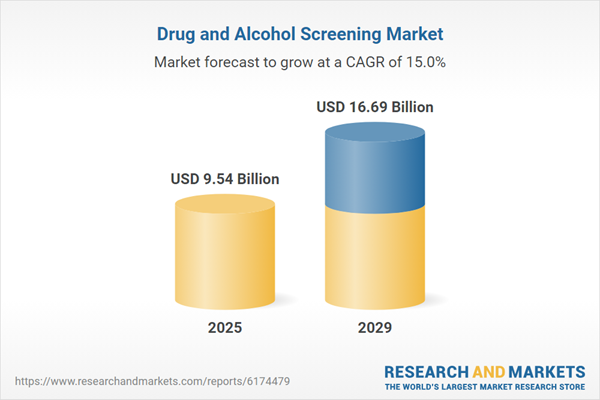

The drug and alcohol screening market size is expected to see rapid growth in the next few years. It will grow to $16.69 billion in 2029 at a compound annual growth rate (CAGR) of 15%. The growth during the forecast period can be attributed to the rising use of narcotics among youth, increasing adoption of on-site testing solutions, expanding workplace compliance requirements, growing demand for employment drug screening, the expansion of healthcare screening programs, and greater emphasis on school-based drug testing. Key trends in the forecast period include technological advancements in rapid testing kits, innovations in multi-panel drug testing devices, research and development in biosensors, increased investment in portable screening technologies, and progress in laboratory automation and robotic systems.

The rising use of narcotics and illegal drugs is expected to drive the growth of the drug and alcohol screening market in the coming years. Narcotics and illegal drugs are substances that affect the central nervous system, often used for pain relief or mind-altering effects. Their usage is increasing as more individuals turn to substances to cope with rising mental health issues such as anxiety, depression, and trauma. Drug and alcohol screening helps address this trend by enabling early detection, ensuring safety, and supporting timely interventions in workplaces, healthcare, and legal settings. For example, in November 2023, the Substance Abuse and Mental Health Services Administration (SAMHSA), a US-based branch of the Department of Health and Human Services, reported that approximately 70 million Americans aged 12 or older, about 25% of the population, used illicit substances in 2022, reflecting an increase of roughly 15% from 2021. Therefore, the growing use of narcotics and illegal drugs is propelling the drug and alcohol screening market.

Leading companies in the drug and alcohol screening market are developing advanced solutions, such as wearable alcohol detection software, to improve the accuracy, speed, and reliability of screening procedures. Alcohol detection software is a digital tool that processes and manages data from alcohol testing devices, enabling real-time monitoring, automated reporting, and enhanced compliance in safety-critical environments. For instance, in October 2024, Sobrsafe Inc., a US-based behavioral health safety company, launched a fully integrated enterprise software platform for alcohol detection and monitoring. The system combines two key products, SOBRcheck for point-of-care screening and SOBRsure for continuous monitoring, using advanced touch-based transdermal alcohol detection, eliminating the need for invasive breath, blood, or urine tests. The platform provides real-time visibility across multiple users and locations through a unified dashboard accessible on computers and mobile devices, integrating seamlessly with electronic medical records (EMR).

In May 2024, eMed LLC, a US-based healthcare technology company specializing in at-home and virtual diagnostics, partnered with i3screen to launch a virtual drug screening program for employers. This initiative provides employers with a convenient, fully remote, and instant oral drug screening solution, streamlining pre-employment testing, enabling faster hiring decisions, and maintaining test integrity and compliance. i3screen is a US-based company specializing in screening management systems, including drug and alcohol testing solutions.

Major players in the drug and alcohol screening market are Thermo Fisher Scientific Inc., Abbott Laboratories, Siemens Healthineers AG, Laboratory Corporation of America Holdings, Quest Diagnostics Incorporated, Drägerwerk AG & Co. KGaA, Agilent Technologies Inc., Bio-Rad Laboratories Inc., Randox Laboratories Ltd., OraSure Technologies Inc., MEDTOX Laboratories Inc., Psychemedics Corporation, SureHire Inc., Alcohol Countermeasure Systems Corp., Phamatech Inc., Premier Biotech Inc., Alfa Scientific Designs Inc., Omega Laboratories Inc., Lifeloc Technologies Inc., Smartox Biotechnology SAS, Millennium Health LLC, Aegis Sciences Corporation, Cordant Health Solutions Inc., and Intoximeters Inc.

North America was the largest region in the drug and alcohol screening market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in drug and alcohol screening market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East and Africa. The countries covered in the drug and alcohol screening market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Note that the outlook for this market is being affected by rapid changes in trade relations and tariffs globally. The report will be updated prior to delivery to reflect the latest status, including revised forecasts and quantified impact analysis. The report’s Recommendations and Conclusions sections will be updated to give strategies for entities dealing with the fast-moving international environment.

