United States Cell and Gene Therapy Third-Party Logistics Industry Overview

The United States cell and gene therapy third-party logistics (3PL) market has become a crucial component of the biopharmaceutical supply chain. As cell and gene therapies transition from research to commercialization, their unique logistics requirements have highlighted the importance of specialized service providers. These therapies often require stringent temperature control, real-time monitoring, and secure chain-of-custody measures to maintain viability and ensure compliance with regulatory standards. The role of 3PL providers in this landscape is vital, offering tailored solutions to manage complex transportation, storage, and delivery processes. The growing pipeline of cell and gene therapies is fueling demand for advanced logistics capabilities across the country.Technology adoption is also reshaping the U.S. 3PL market for cell and gene therapies. Providers are leveraging digital tools such as IoT-enabled tracking, AI-based demand forecasting, and blockchain for enhanced transparency and compliance. These technologies ensure that therapies are delivered to patients safely and efficiently, reducing risks of temperature excursions or delays. Strategic collaborations between therapy developers, logistics providers, and healthcare institutions are further strengthening the ecosystem. This synergy allows therapy manufacturers to focus on innovation while relying on experienced 3PL providers to manage critical supply chain operations, ensuring timely and compliant deliveries.

Despite these advancements, the market faces challenges such as high costs of specialized logistics services and the need for continuous workforce training. Nonetheless, with increasing regulatory oversight and growing patient access to advanced therapies, demand for reliable logistics solutions is expected to expand. As biopharmaceutical companies scale their commercialization efforts, third-party logistics providers will remain indispensable, offering the infrastructure and expertise required to manage the complexities of cell and gene therapy supply chains across the United States.

Key Factors Driving the United States Cell and Gene Therapy Third-Party Logistics Market Growth

Expanding Cell and Gene Therapy Pipeline

The rapid growth of the cell and gene therapy pipeline in the U.S. is a major driver of logistics demand. As more therapies move through clinical trials and gain regulatory approval, logistics providers must ensure reliable and compliant delivery from manufacturing facilities to treatment centers. These therapies are often patient-specific, requiring time-sensitive, customized handling and transportation. The surge in commercialization activities is pushing logistics providers to scale their infrastructure and adopt advanced monitoring technologies to maintain viability throughout the supply chain. This expansion is increasing reliance on third-party logistics providers with expertise in managing sensitive, high-value therapies, creating long-term growth opportunities in the market.Stringent Regulatory Requirements

The highly regulated nature of cell and gene therapy logistics is driving demand for specialized 3PL services in the United States. Regulatory bodies mandate strict adherence to Good Distribution Practices (GDP), chain-of-custody protocols, and temperature-controlled environments to preserve therapy efficacy. Compliance with these requirements necessitates advanced infrastructure, trained personnel, and detailed documentation throughout the logistics process. Third-party providers are uniquely positioned to deliver these capabilities, offering therapy developers assurance of compliance and reduced operational risks. As regulators continue to enhance oversight, biopharmaceutical companies are increasingly turning to 3PL providers with proven track records in compliance management, further fueling market growth.Rising Adoption of Cold Chain Technologies

The increasing reliance on cold chain technologies is another key driver in the U.S. cell and gene therapy logistics market. Most therapies require ultra-low temperatures, cryogenic storage, or liquid nitrogen-based transport solutions to maintain their stability. As demand grows, logistics providers are investing in advanced cold chain infrastructure, IoT-enabled monitoring systems, and real-time tracking solutions to ensure therapy safety and efficacy. These investments not only support regulatory compliance but also provide confidence to therapy developers and healthcare providers. With patient outcomes dependent on the integrity of these therapies, cold chain innovations are becoming central to third-party logistics growth, reinforcing their role as critical partners in therapy delivery.Challenges in the United States Cell and Gene Therapy Third-Party Logistics Market

High Cost of Specialized Logistics Services

A significant challenge for the U.S. cell and gene therapy 3PL market is the high cost of specialized logistics solutions. Maintaining ultra-cold temperatures, secure chain-of-custody, and advanced tracking systems requires substantial infrastructure investment and ongoing operational expenses. These costs can be prohibitive for smaller therapy developers or early-stage clinical trials. Additionally, limited economies of scale in this niche market contribute to elevated per-shipment costs, potentially impacting therapy affordability and accessibility. Balancing the need for highly reliable logistics while controlling costs remains a pressing issue for providers and stakeholders across the value chain.Limited Workforce Expertise

