This shift is being supported by changing emissions standards, the rise of electric models, and improved telematics integration. Recent developments in e-commerce and logistics, particularly after the pandemic, have driven companies to modernize their fleets by embracing predictive analytics and real-time monitoring. State-level grants and electrification incentives are further accelerating this trend, particularly among utility fleets and city governments incorporating sustainability mandates into vehicle procurement. Innovation in chassis and drivetrain platforms is becoming essential for maintaining brand competitiveness in this increasingly dynamic market.

The diesel segment held a 64% share in 2024 and is projected to grow at a CAGR of 6% through 2034. The diesel-powered Class 6 truck segment continues to lead due to its extensive fueling infrastructure, robust technology base, and strong track record in long-haul and demanding operations. Most medium-duty fleets remain diesel-centric, benefiting from the reliability and range that diesel engines offer. Major OEMs offering diesel platforms have managed to retain their edge by meeting evolving emissions standards while preserving engine efficiency and power delivery for heavy-duty tasks.

The box body configuration segment held a 46% share in 2024 and is forecasted to grow at a CAGR of 7% through 2034. Its enclosed, built, and secure structure makes it a preferred choice across a wide array of industries - from retail logistics and wholesale distribution to consumer shipping. Box body trucks are integral to regional logistics and remain vital for businesses needing secure, versatile, and weather-resistant freight solutions.

U.S. Class 6 truck market held an 87% share and generated USD 4.31 billion in 2024. The country’s leadership is driven by its expansive highway systems, advanced logistics capabilities, and consistent demand across last-mile, urban, and regional transport sectors. The strength of local assembly, innovation pipelines, and well-supported aftermarket services continues to elevate the market's maturity.

Key players involved in the North America Class 6 Truck Market include OEMs such as Navistar, Mack Trucks, Ford, Peterbilt Motors, Volvo Trucks, PACCAR, Daimler Truck, Isuzu Commercial Truck, Lion Electric, and Hino Motors either headquartered or operating extensively within the US, the region enjoys a robust supply chain and high frequency of product updates. Key players are focusing on platform-level upgrades to boost fuel efficiency, reduce emissions, and extend vehicle life cycles. Investments in electric drivetrains and alternative fuels are accelerating to meet sustainability regulations and customer demands. Companies are also integrating advanced telematics for real-time diagnostics, remote monitoring, and enhanced fleet visibility. Collaborations with state programs and energy agencies are helping OEMs secure funding and streamline deployment of zero-emission models. Modular vehicle designs are being introduced to offer greater flexibility across industries. Moreover, partnerships with technology providers are enabling seamless connectivity for predictive maintenance and route optimization.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The key companies profiled in this North America Class 6 Truck market report include:- Daimler Truck

- Ford

- Volvo Trucks

- PACCAR

- Navistar

- Hino Motors

- Isuzu Commercial Truck

- Peterbilt Motors

- Mack Trucks

- Scania

- Autocar Trucks

- Spartan Motors

- Western Star Trucks

- Kenworth

- Blue Bird Corporation

- International Trucks

- Freightliner Trucks

- Oshkosh Corporation

- Nikola Corporation

- IC Bus

- Lion Electric

- Workhorse Group

- GreenPower Motor Company

- Xos Trucks

- VIA Motors

- REE Automotive

- Canoo

- Phoenix Motorcars

- SEA Electric

- Battle Motors

Table Information

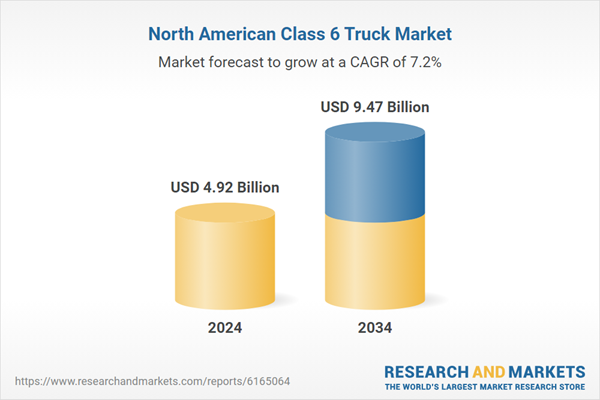

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | August 2025 |

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 4.92 Billion |

| Forecasted Market Value ( USD | $ 9.47 Billion |

| Compound Annual Growth Rate | 7.2% |

| Regions Covered | North America |

| No. of Companies Mentioned | 31 |