Speak directly to the analyst to clarify any post sales queries you may have.

Exploring the Dynamic Horizon of Ready-to-Eat Frozen Food Through Emerging Trends, Consumer Preferences, and Innovative Market Drivers

In the rapidly shifting landscape of modern consumption, ready-to-eat frozen food has emerged as a pivotal solution for consumers seeking convenience without sacrificing quality. The interplay of busy lifestyles and rising health consciousness has propelled demand for options that deliver robust flavors, diverse textures, and balanced nutrition. As meal planning becomes ever more complex, ready-to-eat frozen meals alleviate decision fatigue by offering reliable, chef-inspired recipes that require minimal preparation.This category's evolution is further shaped by a diversified ingredient framework encompassing non-vegetarian selections, plant-based proteins for vegan diets, and an array of vegetarian specialties. The expansion of these ingredient categories not only caters to traditional dietary preferences but also fosters new avenues for clean-label innovations, allergen-free formulations, and fortified offerings designed to support specific health objectives.

Alongside ingredient diversification, the proliferation of digital commerce platforms has redefined product discovery and brand-consumer interactions. Evolving e-commerce marketplaces and direct-to-consumer channels empower smaller artisanal brands to compete against established players by leveraging targeted marketing and data-driven consumer insights. This digital momentum underscores the urgency for established manufacturers to optimize omnichannel fulfillment, enhance cold chain logistics, and bolster last-mile delivery capabilities.

Regulatory frameworks emphasizing food safety, traceability, and environmental stewardship have intensified the imperative for transparent sourcing and sustainable packaging. Meanwhile, technological advancements in freezing techniques, from individually quick frozen (IQF) processes to novel cryogenic methods, have elevated product quality and extended shelf life. These converging dynamics form the foundation for a comprehensive exploration of transformative market shifts, tariff impacts, segmentation nuances, regional variations, competitive strategies, and actionable recommendations.

Unraveling the Powerful Transformations Reshaping Ready-to-Eat Frozen Food Dynamics Through Technology Advancements, Sustainability, and Evolving Consumer Behaviors

The ready-to-eat frozen food sector is undergoing a profound metamorphosis driven by converging technological, environmental, and consumer-led forces. Advances in freezing technology, including novel cryogenic methods and precision temperature control, have enabled producers to lock in freshness and nutritional integrity at unprecedented levels. At the same time, intelligent packaging solutions equipped with freshness indicators and barrier films are enhancing shelf stability and reducing waste, reinforcing consumer confidence in product safety and quality.Concurrently, sustainability initiatives have become central to corporate strategy as manufacturers pursue recyclable packaging materials, carbon footprint reduction, and renewable energy integration within production facilities. Articulating a credible environmental narrative has grown indispensable for brand differentiation, especially as regulatory bodies worldwide tighten standards on packaging waste and greenhouse gas emissions. The integration of lifecycle assessment tools and circular economy principles has also spurred innovation in reusable and compostable packaging formats.

On the consumer front, a surge in global culinary curiosity has fueled demand for regionally inspired flavors spanning Asian, Indian, Latin American, Middle Eastern, and Western Continental cuisines. This appetite for authenticity intersects with interest in functional ingredients, such as plant-based proteins, superfood inclusions, and fortified preparations that support targeted wellness goals. As a result, product development teams are collaborating with nutritionists and culinary experts to deliver multipurpose meals that satisfy both indulgence and health criteria.

The digital revolution continues to reshape purchasing behaviors, with online marketplaces and direct-to-consumer platforms offering personalized recommendations and subscription-based meal plans. These channels are redefining distribution dynamics and accelerating the adoption of contactless delivery solutions. Such transformative shifts pave the way for deeper analysis of external headwinds, including the cumulative impact of United States tariffs in 2025 and beyond.