Another challenge lies in the need for a highly skilled workforce trained in handling advanced cell and gene therapies. The logistics of these therapies are complex, requiring knowledge of specialized equipment, regulatory compliance, and emergency protocols in case of shipment deviations. However, there is a shortage of trained personnel capable of managing these critical supply chain operations. Without sufficient expertise, providers risk compromising therapy viability, patient safety, and compliance standards. Expanding training programs and workforce readiness is essential to overcome this barrier and ensure the safe, efficient delivery of therapies across the United States.United States Cell and Gene Therapy Third-Party Logistics Market Overview by States

Regional growth is concentrated in California, Texas, New York, and Florida, driven by strong biopharmaceutical activity, advanced healthcare infrastructure, and investments in specialized logistics networks supporting the delivery of cell and gene therapies. The following provides a market overview by States:

California Cell and Gene Therapy Third-Party Logistics Market

California is a leading hub for cell and gene therapy logistics, supported by its thriving biopharmaceutical sector and extensive research infrastructure. The state hosts numerous therapy developers and clinical research organizations, creating significant demand for specialized logistics services. Major cities such as San Francisco, San Diego, and Los Angeles are key centers for therapy development and clinical trials, necessitating reliable supply chain solutions. Logistics providers in California are investing heavily in cold chain infrastructure and advanced monitoring systems to support patient-specific therapies. The state’s strong regulatory framework, combined with its innovation-driven ecosystem, further accelerates adoption of third-party logistics services. California’s role as a biotechnology leader ensures its continued prominence in the U.S. cell and gene therapy 3PL market.Texas Cell and Gene Therapy Third-Party Logistics Market

Texas is emerging as a significant market for cell and gene therapy logistics, driven by its expanding healthcare network and growing biopharmaceutical presence. Cities like Houston and Dallas are home to leading medical institutions and research centers actively involved in advanced therapy development. The state’s strategic geographic location also supports logistics connectivity across the U.S., making it a key distribution hub. Third-party logistics providers are strengthening their presence in Texas by investing in cold chain storage, cryogenic transport, and digital monitoring technologies. Additionally, state-level initiatives promoting biotechnology innovation are reinforcing demand for specialized logistics solutions. With its combination of healthcare infrastructure, research activity, and logistical advantages, Texas is playing an increasingly important role in the U.S. cell and gene therapy 3PL landscape.New York Cell and Gene Therapy Third-Party Logistics Market

New York represents a critical market for cell and gene therapy logistics, supported by its concentration of research institutions, medical centers, and therapy developers. The state’s healthcare infrastructure and strong regulatory framework make it a hub for clinical adoption of advanced therapies. New York City, in particular, has become a focal point for therapy innovation, requiring reliable third-party logistics services to support supply chain needs. Providers in the state are enhancing their capabilities with investments in cold chain systems, IoT-enabled tracking, and real-time monitoring solutions. With strong demand from both clinical trials and commercialization efforts, New York continues to drive adoption of specialized logistics solutions. Its position as a healthcare and innovation hub ensures continued growth in the U.S. market.Florida Cell and Gene Therapy Third-Party Logistics Market

Florida is becoming a growing market for cell and gene therapy logistics, fueled by its large patient population, aging demographics, and expanding network of specialty clinics and hospitals. Miami, Tampa, and Orlando are leading centers for advanced healthcare delivery, creating strong demand for reliable logistics services. Third-party providers are increasingly focused on supporting therapy developers and treatment centers in the state by expanding cold chain infrastructure and adopting advanced monitoring technologies. Florida’s geographic proximity to Latin American markets also adds to its strategic importance as a distribution hub. With rising demand for personalized therapies and investments in healthcare innovation, Florida is positioned to play a critical role in the adoption and expansion of cell and gene therapy logistics in the U.S.Market Segmentations

Type

- Clinical

- Commercial

Product

- Cell Therapies

- Gene Therapies

Therapeutic Area

- Oncology

- Neurology

- Cardiovascular Diseases

- Ophthalmology

- Infectious Diseases

- Others

End Use

- Biopharmaceutical Companies

- CDMOs/CMOs

- Others

States

- California

- Texas

- New York

- Florida

- Illinois

- Pennsylvania

- Ohio

- Georgia

- New Jersey

- Washington

- North Carolina

- Massachusetts

- Virginia

- Michigan

- Maryland

- Colorado

- Tennessee

- Indiana

- Arizona

- Minnesota

- Wisconsin

- Missouri

- Connecticut

- South Carolina

- Oregon

- Louisiana

- Alabama

- Kentucky

- Rest of United States

All the Key players have been covered

- Overviews

- Key Person

- Recent Developments

- SWOT Analysis

- Revenue Analysis

Company Analysis:

- Cencora Corporation

- Cardinal Health

- McKesson Corporation

- EVERSANA

- Knipper Health

- Arvato SE

- DHL

- Kuehne+Nagel

Table of Contents

Companies Mentioned

- Cencora Corporation

- Cardinal Health

- McKesson Corporation

- EVERSANA

- Knipper Health

- Arvato SE

- DHL

- Kuehne+Nagel

Methodology

In this report, for analyzing the future trends for the studied market during the forecast period, the publisher has incorporated rigorous statistical and econometric methods, further scrutinized by secondary, primary sources and by in-house experts, supported through their extensive data intelligence repository. The market is studied holistically from both demand and supply-side perspectives. This is carried out to analyze both end-user and producer behavior patterns, in the review period, which affects price, demand and consumption trends. As the study demands to analyze the long-term nature of the market, the identification of factors influencing the market is based on the fundamentality of the study market.

Through secondary and primary researches, which largely include interviews with industry participants, reliable statistics, and regional intelligence, are identified and are transformed to quantitative data through data extraction, and further applied for inferential purposes. The publisher's in-house industry experts play an instrumental role in designing analytic tools and models, tailored to the requirements of a particular industry segment. These analytical tools and models sanitize the data & statistics and enhance the accuracy of their recommendations and advice.

Primary Research

The primary purpose of this phase is to extract qualitative information regarding the market from the key industry leaders. The primary research efforts include reaching out to participants through mail, tele-conversations, referrals, professional networks, and face-to-face interactions. The publisher also established professional corporate relations with various companies that allow us greater flexibility for reaching out to industry participants and commentators for interviews and discussions, fulfilling the following functions:

- Validates and improves the data quality and strengthens research proceeds

- Further develop the analyst team’s market understanding and expertise

- Supplies authentic information about market size, share, growth, and forecast

The researcher's primary research interview and discussion panels are typically composed of the most experienced industry members. These participants include, however, are not limited to:

- Chief executives and VPs of leading corporations specific to the industry

- Product and sales managers or country heads; channel partners and top level distributors; banking, investment, and valuation experts

- Key opinion leaders (KOLs)

Secondary Research

The publisher refers to a broad array of industry sources for their secondary research, which typically includes, however, is not limited to:

- Company SEC filings, annual reports, company websites, broker & financial reports, and investor presentations for competitive scenario and shape of the industry

- Patent and regulatory databases for understanding of technical & legal developments

- Scientific and technical writings for product information and related preemptions

- Regional government and statistical databases for macro analysis

- Authentic new articles, webcasts, and other related releases for market evaluation

- Internal and external proprietary databases, key market indicators, and relevant press releases for market estimates and forecasts

LOADING...

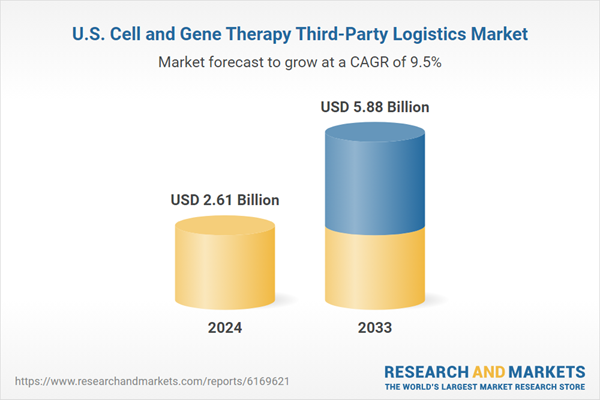

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | August 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 2.61 Billion |

| Forecasted Market Value ( USD | $ 5.88 Billion |

| Compound Annual Growth Rate | 9.4% |

| Regions Covered | United States |

| No. of Companies Mentioned | 8 |