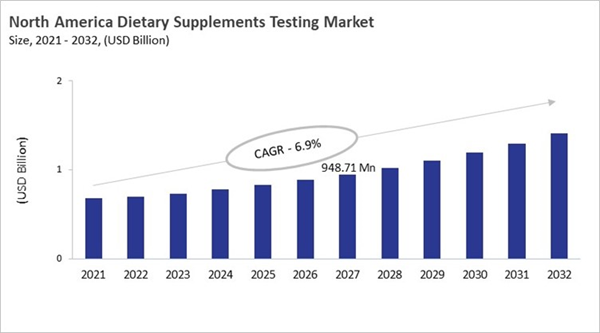

The US market dominated the North America Dietary Supplement Testing Market by country in 2024, and is expected to continue to be a dominant market till 2032; thereby, achieving a market value of $1.03 billion by 2032. The Canada market is experiencing a CAGR of 10.1% during 2025-2032. Additionally, the Mexico market is expected to exhibit a CAGR of 9.3% during 2025-2032. The US and Canada led the North America Dietary Supplements Testing Market by Country with a market share of 77.2% and 12% in 2024.

The market for testing dietary supplements in North America is highly regulated and advanced. This is due to the region's unique rules, high demand from consumers, and a complicated legal environment. The Dietary Supplement Health and Education Act (DSHEA) and the FDA's cGMP rules in the U.S. require strict testing for identity, potency, purity, and safety. Canada's NNHPD licensing imposes similar strict rules. High consumer use, public health priorities, and a litigious environment all help the market grow. Manufacturers are held legally responsible for their products and must use comprehensive third-party testing. To protect themselves from class actions and enforcement actions, they also need traceability and strong documentation.

The use of advanced analytical technologies is a major trend. High-performance liquid chromatography, mass spectrometry, and DNA barcoding are changing the market. These technologies make it easier to verify ingredients and find adulteration. Major chains like Walmart and CVS also set quality standards. Suppliers must meet these standards to get independent test certifications. Leading labs and OEMs set themselves apart through integrated service models. They combine production and testing, make partnerships with certifying bodies (like USP and NSF), and are open with customers. For example, they may provide online certificates of analysis. The competitive landscape is defined by the ability to offer scientifically rigorous, defensible, and comprehensive testing solutions. This builds trust in a market shaped by regulatory, retail, and legal pressures.

Technology Outlook

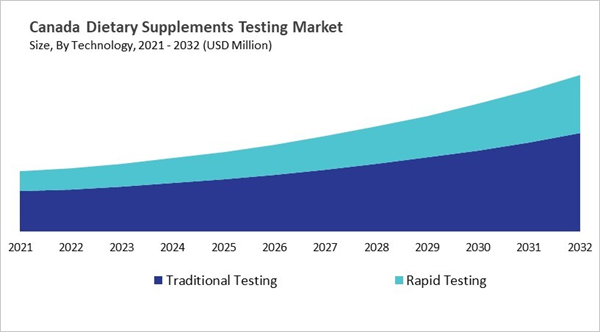

Based on Technology, the market is segmented into Traditional Testing and Rapid Testing. The Traditional Testing market segment dominated the Canada Dietary Supplements Testing Market by Technology is expected to grow at a CAGR of 9.4 % during the forecast period thereby continuing its dominance until 2032. Also, The Rapid Testing market is anticipated to grow as a CAGR of 11.5 % during the forecast period during 2025-2032.Service Provider Outlook

Based on Service Provider, the market is segmented into Contract Research Organizations (CROs), Independent Third-Party Testing Laboratories, and Other Service Provider. With a compound annual growth rate (CAGR) of 9.9% over the projection period, the Contract Research Organizations (CROs) Market, dominate the Mexico Dietary Supplements Testing Market by Service Provider in 2024 and would be a prominent market until 2032. The Other Service Provider market is expected to witness a CAGR of 10.9% during 2025-2032.Test Type Outlook

Based on Test Type, the market is segmented into Contaminants (heavy metals, pesticides, solvents), Microbiological, Potency, Identity / Authentication, Adulteration, Label Claim Verification, Stability & Shelf Life, Allergen & GMO Testing, and Other Test Types. Among various US Dietary Supplements Testing Market by Test Type; The Contaminants (heavy metals, pesticides, solvents) market achieved a market size of USD $155.5 Million in 2024 and is expected to grow at a CAGR of 5.3 % during the forecast period. The Stability & Shelf Life market is predicted to experience a CAGR of 8.5% throughout the forecast period from (2025 - 2032).Country Outlook

The Dietary Supplement Health and Education Act (DSHEA) of 1994 sets the rules for the U.S. dietary supplement testing market. It classifies supplements as foods. This means they can enter the market without FDA approval before they are sold, but they need to be monitored after they are sold. The rise of testing services is fueled by a strong demand for safe, accurately labeled, and contamination-free products. Institutions like NIST, USP, and AOAC provide reference standards and validated methods to help with this. Market trends stress third-party certification and advanced analytical methods like chromatography, spectrometry, and DNA barcoding. These methods make sure that tests are quick and accurate. Technical know-how, following the rules, and trust are the main areas of competition. Both independent labs and corporate labs work hard to meet changing industry standards for openness and dependability.List of Key Companies Profiled

- Eurofins Scientific SE

- Tentamus Group GmbH

- Intertek Group PLC

- Alkemist Labs

- SGS S.A.

- AGROLAB GmbH

- Anresco, Inc.

- FoodChain ID Group, Inc.

- BeaconPointLabs, LLC

- Certified Laboratories, LLC

Market Report Segmentation

By Technology

- Traditional Testing

- Rapid Testing

By Ingredient Type

- Ingredient-Level Testing

- Finished Product Testing

By Service Provider

- Contract Research Organizations (CROs)

- Independent Third-Party Testing Laboratories

- Other Service Provider

By End User

- Nutraceutical Companies

- Contract Manufacturers

- Distributors / Label Claim Verificationers (Online & Offline)

- Regulatory Authorities

- Other End User

By Test Type

- Contaminants (heavy metals, pesticides, solvents)

- Microbiological

- Potency

- Identity / Authentication

- Adulteration

- Label Claim Verification

- Stability & Shelf Life

- Allergen & GMO Testing

- Other Test Types

By Country

- US

- Canada

- Mexico

- Rest of North America

Table of Contents

Companies Mentioned

- Eurofins Scientific SE

- Tentamus Group GmbH

- Intertek Group PLC

- Alkemist Labs

- SGS S.A.

- AGROLAB GmbH

- Anresco, Inc.

- FoodChain ID Group, Inc.

- BeaconPointLabs, LLC

- Certified Laboratories, LLC