Assessing the Multidimensional Impact of United States Tariffs on Ready-to-Eat Frozen Food Supply Chains, Pricing Structures, and Trade Relationships in 2025

In 2025, the implementation of additional tariffs by the United States on key ingredients and packaging components has reshaped global supply chain dynamics within the ready-to-eat frozen food sector. Increased duties on imported proteins, specialty spices, and certain film substrates have elevated production costs, compelling manufacturers to recalibrate pricing strategies. This rise in input expenses has reverberated across the value chain, from raw material procurement and manufacturing to distribution and retail pricing.Facing these headwinds, companies are exploring alternative sourcing regions and forging strategic alliances with domestic suppliers to mitigate tariff-related cost inflation. The shift toward nearshore partnerships has gained momentum as organizations seek to balance affordability with supply security. Simultaneously, elevated duties on metal cans and certain rigid containers have encouraged a broader pivot toward flexible packaging formats like films and zip-lock bags, which remain less affected by the new tariff regime.

Retailers in both offline and online channels have had to navigate fluctuating shelf prices while maintaining promotional intensity to preserve consumer demand. Supermarkets and hypermarkets, convenience stores, and specialty grocers are negotiating vendor agreements that share the burden of increased duties, whereas digital marketplaces are leveraging dynamic pricing algorithms to flexibly adjust to cost fluctuations. These adaptive measures are crucial as end users, spanning households, commercial foodservice operators, and institutional buyers, respond sensitively to even marginal price shifts.

Although these tariff measures present near-term challenges, they are also catalyzing resilience through supply chain optimization, product reformulation, and cost transparency. As the industry continues to adapt, understanding the nuances of segmentation layers, regional distinctions, and corporate response strategies will be essential for stakeholders striving to maintain competitiveness and profitability.

Revealing Critical Segmentation Insights Spanning Ingredients, Cuisine Types, Packaging Innovations, Distribution Channels, and Diverse End Users

Segmentation by ingredient foundations has illuminated shifting consumer priorities within the ready-to-eat frozen food market. Non-vegetarian offerings have traditionally dominated, fueled by high-protein comfort meals and indulgent recipes. More recently, vegan options have experienced robust traction, underpinned by plant-based protein innovations that mimic traditional meat textures and flavors. Vegetarian selections continue to appeal to flexitarian consumers seeking a balance between nutrition and sustainability objectives. These ingredient-driven segments are converging as manufacturers introduce hybrid formulations that marry meat, plant derivatives, and nutrient-rich vegetables in single-serve or family-sized meals.Culinary diversity emerges as another critical lens through which market dynamics are scrutinized. Asian-inspired stir-fries, curries, and noodle dishes benefit from widespread global appeal, while Indian offerings attract consumers seeking spice-forward experiences. Latin American flavors bring vibrant, heritage-rich profiles to freezers, and Middle Eastern meals leverage aromatic blends of grains, legumes, and proteins. Western Continental staples maintain a strong presence through dishes like pasta bakes and casseroles. The interplay of these cuisine types reflects a broader trend of culinary cross-pollination, driving product line expansions and co-branding collaborations with regional chefs.

Packaging innovation has become a pivotal segmentation axis, with flexible formats capturing attention due to their lightweight nature and cost-efficiency. Films that seal preservative-free meals, resealable pouches that accommodate multiple servings, and zip-lock bags that facilitate portion control have gained prominence. Conversely, rigid containers-including metal cans, cardboard cartons, plastic trays, and durable tubs-continue to serve premium lines and family packs that emphasize convenience and reheating versatility. The packaging choice often aligns with meal complexity, reheating methods, and consumer consumption occasions.

Distribution channels reveal a dual narrative of brick-and-mortar resilience and digital ascendancy. Traditional outlets such as convenience stores, grocery chains, specialty food retailers, and large-scale supermarkets continue to anchor consumer discovery. Parallel to this, e-commerce growth is buoyed by brand websites offering subscription models and third-party marketplaces that aggregate diverse ready-to-eat frozen portfolios. This channel bifurcation underscores the necessity for integrated omnichannel strategies that synchronize inventory, pricing, and promotional activities.

End users encompass a triad of commercial entities, household shoppers, and institutional clients. Foodservice operators rely on bulk frozen menus to streamline kitchen operations, while households favor portion-perfect packaging for weeknight meals. Institutional purchasers, including schools, hospitals, and corporate cafeterias, prioritize nutritional compliance, scalability, and cost management. These user-driven differences inform product sizing, nutritional labeling, and service-level agreements, enabling manufacturers to tailor solutions that resonate across the demand spectrum.

