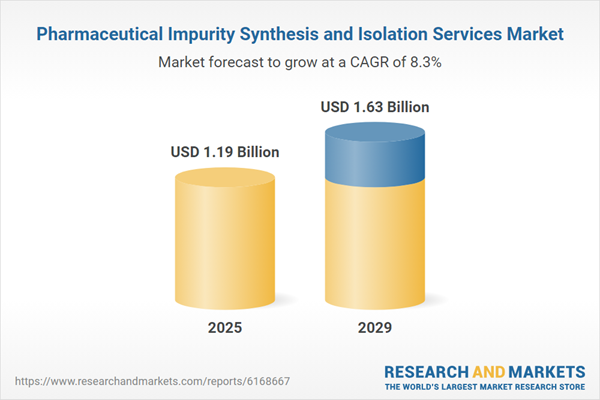

The pharmaceutical impurity synthesis and isolation services market size is expected to see strong growth in the next few years. It will grow to $1.63 billion in 2029 at a compound annual growth rate (CAGR) of 8.3%. The growth in the forecast period can be attributed to the expanding biopharmaceutical pipelines, increasing demand for high-purity active pharmaceutical ingredients (APIs), heightened regulatory focus on nitrosamine and genotoxic impurities, growth in personalized medicine, and rising investment in contract research and manufacturing services (CRO/CDMO). Key trends expected during this period include the adoption of AI-driven impurity identification, integration of green chemistry principles in synthesis processes, expansion of globally compliant GMP service providers, utilization of high-resolution mass spectrometry and nuclear magnetic resonance (NMR) techniques, and strategic collaborations aimed at accelerating impurity profiling and isolation efforts.

The growing production of biosimilars is anticipated to drive the expansion of the pharmaceutical impurity synthesis and isolation services market in the coming years. Biosimilars are biologic medications that closely resemble an already approved reference product, with no significant differences in terms of safety, efficacy, or quality. This increase in biosimilar production is largely due to the expiration of patents on original biologic drugs, which allows manufacturers to develop more cost-effective alternatives and enhance access to treatment. Pharmaceutical impurity synthesis and isolation services play a crucial role in biosimilar development by enabling the identification, characterization, and control of impurities, ensuring the biosimilar meets safety, quality, and regulatory standards. For example, in March 2025, the African Development Bank reported that the new XpandC facility aims to increase annual biosimilar production capacity from 3 million to 7.65 million doses by 2032 and plans to introduce two new biosimilars. As a result, the rising production of biosimilars is fueling growth in the pharmaceutical impurity synthesis and isolation services market.

Leading companies in the pharmaceutical impurity synthesis and isolation services market are developing advanced solutions, such as lidocaine impurity validation and testing, to ensure drug safety, meet regulatory standards, and improve the quality of pharmaceutical products. Lidocaine impurity validation and testing involve detecting and quantifying impurities in lidocaine formulations to confirm their safety, stability, and compliance with health regulations. For instance, in July 2025, Advent Pharma Limited, a pharmaceutical company based in Bangladesh, introduced a high-purity reference standard for a key lidocaine impurity - 1,4-Bis(2,6-dimethylphenyl) piperazine-2,5-dione. This impurity can form during the synthesis or degradation of lidocaine and requires consistent monitoring to ensure drug efficacy and safety. Advent’s standard, which has a purity of at least 97%, comes with comprehensive analytical documentation and complies with stringent regulatory standards such as ICH Q3A/B and Q2 guidelines, supporting method validation, stability studies, and regulatory submissions.

In October 2022, Symeres B.V., a Netherlands-based contract development and manufacturing organization, acquired Exemplify BioPharma for an undisclosed sum. This acquisition was intended to bolster Symeres’ strategic footprint in the United States by integrating Exemplify BioPharma’s specialized capabilities in process chemistry, analytical chemistry, and formulation development. This move enhances Symeres’ comprehensive drug development offerings and strengthens its ability to serve biotech and pharmaceutical clients across North America as part of its broader transatlantic expansion plan. Exemplify BioPharma is a U.S.-based company providing services in pharmaceutical impurity synthesis and isolation.

Major players in the pharmaceutical impurity synthesis and isolation services market are Thermo Fisher Scientific Inc., Merck KGaA, Laboratory Corporation of America Holdings, SGS SA, Eurofins Scientific SE, Agilent Technologies Inc., WuXi AppTec Co. Ltd., Catalent Inc., Charles River Laboratories International Inc., Intertek Group plc, Waters Corporation, Almac Group Limited, Piramal Pharma Limited, Cambrex Corporation, Syngene International Limited, Frontage Laboratories Inc., Pharmaron Beijing Co. Ltd., Symeres B.V., Synergenics Canada Inc., Veeda Clinical Research Limited, Alfa Chemistry LLC, Epichem Pty Ltd., Creative Dynamics Inc., PCI Pharma Services LLC, and VEEPRHO s.r.o.

North America was the largest region in the pharmaceutical impurity synthesis and isolation services market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in pharmaceutical impurity synthesis and isolation services report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East and Africa. The countries covered in the pharmaceutical impurity synthesis and isolation services market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

The pharmaceutical impurity synthesis and isolation services market consists of revenues earned by entities by providing services such as synthesis of impurities, isolation of impurities, impurity testing and characterization, and analytical control strategies. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

Note that the outlook for this market is being affected by rapid changes in trade relations and tariffs globally. The report will be updated prior to delivery to reflect the latest status, including revised forecasts and quantified impact analysis. The report’s Recommendations and Conclusions sections will be updated to give strategies for entities dealing with the fast-moving international environment.

The sudden escalation of U.S. tariffs and the consequent trade frictions in spring 2025 are severely impacting the pharmaceutical companies contend with tariffs on APIs, glass vials, and lab equipment inputs with few alternative sources. Generic drug makers, operating on razor-thin margins, are especially vulnerable, with some reducing production of low-profit medicines. Biotech firms face delays in clinical trials due to tariff-related shortages of specialized reagents. In response, the industry is expanding API production in India and Europe, increasing inventory stockpiles, and pushing for trade exemptions for essential medicines.

The pharmaceutical impurity synthesis and isolation services market research report is one of a series of new reports that provides pharmaceutical impurity synthesis and isolation services market statistics, including pharmaceutical impurity synthesis and isolation services industry global market size, regional shares, competitors with a pharmaceutical impurity synthesis and isolation services market share, detailed pharmaceutical impurity synthesis and isolation services market segments, market trends and opportunities, and any further data you may need to thrive in the pharmaceutical impurity synthesis and isolation services industry. This pharmaceutical impurity synthesis and isolation services market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

Pharmaceutical impurity synthesis and isolation services involve specialized processes aimed at deliberately generating and isolating trace-level impurities that may occur during the production, storage, or degradation of pharmaceutical products. These services are critical for helping pharmaceutical companies accurately identify, characterize, and quantify impurities to meet regulatory requirements and ensure the safety, efficacy, and quality of their drug products.

The primary types of services offered include synthesis services, isolation services, and analytical services. Synthesis services involve the controlled creation of chemical compounds - such as active ingredients, intermediates, or impurities - through chemical reactions and purification techniques. These services target various impurity types, including organic impurities, inorganic impurities, and residual solvents, and utilize advanced techniques such as chromatography, spectroscopy, crystallization, hyphenated methods, and more. They are applied in areas such as drug development, commercial manufacturing, quality control, and regulatory compliance, serving a range of end users including pharmaceutical and biotechnology companies, contract research organizations (CROs), and others.

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 1-3 business days.

Table of Contents

Executive Summary

Pharmaceutical Impurity Synthesis and Isolation Services Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on pharmaceutical impurity synthesis and isolation services market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as geopolitical conflicts, trade policies and tariffs, post-pandemic supply chain realignment, inflation and interest rate fluctuations, and evolving regulatory landscapes.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for pharmaceutical impurity synthesis and isolation services? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward, including technological disruption, regulatory shifts, and changing consumer preferences? The pharmaceutical impurity synthesis and isolation services market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the technological advancements such as AI and automation, Russia-Ukraine war, trade tariffs (government-imposed import/export duties), elevated inflation and interest rates.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Service: Synthesis Services; Isolation Services; Analytical Services2) By Impurity Type: Organic Impurities; Inorganic Impurities; Residual Solvents

3) By Technique: Chromatography; Spectroscopy; Crystallization; Hyphenated Techniques; Other Techniques

4) By Application: Drug Development; Commercial Manufacturing; Quality Control; Regulatory Compliance

5) By End User: Biotech and Pharmaceutical Companies; Contract Research Organizations (CRO); Other End Users

Subsegments:

1) By Synthesis Services: Custom Impurity Synthesis; Stable Isotope-Labeled Impurity Synthesis; Process-Related Impurity Synthesis; Degradation Product Synthesis; Metabolite Synthesis2) By Isolation Services: Isolation of Process Impurities; Isolation of Degradation Impurities; Preparative Chromatography-Based Isolation; Crystallization-Based Isolation; Flash Chromatography Isolation

3) By Analytical Services: Impurity Profiling; Structural Elucidation; Quantitative Analysis; Genotoxic Impurity Analysis; Stability Studies

Companies Mentioned: Thermo Fisher Scientific Inc.; Merck KGaA; Laboratory Corporation of America Holdings; SGS SA; Eurofins Scientific SE; Agilent Technologies Inc.; WuXi AppTec Co. Ltd.; Catalent Inc.; Charles River Laboratories International Inc.; Intertek Group plc; Waters Corporation; Almac Group Limited; Piramal Pharma Limited; Cambrex Corporation; Syngene International Limited; Frontage Laboratories Inc.; Pharmaron Beijing Co. Ltd.; Symeres B.V.; Synergenics Canada Inc.; Veeda Clinical Research Limited; Alfa Chemistry LLC; Epichem Pty Ltd.; Creative Dynamics Inc.; PCI Pharma Services LLC; and VEEPRHO s.r.o.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain.

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The companies featured in this Pharmaceutical Impurity Synthesis and Isolation Services market report include:- Thermo Fisher Scientific Inc.

- Merck KGaA

- Laboratory Corporation of America Holdings

- SGS SA

- Eurofins Scientific SE

- Agilent Technologies Inc.

- WuXi AppTec Co. Ltd.

- Catalent Inc.

- Charles River Laboratories International Inc.

- Intertek Group plc

- Waters Corporation

- Almac Group Limited

- Piramal Pharma Limited

- Cambrex Corporation

- Syngene International Limited

- Frontage Laboratories Inc.

- Pharmaron Beijing Co. Ltd.

- Symeres B.V.

- Synergenics Canada Inc.

- Veeda Clinical Research Limited

- Alfa Chemistry LLC

- Epichem Pty Ltd.

- Creative Dynamics Inc.

- PCI Pharma Services LLC

- and VEEPRHO s.r.o.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | October 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 1.19 Billion |

| Forecasted Market Value ( USD | $ 1.63 Billion |

| Compound Annual Growth Rate | 8.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 25 |