Speak directly to the analyst to clarify any post sales queries you may have.

An in-depth introduction to Clonixin dynamics highlighting clinical demand, formulation diversity, and evolving care pathways that shape strategic decision-making

The introductory landscape for Clonixin is marked by converging clinical demand and evolving delivery technologies that shape how stakeholders approach pain management therapeutics. Clonixin, as an established NSAID-class analgesic in several jurisdictions, has demonstrated clinical relevance across acute dental pain, dysmenorrhea, headache and migraine, musculoskeletal disorders, and postoperative pain. These therapeutic applications create differentiated prescribing patterns, influenced both by formulation advantages and the settings in which care is delivered. In recent years, prescribers and procurement teams have shown heightened interest in formulations that optimize onset of action, tolerability, and ease of administration.Against this backdrop, formulation diversity plays a critical role. Injectable solutions targeted for intramuscular and intravenous administration remain important in hospital and surgical settings where rapid analgesia is essential, while oral tablets-available as capsules, tablets, and oral suspensions-support outpatient and homecare management where adherence and convenience matter. Topical forms, including creams and gels, continue to be developed to provide localized effects with reduced systemic exposure, appealing to clinicians seeking to mitigate gastrointestinal and systemic risks associated with oral NSAIDs.

Taken together, these dynamics underscore a market environment where clinical utility, route of administration, distribution pathways, and end-user needs intersect. A nuanced understanding of these factors is vital for product teams, formulary committees, and commercial strategists aiming to align development and market access plans with real-world care pathways and patient preferences.

Transformative shifts in safety regulation, formulation innovation, and healthcare delivery that are reshaping Clonixin commercialization and clinical adoption

The market landscape for Clonixin is undergoing transformative shifts driven by regulatory emphasis on patient safety, technological advances in formulation and delivery, and changes in healthcare delivery models. Regulatory authorities are increasingly focused on post-marketing surveillance and real-world evidence, prompting manufacturers to allocate more resources to safety studies and pharmacovigilance programs. Concurrently, formulation science has advanced, enabling improved bioavailability for oral preparations and more stable topical matrices, while parenteral administration benefits from refined excipient selections and syringe-ready presentations.Health systems are also adapting care pathways to favor outpatient management and minimally invasive procedures, which elevates demand for oral tablets and topical gels that enable early discharge and home-based care. At the same time, hospital reliance on injectable solutions for acute perioperative pain remains resilient, driving continuous optimization of intramuscular and intravenous dosing strategies. Distribution channels are shifting as well; online pharmacies and digital prescribing platforms expand reach and convenience, while hospital and retail pharmacies maintain critical roles in acute and chronic care settings.

These shifts are reshaping commercial and clinical strategies. Manufacturers must balance investment across multiple formulations, invest in lifecycle management that emphasizes safety and differentiation, and cultivate partnerships across hospital systems, ambulatory centers, and digital health providers. The net effect is a landscape that rewards agility, evidence-based differentiation, and close alignment with evolving care models.

Cumulative operational consequences of recent United States tariff adjustments on procurement, supply chain resilience, and clinical availability for Clonixin therapies

Policy measures enacted in and around 2025, specifically adjustments to tariffs and trade policies by the United States, have imparted a cumulative impact across pharmaceutical supply chains that extend to active ingredients, excipients, and finished formulations used in Clonixin therapies. Tariff-related cost pressures have prompted firms to reassess sourcing strategies, with procurement teams conducting granular cost-to-serve analyses and exploring alternative supply bases that reduce exposure to tariff volatility. Manufacturers with vertically integrated procurement or flexible contract manufacturing networks have been better positioned to absorb or mitigate incremental input costs.Beyond procurement, tariffs influenced logistics choices and inventory management practices. Firms extended lead times for critical inputs to buffer against price fluctuations and customs delays, while some shifted toward regionalized supply chains that prioritize resilience over lowest-cost sourcing. Regulatory filing strategies were adjusted to accommodate new supplier qualification timelines, and quality teams intensified supplier audits to ensure continuity and compliance when alternate vendors were engaged.

Clinically, these operational adjustments affected availability patterns for specific formulations in certain regions, with hospital pharmacies and procurement departments adapting purchasing behavior to ensure uninterrupted access for acute care settings. The broader implication is that trade policy changes catalyze operational contingency planning across manufacturing, quality, regulatory, and commercial functions, reinforcing the importance of diversified sourcing and agile supply-chain governance to sustain product availability and patient care continuity.

