Speak directly to the analyst to clarify any post sales queries you may have.

Exploring the Evolution and Strategic Imperatives of the Electric Motorcycle Market as It Accelerates Adoption Across Consumer and Commercial Verticals

The electric motorcycle sector is witnessing a profound evolution as legacy combustion engines give way to battery-powered platforms across both consumer and commercial environments. Growing societal emphasis on sustainability, combined with rapid advancements in battery energy density, has elevated electric motorcycles from niche novelty to mainstream contender. As urban centers grapple with air quality concerns and municipalities implement low-emission zones, the allure of silent, zero-emission two-wheelers is becoming undeniable. Consequently, manufacturers are prioritizing lightweight materials and modular architectures to optimize performance without sacrificing range.Moreover, shifting consumer preferences toward connected and smart mobility solutions are reshaping the competitive landscape. Early adopters value integrated digital interfaces that provide real-time telemetry, navigation, and over-the-air software updates. In parallel, fleet operators in logistics and shared-mobility services are exploring electric motorcycles for last-mile deliveries, drawn by the promise of lower total cost of ownership and reduced maintenance overheads. This dual momentum in retail and commercial applications underscores the strategic imperative for stakeholders to refine their value propositions.

In light of these developments, this report offers a comprehensive introduction to the transformative forces at play. It examines how regulatory frameworks, infrastructure rollouts, and evolving consumer behaviors converge to drive electrification. By setting the stage with macroeconomic trends and technological enablers, this introduction lays the groundwork for deeper analysis in subsequent sections. Ultimately, industry participants will gain clarity on the strategic imperatives necessary to navigate an ecosystem defined by rapid innovation and shifting market dynamics.

Disruptive Technological Advances and Policy Innovations Driving Unprecedented Transformation in the Electric Motorcycle Sector Globally

The electric motorcycle landscape is undergoing a fundamental transformation propelled by disruptive technological breakthroughs and supportive policy interventions. Solid-state battery prototypes promise higher energy densities and enhanced safety profiles, challenging the long-standing dominance of lithium-ion chemistries. Simultaneously, rapid prototyping techniques and digital twin simulations enable manufacturers to accelerate design cycles, reducing time to market while ensuring rigorous validation of novel powertrain architectures. As a result, OEMs are repositioning themselves as mobility solution providers rather than mere vehicle assemblers.Concurrently, government policies across key geographies are reinforcing this shift. Incentive schemes for zero-emission vehicles, coupled with stricter emission regulations for conventional motorcycles, are catalyzing a reallocation of R&D budgets toward electrification. Innovative financing models, including subscription-based battery leasing and pay-per-mile charging, are lowering adoption barriers for cost-sensitive riders. Furthermore, the convergence of public and private investment in charging infrastructure is addressing one of the most pressing challenges facing electrified two-wheelers: predictable and rapid energy top-ups.

Consumer expectations are evolving in tandem with these structural changes. Riders now demand seamless integration of navigation, telematics, and mobile payment systems, driving the proliferation of connected features. Over time, data-driven insights derived from fleet operations will refine usage patterns and inform tailored service offerings. Thus, the landscape is shifting from a purely product-centric paradigm to an integrated ecosystem where technology platforms, charging networks, and mobility services coalesce. This transformation underscores the need for stakeholders to adopt agile business models that can adapt to continuous technological and regulatory flux.

Assessing How United States Tariff Measures Enacted in 2025 Are Redefining Cost Structures, Supply Chains, and Competitive Dynamics in Electric Motorcycle Markets

The introduction of new tariff measures by the United States in 2025 has reshaped cost equations and strategic priorities within the electric motorcycle supply chain. By imposing duties on key imported components-including battery cells, motor assemblies, and electronic control units-manufacturers have faced material headwinds that necessitate swift adaptation. These tariffs have elevated the landed cost of finished vehicles, compelling companies to reassess sourcing strategies and negotiate more favorable agreements with regional suppliers.In response, a number of international players have accelerated plans to establish local production facilities or forge joint ventures with domestic assemblers. This strategic pivot not only mitigates tariff exposure but also streamlines logistics and reduces lead times. Furthermore, engineering teams are redesigning product architectures to accommodate alternative components that are sourced from tariff-free regions, without compromising performance or reliability. Over time, this approach has contributed to a more localized and resilient ecosystem.

Beyond manufacturing, tariff-induced cost pressures have influenced pricing strategies and value propositions. Companies are experimenting with tiered product lines, offering entry-level models with simplified features while reserving advanced technologies for premium segments. Concurrently, service and maintenance agreements are being packaged with initial sales to enhance lifetime value and offset higher upfront costs. Importantly, this shift underscores a broader trend: tariffs are no longer viewed merely as barriers but as catalysts that drive regional innovation, supply-chain diversification, and heightened collaboration between OEMs and local partners.

