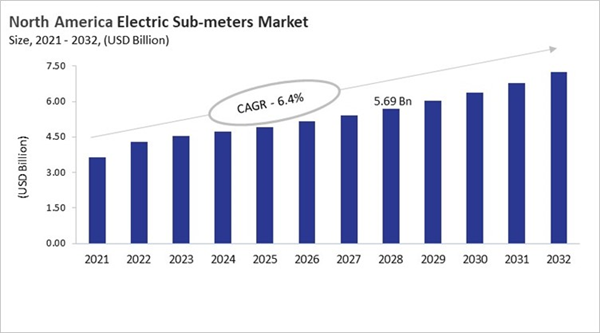

The US market dominated the North America Electric Sub-meters Market by country in 2024, and is expected to continue to be a dominant market till 2032; thereby, achieving a market value of USD 4.71 billion by 2032. The Canada market is experiencing a CAGR of 7.4% during 2025-2032. Additionally, the Mexico market is expected to exhibit a CAGR of 6.6% during 2025-2032. The US and Canada led the North America Electric Sub-meters Market by Country with a market share of 69.1% and 15.1% in 2024.

The North American electric sub-meter market has grown from a niche billing tool to a key part of energy efficiency, following the rules, and keeping costs in check. Sub-meters were first used in multi-family and public housing to cut down on tenant disputes. They became more popular during the energy conservation movements of the 1970s and 1980s. The Energy Policy Act of 2005 and state-level building codes helped speed up the adoption of the technology, especially in hospitals, universities, and commercial buildings. New technology made it possible for digital meters to measure a wide range of electrical parameters and work with building automation systems. Sub-meters now support demand response programs, real-time monitoring, and corporate sustainability goals. This shows that the market has matured thanks to policy, economics, and technology.

In North America, some important trends are working with utility incentive programs, following changing building energy codes, and managing distributed energy resources like rooftop solar, EV chargers, and battery storage. Market leaders use strategies like working with utilities to get rebates, connecting with DER platforms, improving cybersecurity, and providing service-oriented models that combine hardware, software, and analytics. Education and outreach to building owners and managers also help more people use it. There is a lot of competition. Multinationals offer complete solutions, regional specialists offer cheap and customizable options, and startups focus on new software and analytics. Different rules in different states and provinces affect prices, features, and how people use them.

Type Outlook

Based on Type, the market is segmented into Electronic Sub-Meters, Smart Sub-Meters, Digital Sub-Meters, Analog / Conventional Sub-Meters, and Other Type. Among various US Electric Sub-meters Market by Type; The Electronic Sub-Meters market achieved a market size of USD $1.14 billion in 2024 and is expected to grow at a CAGR of 4.1 % during the forecast period. The Analog / Conventional Sub-Meters market is predicted to experience a CAGR of 5.8% throughout the forecast period from (2025 - 2032).Connectivity Outlook

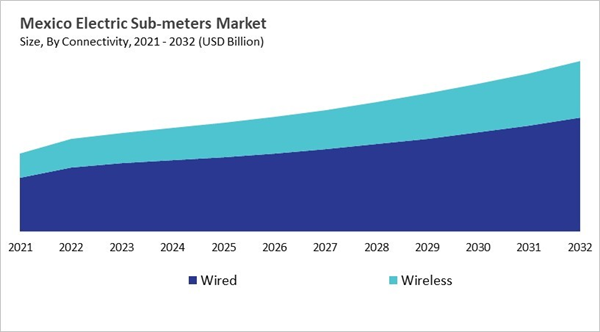

Based on Connectivity, the market is segmented into Wired, and Wireless. With a compound annual growth rate (CAGR) of 6.2% over the projection period, the Wired Market, dominate the Mexico Electric Sub-meters Market by Connectivity in 2024 and would be a prominent market until 2032. The Wireless market is expected to witness a CAGR of 7.4% during 2025-2032.Country Outlook

Different state and local rules govern the U.S. electric sub-meter market. These rules stress fairness, energy efficiency, and clear billing. Sub-metering lets property owners see how much electricity each tenant uses, but the rules for installation, billing, and tenant protections are different. Adoption is driven by rising energy costs, stricter building codes, and smart grid projects. At the same time, consumers want accurate and clear metering. Some trends are updating older buildings, adding real-time data and energy management systems, and growing demand-response programs. More and more, state and city laws require or encourage sub-metering, which opens up new business opportunities. There is competition among meter makers, service providers, and software companies, but new companies have to deal with problems like meeting accuracy standards, getting regulatory approvals, and showing property owners that their services are worth the money.List of Key Companies Profiled

- Schneider Electric SE

- Siemens AG

- Honeywell International, Inc.

- ABB Ltd.

- Itron, Inc.

- Landis+Gyr Group AG

- Eaton Corporation plc

- General Electric Company

- Mitsubishi Electric Corporation

- Xylem, Inc. (Sensus)

Market Report Segmentation

By Phase

- Three Phase

- Single Phase

By Type

- Electronic Sub-Meters

- Smart Sub-Meters

- Digital Sub-Meters

- Analog / Conventional Sub-Meters

- Other Type

By Connectivity

- Wired

- Wireless

By End Use

- Industrial

- Commercial

- Residential

- Other End Use

By Country

- US

- Canada

- Mexico

- Rest of North America

Table of Contents

Companies Mentioned

- Schneider Electric SE

- Siemens AG

- Honeywell International, Inc.

- ABB Ltd.

- Itron, Inc.

- Landis+Gyr Group AG

- Eaton Corporation plc

- General Electric Company

- Mitsubishi Electric Corporation

- Xylem, Inc. (Sensus)