Key segmentation-driven insights that connect formulation types, clinical applications, distribution channels, and end-user requirements to actionable product and market strategies

Segmentation insights reveal that formulation choice, therapeutic application, distribution channels, and end-user settings each exert distinct strategic implications for product development and market engagement. When viewed through formulation lenses, injectable solutions demand attention to intramuscular and intravenous characteristics that support rapid-onset therapy in acute and perioperative settings, while oral tablets-available as capsules, tablets, and oral suspensions-must balance bioavailability, palatability, and adherence considerations across outpatient and homecare use. Topical preparations, formulated as creams and gels, emphasize localized efficacy and reduced systemic exposure, appealing to clinicians and patients seeking targeted pain relief with lower systemic risk.Application-focused segmentation underscores varied clinical pathways: dental pain management prioritizes rapid onset and convenient dosing for short-term use; dysmenorrhea treatments require predictable, tolerable regimens that fit cyclical use patterns; headache and migraine therapies benefit from formulations offering fast relief and minimal adverse effects; musculoskeletal pain management often integrates both systemic and topical approaches depending on chronicity and patient comorbidities; postoperative pain calls for coordination with anesthetic and surgical teams to achieve multimodal analgesia. Distribution channels shape access dynamics, with hospital pharmacies serving acute inpatient needs, retail pharmacies enabling community availability, and online pharmacies expanding reach for outpatient and home-delivered solutions.

End-user segmentation frames procurement and adoption behaviors: ambulatory care centers and dental clinics prioritize ease of administration and rapid therapeutic effect; homecare settings emphasize safety, adherence supports, and patient education; hospitals and surgical centers require formulations compatible with established perioperative protocols; research and academic institutes value data-rich products that support comparative studies and post-market research. Strategic initiatives that tailor product attributes, evidence generation, and commercial models to these intersecting segmentation dimensions will find stronger alignment with clinical workflows and purchasing priorities.

Regional dynamics across Americas, Europe Middle East & Africa, and Asia-Pacific that dictate differentiated regulatory, distribution, and commercialization approaches for Clonixin

Regional dynamics are central to strategic planning for Clonixin, with each global region exhibiting distinct regulatory, distribution, and clinical practice patterns that influence product prioritization. In the Americas, formulary processes and payer negotiations often influence the commercial trajectory for new and reformulated products, while established hospital networks and outpatient clinics create a structured pathway for both injectable and oral therapies. Regulatory frameworks and post-market surveillance expectations in the region underscore the importance of robust safety data and pharmacovigilance systems.Across Europe, the Middle East & Africa, heterogeneous regulatory regimes and procurement mechanisms demand adaptable market access strategies. In certain European markets, centralized and national reimbursement mechanisms require tailored health economic evidence, whereas in Middle Eastern and African contexts, distribution partnerships and supply-chain logistics frequently determine availability and uptake. These regions also present opportunities for topical and oral formulations that align with outpatient management trends.

The Asia-Pacific region is characterized by rapid adoption of digital health platforms and expanding retail and online pharmacy channels, which facilitate broader patient access to oral and topical products. Manufacturing scale and active pharmaceutical ingredient production capacity in parts of Asia-Pacific also shape global sourcing patterns, prompting strategic engagement with regional partners for both commercial presence and supply stability. Together, these regional distinctions necessitate differentiated regulatory, commercial, and operational playbooks to effectively support product launches and lifecycle management.

Company-level strategies that combine formulation differentiation, operational resilience, and targeted evidence generation to strengthen competitive positioning for Clonixin

Company-level dynamics in the Clonixin space reflect a spectrum of strategic choices, from firms emphasizing formulation innovation and lifecycle extension to organizations prioritizing supply chain integration and regulatory demonstration of safety. Leading manufacturers that invest in formulation science-improving bioavailability for oral forms or enhancing topical delivery systems-can create clear clinical and commercial differentiation that resonates with prescribers and procurement committees. Those that align clinical trial designs and post-marketing studies with real-world practice generate compelling evidence for formulary inclusion and guideline consideration.Operationally, companies that have developed flexible manufacturing networks and diversified supplier relationships demonstrate greater resilience when confronted with trade policy shifts or input shortages. Quality systems that support rapid supplier qualification and rigorous audit programs help preserve product continuity. Commercial organizations that cultivate relationships across hospital networks, ambulatory centers, dental clinics, and digital pharmacy platforms gain advantages in distribution breadth and adoption velocity. Strategic collaborations with research institutions and clinical investigators further strengthen evidence generation and thought-leader engagement.

In summary, companies that combine technical differentiation, operational resilience, and targeted evidence strategies position themselves to navigate complex regulatory and procurement environments while capturing clinician and patient trust through demonstrated performance and reliability.

Actionable recommendations for leaders to pair immediate supply resilience with targeted formulation innovation and evidence strategies to drive durable competitive advantage

Industry leaders should adopt a dual approach that pairs near-term operational resilience with long-term clinical differentiation to secure sustainable advantage in the Clonixin landscape. In the near term, firms must prioritize supply-chain diversification and robust supplier qualification processes to mitigate exposure to trade policy shifts and logistics disruptions. This includes expanding regional manufacturing capabilities and establishing contingency inventory strategies that balance service levels with working capital constraints. Simultaneously, investment in pharmacovigilance and real-world evidence capabilities will address regulatory expectations and support confidence among clinicians and payers.Over the medium and long term, companies should accelerate formulation innovation that responds to distinct clinical applications and care settings-optimizing injectable profiles for acute care, refining oral tablet bioavailability for outpatient adherence, and enhancing topical matrices for localized pain management. Evidence generation should be targeted, pragmatic, and aligned to payer and prescriber decision criteria, emphasizing safety, tolerability, and meaningful improvements in patient-reported outcomes. Commercially, organizations need to cultivate integrated channel strategies that leverage hospital partnerships, retail and online pharmacy reach, and digital health platforms to support adherence and patient education.