Decoding Market Dynamics Through Comprehensive Segmentation Analysis Spanning Vehicle Type, Battery Configuration, Drive Mechanism, Power Capacity, and User Profiles

A nuanced understanding of market performance emerges when the industry is dissected through multiple segmentation lenses. From the perspective of vehicle classification, the market distinguishes between cruiser electric motorcycles designed for comfort and style, off-road electric motorcycles engineered for rugged terrain, and sport electric motorcycles optimized for agility and speed. Battery configurations form another critical dimension, encompassing legacy lead-acid designs, established lithium-ion systems, mature nickel-metal hydride chemistries, and emergent solid-state solutions promising next-generation energy density.Drive mechanisms further segment performance characteristics, with belt drive setups offering low maintenance, chain drive configurations delivering familiar handling dynamics, and hub motor designs enabling compact, integrated assemblies. Power capacity tiers range from sub-5 kW motors suitable for urban commuters to mid-range 5 kW to 10 kW units balancing efficiency and acceleration, as well as high-power systems exceeding 10 kW for premium and commercial applications. Technological modalities such as battery swapping, plug-in charging infrastructures, and regenerative braking integrations shape convenience and energy recapture capabilities. Range classifications delineate vehicles offering less than 75 miles per charge, models in the 75- to 100-mile corridor, and extended-range options surpassing 100 miles.

Voltage thresholds represent another axis of differentiation, with vehicles operating below 48V prioritizing cost-effectiveness, those in the 48V to 60V bracket balancing performance and affordability, and premium systems exceeding 60V unlocking higher torque and range optimization. User segmentation contrasts commercial deployments-spanning logistics fleets and shared-mobility services-with individual ownership, while distribution channels bifurcate between traditional offline dealerships and evolving online sales platforms. This comprehensive segmentation framework illuminates the diverse needs of end users and highlights the strategic focus areas for product development, marketing, and channel expansion.

Unearthing Regional Variations and Growth Drivers Across Americas, Europe Middle East Africa, and Asia Pacific in the Electric Motorcycle Industry Landscape

Regional dynamics play a pivotal role in shaping the trajectory of electric motorcycle adoption. In the Americas, robust government incentives combined with a growing network of fast-charging corridors are accelerating consumer uptake. Urban centers in North America are witnessing a surge in micro-mobility solutions, and fleet operators in Latin America are piloting electric two-wheelers to address rising fuel costs and urban congestion. Consequently, partnerships between infrastructure providers and local municipalities are fostering environments conducive to mass adoption.In Europe, Middle East and Africa, the regulatory mosaic is particularly complex yet opportunistic. European Union directives mandating zero-emission zones in city centers are pushing OEMs to deliver compliant electric motorcycles with versatile powertrains and modular battery packs. Meanwhile, rapid urbanization in select African markets presents untapped growth potential for cost-effective models tailored to emerging economies. In the Gulf region, sovereign wealth incentives and large-scale logistics projects are fueling demand for electric delivery fleets, with an emphasis on low-maintenance designs and remote monitoring capabilities.

Asia-Pacific remains the epicenter of manufacturing prowess and early market adoption. India's urban mobility initiatives are creating demand for entry-level electrified two-wheelers, while Southeast Asian countries are piloting battery-swap networks to address range anxiety. China continues to lead in production scale, driving down component costs and exporting finished vehicles globally. Japan and South Korea are at the forefront of next-generation battery and power electronics research, impacting regional supply chains and technology roadmaps. Overall, these varied regional narratives underscore the importance of tailored market strategies and agile operational models.

Revealing Strategic Positioning, Competitive Advantages, and Innovation Portfolios of Leading Electric Motorcycle Manufacturers and Solution Providers Worldwide

Leading companies in the electric motorcycle realm are carving out competitive advantages through strategic investments in research and development, vertical integration, and brand differentiation. Some established two-wheeler OEMs are leveraging their existing dealer networks and service ecosystems to introduce electric variants alongside legacy combustion models, thereby capturing early adopters without disrupting traditional channels. Others are emerging as pure-play electric specialists, forging alliances with battery suppliers and software developers to deliver holistic mobility solutions that blend hardware with digital services.Innovation portfolios vary significantly. Certain players prioritize battery technology, collaborating with material science startups to develop high-energy-density cells. Others focus on lightweight composite frames and advanced power electronics to maximize efficiency and performance. A growing number of entrants are embedding connectivity platforms that enable predictive maintenance, fleet management, and over-the-air software calibration. These capabilities are becoming critical differentiators as customers seek vehicles that evolve through regular feature enhancements.

