Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

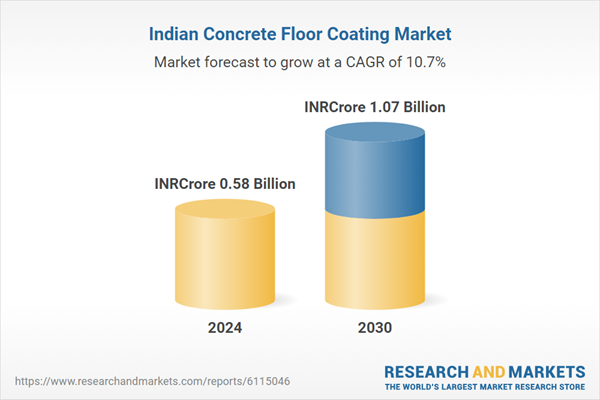

Backed by favorable macroeconomic conditions, evolving safety and environmental regulations, and a growing focus on maximizing infrastructure lifecycle value, the market offers significant growth opportunities across industrial, commercial, and institutional segments.

Key Market Drivers

Rapid Industrialization and Warehousing Growth

Rapid industrialization and the exponential growth of warehousing infrastructure are among the most influential forces accelerating the expansion of the India Concrete Floor Coating Market. India’s industrial sector is demonstrating solid momentum, with the Economic Survey 2024-25 forecasting a 6.2% growth for FY25, primarily supported by robust performances in the electricity and construction segments. Notably, the manufacturing sector recorded an impressive 11.6% year-on-year growth in a recent quarter, reflecting increased production activity and operational capacity utilization. Meanwhile, the construction sector posted a strong 9.5% expansion, underscoring the sustained demand for infrastructure and real estate development across the country. India's industrial landscape is expanding rapidly, driven by initiatives such as ‘Make in India’, PLI (Production-Linked Incentive) schemes, and significant foreign direct investment (FDI) in manufacturing sectors like automotive, pharmaceuticals, electronics, and chemicals.Industrial floors are subjected to high mechanical loads, vibration, and movement of heavy machinery. Concrete floor coatings especially epoxy and polyurethane systems offer necessary resistance against wear, abrasion, and chemical spillage. Many industries, especially in pharmaceuticals, food processing, and cleanroom manufacturing, are required to maintain hygienic, seamless, and slip-resistant flooring surfaces to meet compliance standards. Concrete floor coatings help meet these strict requirements efficiently. Coated concrete floors are easier to clean and maintain, helping reduce downtime and increase productivity in fast-paced industrial settings.

As more industrial zones and special economic zones (SEZs) are developed, the demand for high-performance flooring systems continues to rise proportionately. India’s Special Economic Zones (SEZs) have experienced substantial expansion following the enactment of the SEZ Act in 2005. Since then, there has been a marked increase in capital investment, export volume, and job creation within these zones. As of now, 280 SEZs are fully operational, reflecting the government's continued focus on fostering export-driven industrial hubs with streamlined regulatory frameworks and infrastructure support.

India’s warehousing sector has been undergoing a structural transformation, largely driven by the growth of e-commerce, organized retail, and 3PL (third-party logistics) players. Warehouses experience constant movement of forklifts, pallet jacks, and trolleys. Concrete floor coatings provide smooth, impact-resistant surfaces that can withstand repeated mechanical stress. Large warehouses often struggle with dust and debris on bare concrete floors.

Floor coatings seal the surface, making it dust-free and easier to maintain hygiene standards, especially important in FMCG and pharmaceutical storage. Warehousing operations require fast turnaround times during renovation or expansion. Fast-curing systems like polyaspartic coatings are increasingly being adopted for their quick setting times and reduced operational disruption. This sector alone is creating substantial volume-based demand for concrete floor coatings across metros, Tier 2 cities, and industrial corridors.

Key Market Challenges

Lack of Skilled Applicators and Standardized Installation Practices

One of the most persistent challenges is the shortage of skilled professionals capable of executing high-quality floor coating applications. Concrete floor coatings require precise surface preparation, mixing, and application techniques. Any deviation can compromise performance, durability, and appearance.Formal training programs for floor coating applicators are scarce in India. Most technicians learn through informal channels, leading to inconsistency in workmanship. Due to the absence of standard operating procedures (SOPs), outcomes often vary widely from one project to another, resulting in customer dissatisfaction and rework. Even high-quality coating products can fail if poorly applied, damaging the credibility of manufacturers and deterring potential users from adopting advanced systems like polyaspartics or polyurethane. This challenge highlights the urgent need for industry-wide training programs, certification standards, and quality control protocols.

Key Market Trends

Integration of Smart Coating Technologies

A prominent trend shaping the future of the Indian floor coatings industry is the rise of smart and functional coatings designed to deliver performance beyond mere surface protection.Emerging innovations are leading to floor coatings that can automatically repair micro-cracks, thus extend service life and reducing maintenance. With the rapid growth of electronics manufacturing, data centers, and pharmaceutical facilities in India, demand for electrostatic discharge (ESD)-resistant coatings is increasing. Though still in the early stage in India, there is growing global interest in coatings that change color with temperature or contain embedded sensors for wear monitoring, which could see gradual adoption in high-tech Indian sectors. This trend represents a move towards intelligent infrastructure, where coatings not only protect but also interact with their environment.

Key Market Players

- Akzo Nobel N.V.

- Asian Paints

- Berger Paints India Limited

- Kansai Nerolac

- Nippon Paints

Report Scope:

In this report, the India Concrete Floor Coating Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:India Concrete Floor Coating Market, By Product:

- Epoxy

- Polyurethane

- Polyaspartic

- Others

India Concrete Floor Coating Market, By Application:

- Indoor

- Outdoor

India Concrete Floor Coating Market, By Region:

- North India

- South India

- East India

- West India

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the India Concrete Floor Coating Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Akzo Nobel N.V.

- Asian Paints

- Berger Paints India Limited

- Kansai Nerolac

- Nippon Paints

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 85 |

| Published | July 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( INRCrore | INRCrore 0.58 Billion |

| Forecasted Market Value ( INRCrore | INRCrore 1.07 Billion |

| Compound Annual Growth Rate | 10.7% |

| Regions Covered | India |

| No. of Companies Mentioned | 5 |