Speak directly to the analyst to clarify any post sales queries you may have.

Comprehensive Overview of Suppositories Market Dynamics Highlighting Historical Evolution, Key Drivers, Challenges and Emerging Opportunities for Future Growth

The global suppositories market represents a convergence of pharmaceutical innovation, evolving patient needs and regulatory oversight that has steadily reshaped therapeutic delivery channels over the past decades. From its early roots in simple fatty or glycerinated gelatin carriers to modern polymer-based systems, this segment has advanced through material science breakthroughs and enhanced understanding of mucosal absorption kinetics. Alongside these formulation developments, demographic shifts such as aging populations, rising prevalence of gastrointestinal and anorectal conditions, and increasing consumer preference for non-oral administration have driven sustained interest among pharmaceutical companies and healthcare providers.Economic, clinical and technological forces have concurrently introduced both opportunities and challenges. Cost containment pressures within public and private healthcare systems have spurred investment in cost-effective dosage forms, while regulatory agencies have intensified scrutiny on excipient safety profiles and manufacturing consistency. As a result, industry stakeholders have pursued collaborations between formulators, contract manufacturers and research institutions to accelerate product development cycles. By understanding the interplay of these drivers, decision-makers can better anticipate emerging trends and position their portfolios to meet evolving patient and payer demands.

How Recent Advances in Formulation Science, Digital Distribution and Regulatory Pathways Are Redefining Suppository Development and Market Expansion

In recent years, the suppositories landscape has been transformed by breakthroughs in polymer science and targeted delivery strategies that enhance bioavailability while reducing systemic side effects. Novel water-soluble bases and polyethylene glycol matrices tailored for controlled release have expanded therapeutic windows for anti inflammatory and analgesic agents, fostering broader clinical acceptance. Meanwhile, digitization of healthcare channels and growth in e-commerce have revolutionized distribution, enabling direct-to-consumer access that bypasses traditional pharmacy networks.Regulatory shifts have further accelerated innovation, with agencies introducing streamlined pathways for generic equivalence and bio-performance testing, encouraging reformulators to revisit established products and improve performance. The rise of personalized medicine has also catalyzed reformulation efforts, prompting manufacturers to explore suppository platforms for niche indications and patient populations that benefit from localized treatment approaches. As these transformative forces continue to converge, companies must adapt their R&D and commercialization strategies to stay ahead of the curve and leverage new avenues for value creation.

Comprehensive Analysis of the 2025 United States Tariff Revisions Revealing Supply Chain Shifts, Cost Pressures and Strategic Localization Responses

The introduction of new tariff schedules by the United States in 2025 has reverberated across the suppositories market, impacting raw material sourcing, manufacturing costs and supply chain resilience. Import duties on key excipients such as polyethylene glycol derivatives, fatty acid blends and specialized emulsifiers have incrementally eroded cost advantages for producers reliant on international suppliers. Concurrently, tightened trade policies have increased lead times for overseas procurement, prompting manufacturers to reevaluate vertical integration and diversify supplier networks to mitigate disruption.These fiscal measures have also affected downstream margins, as distributors and pharmacies grapple with incremental pass-through expenses. In response, several industry players have leveraged domestic production incentives and collaborated with regional partners to establish nearshoring initiatives. By localizing critical steps in the supply chain, organizations can offset tariff pressures, reduce exposure to cross-border volatility and enhance supply assurance. As these strategies unfold, they underscore the importance of agile procurement frameworks and strategic inventory management for sustaining competitive positioning under evolving trade regimes.

In-Depth Segmentation Insights Demonstrating How Product, Material, Prescription, Therapeutic, End User and Distribution Dimensions Shape Market Dynamics

Through the lens of product diversification, rectal, urethral and vaginal suppository segments reveal distinct growth trajectories driven by therapeutic demand and patient convenience. Rectal applications continue to dominate general analgesic and antihemorrhoidal treatments, while urethral and vaginal platforms gain traction for targeted antifungal and antibacterial therapies. Material innovation further stratifies the market, as emulsifying and fatty bases compete with glycerinated gelatin and advanced polyethylene glycol variants-PEG 3350 and PEG 4000-each offering unique dissolution profiles and moisture stability.Regulatory classification adds another dimension, differentiating over-the-counter accessibility from prescription-only formulations, which require stringent compliance and clinical validation. Therapeutic applications underscore this complexity: acetaminophen and NSAID analgesics cater to acute pain relief, antiemetics address chemotherapy-induced nausea, anti inflammatory agents manage local inflammatory conditions, and laxatives and antihemorrhoidal products meet urgent gastrointestinal needs via both steroidal and non-steroidal approaches. End-user channels range from patient self-administration at home to clinician-supervised use in hospitals and clinics, while distribution models evolve to encompass both traditional brick-and-mortar pharmacies and rapidly expanding online platforms seeking to streamline delivery and broaden patient reach.