Mergers and acquisitions have also intensified, with larger incumbents acquiring nimble startups to accelerate time-to-market and access specialized expertise. Meanwhile, strategic joint ventures between OEMs and energy providers are creating integrated charging ecosystems, reducing complexity for end users. This competitive dance underscores a broader trend: success hinges on an ecosystem approach where partnerships across the value chain amplify core strengths and unlock new revenue streams.

Strategic Roadmap for Industry Leaders to Capitalize on Emerging Trends, Navigate Regulatory Landscapes, and Accelerate Growth in the Electric Motorcycle Domain

Industry leaders should prioritize partnerships with advanced battery developers to secure early access to solid-state and next-generation chemistries that will define performance benchmarks. By collaborating on pilot programs, companies can validate battery safety, charging speed, and lifecycle metrics under real-world conditions, thereby de-risking full-scale deployments. Furthermore, aligning with established energy retailers to co-invest in urban charging corridors will enhance accessibility while preserving brand visibility in high-traffic areas.Optimizing supply chains through regional assembly hubs can mitigate tariff exposure and logistics disruptions. Establishing modular manufacturing cells enables rapid configuration of models tailored to local regulatory and consumer requirements. Concurrently, adopting digital platforms for dealer and customer engagement will streamline sales processes and provide data-driven insights into usage patterns. These insights should inform product roadmaps, pricing strategies, and after-sales service offerings to boost customer retention and lifetime value.

In parallel, companies need to diversify product portfolios across the segmentation spectrum-balancing entry-level urban commuters with high-performance sport variants and robust off-road models. Investing in scalable platforms that accommodate multiple drive mechanisms and power capacities can unlock economies of scale while catering to diverse market niches. Finally, establishing dedicated task forces to monitor evolving tariff policies and regulatory changes will ensure proactive compliance and strategic agility.

Comprehensive Research Framework Incorporating Primary Stakeholder Interviews, Secondary Data Validation, and Rigorous Analytical Techniques for Electric Motorcycle Market Insights

This research employs a dual-pronged methodology combining primary and secondary approaches to ensure comprehensive and validated insights. Primary research entailed in-depth interviews with a broad spectrum of stakeholders, including OEM executives, battery suppliers, infrastructure developers, and fleet operators. These qualitative discussions provided ground-level perspectives on technology adoption challenges, regulatory compliance imperatives, and evolving customer expectations.Secondary research incorporated a rigorous review of industry publications, patent filings, policy documents, and financial disclosures. This was complemented by data triangulation, whereby findings from primary interviews were cross-checked against secondary sources to verify consistency and accuracy. Analytical frameworks such as SWOT assessments, PESTLE analysis, and Porter's Five Forces were applied to identify competitive pressures, market opportunities, and potential disruptors.

Geographic segmentation data were collected from regional trade associations and government portals, while company profiling drew upon annual reports, press releases, and expert commentary. Throughout the process, a multi-stage validation protocol was upheld, involving senior research advisors who reviewed draft insights for coherence and factual integrity. This systematic approach ensures that the resulting market intelligence is robust, actionable, and reflective of the current electric motorcycle landscape.

Synthesizing Key Findings and Strategic Implications to Chart the Future Trajectory of the Electric Motorcycle Market Ecosystem

In conclusion, the electric motorcycle market stands at the intersection of technological innovation, policy momentum, and shifting consumer priorities. The convergence of advanced battery chemistries, intelligent powertrain designs, and digital connectivity is redefining two-wheeler mobility across global regions. At the same time, evolving regulatory frameworks and tariff landscapes are prompting a strategic recalibration of manufacturing footprints and supply-chain architectures.Segmentation insights reveal a diverse ecosystem where vehicle type, battery technology, drive mechanism, power capacity, and end-user requirements shape product roadmaps and go-to-market strategies. Regional nuances-from infrastructure rollouts in the Americas to manufacturing scale in Asia-Pacific and regulatory complexity in Europe, Middle East and Africa-underscore the need for a tailored approach. Leading companies are differentiating through partnerships, vertical integration, and ecosystem orchestration, setting the stage for accelerated electrification.

Ultimately, success in this dynamic market will hinge on the ability to anticipate evolving regulatory demands, harness breakthrough technologies, and deliver seamless customer experiences. Stakeholders that embrace agility, foster collaborative networks, and invest in data-driven decision-making will be best positioned to capture emerging opportunities and steer the future trajectory of electric two-wheeled mobility.

