Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

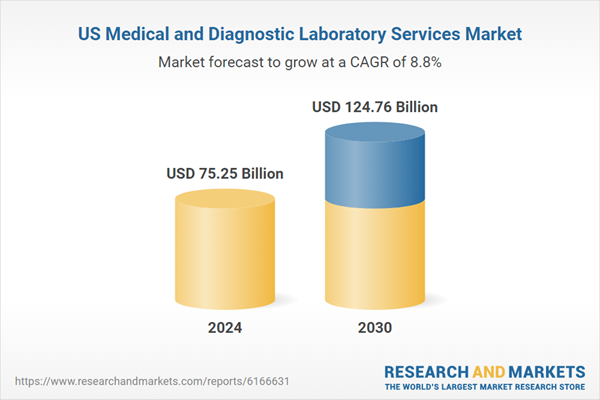

This market is experiencing a fundamental transformation shifting away from traditional, high-volume, hospital-based operations toward a more integrated, technology-driven, and patient-focused model. As diagnostic testing becomes increasingly central to value-based care strategies, chronic disease monitoring, and the rise of precision medicine, the industry is well-positioned for long-term growth. This momentum is being fueled by advancements in diagnostics, increased demand for accessible testing solutions, and deeper integration with emerging care delivery frameworks across the healthcare continuum.

Key Market Drivers

Rising Burden of Chronic and Lifestyle-Related Diseases

The increasing prevalence of chronic and lifestyle-related diseases is a critical demand driver for the U.S. Medical and Diagnostic Laboratory Services market. These conditions are responsible for a dominant share of national healthcare expenditures, with total costs encompassing direct medical treatment and indirect economic losses from reduced workforce productivity surpassing USD1 trillion annually. This growing economic strain underscores the urgent need for scalable, data-driven interventions, particularly in diagnostics and early disease management.Chronic conditions require ongoing, routine diagnostics for effective disease management, risk stratification, and treatment monitoring: Patients require regular testing for blood glucose levels, HbA1c, lipid profiles, kidney function (e.g., creatinine, microalbumin), and electrolyte panels. These tests are performed multiple times per year, creating a high-frequency revenue stream for labs.

Cardiovascular disease (CVD) remains the foremost cause of mortality in the United States, accounting for one in every five deaths. In 2022 alone, heart disease claimed the lives of 702,880 individuals, according to data from the CDC. Health Affairs estimates that approximately one in three U.S. adults equating to nearly 71.3 million people are currently living with one or more forms of CVD. This widespread prevalence not only highlights a critical public health concern but also signals sustained demand for diagnostic and monitoring services within the nation’s healthcare infrastructure.

Cancer patients depend on diagnostic labs for tumor markers, pathology review, genomic profiling, and post-treatment monitoring, including through liquid biopsies and molecular diagnostics. In 2025, the United States is projected to see a significant rise in cancer incidence, with the American Cancer Society forecasting approximately 2,041,910 new cancer diagnoses over the year. This equates to an average of nearly 5,600 new cases each day. The growing volume of cancer diagnoses underscores the critical role of diagnostic laboratories in early detection, disease staging, and treatment planning reinforcing the sector’s strategic importance within the broader oncology care continuum. This ongoing demand from chronic care supports sustained test volumes, enhances customer retention, and ensures predictable cash flow for service providers.

As healthcare policy shifts toward early detection and prevention to control long-term costs, diagnostics are being used not just for diagnosis, but as a frontline tool for prevention: Lipid panels, blood pressure-related bloodwork, metabolic panels, and liver/kidney function tests are now routinely ordered for individuals at risk due to age, obesity, or family history.

Labs are central to identifying at-risk patients early, enabling lifestyle interventions before disease progression. This increases the volume of low-cost, high-frequency tests performed in wellness programs and primary care settings. Insurers and employers promote regular screenings as part of corporate wellness initiatives. Diagnostic labs benefit directly from this trend, particularly in B2B contracts and population health programs. This preventive orientation further widens the diagnostic touchpoint with patients beyond acute clinical need.

