This steady market expansion is driven by rising global demand for eco-conscious and renewable raw materials across a range of industries. With increasing environmental concerns, both manufacturers and consumers are turning toward natural fibers such as jute, flax, sisal, and hemp due to their biodegradability, renewability, and reduced environmental impact. In addition, regulatory bodies in multiple regions are encouraging sustainable agriculture while imposing restrictions on synthetic materials, further accelerating the shift toward greener alternatives. This regulatory push continues to support the growth trajectory of the specialty fiber crops sector.

Textile and apparel manufacturers are increasingly incorporating organic fibers into their product lines to appeal to a growing segment of sustainability-focused consumers. Advances in processing and fiber blending technologies have also elevated the quality and application range of these natural fibers, making them more competitive with synthetic counterparts in terms of durability, strength, and texture. Beyond fashion, the adoption of specialty fibers has grown in non-traditional industries, including automotive, construction, and composites, expanding their market footprint significantly.

The flax fiber segment was valued at USD 3.16 billion in 2024 and is projected to grow at a CAGR of 8.2% from 2025 to 2034. The surge in demand for both flax and hemp fibers stems from their strength, longevity, and low environmental impact, making them increasingly preferred for use in composites, textiles, and building materials. Specialty fibers derived from cotton and kenaf are also witnessing greater usage due to their biodegradable properties and application across packaging, paper, and premium textile segments. Additionally, leaf and fruit-based fibers such as coir, banana, and sisal are becoming viable materials for eco-friendly packaging, domestic textiles, and geotextile uses due to their sustainability and wide availability.

In 2024, the automotive end-use segment reached USD 2.93 billion in value and is expected to grow at an 8.7% CAGR, representing a 32.2% share during the 2025-2034 period. These natural fibers are increasingly used in vehicle interiors and composite materials, offering a lightweight and strong alternative to synthetics. The building and construction sector is also integrating these fibers in insulation panels and reinforcement components, owing to their strength and green credentials.

North America Specialty Fiber Crops Market generated USD 2.24 billion in 2024. The demand across this region is rising steadily as industries such as construction, automotive, and textiles move toward integrating sustainable materials. The shift is further supported by greater environmental awareness, growing consumer demand for sustainable products, and government incentives promoting eco-friendly farming practices. The expansion of the North American market is also facilitated by ongoing innovations in fiber processing and composite development, which are unlocking new applications for specialty fibers.

Prominent players leading the Global Specialty Fiber Crops Market include Natural Fibers Corporation, Kenaf Partners USA, and K.E.F.I. S.p.A. (Italy), ANDRITZ Group, and Hemp Inc., among others. To strengthen their presence, companies in the Global Specialty Fiber Crops Market are adopting a variety of strategic approaches. Many are expanding their production capacities to meet growing global demand for sustainable materials. R&D investments are focused on enhancing fiber quality and broadening applications through innovations in blending, processing, and composite engineering. Partnerships with construction, automotive, and textile companies are helping manufacturers integrate specialty fibers into end-use products more seamlessly. In addition, businesses are exploring vertical integration models to secure consistent supply chains and improve cost efficiency.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies profiled in this Specialty Fiber Crops market report include:- K.E.F.I. S.p.a. (Italy)

- Natural Fibers Corporation

- Mississippi Delta Fiber Cooperative

- Kenaf Partners USA

- ANDRITZ Group

- Formation AG

- Hempflax Group

- Canadian Greenfield Technologies

- Hemp Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 210 |

| Published | October 2025 |

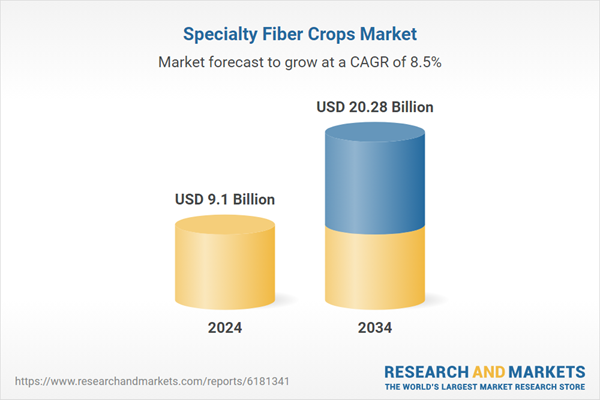

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 9.1 Billion |

| Forecasted Market Value ( USD | $ 20.28 Billion |

| Compound Annual Growth Rate | 8.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |