What do businesses use our reports for?

Industry and Market Insights, Opportunity Assessment, Product Demand Forecasting, Market Entry Strategy, Geographical Expansion, Capital Investment Decisions, Regulatory Framework & Implications, New Product Development, Competitive IntelligenceReport Coverage:

- Historical data from 2022 to 2024 & forecast data from 2025 to 2030

- Growth Opportunities, Challenges, Supply Chain Outlook, Regulatory Framework, and Trend Analysis

- Competitive Positioning, Strategies, and Market Share Analysis

- Revenue Growth and Forecast Assessment of segments and regions including countries

- Company Profiling (Strategies, Products, Financial Information, and Key Developments among others).

Segmentation:

By Type

- Fodder

- Forage

- Compound Feed

By Raw Material

- Cereals & grains

- Wheat

- Maize

- Barley

- Oilseeds

- Soybean

- Rapeseed

- Others

- Pulses

- Others

By Form

- Liquid

- Dry

By Livestock

- Ruminants

- Swine

- Poultry

- Aquatic Animals

- Others

By Distribution Channel

- Direct/Bulk Supply

- Retail

- Online Channels

By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- UK

- Germany

- France

- Spain

- Italy

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Indonesia

- Taiwan

- Thailand

- Others

Table of Contents

Companies Mentioned

- ADM

- Aller Aqua Group

- Purina Animal Nutrition LLC.

- Scratch and Peck Feeds

- Cargill, Incorporated

- THE ORGANIC FEED COMPANY

- Feedex Companies

- COUNTRY JUNCTION FEEDS

- Yorktown Organics, LLC

- Unique Organics

- ForFarmers

Table Information

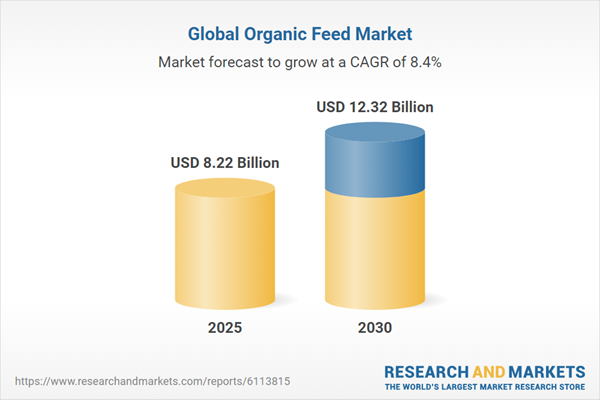

| Report Attribute | Details |

|---|---|

| No. of Pages | 140 |

| Published | June 2025 |

| Forecast Period | 2025 - 2030 |

| Estimated Market Value ( USD | $ 8.22 Billion |

| Forecasted Market Value ( USD | $ 12.32 Billion |

| Compound Annual Growth Rate | 8.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |