World Tires Market Analysis

Tire is a circular, elastic part fitted onto a vehicle's wheel rim that transmits power, reduces shock, and carries the weight of the vehicle. Natural or synthetic rubber and reinforcing materials such as steel or textile are usually used to manufacture tires, which are made to serve in different road and climatic conditions. Radial, tubeless, winter, all-season, and performance tires are various types of tires depending on their use.Tires are vital for vehicle safety, fuel economy, and comfort. They find application in many modes of transportation, including cars, trucks, buses, motorcycles, bicycles, aircraft, and heavy equipment. In recent years, with the improvement in car technology, tires have come equipped with features such as run-flat tires, low rolling resistance, and environmental friendliness.

Globally, tire demand is continuously expanding with the rise in vehicle possession, urbanization, and growth in the logistics and e-commerce industries. Furthermore, sustainability projects and heightened interest in electric vehicles are compelling companies to develop new designs for tires, further catapulting their global applicability and demand in the transportation and mobility industries.

Growth Drivers in the Global Tires Market

Increasing Vehicle Production and Ownership

One of the most significant growth drivers for the global tire market has been the consistent growth in vehicle production and ownership, particularly across emerging nations. The demand for OEM as well as replacement tires increases in parallel with growing access to mobility solutions at affordable costs. Urbanization as well as a boost in per capita disposable incomes in countries such as India, China, and Brazil is causing this surge. Also, increasing logistics and transportation industries further increase the demand for commercial vehicle tires, providing a larger customer base for tire companies. December 2023, Sailun Group said it is to increase its investment in a new tire factory in León, Guanajuato, Mexico. This project is being implemented in the form of a joint venture (JV) with TD International Holding, a Mexican company, to increase Sailun's manufacturing capacity in North America and maximize its global supply chain. The factory will manufacture different types of tires, such as those for passenger vehicles, light trucks, and commercial trucks, to cater to regional and international market requirements.Technological Upgrades in Tire Production

The tire sector is facing dramatic change with the improvement of smart tire technology, green materials, and new tread patterns. Firms are investing heavily in research and development to produce tires that consume less fuel, are safer, and have a longer life. Major innovations like run-flat, noise-reducing tread, and environmentally friendly materials are especially appealing to green consumers and are generating demand in premium market segments. In May 2023, Kumho Petrochemical Co., Ltd. (KKPC) and Hankook Tire & Technology made a significant move by signing a Memorandum of Understanding (MOU) to promote sustainable tires. Their partnership is centered on the development of solution-polymerized styrene-butadiene rubber (Eco-SSBR) under their sustainability drive.Expansion in Electric and Hybrid Vehicles

The growing worldwide uptake of electric cars (EVs) is driving a separate market demand for EV-specific tires that meet their specific needs. EVs require tires with reduced rolling resistance and high torque tolerance. In light of this, top tire companies are investing in the production of tires compatible with electric cars, which is expected to significantly boost market expansion over the next few years. For example, Sumitomo Rubber Industries Ltd. launched in March 2023 the FALKEN "e. ZIEX," a new series of replacement tires exclusively for electric vehicles. The FALKEN brand will offer maximum fuel efficiency through this product.Global Tires Market Challenges

Volatility in Raw Materials Price

The world tire industry generates a large portion of its dependence on major raw materials, such as natural rubber, synthetic rubber, and crude oil derivatives. Prices for these commodities tend to range widely, and are frequently affected by geopolitical tensions and fluctuating weather patterns. This volatility affects the level of predictability in manufacturing costs, which can then affect pricing strategies and profit margins for producers. This uncertainty is, therefore, a significant challenge to the industry.Environmental Regulations and Sustainability Pressure

Governments globally are in the process of reinforcing regulations on tire production and disposal. Pressure to decrease carbon emissions and move towards sustainable processes is pushing businesses to invest in cleaner technologies, which might be expensive. Also, illegal tire dumping and non-biodegradable waste are issues of environmental concern, which is a significant challenge for the industry to pursue sustainability.Global Radial Tires Market

The radial tire market globally is mainly influenced by their excellent performance features. Radial tires benefit from improved fuel economy, better traction, and longer tread life, which qualifies them as a favorite for passenger vehicles as well as commercial ones. Their design is one of the foremost advantages that reduces heat generation and road friction, allowing them to perform at high speeds. This structural advantage contributes importantly to sustained demand for radial tires throughout the global automotive sector.Global Bias Tires Market