Market Segmentation & Coverage

This research report forecasts revenues and analyzes trends in each of the following sub-segmentations:- Motorcycle

- Cruiser Electric Motorcycles

- Off-Road Electric Motorcycles

- Sport Electric Motorcycles

- Battery Type

- Lead-acid Battery

- Lithium-ion Battery

- Nickel-metal Hydride

- Solid-state Battery

- Drive Type

- Belt Drive

- Chain Drive

- Hub Motor

- Power Capacity

- 5 kW to 10 kW

- Less than 5 kW

- More than 10 kW

- Technology

- Battery Swapping

- Plug-in Charging

- Regenerative Braking

- Charge Range

- Between 75-100 Miles

- Less than 75 Miles

- More than 100 Miles

- Voltage

- Between 48V-60V

- Less than 48V

- More than 60V

- End User

- Commercial

- Logistics

- Shared Mobility

- Individual

- Commercial

- Distribution Channel

- Offline

- Online

- Americas

- North America

- United States

- Canada

- Mexico

- Latin America

- Brazil

- Argentina

- Chile

- Colombia

- Peru

- North America

- Europe, Middle East & Africa

- Europe

- United Kingdom

- Germany

- France

- Russia

- Italy

- Spain

- Netherlands

- Sweden

- Poland

- Switzerland

- Middle East

- United Arab Emirates

- Saudi Arabia

- Qatar

- Turkey

- Israel

- Africa

- South Africa

- Nigeria

- Egypt

- Kenya

- Europe

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Thailand

- Malaysia

- Singapore

- Taiwan

- AIMA TECHNOLOGY GROUP CO.,LTD.

- BMW AG

- Damon Motors Inc.

- Dat Bike Vietnam Company Limited

- Ducati Motor Holding S.p.A. by AUDI AG

- Energica Motor Company S.p.A.

- Evoke Electric Motorcycles (HK) Ltd.

- Gogoro Inc.

- Greaves Electric Mobility Limited

- Hangzhou QiuLong Technology Co., Ltd.

- Honda Motor Co., Ltd.

- Jiangsu Xinri E-Vehicle Co.,Ltd

- Kawasaki Heavy Industries, Ltd.

- Kwang Yang Motor Co., Ltd.

- Lightning Motors Corporation

- LiveWire EV, LLC

- Maeving Limited

- Ola Electric Mobility Ltd.

- Shenzhen Rooder Technology Co.,Ltd

- Srivaru Motors Private Limited

- Suzuki Motor Corporation

- TACITA SRL

- Vmoto Limited

- Yadea Technology Group Co. Ltd.

- Zero Motorcycles, Inc.

- ZheJiang Lv Ju Vehicle Industry Co.,Ltd.

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this Electric Motorcycle Market report include:- AIMA TECHNOLOGY GROUP CO.,LTD.

- BMW AG

- Damon Motors Inc.

- Dat Bike Vietnam Company Limited

- Ducati Motor Holding S.p.A. by AUDI AG

- Energica Motor Company S.p.A.

- Evoke Electric Motorcycles (HK) Ltd.

- Gogoro Inc.

- Greaves Electric Mobility Limited

- Hangzhou QiuLong Technology Co., Ltd.

- Honda Motor Co., Ltd.

- Jiangsu Xinri E-Vehicle Co.,Ltd

- Kawasaki Heavy Industries, Ltd.

- Kwang Yang Motor Co., Ltd.

- Lightning Motors Corporation

- LiveWire EV, LLC

- Maeving Limited

- Ola Electric Mobility Ltd.

- Shenzhen Rooder Technology Co.,Ltd

- Srivaru Motors Private Limited

- Suzuki Motor Corporation

- TACITA SRL

- Vmoto Limited

- Yadea Technology Group Co. Ltd.

- Zero Motorcycles, Inc.

- ZheJiang Lv Ju Vehicle Industry Co.,Ltd.

Table Information

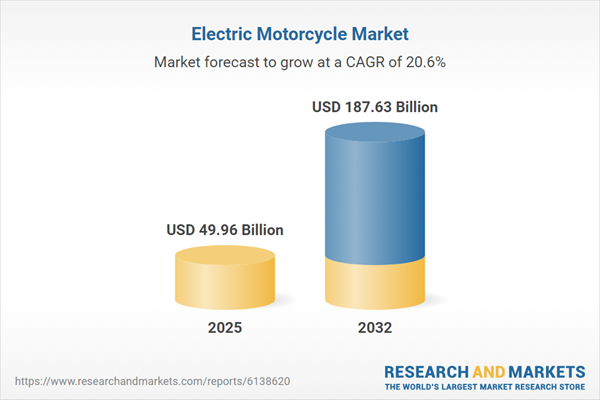

| Report Attribute | Details |

|---|---|

| No. of Pages | 195 |

| Published | November 2025 |

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 49.96 Billion |

| Forecasted Market Value ( USD | $ 187.63 Billion |

| Compound Annual Growth Rate | 20.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 27 |