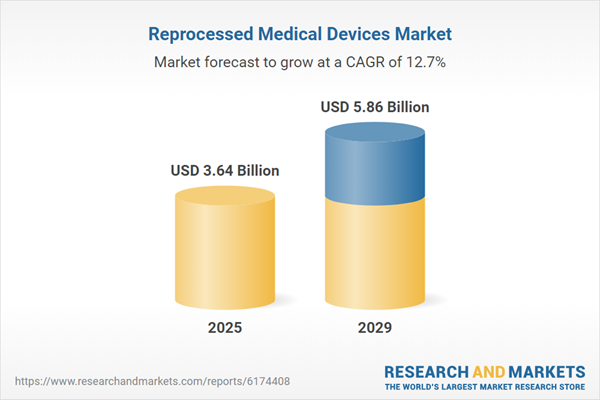

The reprocessed medical devices market size is expected to see rapid growth in the next few years. It will grow to $5.86 billion in 2029 at a compound annual growth rate (CAGR) of 12.7%. The growth in the forecast period can be attributed to an increasing emphasis on circular economy practices in healthcare, greater focus on patient safety and quality assurance, rising hospital budgets for sustainability initiatives, expanding collaborations between hospitals and reprocessing companies, and growing cost-cutting pressures from healthcare payers. Key trends in the forecast period include advancements in sterilization technologies, improvements in cleaning and decontamination processes, integration of data analytics for quality assurance, innovations in material science, and technological enhancements in automated reprocessing equipment.

The rising number of surgical procedures is driving growth in the reprocessed medical devices market. Surgical procedures, which involve manual or instrumental techniques performed by surgeons to diagnose, treat, or prevent medical conditions, are increasing due to advances in medical technology that make surgeries safer, less invasive, and more effective. Reprocessed medical devices support these procedures by providing high-quality, sterilized instruments that can be safely reused, helping reduce costs and improve sustainability. For example, in June 2024, according to the International Society of Aesthetic Plastic Surgery (ISAPS), liposuction became the most common surgical procedure among women, with 1.8 million procedures performed a 29% increase from 2021 highlighting growing surgical demand.

Companies in the market are focusing on sustainable solutions and facility expansions to meet this demand. A circular business model, which emphasizes reusing, refurbishing, and recycling products to extend their life cycle and reduce waste, is being adopted. In August 2024, Arjo, a Sweden-based medical technology company, opened a new, state-of-the-art reprocessing facility 50% larger than its previous site. The facility features advanced automated cleaning, disinfection, and testing systems for devices such as medical beds, patient lifts, slings, and hygiene systems. This expansion supports Arjo’s Arjo ReNu initiative by enhancing efficiency, reducing water and energy use, and promoting circular healthcare practices.

In July 2024, Innovative Health, Inc., a US-based medical device company, partnered with MC Healthcare Inc., a Japan-based healthcare services provider, to launch a sustainable single-use medical device reprocessing program. The partnership aims to reduce medical waste, lower healthcare costs, and support sustainable healthcare systems by enabling the safe reuse of single-use devices.

Major players in the reprocessed medical devices market are Cardinal Health Inc., Johnson & Johnson, Siemens AG, 3M Company, Medline Industries, LP, Fresenius SE & Co. KGaA, Stryker Corporation, GE HealthCare Technologies Inc., Olympus Corporation, Getinge AB, Arjo AB, Vanguard AG, Nanosonics Limited, Steripro Canada Inc., Integrity Medical Systems Inc., Innovative Health Inc., Medicon eG, NEScientific Inc., SureTek Medical, and Vitruvia Medical AG.

North America was the largest region in the reprocessed medical devices market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in reprocessed medical devices market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East and Africa. The countries covered in the reprocessed medical devices market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Note that the outlook for this market is being affected by rapid changes in trade relations and tariffs globally. The report will be updated prior to delivery to reflect the latest status, including revised forecasts and quantified impact analysis. The report’s Recommendations and Conclusions sections will be updated to give strategies for entities dealing with the fast-moving international environment.

The fast surge in U.S. tariffs and the trade tensions that followed in spring 2025 are heavily affecting the medical equipment sector, particularly for imported imaging machine components, surgical-grade stainless steel, and plastic disposables. Hospitals and clinics resist price hikes, pressuring manufacturers’ margins. Regulatory hurdles compound the problem, as tariff-related supplier changes often require re-certification of devices, delaying time-to-market. Companies are mitigating risks by dual-sourcing critical parts, expanding domestic production of commoditized items, and accelerating R&D in cost-efficient materials.