Bias tires, or cross-ply tires, are mainly fitted in heavy-duty vehicles and farm machinery. Although their market share decreased due to radial tires, they are still essential in areas of poor terrain or certain load-carrying capacities. The strength of their sidewalls and relatively low price make them ideal for off-road use and industrial situations where toughness is more important than comfort.Global OEM Tires Market

OEM tires are delivered to auto makers at the time of new vehicle assembly. Increasing vehicle manufacturing worldwide directly increases OEM tire demand. Vehicle OEMs partner with tire makers for special solutions that match vehicle performance, safety, and fuel efficiency standards. Premium and mid-size vehicle segments are the key drivers of OEM tire consumption across the world.Global Passenger Cars Tires Market

The tires market for passenger cars is a big segment fueled by growing consumer car ownership. Urban life, earnings growth, and extended commuting requirements underpin steady demand. Consumers also often replace old tires, stimulating replacement business. Tire improvements in safety, fuel efficiency, and seasonal types such as winter and all-weather tires improve market expansion.Global Two-Wheelers Tires Market

The market for the two-wheelers tire is expanding immensely, particularly in Asia-Pacific nations such as India, Vietnam, and Indonesia. The high usage of scooters and motorcycles as economical modes of travel increases tire sales. Replacement cycles are fairly high because of diverse road conditions, which maintains a consistent aftermarket. Innovations in tubeless and puncture-resistant tires also contribute to growth.United States Tires Market

The United States tire market is mature and innovation-driven. With a high vehicle-per-capita ratio, both OEM and replacement segments see steady demand. Consumers are increasingly favoring fuel-efficient and all-season tires. Regulatory standards encourage safety and environmental compliance, pushing manufacturers toward sustainable practices. Premium tire brands and specialty segments like SUV tires are highly popular.France Tires Market

France's automobile manufacturing base is strong and supports the tire market with strict quality controls. Consumers are focused on safety and performance of tires because of regular driving conditions in urban and rural areas. Winter tire use laws in certain areas also enhance seasonal sales. The nation also focuses on environmentally friendly and low-rolling-resistance tires in accordance with EU sustainability targets.India Tires Market

India's automotive tire market is growing quickly with an increasing automotive industry and infrastructure growth. Two-wheelers lead in terms of volumes, and there is a growing demand for passenger and commercial vehicle tires. Government programs such as "Make in India" and increased vehicle exports are encouraging local manufacturing. The trend towards commercial vehicle radialization is also affecting the market. March 2025, CEAT introduced its new SportDrive series of tyres in India with three cutting-edge innovations for ultra-luxury and high-performance vehicles and SUVs. The ultra-high performance and run-flat tyres are meticulously tested in Germany. The run-flat technology enables cars to keep running for a temporary period even after a puncture, providing added safety and convenience. These are high-end tyres that cost between ₹15,000 to ₹20,000 per tyre and serve the luxury sedans and SUVs.Brazil Tires Market

Brazil's tire market is driven by its huge agricultural and commercial vehicle fleet. The replacement tire market is high in the face of rugged terrain and frequent usage. Import reliance and currency fluctuations can affect prices, but domestic production is on the rise. The automotive sector's increasing exports and infrastructure developments in the country contribute well to long-term tire market expansion.Saudi Arabia Tires Market

Saudi Arabia's tire industry is influenced by extreme climatic conditions, necessitating strong, heat-absorbing tires. Passenger vehicles and light commercial vehicles dominate demand. As vehicle sales improve and tourism facilities develop, tire usage is on the increase. The aftermarket is active as a result of high replacements due to roadwear and heat. November 2024, Saudi Arabia's Black Arrow tyre Co., or Blatco, and Thailand's Golden Star Rubber Co. have joined forces to establish the largest tyre factory in the Middle East in Yanbu, with a USD 470 million investment. The factory will initially have the capacity to produce 4 million tyres per year with an aim to grow to 6 million tyres per annum.Market Segmentation

Design

- Radial Market

- Bias Market

End-Use

- OEM Market

- Replacement Market

Vehicle Type

- Passenger Cars

- Light Commercial Vehicles

- Medium and Heavy Commercial Vehicles

- Two Wheelers

- Three Wheelers

- Off-The-Road (OTR)

Distribution Channel

- Offline

- Online

Countries

North America

- United States

- Canada

Europe

- France

- Germany

- Italy

- Spain

- United Kingdom

- Belgium

- Netherlands

- Turkey

Asia-Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Malaysia

- Indonesia

- Australia

- New Zealand

Latin America

- Brazil

- Mexico

- Argentina

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

Key Players Analysis (Overviews, Key Persons, Recent Developments, SWOT Analysis, Revenue Analysis)

- Apollo Tyres Ltd.