The sudden escalation of U.S. tariffs and the consequent trade frictions in spring 2025 are severely impacting the healthcare sector, particularly in the supply of critical medical devices, diagnostic equipment, and pharmaceuticals. Hospitals and healthcare providers are facing higher costs for imported surgical instruments, imaging equipment, and consumables such as syringes and catheters, many of which have limited domestic alternatives. These increased costs are straining healthcare budgets, leading some providers to delay equipment upgrades or pass on expenses to patients. Additionally, tariffs on raw materials and components are disrupting the production of essential drugs and devices, causing supply chain bottlenecks. In response, the industry is diversifying sourcing strategies, boosting local manufacturing where possible, and advocating for tariff exemptions on life-saving medical products.

Drug and alcohol screening is a structured process designed to identify and quantify the presence of drugs or alcohol in an individual’s system using scientifically validated testing techniques. This procedure is essential for ensuring safety, maintaining compliance with regulatory standards, and supporting informed decision-making in various personal, professional, and legal contexts.

The primary types of samples used in drug and alcohol screening include urine, oral fluid, hair, and other specimens. Urine samples are one of the most commonly collected biological specimens, used to detect drugs, alcohol, or their metabolites. This method is non-invasive, cost-effective, and particularly effective for detecting recent substance use. Urine testing finds applications in workplaces, criminal justice and law enforcement systems, drug treatment programs, pain management clinics, and testing laboratories. It serves a wide range of end users, including hospitals, treatment centers, law enforcement agencies, sports organizations, and others.

The drug and alcohol screening market research report is one of a series of new reports that provides drug and alcohol screening market statistics, including drug and alcohol screening industry global market size, regional shares, competitors with a drug and alcohol screening market share, detailed drug and alcohol screening market segments, market trends and opportunities, and any further data you may need to thrive in the drug and alcohol screening industry. This drug and alcohol screening market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The drug and alcohol screening market includes revenues earned by entities by providing services, such as pre-employment screening, random testing, reasonable suspicion testing, rehabilitation and monitoring programs, and follow-up testing. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Drug and Alcohol Screening Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on drug and alcohol screening market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as geopolitical conflicts, trade policies and tariffs, post-pandemic supply chain realignment, inflation and interest rate fluctuations, and evolving regulatory landscapes.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for drug and alcohol screening? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward, including technological disruption, regulatory shifts, and changing consumer preferences? The drug and alcohol screening market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the technological advancements such as AI and automation, Russia-Ukraine war, trade tariffs (government-imposed import/export duties), elevated inflation and interest rates.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Sample Type: Urine Samples; Oral Fluid Samples; Hair Samples; Other Sample Types2) By Application: Work Place; Criminal Justice Systems and Law Enforcing Systems; Drug Treatment Centers; Pain Management Centers; Drug Testing Laboratories

3) By End-User: Hospitals and Treatment Facilities; Law and Enforcement; Sporting Events, Other End-Users

Subsegments:

1) By Urine Samples: Laboratory-Based Urine Testing; Instant Or Rapid Urine Testing2) By Oral Fluid Samples: on-Site Oral Fluid Testing; Laboratory-Based Oral Fluid Testing

3) By Hair Samples: Head Hair Testing; Body Hair Testing

4) By Other Sample Types: Sweat Patch Testing; Breathalyzer Testing; Blood Testing

Companies Mentioned: Thermo Fisher Scientific Inc.; Abbott Laboratories; Siemens Healthineers AG; Laboratory Corporation of America Holdings; Quest Diagnostics Incorporated; Drägerwerk AG & Co. KGaA; Agilent Technologies Inc.; Bio-Rad Laboratories Inc.; Randox Laboratories Ltd.; OraSure Technologies Inc.; MEDTOX Laboratories Inc.; Psychemedics Corporation; SureHire Inc.; Alcohol Countermeasure Systems Corp.; Phamatech Inc.; Premier Biotech Inc.; Alfa Scientific Designs Inc.; Omega Laboratories Inc.; Lifeloc Technologies Inc.; Smartox Biotechnology SAS; Millennium Health LLC; Aegis Sciences Corporation; Cordant Health Solutions Inc.; Intoximeters Inc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The companies featured in this Drug and Alcohol Screening market report include:- Thermo Fisher Scientific Inc.

- Abbott Laboratories

- Siemens Healthineers AG

- Laboratory Corporation of America Holdings

- Quest Diagnostics Incorporated

- Drägerwerk AG & Co. KGaA

- Agilent Technologies Inc.

- Bio-Rad Laboratories Inc.

- Randox Laboratories Ltd.

- OraSure Technologies Inc.

- MEDTOX Laboratories Inc.

- Psychemedics Corporation

- SureHire Inc.

- Alcohol Countermeasure Systems Corp.

- Phamatech Inc.

- Premier Biotech Inc.

- Alfa Scientific Designs Inc.

- Omega Laboratories Inc.

- Lifeloc Technologies Inc.

- Smartox Biotechnology SAS

- Millennium Health LLC

- Aegis Sciences Corporation

- Cordant Health Solutions Inc.

- Intoximeters Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | September 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 9.54 Billion |

| Forecasted Market Value ( USD | $ 16.69 Billion |

| Compound Annual Growth Rate | 15.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 25 |