Key Market Trends and Insights:

- The South India water purifier market dominated the market in 2024 and is projected to grow at a CAGR of 11.4% over the forecast period.

- By product type, point-of-use water filters is projected to witness a CAGR of 11.1% over the forecast period.

- By application, the residential segment is expected to register 11.3% CAGR over the forecast period with rising urbanization, government incentives, and cost efficiency.

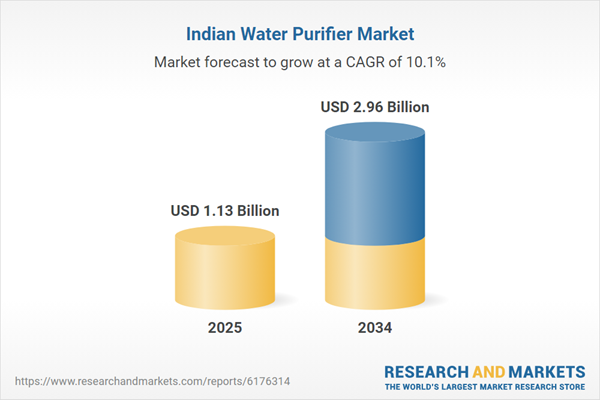

Market Size & Forecast:

- Market Size in 2024: USD 1.13 Billion

- Projected Market Size in 2034: USD 2.96 Billion

- CAGR from 2025-2034: 10.10%

- Fastest-Growing Regional Market: South India

The India water purifier industry value is rising with public awareness about contaminants like heavy metals, arsenic, and industrial pollutants, backed by campaigns from NGOs and government agencies. In May 2022, Sharp India launched its WJ-R515V-H purifier deploying patented AF Disruptor Tech with 6-stage RO+UV filtration, removing heavy metals and conserving water. This heightened consciousness has led to increased consumer preference for advanced purification technologies that effectively remove both chemical and microbial impurities.

Increasing cases of typhoid, cholera, diarrhea, and jaundice across India have heightened concern over unsafe drinking water. According to a March 2024 Ahmedabad Municipal report, hundreds of diarrhea and typhoid cases emerged in a fortnight, highlighting urgent need for safe water. As consumers become more health-conscious, adoption of purification systems that effectively remove pathogens is accelerating, making health-driven demand a primary catalyst in the India water purifier market.

Key Trends and Recent Developments

June 2025

Eureka Forbes unveiled new Aquaguard water purifiers featuring Longlife Nanopore Filter technology, offering up to two years of filter life without replacements. This innovation modernizes Indian homes by reducing maintenance and long-term costs.October 2024

Kent RO Systems partnered with BLACK+DECKER to introduce two advanced water purifiers in India, the Crest RO Purifier and Zenith RO Purifier. These products feature robust multi-stage purification systems and sleek licensing collaboration, boosting the India water purifier industry value.September 2024

LG Electronics India introduced nine new water purifier models with SS-304 airtight tanks, mineral boosters, EverFresh UV LED, 7-stage filtration, and contactless maintenance. This helped in enhancing safety, hygiene, aesthetics, and convenience for Indian households.July 2023

Hindustan Unilever’s Pureit Revito series features DURAViva™ filtration technology, offering WQA-certified heavy metal removal and enriching water with calcium and magnesium. It conserves up to 70% water and delivers 8,000 liters before needing a filter change, while incorporating in-tank UV sterilization and improved turbidity reduction to meet modern health and sustainability needs.Government Initiatives

The India water purifier market outlook is influenced by the rise in government-led programs that have drastically expanded tap water access, especially in rural areas. In July 2022, Burhanpur became India’s first Har Ghar Jal-certified district, ensuring tap water access in all 254 rural villages. These initiatives, combined with BIS quality standards, have boosted consumer trust in purification products and widened market reach.Smart and IoT-Enabled Purifiers

Smart purifiers with app connectivity, filter-life alerts, usage tracking, and smart diagnostics are gaining popularity among technology-savvy urban consumers. These features improve product reliability and long-term engagement. For instance, In October 2023, Urban Company launched Native smart RO purifiers with two-year no-service operation, zero-cost warranty, rapid reverse-rinse technology, and app-based filtration tracking.Technological Advancements in Filtration