Reprocessed medical devices are single-use medical instruments that, after their initial use, undergo thorough cleaning, sterilization, and performance testing to ensure they can be safely reused. Healthcare facilities employ reprocessed devices to reduce costs and medical waste while maintaining safety and functionality.

The primary types of reprocessed medical devices include third-party reprocessing and in-house reprocessing. Third-party reprocessing involves outsourcing the cleaning, testing, and sterilization of single-use devices to specialized external companies so they can be safely reused. These devices encompass various types such as electrophysiology devices, surgical instruments, catheters, endoscopes, implants, and dialysis devices, made from materials including metal, plastic, silicone, rubber, and composites. They are applied across medical specialties like cardiology, orthopedics, gastroenterology, urology, neurology, and oncology, and serve end users including hospitals, clinics, ambulatory surgical centers, community healthcare providers, and diagnostic laboratories.

The reprocessed medical devices market research report is one of a series of new reports that provides reprocessed medical devices market statistics, including reprocessed medical devices industry global market size, regional shares, competitors with a reprocessed medical devices market share, reprocessed medical devices market segments, market trends and opportunities, and any further data you may need to thrive in the reprocessed medical devices industry. This reprocessed medical devices market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The reprocessed medical devices market includes revenues earned by entities by providing services such as collection of used devices, cleaning and sterilization, functional testing, repackaging and relabeling, and regulatory documentation management. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Reprocessed Medical Devices Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on reprocessed medical devices market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as geopolitical conflicts, trade policies and tariffs, post-pandemic supply chain realignment, inflation and interest rate fluctuations, and evolving regulatory landscapes.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for reprocessed medical devices? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward, including technological disruption, regulatory shifts, and changing consumer preferences? The reprocessed medical devices market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the technological advancements such as AI and automation, Russia-Ukraine war, trade tariffs (government-imposed import/export duties), elevated inflation and interest rates.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Type: Third-Party Reprocessing; in-House Reprocessing2) By Device Type: Electrophysiology Devices; Surgical Instruments; Catheters; Endoscopes; Implants; Dialysis Devices

3) By Material: Metal; Plastic; Silicone; Rubber; Composite Materials

4) By Application: Cardiology; Orthopedics; Gastroenterology; Urology; Neurology; Oncology

5) By End User: Hospitals; Clinics; Ambulatory Surgical Centers; Community Healthcare; Diagnostic Laboratories; Other End Users

Subsegments:

1) By Third-Party Reprocessing: Cardiovascular Devices; Gastroenterology Devices; Laparoscopic Devices; Orthopedic Devices; General Surgery Devices; Other Devices2) By in-House Reprocessing: Surgical Instruments; Respiratory Devices; Endoscopy Devices; Ultrasound Probes; Other Devices

Companies Mentioned: Cardinal Health Inc.; Johnson & Johnson; Siemens AG; 3M Company; Medline Industries, LP; Fresenius SE & Co. KGaA; Stryker Corporation; GE HealthCare Technologies Inc.; Olympus Corporation; Getinge AB; Arjo AB; Vanguard AG; Nanosonics Limited; Steripro Canada Inc.; Integrity Medical Systems Inc.; Innovative Health Inc.; Medicon eG; NEScientific Inc.; SureTek Medical; Vitruvia Medical AG.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The companies featured in this Reprocessed Medical Devices market report include:- Cardinal Health Inc.

- Johnson & Johnson

- Siemens AG

- 3M Company

- Medline Industries, LP

- Fresenius SE & Co. KGaA

- Stryker Corporation

- GE HealthCare Technologies Inc.

- Olympus Corporation

- Getinge AB

- Arjo AB

- Vanguard AG

- Nanosonics Limited

- Steripro Canada Inc.

- Integrity Medical Systems Inc.

- Innovative Health Inc.

- Medicon eG

- NEScientific Inc.

- SureTek Medical

- Vitruvia Medical AG.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | September 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 3.64 Billion |

| Forecasted Market Value ( USD | $ 5.86 Billion |

| Compound Annual Growth Rate | 12.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 21 |