Modern chronic care management programs rely heavily on diagnostics for informed, data-driven interventions: Diagnostic data is used to segment patient populations, set clinical baselines, and measure health outcomes under bundled payment or capitation models. Labs play a strategic role in achieving quality metrics tied to reimbursement. For chronic patients, especially the elderly and immobile, diagnostic services are being extended into home settings via mobile phlebotomy or self-collection kits, often integrated with RPM platforms. Labs are increasingly partnering with primary care providers, specialists, and health systems to co-manage chronic disease cohorts, providing not just test results, but also interpretive insights and trend analysis. These integrations position labs as clinical enablers, not just transactional service providers, increasing their relevance and embeddedness in care pathways.

Key Market Challenges

Reimbursement Pressure and Regulatory Constraints

One of the most significant barriers to growth is the ongoing pressure from federal reimbursement policies and increasing regulatory oversight: The Protecting Access to Medicare Act (PAMA) has led to sharp reductions in reimbursement rates for a wide range of clinical laboratory tests. These rate cuts disproportionately affect independent labs and smaller regional providers that rely heavily on Medicare payments for revenue.Diagnostic laboratories must navigate a highly complex web of Current Procedural Terminology (CPT) codes, medical necessity documentation, and insurance claim validations. Errors or delays in billing processes can result in reimbursement denials and operational inefficiencies. Labs are subject to strict quality and operational standards under frameworks such as CLIA (Clinical Laboratory Improvement Amendments), CAP (College of American Pathologists), and HIPAA. Compliance requires significant investment in administrative overhead, IT systems, and ongoing audits particularly challenging for mid-sized and independent operators.

Key Market Trends

Shift Toward Preventive and Personalized Medicine

One of the most impactful trends driving future growth is the U.S. healthcare system’s transition from reactive treatment to preventive, predictive, and personalized care. Medical laboratories are at the center of this shift: There is growing emphasis on early detection of diseases such as cancer, cardiovascular conditions, and diabetes. This has led to increased demand for diagnostic panels, genetic screenings, and biomarker testing especially for at-risk populations. Companion diagnostics are gaining traction in oncology, immunology, and rare diseases. Laboratories are increasingly providing precision diagnostic services that help physicians tailor treatments based on individual genetic and molecular profiles. As chronic disease prevalence continues to rise, particularly among aging demographics, labs are seeing expanded roles in ongoing patient monitoring and treatment optimization.This trend is strengthening the strategic relevance of diagnostic services within the broader care continuum and fueling demand for higher test volumes and specialized capabilities.

Key Market Players

- Quest Diagnostics Incorporated

- Thermo Fisher Scientific Inc.

- BIOMÉRIEUX

- Siemens Medical Solutions USA, Inc.

- Laboratory Corporation of America® Holdings

- Sonic Healthcare USA

- Bio-Rad Laboratories, Inc.

- Charles River Laboratories

- Danaher Corp.

Report Scope:

In this report, the US Medical and Diagnostic Laboratory Services Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:US Medical and Diagnostic Laboratory Services Market, By Test:

- Lipid Panel

- Liver Panel

- Renal Panel

- Complete Blood Count

- Electrolyte Testing

- Infectious Disease Testing

- Other

US Medical and Diagnostic Laboratory Services Market, By Product:

- Instruments

- Reagents

- Other

US Medical and Diagnostic Laboratory Services Market, By End User:

- Hospital Laboratory

- Diagnostic Laboratory

- Point-of-care Testing

- Other

US Medical and Diagnostic Laboratory Services Market, By Region:

- North-east

- Mid-west

- West

- South

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the US Medical and Diagnostic Laboratory Services Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Quest Diagnostics Incorporated

- Thermo Fisher Scientific Inc.

- BIOMÉRIEUX

- Siemens Medical Solutions USA, Inc.

- Laboratory Corporation of America® Holdings

- Sonic Healthcare USA

- Bio-Rad Laboratories, Inc.

- Charles River Laboratories

- Danaher Corp.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 85 |

| Published | August 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 75.25 Billion |

| Forecasted Market Value ( USD | $ 124.76 Billion |

| Compound Annual Growth Rate | 8.7% |

| Regions Covered | United States |

| No. of Companies Mentioned | 9 |