Illuminating Regional Growth Drivers and Consumer Preferences Across the Americas, Europe Middle East & Africa, and Asia-Pacific Ready-to-Eat Frozen Food Markets

Regional analysis reveals distinct trajectories for the ready-to-eat frozen food market. In the Americas, consumers display a strong preference for indulgent comfort foods alongside a burgeoning interest in health-oriented alternatives. North American demand is propelled by widespread supermarket penetration and a robust e-commerce ecosystem that emphasizes door-to-door delivery and subscription meal kits. In Latin America, urbanization and rising disposable incomes have elevated the appeal of premium frozen assortments, although cold chain improvements remain essential to unlock full market potential.Across Europe, Middle East, and Africa, market maturity varies significantly. Western European countries benefit from sophisticated retail infrastructures and stringent regulatory frameworks, fostering uptake of clean-label and organic frozen products. In contrast, several Eastern European and Middle Eastern markets are characterized by opportunistic growth in affordable and traditional flavors, with regulatory harmonization efforts gradually enhancing food safety and quality benchmarks. African markets, while nascent, show promise as infrastructure investments expand cold storage capacity and distribution networks.

The Asia-Pacific region exhibits the fastest growth rates, driven by expanding middle-class populations, rising urban dwellers, and evolving consumption habits. Nations such as Japan and South Korea display high per capita consumption, with consumers favoring single-serve rice bowls, dumplings, and seafood preparations. Southeast Asian markets, including Malaysia, Thailand, and Vietnam, are witnessing rapid introduction of global cuisine concepts adapted to local palates. Meanwhile, China and India offer massive scale opportunities, although localization of flavors and price points is critical to address diverse socio-economic segments.

Understanding these regional nuances allows stakeholders to align product portfolios with local taste preferences, regulatory requirements, and logistical realities. The interplay of developed and emerging markets underscores the importance of adaptable go-to-market strategies and region-specific value propositions.

Examining Strategic Expansion, Product Innovation, and Sustainability Leadership of Prominent Ready-to-Eat Frozen Food Companies Driving Transformative Market Evolution

Major players in the ready-to-eat frozen category are intensifying efforts to secure competitive advantage through targeted innovation, strategic acquisitions, and sustainability commitments. Industry titans renowned for extensive distribution networks have expanded their frozen food divisions by integrating emerging brands that specialize in plant-based proteins and international cuisine. Simultaneously, privately held innovators have gained traction, leveraging digital-first marketing strategies and nimble supply chains to introduce limited-edition flavor profiles and collaborations with celebrity chefs.Leading manufacturers are also piloting advanced freezing technologies, such as cryogenic chilling and high-pressure processing, to retain texture and nutritional quality. These investments are often paired with eco-friendly packaging initiatives that replace single-use plastics with recyclable or compostable alternatives, resonating with environmentally conscious consumers. Additionally, integrated foodservice solutions providers are forging partnerships with institutional clients to deliver customized meal programs, reflecting an emphasis on long-term contract stability and volume assurance.

Meanwhile, mid-sized companies are differentiating their offerings by emphasizing traceability and ingredient provenance, incorporating QR codes and blockchain-based platforms to provide end users with transparent supply chain visibility. Several enterprises have also targeted distribution diversification, balancing traditional supermarket shelf space with direct-to-consumer subscription models and third-party logistics collaborations. This omnichannel orientation has enabled them to capture emerging consumer segments, such as time-strapped professionals and health-oriented families, while maintaining robust relationships with legacy retail partners.

Collectively, these corporate maneuvers underscore a landscape where scale-oriented strategies coexist with agile innovation. As market boundaries blur and consumer expectations evolve, the delineation between mass-market appeal and premium positioning grows increasingly nuanced, compelling all players to refine their value propositions continuously.