The India water purifier industry is driven by innovations, such as RO, UV, UF, and nanofiltration technologies to improve purification effectiveness and affordability. In March 2022, LG introduced a pioneering UF+UV water purifier in India, featuring a seven-stage filtration system to remove seven heavy metals and viruses while ensuring zero wastewater. Multi-layer systems also deliver reliable water quality while addressing specific contaminants, accelerating consumer adoption.Rising Disposable Income and Middle-Class Expansion

Growth of India’s middle class and increasing disposable incomes enable households to invest in premium filtration systems offering multi-stage purification, mineral retention, and smart features. As per GDP Data, India's per capita disposable income was expected to be ₹2.14 lakh in 2023-24. Affordability is further driving up adoption beyond metro areas, boosting the India water purifier market share.Demand for Mineral Retention & Eco-Friendly Designs

Modern consumers demand purified water with essential minerals intact and prefer energy-efficient systems with minimal wastewater. To that end, purifiers emphasize sustainable features, such as reduced water wastage and recyclable components to cater to health and environmental expectations. In October 2024, Mumbai-based startup Kalki Ecosphere introduced Impactpure, a portable plug-and-play purifier designed from eco-friendly materials.India Water Purifier Industry Segmentation

The report titled “India Water Purifier Market Report and Forecast 2025-2034” offers a detailed analysis of the market based on the following segments:Market Breakup by Product

- Point-of-Use Water Filters

- Counter-top Filters

- Under the counter Filters

- Pitcher Filters

- Faucet-mounted Filters

- Others

- Point-of-Entry Water Filters

Market Breakup by Category

- RO Filters

- UV Filters

- Gravity Filters

- Others

Market Breakup by Application

- Residential

- Commercial

Market Breakup by Region

- North India

- East India

- South India

- West India

India Water Purifier Market Share

Point-of-entry Filters Lead in the Market with Higher Application Scope

Point-of-entry filters are gaining traction as they are commonly used in larger buildings and commercial establishments. POE systems effectively remove hardness, sediments, and chlorine, improving water quality for all uses. For example, Rite Water’s NanoBlue POE “Water Shield” plug-and-play system treats whole-house water, including drinking, shower, and kitchen supply. Though growing, POE filters have lower penetration compared to POU systems, especially in emerging markets like India.UV Filters to Witness Popularity in India with Surging Government Support

UV (Ultraviolet) filters are among the most dominating segments in the India water purifier market due to their effective disinfection capabilities. They use UV light to kill bacteria, viruses, and other microorganisms without chemicals, making them popular in urban households where tap water often contains microbial contaminants. Brands widely promote UV purifiers, appealing to health-conscious consumers seeking safe drinking water. The growing awareness of waterborne diseases and government initiatives for clean drinking water have further boosted UV filter demand.Gravity filters hold a significant position in the market, as they are particularly popular in rural and semi-urban regions with limited or no electricity access. These purifiers operate using gravity to push water through activated carbon and sediment filters, removing impurities and improving taste but offering limited microbial disinfection compared to UV systems. In June 2025, Kent launched Kent Gold Plus, a non-electric, gravity-based purifier, ideal for low-pressure areas or power cuts, offering safe, reliable filtration, adding to the market growth.

Commercial Sector Leads the Market with Innovations

The commercial segment of the India water purifier industry is growing steadily due to expanding sectors, such as hospitality, healthcare, education, and offices requiring bulk water purification. Industries and institutions increasingly adopt advanced purification systems to ensure water safety. Companies also provide customized commercial water purifiers with higher capacity, robust filtration, and compliance with regulatory standards. In July 2023, Alfaa UV introduced a new commercial-grade RO purifier designed for offices, restaurants, educational institutions, and industrial facilities.India Water Purifier Market Regional Analysis

