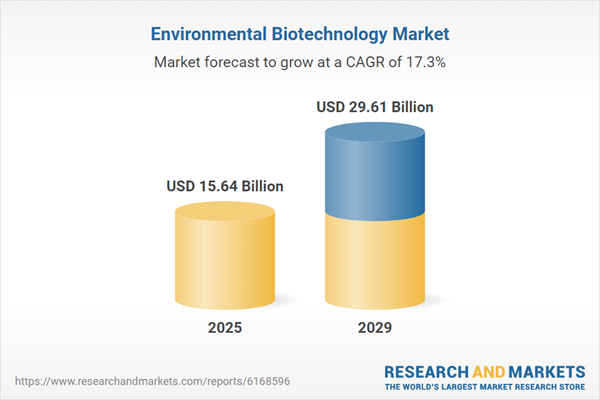

The environmental biotechnology market size is expected to see rapid growth in the next few years. It will grow to $29.61 billion in 2029 at a compound annual growth rate (CAGR) of 17.3%. The growth in the forecast period can be attributed to a growing emphasis on climate change mitigation, increased investment in circular bioeconomy models, rising demand for environmentally friendly industrial processes, heightened need for low-carbon industrial solutions, and a surge in climate-related disasters. Major trends during the forecast period include the development of bioplastics from agricultural waste, advancement of bioleaching techniques for e-waste recycling, incorporation of bioinformatics in pollution gene mapping, adoption of sustainable practices within industrial biotechnology, and innovations in enzyme-based soil detoxification.

The rising demand for wastewater treatment is expected to drive the growth of the environmental biotechnology market in the coming years. Wastewater treatment involves the removal of contaminants, pollutants, and harmful substances from used or dirty water to make it safe for release into the environment or for reuse. This growing demand is primarily fueled by increasing water pollution levels, which pose risks to public health, ecosystems, and the availability of clean water. Environmental biotechnology improves wastewater treatment by employing biological processes and organisms to effectively break down pollutants, reduce toxic waste, and support cleaner water discharge. For example, in 2025, a report published by the American Society of Civil Engineers, a US-based professional organization, indicated that the estimated annual investment gap for water infrastructure - including drinking water, wastewater, and stormwater - in 2024 was $99 billion, up from $81 billion reported in ASCE’s 2021 study. Hence, the rising need for wastewater treatment is propelling the environmental biotechnology market’s growth.

Leading companies in the environmental biotechnology sector are focusing on creating innovative solutions such as enzyme-based biocatalysts to improve the efficiency and sustainability of pollution control and waste treatment processes. Enzyme-based biocatalysts are biological molecules that speed up chemical reactions, enabling faster and more efficient environmental applications like waste degradation and pollutant removal. For instance, in November 2024, Novonesis A/S, a Denmark-based biotechnology firm, introduced Eversa Advance, an enzymatic biosolution designed to enhance the efficiency and sustainability of biodiesel feedstock processing, particularly for materials containing up to 20% free fatty acids. This breakthrough allows biodiesel manufacturers to process waste-based feedstocks without requiring acid esterification, reducing pretreatment operating costs by up to 45%, while also minimizing equipment wear and downtime. By increasing feedstock flexibility, this solution helps improve plant profitability and supports more sustainable biodiesel production.

In August 2024, PI Industries Ltd., an India-based chemical company, acquired Plant Health Care Plc for an undisclosed sum. Through this acquisition, PI Industries Ltd. seeks to bolster its position in the global biologicals market by integrating Plant Health Care’s advanced peptide technology and expanding its portfolio of sustainable agricultural inputs. Plant Health Care Plc is a UK-based firm specializing in biological, peptide-based agricultural products.

Major players in the environmental biotechnology market are BASF SE, Dow Chemical Company, Thermo Fisher Scientific Inc., Merck KGaA, Evonik Industries AG, Ecolab Inc., DuPont de Nemours Inc., Suez SA, Agilent Technologies Inc., Novonesis A/S, LCY Chemical Corporation, Ginkgo Bioworks Holdings Inc., Praj Industries Limited, Genomatica Inc., LanzaTech Global Inc., Biorem Inc., Green Biologics Ltd., Veolia Environnement S.A., Alken-Murray Corporation, and SynBioBeta LLC.

North America was the largest region in the environmental biotechnology market in 2024. The regions covered in environmental biotechnology report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East and Africa. The countries covered in the environmental biotechnology market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

The environmental biotechnology market includes revenues earned by entities by providing services such as bioremediation, waste management, resource recovery, and environmental monitoring. The market value includes the value of related goods sold by the service provider or included within the service offering. The environmental biotechnology market also includes sales of biofertilizers, biopesticides, biogas, bioremediation agents, and biofilters. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

Note that the outlook for this market is being affected by rapid changes in trade relations and tariffs globally. The report will be updated prior to delivery to reflect the latest status, including revised forecasts and quantified impact analysis. The report’s Recommendations and Conclusions sections will be updated to give strategies for entities dealing with the fast-moving international environment.