Taken together, these actions create a complementary posture that protects supply continuity while advancing product differentiation and market access, enabling organizations to respond to current challenges and capture opportunities as care models evolve.

A rigorous mixed-methods research approach combining clinician interviews, regulatory review, and supply-chain analysis to generate actionable insights across Clonixin segments

The research methodology underpinning this analysis integrates qualitative expert interviews, regulatory and clinical literature synthesis, and operational supply-chain review to produce a multidimensional perspective on Clonixin dynamics. Primary insights derive from structured discussions with clinicians, hospital pharmacists, procurement specialists, formulary committee members, and manufacturing leads, providing a practical view of therapeutic preferences, administration settings, and procurement drivers. Secondary sources include peer-reviewed clinical studies, regulatory guidance documents, and industry publications that illuminate safety considerations, formulation science, and distribution trends.Operational assessments incorporated supplier mapping, logistics flow analysis, and scenario-based evaluation of trade policy impacts to identify vulnerabilities and resilience levers across manufacturing and distribution networks. Segmentation analysis combined clinical application, formulation type, distribution channel, and end-user setting to surface actionable alignment opportunities between product attributes and care pathways. Regional intelligence was built through jurisdiction-specific regulatory review and stakeholder interviews to ensure recommendations reflect local practice patterns and procurement mechanisms.

The methodology emphasizes triangulation across data sources to validate findings, with sensitivity to areas where evidence may be evolving. This approach ensures that insights are grounded in both practitioner experience and documented science, enabling pragmatic recommendations that are operationally feasible and clinically relevant.

A conclusive synthesis of how formulation choice, clinical applications, supply resilience, and regional nuances collectively determine strategic priorities for Clonixin

In conclusion, the Clonixin landscape presents a complex interplay of formulation choices, clinical applications, distribution pathways, and regional nuances that together shape product prioritization and commercial strategy. Injectable solutions retain critical importance for acute and perioperative care, oral tablets continue to meet the needs of outpatient and home-based management, and topical creams and gels offer targeted approaches that reduce systemic exposure. These formulation dynamics intersect with application-specific requirements-dental pain, dysmenorrhea, headache and migraine, musculoskeletal pain, and postoperative pain-necessitating tailored evidence and engagement strategies.Operational pressures, including trade policy shifts and supply-chain disruptions, underscore the value of diversified sourcing, flexible manufacturing, and enhanced pharmacovigilance. Companies that invest in formulation differentiation, real-world evidence, and integrated distribution strategies will better align with evolving care models and payer expectations. Regional differences across the Americas, Europe, Middle East & Africa, and Asia-Pacific require localized regulatory and commercial playbooks to ensure that product introductions and lifecycle management plans resonate with market realities.

Ultimately, stakeholders who balance operational resilience with clinically grounded innovation will be best positioned to support clinicians and patients while navigating the regulatory and procurement complexities inherent to modern healthcare systems.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

16. China Clonixin Market

Companies Mentioned

The key companies profiled in this Clonixin market report include:- Adooq Bioscience LLC.

- Bayer AG

- Cayman Chemical

- Chemicea Pharmaceuticals Pvt Ltd

- ChemScene LLC

- Conscientia Industrial Co Ltd

- GlaxoSmithKline plc

- Merck KGaA

- Santa Cruz Biotechnology

- SimSon Pharma Limited

- Takeda Pharmaceutical Company Limited

- TargetMol Chemicals Inc.

- Teva Pharmaceutical Industries Ltd.

- Thermo Fisher Scientific Inc.

- VWR International

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 181 |

| Published | January 2026 |

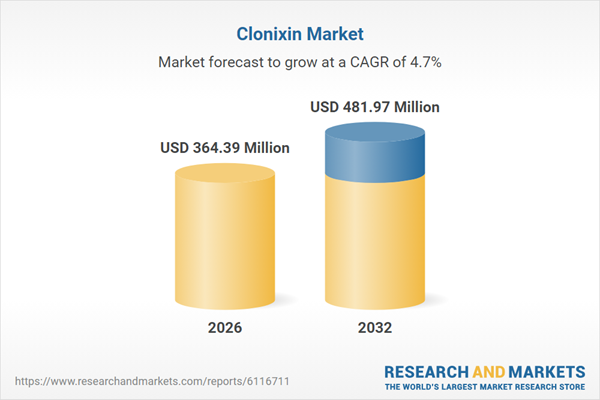

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 364.39 Million |

| Forecasted Market Value ( USD | $ 481.97 Million |

| Compound Annual Growth Rate | 4.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 16 |