Government regulations and infrastructure upgrades across the Asia-Pacific are actively reshaping this market. Recent environmental policies are pushing two-wheeler manufacturers to adopt cleaner engines and electric powertrains. Changes in licensing laws and continued financial support for electric vehicle adoption across multiple nations are influencing design priorities and consumer buying behavior. Leading brands are integrating smart features, enhanced safety technologies, and connected systems to capture a tech-forward customer base. The market has evolved post-pandemic, with increased focus on private mobility and contactless transport solutions bolstering demand for personal two-wheelers.

The motorcycles segment held 69% share and is forecasted to grow at 3.5% CAGR through 2034. These vehicles dominate due to their popularity in major countries like China, India, Thailand, and Indonesia. Buyers choose motorcycles for their higher engine displacement, superior road performance, and suitability for longer commutes. From delivery services to individual consumers, motorcycles serve a diverse user group seeking a balance of utility, speed, and style.

In 2024, the internal combustion engine (ICE) segment held an 82% share and is expected to grow at a CAGR of 4% through 2034. Affordable ICE two-wheelers and widespread fuel access drive high adoption in markets such as Vietnam, Indonesia, and India. Consumers continue to favor ICE-powered models due to their greater mileage, lower purchase cost, and fast refueling options - critical for daily commuting and service-based applications in both urban and rural environments.

India Motorcycles and Scooters Market held a 25% share and generated USD 28.3 billion in 2024. The country’s vast population, rising urban demand, and deep-rooted two-wheeler culture make it the largest market across the region. Strong infrastructure support and a value-driven consumer base have ensured that motorcycles and scooters remain the top choice for mobility across both metro areas and rural zones.

Key industry players shaping the Asia-Pacific Motorcycles and Scooters Market include Suzuki Motor, Hero MotoCorp, TVS Motor, Bajaj Auto, Yamaha Motor, Honda Motor, KTM AG, Royal Enfield, Kawasaki, and Yadea Group. Companies operating in the Asia-Pacific motorcycles and scooters industry are implementing a mix of innovation, regional expansion, and product diversification to strengthen their market position. Emphasis is being placed on electric vehicle development, with investments in advanced battery technologies and charging infrastructure. Manufacturers are also rolling out smart features such as Bluetooth connectivity, GPS tracking, and digital dashboards to appeal to younger, tech-conscious riders. Expanding dealership networks and service points, especially in Tier II and III cities, is helping improve accessibility. Many companies are collaborating with local governments on sustainability initiatives, while also developing entry-level models to attract price-sensitive buyers.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The key companies profiled in this Asia-Pacific Motorcycles and Scooters market report include:- Bajaj Auto

- BMW Motorrad

- CFMoto

- Harley-Davidson

- Hero MotoCorp

- Honda Motor

- Kawasaki Heavy Industries

- KTM AG

- Lifan Technology

- Loncin Motor

- Piaggio & C. SpA

- Suzuki Motor

- TVS Motor Company

- Yamaha Motor

- Ather Energy

- Energica Motor

- Gogoro

- Horwin

- NIU Technologies

- Okinawa Autotech

- Yadea Group

- Benelli Q.J.

- Felo Technology

- Kymco

- Mahindra Two Wheelers

- Royal Enfield

- SYM (Sanyang Motor Co., Ltd.)

- Zongshen Industrial

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | August 2025 |

| Forecast Period | 2024 - 2034 |

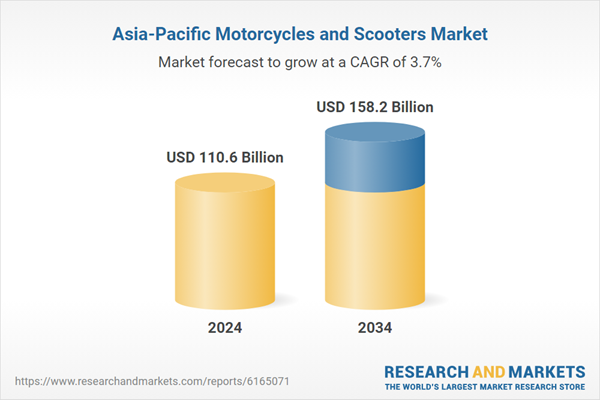

| Estimated Market Value ( USD | $ 110.6 Billion |

| Forecasted Market Value ( USD | $ 158.2 Billion |

| Compound Annual Growth Rate | 3.7% |

| Regions Covered | Asia Pacific |

| No. of Companies Mentioned | 29 |