The demand is also spreading across sectors due to their versatile use in producing sustainable fabrics, reinforced green building materials, and eco-friendly packaging. These natural fibers, being renewable and compostable, fit into circular economy models and help reduce dependence on plastic and petroleum-based products. As industries innovate toward sustainability, the specialty fiber crop seeds market is responding with expanded offerings and improved seed performance.

In 2024, cotton seed led the market segment by generating USD 913 million and is expected to grow at a CAGR of 5.6%. Cotton remains the most prevalent fiber crop worldwide due to its broad adaptability, high yield potential, and widespread cultivation. With advancements in biotechnology, including pest-resistant and high-efficiency strains, cotton continues to dominate the specialty fiber crop category. Genetic improvements have strengthened its productivity while reducing losses, making it a vital part of the fiber economy in both developed and developing regions.

Traditional breeding methods held 40.2% share in 2024 and is expected to grow at a CAGR of 5.9% through 2034. Specialists pointed out that while newer genetic technologies are gaining momentum, conventional breeding still plays a major role in seed development. It remains a preferred method for many due to its proven reliability, affordability, and broad regulatory acceptance. The process, based on generations of selective cross-breeding, aligns with traditional farming systems, making it a staple in many agricultural communities around the world. Despite the emergence of more advanced genetic tools, conventional breeding continues to receive widespread industry support.

North America Specialty Fiber Crop Seeds Market held 81% generating USD 507.9 million in 2024. The region’s growth is being fueled by rising demand for sustainable agriculture and high-performance natural fibers. Consumers across the US and Canada are favoring organic and environmentally friendly products, prompting seed companies to invest in drought-tolerant and genetically enhanced varieties that can perform well despite changing climate conditions. As the focus sharpens on climate resilience and eco-conscious farming, the US market is anticipated to lead future developments in fiber crop innovation.

Key players in the Global Specialty Fiber Crop Seeds Market include Nuziveedu Seeds Limited, Limagrain Group, BASF SE (Agricultural Solutions), Nufarm Limited, Mahyco, Bayer AG (Crop Science Division), Corteva Agriscience, KWS SAAT SE & Co. KGaA, Syngenta AG, Advanta Seeds, and Territorial Seed Company. To gain competitive advantage, companies in the specialty fiber crop seeds market are pursuing a blend of innovation, partnerships, and sustainability. One major approach involves investing heavily in R&D to develop climate-resilient, high-yield seed varieties that align with environmental standards. Firms are also forging strategic alliances with textile manufacturers, construction companies, and packaging businesses to ensure consistent demand for their fiber crops. Expansion into emerging markets with adaptable seed lines is another key strategy. Additionally, many companies are integrating traceability features and promoting organic certifications to meet evolving consumer preferences.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The key companies profiled in this Specialty Fiber Crop Seeds market report include:- Bayer AG (Crop Science Division)

- Syngenta AG

- Corteva Agriscience

- BASF SE (Agricultural Solutions)

- Limagrain Group

- Nufarm Limited

- Territorial Seed Company

- KWS SAAT SE & Co. KGaA

- Nuziveedu Seeds Limited

- Advanta Seeds

- Mahyco

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 192 |

| Published | August 2025 |

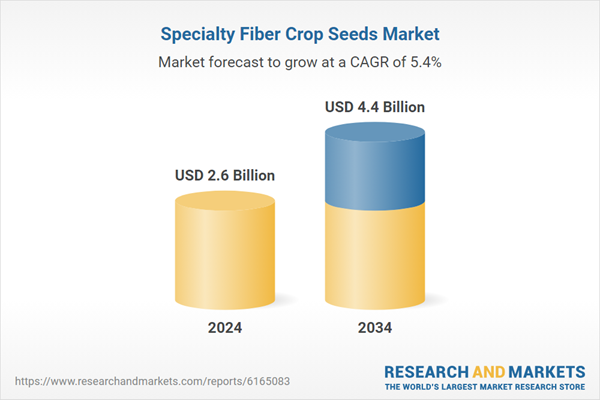

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 2.6 Billion |

| Forecasted Market Value ( USD | $ 4.4 Billion |

| Compound Annual Growth Rate | 5.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 12 |