Comprehensive Regional Analysis Revealing Distinct Drivers, Regulatory Pathways and Market Entry Strategies Across Americas, EMEA and Asia-Pacific

Regional performance in the Americas continues to reflect robust demand propelled by extensive healthcare infrastructure, high patient awareness of rectal and vaginal delivery benefits, and supportive reimbursement frameworks. Research and development hubs within North America accelerate formulation breakthroughs, which subsequently disseminate through established pharmaceutical networks across Latin America. In Europe, Middle East & Africa, diverse regulatory environments and variable healthcare funding create both barriers and localized opportunities, with European Union harmonization efforts fostering cross-border product approvals even as emerging markets in the Middle East and North Africa explore expanded generics adoption.Asia-Pacific exhibits dynamic growth driven by rising healthcare expenditure, increasing per capita income and growing penetration of online pharmacy channels. Regulatory modernization in key markets such as China, India and Southeast Asian nations has catalyzed domestic capacity expansion, enabling local manufacturers to compete on quality and cost. Collectively, these regional variations highlight the necessity for tailored market entry strategies, adaptive regulatory pathways and nuanced go-to-market approaches, ensuring that product portfolios align with local patient needs, reimbursement landscapes and distribution infrastructures.

Key Competitive Landscape Insights Highlighting Formulation Innovation, Strategic Partnerships and Digital Distribution Trends Among Market Leaders

Industry incumbents and pharmaceutical innovators are jostling for supremacy through formulation enhancements, strategic partnerships and distribution network expansions. Leading global pharmaceutical companies have prioritized controlled-release formulations based on polyethylene glycol matrices and advanced emulsifying carriers to differentiate on performance. Contract development and manufacturing organizations have emerged as pivotal collaborators, enabling both established firms and emerging biopharma entities to leverage specialized expertise and scalable production capabilities.At the same time, nimble generic players are capitalizing on streamlined regulatory routes to introduce cost-effective alternatives, fostering price competition and widening patient access. Digital health start-ups are reshaping the distribution landscape by integrating telehealth consultations with online pharmacy fulfilment, driving convenience and adherence. This competitive environment underscores the importance of continuous innovation, agile commercialization frameworks and cross-sector alliances to secure lasting market advantage and respond swiftly to evolving therapeutic demands.

Actionable Strategies for Strengthening Supply Chain Resilience, Advancing Formulation Differentiation and Expanding Digital Distribution Capabilities

Industry leaders should prioritize multi-sourcing strategies for critical excipients to reduce vulnerability to tariff fluctuations and procurement bottlenecks. Establishing collaborative consortia with raw material suppliers and contract manufacturers can foster secure pipelines and joint investment in localized production. Simultaneously, accelerating R&D efforts in polymer-based and water soluble carriers will ensure differentiation and enhanced patient outcomes while addressing regulatory expectations for bio-performance consistency.On the commercial front, integrating telehealth services with digital pharmacy platforms can expand reach, particularly in regions where traditional channels underperform. Embracing adaptive pricing models that reflect local reimbursement criteria and competitive landscapes will optimize market penetration and value capture. Finally, forging cross-industry alliances, including partnerships with academic institutions and technology providers, can expedite clinical validation processes and streamline market access, positioning organizations to thrive amid evolving therapeutic and distribution paradigms.

Rigorous Mixed-Methods Research Approach Combining Expert Interviews, Peer-Reviewed Sources and Data Triangulation for Enhanced Analytical Rigor

This analysis combines qualitative and quantitative research methodologies to ensure robust and reliable findings. Primary research included in-depth interviews with formulation scientists, supply chain executives and regulatory specialists, providing frontline perspectives on material innovations and trade dynamics. Secondary research encompassed a comprehensive review of peer-reviewed journals, industry reports and government publications, ensuring alignment with current regulatory frameworks and clinical standards.Market intelligence data was triangulated across multiple sources to validate supplier capabilities, tariff schedules and distribution trends. A rigorous data cleansing process addressed discrepancies, while expert panels reviewed preliminary insights to refine segmentation definitions and regional classifications. The resulting methodology framework underscores transparency, reproducibility and analytical rigor, enabling stakeholders to confidently leverage these insights for strategic decision making and long-term planning.