The sudden escalation of U.S. tariffs and the consequent trade frictions in spring 2025 are severely impacting the pharmaceutical companies contend with tariffs on APIs, glass vials, and lab equipment inputs with few alternative sources. Generic drug makers, operating on razor-thin margins, are especially vulnerable, with some reducing production of low-profit medicines. Biotech firms face delays in clinical trials due to tariff-related shortages of specialized reagents. In response, the industry is expanding API production in India and Europe, increasing inventory stockpiles, and pushing for trade exemptions for essential medicines.

The environmental biotechnology market research report is one of a series of new reports that provides environmental biotechnology market statistics, including environmental biotechnology global market size, regional shares, competitors with environmental biotechnology market share, detailed environmental biotechnology market segments, market trends and opportunities, and any further data you may need to thrive in the environmental biotechnology industry. The environmental biotechnology market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

Environmental biotechnology involves utilizing biological processes, organisms, or systems to create technologies and products aimed at protecting and restoring the environment. It is widely applied in fields such as waste management, pollution control, and the treatment of wastewater and contaminated soils.

The main product types in environmental biotechnology include microbial blends, nutrients, enzymes, and microbes. Microbial blends consist of mixtures of various strains or species of beneficial microorganisms designed to work together synergistically for specific biological purposes, such as improving soil fertility, degrading waste, or treating wastewater. These products support a variety of technologies including tissue engineering and regeneration, cell-based assays, nanobiotechnology, fermentation, chromatography, DNA sequencing, polymerase chain reaction technology, and more. They are utilized in applications like wastewater treatment and bioremediation, with key end users spanning agriculture, water treatment, energy, waste management, food and beverage, and pharmaceutical industries.

The revenues for a specified geography are consumption values and are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 1-3 business days.

Table of Contents

Executive Summary

Environmental Biotechnology Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on environmental biotechnology market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as geopolitical conflicts, trade policies and tariffs, post-pandemic supply chain realignment, inflation and interest rate fluctuations, and evolving regulatory landscapes.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for environmental biotechnology? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward, including technological disruption, regulatory shifts, and changing consumer preferences? The environmental biotechnology market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the technological advancements such as AI and automation, Russia-Ukraine war, trade tariffs (government-imposed import/export duties), elevated inflation and interest rates.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Product: Microbial Blends; Nutrients; Enzymes; Microbes2) By Technology: Tissue Engineering and Regeneration; Cell-Based Assays; Nanobiotechnology; Fermentation; Chromatography; Deoxyribonucleic Acid (DNA) Sequencing; Polymerase Chain Reaction Technology; Other Technologies

3) By Application: Wastewater Treatment; Bioremediation; Other Applications

4) By End User: Agriculture; Water Treatment; Energy; Waste Management; Food and Beverage; Pharmaceuticals

Subsegments:

1) By Microbial Blends: Bioaugmentation Blends; Bioremediation Microbial Consortia; Waste Decomposition Microbial Mixes; Odor Control Microbial Formulations2) By Nutrients: Nitrogen Supplements; Phosphorus Additives; Trace Mineral Blends; Carbon Source Additives

3) By Enzymes: Waste Degrading Enzymes; Oil and Grease-Degrading Enzymes; Sludge Reduction Enzymes; Odor Control Enzymes

4) By Microbes: Bacteria; Fungi; Algae; Genetically Engineered Microorganisms

Companies Mentioned: BASF SE; Dow Chemical Company; Thermo Fisher Scientific Inc.; Merck KGaA; Evonik Industries AG; Ecolab Inc.; DuPont de Nemours Inc.; Suez SA; Agilent Technologies Inc.; Novonesis a/S; LCY Chemical Corporation; Ginkgo Bioworks Holdings Inc.; Praj Industries Limited; Genomatica Inc.; LanzaTech Global Inc.; Biorem Inc.; Green Biologics Ltd.; Veolia Environnement S.A.; Alken-Murray Corporation; SynBioBeta LLC.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain.

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The companies featured in this Environmental Biotechnology market report include:- BASF SE

- Dow Chemical Company

- Thermo Fisher Scientific Inc.

- Merck KGaA

- Evonik Industries AG

- Ecolab Inc.

- DuPont de Nemours Inc.

- Suez SA

- Agilent Technologies Inc.

- Novonesis A/S

- LCY Chemical Corporation

- Ginkgo Bioworks Holdings Inc.

- Praj Industries Limited

- Genomatica Inc.

- LanzaTech Global Inc.

- Biorem Inc.

- Green Biologics Ltd.

- Veolia Environnement S.A.

- Alken-Murray Corporation

- SynBioBeta LLC.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | October 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 15.64 Billion |

| Forecasted Market Value ( USD | $ 29.61 Billion |

| Compound Annual Growth Rate | 17.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 21 |