East India Leads the Water Purifier Adoption with Booming Agricultural Advances

East India is witnessing growth with growing concerns over microbial contamination and industrial pollutants in Kolkata and Patna. The market here is expanding due to increased government initiatives improving water access and quality, such as the Jal Jeevan Mission’s push in rural Bengal and Bihar. Brands have tailored affordable UV and RO water purifiers for this price-sensitive market. Rising urbanization and industrialization continue to increase demand for advanced purification technologies in both residential and commercial segments.South India water purifier market revenue is supported by high literacy rates and tech-savvy consumers in Bengaluru, Chennai, and Hyderabad. The region has moderate water contamination issues but a preference for advanced smart purifiers. Companies cater well to this market, emphasizing sustainable features and innovative filtration technology. In May 2022, Sharp introduced the WJ-R515V-H purifier in Chennai, featuring AF Disruptor Technology and a six-stage RO + UV filtration system to removes heavy metals, microbes, cysts, and toxins.

Competitive Landscape

Key players in the India water purifier market are employing multiple strategies focusing on innovation, affordability, and expanding reach to capture a diverse consumer base. Companies prioritize developing advanced purification technologies, such as RO, UV, UF, and nanofiltration to address varied water contamination issues across regions. Product differentiation through smart features targets tech-savvy urban consumers. Affordability is addressed via tiered pricing models and subscription-based filter replacement services, making purifiers accessible to rural and semi-urban populations.Strategic partnerships with e-commerce platforms and retail chains enhance distribution and visibility. Market players also leverage government initiatives like the Jal Jeevan Mission to align product offerings with public water safety goals. Emphasis on sustainability is introducing purifiers with reduced water wastage and recyclable components to cater to environmentally conscious consumers. Furthermore, aggressive marketing and localized campaigns boost brand awareness and educate consumers on waterborne health risks, thereby driving demand.

Eureka Forbes Ltd

Founded in 1982 and headquartered in Mumbai, Eureka Forbes is a pioneer in the India water purifier market. Known for its Aquaguard brand, the company has introduced innovations like UV-RO technology and smart purifiers with IoT capabilities, focusing on safe drinking water solutions for urban and rural consumers.KENT RO Systems Ltd

Established in 1999, KENT RO Systems is based in Noida and has revolutionized water purification with patented RO-UV-UF technologies, offering high-efficiency purifiers. The company also introduced subscription-based filter replacement models and portable purifiers, catering to diverse customer needs across India’s urban and semi-urban regions.Hindustan Unilever Limited

Founded in 1933, Hindustan Unilever is headquartered in Mumbai. Its Pureit brand led the affordable water purifier demand in India by combining advanced filtration with user-friendly designs. The company continuously innovates to improve water safety and accessibility, especially in emerging markets through durable and cost-effective purifiers.A.O. Smith India Water Products Pvt. Ltd.

A.O. Smith India, a subsidiary of the American firm founded in 1874, operates from Bengaluru. It focuses on premium water purification systems, integrating smart technology and energy-efficient designs. The company is known for pioneering RO+UV purifiers with high water recovery rates suitable for urban consumers.

Other key players in the report include Livpure Smart Homes Private Limited, Aquafresh RO System, Havells India Limited, Blue Star Limited, BRITA India Water Solutions Pvt. Ltd., 3M India Limited and others.

Key Features of the India Water Purifier Market Report

- In-depth analysis of market size, share, and forecast (2025-2034).

- Regional segmentation with demand trends across North, South, East, and West India.

- Competitive landscape covering key players and their latest product innovations.

- Technological advancements including RO, UV, UF, and smart filtration systems.

- Detailed insights into consumer behaviour, pricing trends, and distribution channels.

- Impact assessment of government programs like Jal Jeevan Mission on rural adoption.

Table of Contents

Companies Mentioned

- Eureka Forbes Ltd.

- KENT RO Systems Ltd.

- Hindustan Unilever Limited

- A.O. Smith India Water Products Pvt. Ltd.

- Livpure Smart Homes Private Limited

- Aquafresh RO System

- Havells India Limited

- Blue Star Limited

- BRITA India Water Solutions Pvt. Ltd.

- 3M India Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 112 |

| Published | October 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 1.13 Billion |

| Forecasted Market Value ( USD | $ 2.96 Billion |

| Compound Annual Growth Rate | 10.1% |

| Regions Covered | India |

| No. of Companies Mentioned | 10 |