One of the key drivers is the rapid evolution of gene therapy as a transformative approach for treating LSDs. Unlike enzyme replacement therapies, gene therapies target the root genetic cause, offering potential long-term or permanent benefits. In the U.S., several candidates for conditions such as MLD, Sanfilippo syndrome, and Gaucher disease are advancing through clinical stages. In March 2024, the FDA approved Lenmeldy (atidarsagene autotemcel), the first gene therapy in the U.S. for early-stage MLD, showing 100% survival at age 6 in treated presymptomatic patients versus 58% in untreated cases. Such milestones are increasing investment, accelerating adoption, and reshaping long-term LSD management.

Another major driver is the advancement of newborn screening programs across the U.S., which has led to earlier diagnosis of various LSDs. States are progressively expanding their recommended panels under the RUSP to include conditions such as Pompe disease and MPS I. Early detection enables the timely initiation of treatment, significantly improving long-term disease outcomes. For instance, in July 2024, Florida Newborn Screening added MPS II to its statewide panel using tandem mass spectrometry, enabling early diagnosis and clinical referral. As more states implement such measures, diagnosed cases are expected to rise. This trend supports proactive management and aligns industry strategies with early therapeutic intervention.

U.S. Lysosomal Storage Disease (LSDs) Treatment Market Report Segmentation

This report forecasts revenue growth at regional levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, the analyst has segmented the U.S. lysosomal storage disease treatment market report based on type and disease type:Type Outlook (Revenue, USD Billion, 2021 - 2033)

- Enzyme Replacement Therapy (ERT)

- Imiglucerase (Cerezyme)

- Alglucosidase alfa (Myozyme/Lumizyme)

- Idursulfase (Elaprase)

- Velaglucerase alfa

- Others

- Substrate Reduction Therapy (SRT)

- Other Types

Disease Type Outlook (Revenue, USD Billion, 2021 - 2033)

- Gaucher Disease

- Fabry Disease

- Pompe Disease

- Mucopolysaccharidoses (MPS)

- Others

Why should you buy this report?

- Comprehensive Market Analysis: Gain detailed insights into the global market across major regions and segments.

- Competitive Landscape: Explore the market presence of key players worldwide.

- Future Trends: Discover the pivotal trends and drivers shaping the future of the global market.

- Actionable Recommendations: Utilize insights to uncover new revenue streams and guide strategic business decisions.

This report addresses:

- Market intelligence to enable effective decision-making

- Market estimates and forecasts from 2018 to 2030

- Growth opportunities and trend analyses

- Segment and regional revenue forecasts for market assessment

- Competition strategy and market share analysis

- Product innovation listing for you to stay ahead of the curve

- COVID-19's impact and how to sustain in these fast-evolving markets

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned

- Pfizer Inc

- Takeda Pharmaceutical Company Limited (Shire Plc)

- Sanofi (Genzyme Corporation)

- BioMarin

- Johnson & Johnson (Actelion Pharmaceuticals Ltd)

- Amicus Therapeutics, Inc

- Alexion Pharmaceuticals, Inc

- Sigilon Therapeutics, Inc

- Orphazyme A/S

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 150 |

| Published | July 2025 |

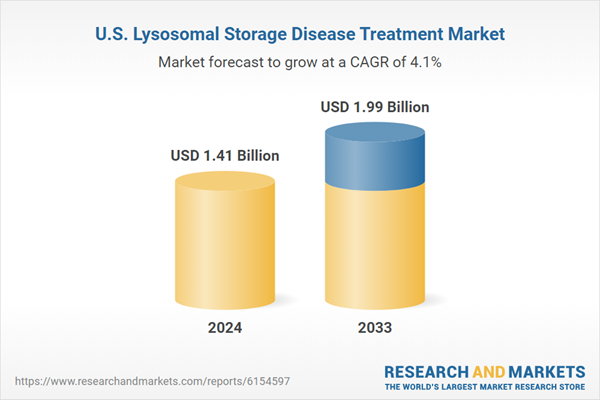

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 1.41 Billion |

| Forecasted Market Value ( USD | $ 1.99 Billion |

| Compound Annual Growth Rate | 4.1% |

| Regions Covered | United States |

| No. of Companies Mentioned | 9 |