ATP assays are essential for detecting adenosine triphosphate levels, which act as indicators of cellular viability, energy metabolism, and cytotoxic response. With the shift toward precision medicine and biologically relevant testing, demand for real-time, cell-based assays is rising. These tests enable researchers to assess cellular behavior, viability, and stress responses during early drug development, environmental monitoring, and toxicity screening. The growing emphasis on targeted drug discovery and high-throughput screening in biotechnology and pharmaceutical labs continues to elevate the role of ATP assays in delivering reliable and scalable biological data essential for next-generation therapeutics.

In 2024, the consumables segment generated USD 2.1 billion and will reach USD 4.5 billion by 2034 at a CAGR of 7.7%. This segment remains dominant due to the recurring need for assay kits, reagents, and specialized lab materials essential for routine procedures. These items form the backbone of most ATP testing workflows and are vital across multiple platforms, particularly in drug screening and contamination detection. As laboratories scale their operations, the continued use of these materials in research and diagnostic applications supports steady segmental growth.

The luminometric assays segment held 41.2% share in 2024. Their widespread adoption stems from high accuracy, fast results, and automation compatibility. The ability of these assays to deliver quantitative data with high sensitivity and low background noise makes them the preferred choice for large-scale screening and laboratory workflows. They are widely used in high-volume research settings for their easy integration with automated systems, real-time monitoring, and multiplexing capabilities. Their efficiency in handling large datasets with minimal manual processing significantly improves throughput while maintaining data consistency.

North America ATP Assay Market held 42.5% share in 2024. The region's advanced infrastructure for research, strong presence of pharmaceutical and biotech firms, and rapid uptake of novel diagnostic technologies continue to drive demand. A growing need for cell-based testing, drug development, and contamination detection across labs in the U.S. and Canada has strengthened the region's leadership. The surge in chronic illness cases and expanding investments in clinical trials also contribute to the rising use of ATP assays across academic and industrial sectors.

Top companies driving the Global ATP Assay Market include Danaher, 3M Company, Promega Corporation, Merck, and Thermo Fisher Scientific - together accounting for 55% of global market share. Key players in the ATP assay market are focusing on innovation-driven growth through continuous R&D in assay sensitivity, scalability, and automation compatibility. Companies are enhancing their product lines by integrating advanced luminometric technologies and microplate-based systems that support high-throughput applications. Strategic collaborations with biotech firms and research institutes help expand their end-user base while strengthening brand recognition. Mergers and acquisitions are also being used to enter new geographic markets and enhance production capacity. Firms are increasingly investing in digital lab solutions and cloud-based analytics to offer better assay monitoring and data traceability.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The key companies profiled in this ATP Assay market report include:- 3M Company

- AAT Bioquest

- Abcam

- Agilent Technologies

- Berthold Technologies

- Biotium

- BioVision

- Cayman Chemical

- Cell Signaling Technology

- Charm Sciences

- Danaher Corporation

- Lonza

- Merck

- PCE Instruments

- Promega

- Reddot Biotech

- Revvity

- Thermo Fisher Scientific

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 138 |

| Published | August 2025 |

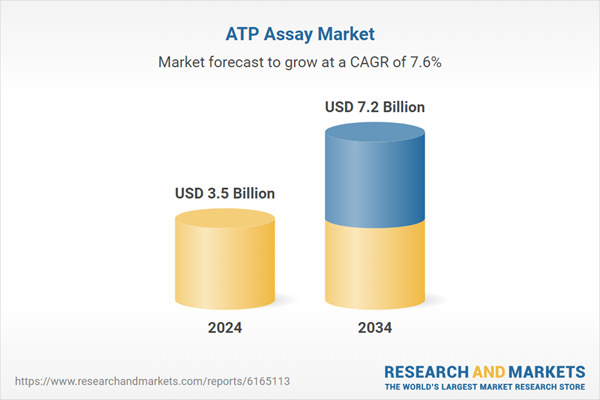

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 3.5 Billion |

| Forecasted Market Value ( USD | $ 7.2 Billion |

| Compound Annual Growth Rate | 7.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 19 |