Deploying Strategic Initiatives for Industry Leaders to Accelerate Growth Through Sustainable Practices, Digital Transformation, and Consumer-Centric Product Innovation

To harness the momentum within the ready-to-eat frozen food segment, companies must prioritize a triad of strategic imperatives. First, embedding sustainability deeper into product lifecycles will yield both environmental and reputational dividends. Embracing recyclable or compostable packaging innovations, optimizing energy-intensive freezing operations, and committing to net-zero targets can differentiate brands and build consumer trust. A transparent sustainability roadmap, underpinned by third-party certifications, will also preempt regulatory pressures and align with institutional procurement standards.Second, digital transformation should be positioned as a growth accelerator rather than a support function. Investing in advanced analytics and AI-driven demand forecasting will refine inventory management, minimize stockouts, and optimize distribution routes. Moreover, enhancing direct-to-consumer capabilities through personalized subscription offerings, loyalty-driven incentives, and interactive meal-planning tools can deepen customer engagement and unlock higher lifetime value. Collaboration with technology partners to implement IoT-enabled cold chain monitoring will further bolster product integrity and reduce logistical losses.

Third, product innovation must continue to reflect evolving dietary trends and global flavor exploration. Expanding plant-based portfolios with nutrient-dense fortification, diversifying global cuisine offerings, and experimenting with hybrid formulations will capture emerging taste preferences. Establishing cross-functional teams that integrate culinary experts, nutrition scientists, and consumer insights analysts can streamline the ideation-to-launch process, ensuring new products resonate with targeted segments.

Finally, strengthening collaboration across the value chain-from ingredient suppliers to retail partners-will be critical to building resilience against external shocks such as tariff fluctuations or raw material shortages. By co-creating risk-sharing frameworks and exploring nearshoring opportunities, stakeholders can enhance cost predictability and supply security. These actionable recommendations serve as a roadmap for industry leaders eager to cement their position in an increasingly competitive landscape.

Unveiling a Rigorous Research Framework Combining Primary Interviews, Secondary Data Collection, and Robust Data Triangulation for Market Insights

The insights presented in this report are grounded in a comprehensive research methodology that integrates both primary and secondary data sources to ensure depth and rigor. Initial secondary research encompassed an exhaustive review of industry publications, regulatory filings, trade association reports, and academic studies related to ready-to-eat frozen food. This phase provided a foundational understanding of market dynamics, technological advances, and regulatory environments across key regions.Primary research involved structured interviews with a diverse array of stakeholders, including senior executives from manufacturing entities, procurement managers at retail and foodservice organizations, supply chain specialists, and culinary experts. These interactions yielded nuanced perspectives on strategic priorities, operational challenges, and innovation trajectories. Insights gleaned from these discussions were synthesized and cross-validated with publicly disclosed financial statements, press releases, and media briefings.

Quantitative analysis was conducted using advanced statistical tools to identify trend correlations, segment performance patterns, and risk factors. A data triangulation approach was employed to reconcile varying viewpoints and ensure consistency between qualitative narratives and quantitative findings. Furthermore, scenario analysis was utilized to assess the potential impact of external variables such as tariff policy shifts, changing consumer sentiment, and supply chain disruptions.

Quality assurance procedures were integrated at every stage, including peer review by subject-matter experts and validation against proprietary databases. This systematic approach underpins the report's credibility and equips decision-makers with reliable insights to navigate the complexities of the ready-to-eat frozen food market.

Synthesizing Key Learnings and Projecting Future Directions for the Ready-to-Eat Frozen Food Industry Amidst Dynamic Consumer and Regulatory Shifts

In summary, the ready-to-eat frozen food sector stands at a pivotal juncture characterized by rapid innovation, shifting consumption patterns, and evolving regulatory landscapes. Technological breakthroughs in freezing and packaging, coupled with dynamic sustainability imperatives, have elevated product quality while reinforcing supply chain resilience. Consumer demand for diverse cuisines, tailored nutritional profiles, and seamless omnichannel experiences continues to recalibrate market benchmarks and competitive differentiation.The implementation of United States tariffs in 2025 has introduced cost pressures that accelerate strategic realignments in sourcing and distribution, prompting manufacturers to explore nearshore partnerships, reformulate products, and optimize packaging choices. Deep segmentation across ingredient categories, cuisine types, packaging formats, distribution channels, and end-user applications underscores the importance of granular market intelligence for informed decision-making.

Regional insights from the Americas, Europe Middle East & Africa, and Asia-Pacific reveal varied growth trajectories and consumer priorities, necessitating localized go-to-market strategies. The strategic maneuvers of leading and niche players alike illustrate a market in flux, where scale economies intersect with agile innovation.

By synthesizing these findings, stakeholders can chart a forward-looking course that leverages sustainability, digitalization, and culinary ingenuity to drive growth. The pathways outlined in this report offer a strategic blueprint for navigating the complexities of an increasingly competitive and opportunity-rich environment.

Market Segmentation & Coverage

This research report forecasts revenues and analyzes trends in each of the following sub-segmentations:- Ingredient

- Non-Vegetarian

- Vegan

- Vegetarian

- Cuisine Type

- Asian

- Indian

- Latin American

- Middle Eastern

- Western / Continental

- Packaging Type

- Flexible Packaging

- Films

- Plastic Pouches

- Zip-lock Bags

- Rigid Packaging

- Cans

- Cartons

- Trays

- Tubs

- Flexible Packaging

- Distribution Channel

- Offline

- Convenience Stores

- Grocery Chains

- Specialty Stores

- Supermarkets & Hypermarkets

- Online

- Company's Websites

- eCommerce Marketplaces

- Offline

- End User

- Commercial

- Households

- Institutional

- Americas

- North America

- United States

- Canada

- Mexico

- Latin America

- Brazil

- Argentina

- Chile

- Colombia

- Peru

- North America

- Europe, Middle East & Africa

- Europe

- United Kingdom

- Germany

- France

- Russia

- Italy

- Spain

- Netherlands

- Sweden

- Poland

- Switzerland

- Middle East

- United Arab Emirates

- Saudi Arabia

- Qatar

- Turkey

- Israel

- Africa

- South Africa

- Nigeria

- Egypt

- Kenya

- Europe

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Thailand

- Malaysia

- Singapore

- Taiwan

- Ajinomoto Co., Inc.

- Bellisio Foods, Inc.

- BRF S.A.

- Campbell Soup Company

- CP Malaysia

- EB Frozen Food Sdn Bhd

- General Mills Inc.

- Grupo Bimbo

- Iceland Foods Ltd.

- JBS S.A.

- Kawan Food Manufacturing Sdn Bhd

- Kellogg Company

- Kidfresh

- Maruha Nichiro

- McCain Foods Limited

- Nestle S.A

- Nissin Foods Co., Inc.

- OOB Organic

- Simplot Global Food, LLC

- TANVI FOODS LTD.

- The Kraft Heinz Company

- Tyson Foods Inc.

- Unilever PLC

- Vandemoortele NV

- Wawona Frozen Foods

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this Ready-to-Eat Frozen Food market report include:- Ajinomoto Co., Inc.

- Bellisio Foods, Inc.

- BRF S.A.

- Campbell Soup Company

- CP Malaysia

- EB Frozen Food Sdn Bhd

- General Mills Inc.

- Grupo Bimbo

- Iceland Foods Ltd.

- JBS S.A.

- Kawan Food Manufacturing Sdn Bhd

- Kellogg Company

- Kidfresh

- Maruha Nichiro

- McCain Foods Limited

- Nestle S.A

- Nissin Foods Co., Inc.

- OOB Organic

- Simplot Global Food, LLC

- TANVI FOODS LTD.

- The Kraft Heinz Company

- Tyson Foods Inc.

- Unilever PLC

- Vandemoortele NV

- Wawona Frozen Foods

Table Information

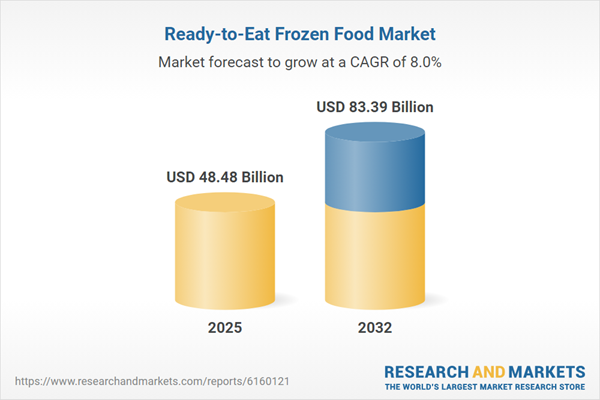

| Report Attribute | Details |

|---|---|

| No. of Pages | 195 |

| Published | November 2025 |

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 48.48 Billion |

| Forecasted Market Value ( USD | $ 83.39 Billion |

| Compound Annual Growth Rate | 7.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 26 |