- Bridgestone Corporation

- Continental AG

- Hankook Tire & Technology Co., Ltd.

- MRF Tyres

- Sumitomo Rubber Industries, Ltd.

- The Goodyear Tire and Rubber Company

- The Michelin Group

- Toyo Tire CorporationYokohama Tire Corporation

Table of Contents

Companies Mentioned

The major companies profiled in this Tires market report include:- Apollo Tyres Ltd.

- Bridgestone Corporation

- Continental AG

- Hankook Tire & Technology Co., Ltd.

- MRF Tyres

- Sumitomo Rubber Industries, Ltd.

- The Goodyear Tire and Rubber Company

- The Michelin Group

- Toyo Tire CorporationYokohama Tire Corporation

Methodology

In this report, for analyzing the future trends for the studied market during the forecast period, the publisher has incorporated rigorous statistical and econometric methods, further scrutinized by secondary, primary sources and by in-house experts, supported through their extensive data intelligence repository. The market is studied holistically from both demand and supply-side perspectives. This is carried out to analyze both end-user and producer behavior patterns, in the review period, which affects price, demand and consumption trends. As the study demands to analyze the long-term nature of the market, the identification of factors influencing the market is based on the fundamentality of the study market.

Through secondary and primary researches, which largely include interviews with industry participants, reliable statistics, and regional intelligence, are identified and are transformed to quantitative data through data extraction, and further applied for inferential purposes. The publisher's in-house industry experts play an instrumental role in designing analytic tools and models, tailored to the requirements of a particular industry segment. These analytical tools and models sanitize the data & statistics and enhance the accuracy of their recommendations and advice.

Primary Research

The primary purpose of this phase is to extract qualitative information regarding the market from the key industry leaders. The primary research efforts include reaching out to participants through mail, tele-conversations, referrals, professional networks, and face-to-face interactions. The publisher also established professional corporate relations with various companies that allow us greater flexibility for reaching out to industry participants and commentators for interviews and discussions, fulfilling the following functions:

- Validates and improves the data quality and strengthens research proceeds

- Further develop the analyst team’s market understanding and expertise

- Supplies authentic information about market size, share, growth, and forecast

The researcher's primary research interview and discussion panels are typically composed of the most experienced industry members. These participants include, however, are not limited to:

- Chief executives and VPs of leading corporations specific to the industry

- Product and sales managers or country heads; channel partners and top level distributors; banking, investment, and valuation experts

- Key opinion leaders (KOLs)

Secondary Research

The publisher refers to a broad array of industry sources for their secondary research, which typically includes, however, is not limited to:

- Company SEC filings, annual reports, company websites, broker & financial reports, and investor presentations for competitive scenario and shape of the industry

- Patent and regulatory databases for understanding of technical & legal developments

- Scientific and technical writings for product information and related preemptions

- Regional government and statistical databases for macro analysis

- Authentic new articles, webcasts, and other related releases for market evaluation

- Internal and external proprietary databases, key market indicators, and relevant press releases for market estimates and forecasts

LOADING...

Table Information

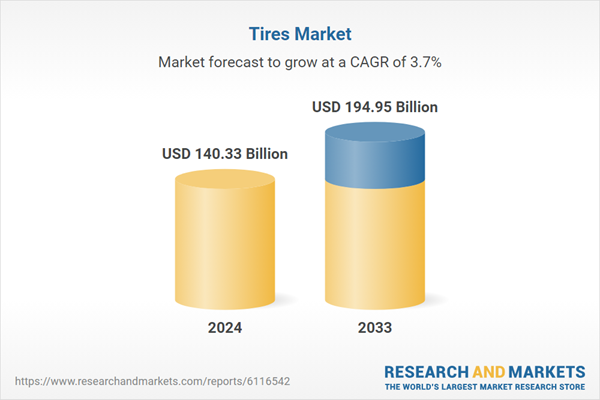

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | July 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 140.33 Billion |

| Forecasted Market Value ( USD | $ 194.95 Billion |

| Compound Annual Growth Rate | 3.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |