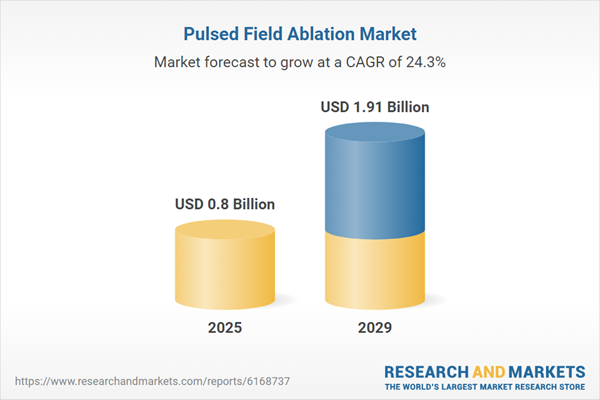

The pulsed field ablation market size is expected to see exponential growth in the next few years. It will grow to $1.91 billion in 2029 at a compound annual growth rate (CAGR) of 24.3%. The growth in the forecast period can be attributed to the increasing adoption of pulsed field ablation technology, a rising incidence of cardiac arrhythmias, growing investments in research and development, expanding awareness among healthcare providers, and the escalating demand for minimally invasive cardiac treatments. Key trends expected during this period include advancements in pulsed field ablation devices, innovations in catheter design, integration of imaging technologies with ablation systems, increased use of artificial intelligence for optimizing procedures, and the development of portable and user-friendly ablation platforms.

The increasing prevalence of atrial fibrillation is expected to drive the growth of the pulsed field ablation market. Atrial fibrillation is characterized by an irregular and often rapid heart rhythm that elevates the risk of stroke and other heart-related complications. This condition is becoming more common due to the aging population, as older individuals are significantly more likely to develop atrial fibrillation. Pulsed field ablation treats this condition by using controlled electrical pulses to precisely destroy abnormal heart tissue that causes irregular rhythms. It offers a quicker, safer, and more targeted alternative compared to traditional ablation techniques. For example, in December 2024, the Australian Institute of Health and Welfare reported that atrial fibrillation caused 2,600 deaths and contributed to 15,500 more in Australia in 2022. Death rates were 1.3 times higher among males, and over 62% of deaths occurred in people aged 85 and older, who faced up to 7.4 times greater risk than those aged 75-84. As a result, the rising incidence of atrial fibrillation is contributing to the expansion of the pulsed field ablation market.

Leading companies in the pulsed field ablation (PFA) market are focusing on innovative technologies such as selective tissue ablation to improve procedural safety and effectiveness. This approach targets only the diseased tissues while preserving surrounding healthy structures, which helps reduce recovery times and enhances long-term outcomes for patients with cardiac arrhythmias. For instance, in March 2025, Abbott, a US-based healthcare firm, received CE Mark approval for its Volt Pulsed Field Ablation System, designed to treat abnormal heart rhythms. The system integrates with Abbott’s EnSite X electrophysiology platform, improving visualization and navigation during procedures. The Volt system marks a significant advancement in electrophysiology by increasing procedural efficiency, delivering sharper imaging, and ensuring more accurate ablation for atrial fibrillation treatment. This next-generation technology is set to enhance patient outcomes and optimize cardiac care delivery.

In January 2024, CardioFocus, a US-based medical device company, acquired the electrophysiology division of Galvanize Therapeutics to strengthen its pulsed field ablation offerings. The acquisition includes the CE-marked CENTAURI System and the developmental QuickShot catheter. This strategic move expands CardioFocus’s footprint in the electrophysiology sector with both focal and single-shot PFA technologies. Galvanize Therapeutics is a US-based manufacturer known for developing the Aliya Pulsed Field Ablation (PFA) system.

Major players in the pulsed field ablation market are Johnson & Johnson, Abbott Laboratories, Medtronic plc, Siemens Healthineers AG, Boston Scientific Corporation, ConMed, AtriCure Inc., AngioDynamics Inc., CardioFocus Inc., Galvanize Therapeutics Inc., Kardium Inc., Acutus Medical Inc., AtriAN Medical Ltd., Field Medical Inc., Thermedical Inc., Adagio Medical Inc., Arga Medtech Inc., Mirai Medical, Pulse Biosciences Inc., and AccuPulse Medical Inc.

North America was the largest region in the pulsed field ablation market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in pulsed field ablation report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East and Africa. The countries covered in the pulsed field ablation market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

The pulsed field ablation market consists of revenues earned by entities by providing services such as consultation and treatment planning services, remote monitoring and telehealth support, and device maintenance and calibration services. The market value includes the value of related goods sold by the service provider or included within the service offering. The pulsed field ablation market also includes sales of training simulators and educational tools and disposable consumables. Values in this market are ‘factory gate’ values, that is, the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD unless otherwise specified).

Note that the outlook for this market is being affected by rapid changes in trade relations and tariffs globally. The report will be updated prior to delivery to reflect the latest status, including revised forecasts and quantified impact analysis. The report’s Recommendations and Conclusions sections will be updated to give strategies for entities dealing with the fast-moving international environment.

The fast surge in U.S. tariffs and the trade tensions that followed in spring 2025 are heavily affecting the medical equipment sector, particularly for imported imaging machine components, surgical-grade stainless steel, and plastic disposables. Hospitals and clinics resist price hikes, pressuring manufacturers’ margins. Regulatory hurdles compound the problem, as tariff-related supplier changes often require re-certification of devices, delaying time-to-market. Companies are mitigating risks by dual-sourcing critical parts, expanding domestic production of commoditized items, and accelerating R&D in cost-efficient materials.

The pulsed field ablation market research report is one of a series of new reports that provides pulsed field ablation market statistics, including the pulsed field ablation industry global market size, regional shares, competitors with the pulsed field ablation market share, detailed pulsed field ablation market segments, market trends, and opportunities, and any further data you may need to thrive in the pulsed field ablation industry. This pulsed field ablation market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

Pulsed field ablation is a minimally invasive cardiac procedure that delivers short bursts of high-voltage electrical pulses to selectively target and destroy abnormal heart tissue responsible for arrhythmias. This approach allows for precise ablation with minimal damage to surrounding tissues, offering a safer alternative to traditional ablation methods. It is increasingly used in the treatment of conditions such as atrial fibrillation.

The primary components of pulsed field ablation systems include catheters and generators. Catheters are flexible, tube-like medical instruments inserted into the body for the delivery or removal of fluids, as well as for performing diagnostic and therapeutic procedures. The key clinical indications for pulsed field ablation are atrial fibrillation and non-atrial fibrillation arrhythmias. Different ablation energy sources include pulsed field energy alone, pulsed field combined with radiofrequency energy, and pulsed field combined with cryoablation energy. The technology is used in various application areas such as ablation only or combined ablation and mapping. Major end users include hospitals, cardiac catheterization labs, ambulatory surgical centers, and other healthcare facilities.

The revenues for a specified geography are consumption values and are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 1-3 business days.

Table of Contents

Executive Summary

Pulsed Field Ablation Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on pulsed field ablation market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as geopolitical conflicts, trade policies and tariffs, post-pandemic supply chain realignment, inflation and interest rate fluctuations, and evolving regulatory landscapes.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for pulsed field ablation? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward, including technological disruption, regulatory shifts, and changing consumer preferences? The pulsed field ablation market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the technological advancements such as AI and automation, Russia-Ukraine war, trade tariffs (government-imposed import/export duties), elevated inflation and interest rates.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Components: Catheters; Generators2) By Indication: Atrial Fibrillation; Non-Atrial Fibrillation

3) By Source of Ablation: Pulsed Field Energy; Pulsed Field and Radiofrequency Energy; Pulsed Field and Cryoablation Energy

4) By Application Area: Ablation; Ablation and Mapping

5) By End Use: Hospitals; Cardiac Catheterization Labs; Ambulatory Surgical Centers; Other End Uses

Subsegments:

1) By Catheters: Single-use Catheters; Reusable Catheters; Diagnostic Catheters; Therapeutic Catheters; Balloon Catheters; Mapping Catheters2) By Generators: Monopolar Generators; Bipolar Generators; Pulsed Power Generators; Radiofrequency Generators With Pulsed Field Ablation Capability; Portable Generators; Fixed or Stationary Generators

Companies Mentioned: Johnson & Johnson; Abbott Laboratories; Medtronic plc; Siemens Healthineers AG; Boston Scientific Corporation; ConMed; AtriCure Inc.; AngioDynamics Inc.; CardioFocus Inc.; Galvanize Therapeutics Inc.; Kardium Inc.; Acutus Medical Inc.; AtriAN Medical Ltd.; Field Medical Inc.; Thermedical Inc.; Adagio Medical Inc.; Arga Medtech Inc.; Mirai Medical; Pulse Biosciences Inc.; AccuPulse Medical Inc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain.

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The companies featured in this Pulsed Field Ablation market report include:- Johnson & Johnson

- Abbott Laboratories

- Medtronic plc

- Siemens Healthineers AG

- Boston Scientific Corporation

- ConMed

- AtriCure Inc.

- AngioDynamics Inc.

- CardioFocus Inc.

- Galvanize Therapeutics Inc.

- Kardium Inc.

- Acutus Medical Inc.

- AtriAN Medical Ltd.

- Field Medical Inc.

- Thermedical Inc.

- Adagio Medical Inc.

- Arga Medtech Inc.

- Mirai Medical

- Pulse Biosciences Inc.

- AccuPulse Medical Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | October 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 0.8 Billion |

| Forecasted Market Value ( USD | $ 1.91 Billion |

| Compound Annual Growth Rate | 24.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 21 |