Strategic Summary Emphasizing Critical Market Forces, Tariff Influences and Cross-Functional Synergies Guiding Future Growth Trajectories

The suppositories segment stands at a pivotal juncture, shaped by material science breakthroughs, digital distribution innovations and shifting trade policies. While new tariff structures in the United States have introduced cost and supply chain complexities, they have simultaneously catalyzed localization strategies and supplier diversification. Evolving patient preferences and therapeutic demands continue to drive segmentation across product types, material bases, prescription frameworks, therapeutic applications, end-user settings and distribution channels.Looking forward, success will hinge on an organization’s ability to harmonize R&D innovation with agile commercial models, adaptive supply chain architectures and collaborative ecosystems. By internalizing these insights, industry stakeholders can devise proactive strategies that balance cost efficiency, regulatory compliance and patient centricity, thereby unlocking sustainable growth in an increasingly competitive global landscape.

Market Segmentation & Coverage

This research report forecasts the revenues and analyzes trends in each of the following sub-segmentations:- Product Type

- Rectal Suppositories

- Urethral Suppositories

- Vaginal Suppositories

- Material Type

- Emulsifying Bases

- Fatty Bases

- Glycerinated Gelatin Base

- Polyethylene Glycol Base

- PEG 3350

- PEG 4000

- Water-Soluble Bases

- Prescription Type

- Over-the-Counter (OTC) Drugs

- Prescription Drugs (Rx)

- Therapeutic Application

- Analgesic

- Acetaminophen Analgesic

- NSAID Analgesic

- Anti Inflammatory

- Antibacterial & Antifungal

- Antiemetic

- Antihemorrhoidal

- Non Steroidal Formulation

- Steroidal Formulation

- Laxative

- Analgesic

- End User

- Home Care

- Hospitals & Clinics

- Distribution Channel

- Offline Pharmacy

- Online Pharmacy

- Americas

- North America

- United States

- Canada

- Mexico

- Latin America

- Brazil

- Argentina

- Chile

- Colombia

- Peru

- North America

- Europe, Middle East & Africa

- Europe

- United Kingdom

- Germany

- France

- Russia

- Italy

- Spain

- Netherlands

- Sweden

- Poland

- Switzerland

- Middle East

- United Arab Emirates

- Saudi Arabia

- Qatar

- Turkey

- Israel

- Africa

- South Africa

- Nigeria

- Egypt

- Kenya

- Europe

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Thailand

- Malaysia

- Singapore

- Taiwan

- Novartis AG

- SANOFI WINTHROP INDUSTRIE

- Zydus Group

- Church & Dwight Co., Inc.

- Bausch Health Companies Inc.

- Teva Pharmaceutical Industries Ltd.

- Sun Pharmaceutical Industries Ltd.

- Aspen Holdings

- Haleon Group of Companies

- Cipla Limited

- Gulf Pharmaceutical Industries

- Prestige Consumer Healthcare Inc.

- Bliss GVS Pharma Ltd

- Corden Pharma

- Recipharm AB

- Pfizer Inc.

- LGM Pharma, LLC

- Aenova Group

- Bayer AG

- Aliyan Pharmaceuticals LLP

- Adragos Pharma GmbH

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this Suppositories market report include:- Novartis AG

- SANOFI WINTHROP INDUSTRIE

- Zydus Group

- Church & Dwight Co., Inc.

- Bausch Health Companies Inc.

- Teva Pharmaceutical Industries Ltd.

- Sun Pharmaceutical Industries Ltd.

- Aspen Holdings

- Haleon Group of Companies

- Cipla Limited

- Gulf Pharmaceutical Industries

- Prestige Consumer Healthcare Inc.

- Bliss GVS Pharma Ltd

- Corden Pharma

- Recipharm AB

- Pfizer Inc.

- LGM Pharma, LLC

- Aenova Group

- Bayer AG

- Aliyan Pharmaceuticals LLP

- Adragos Pharma GmbH

Table Information

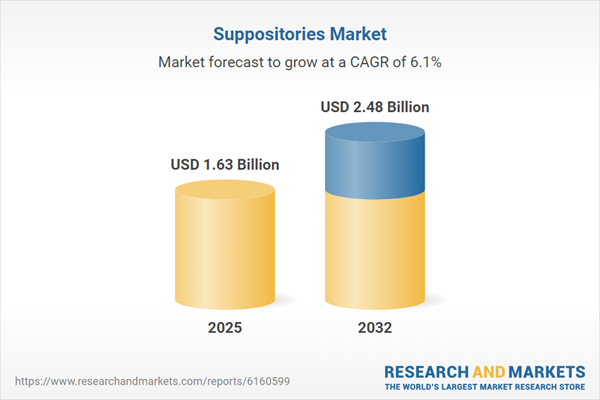

| Report Attribute | Details |

|---|---|

| No. of Pages | 199 |

| Published | October 2025 |

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 1.63 Billion |

| Forecasted Market Value ( USD | $ 2.48 Billion |

| Compound Annual Growth Rate | 6.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 22 |