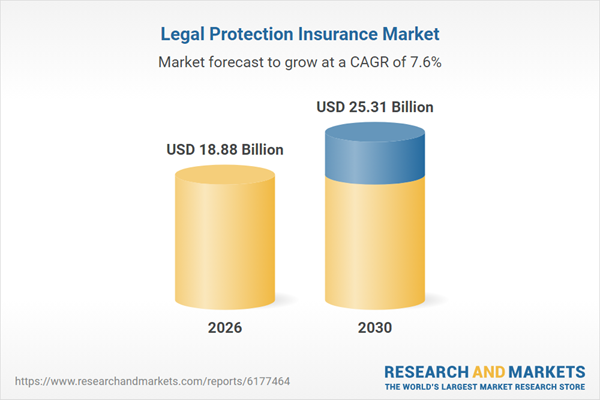

The legal protection insurance market size is expected to see strong growth in the next few years. It will grow to $25.31 billion in 2030 at a compound annual growth rate (CAGR) of 7.6%. The growth in the forecast period can be attributed to increasing demand for on-demand legal support models, rising adoption of digital distribution channels, expansion of legal protection coverage among freelancers, growing focus on preventive legal services, increasing integration of legal analytics platforms. Major trends in the forecast period include increasing adoption of digital legal advisory services, rising demand for subscription-based legal protection policies, growing integration of online claims and case management tools, expansion of business-focused legal coverage plans, enhanced focus on cost transparency and accessibility.

The increasing demand for legal services is expected to drive the growth of the legal protection insurance market in the coming years. Legal services involve professional guidance and assistance provided by qualified lawyers or legal experts to resolve legal issues and disputes. The need for affordable legal services is rising as the high cost of traditional legal representation makes professional legal support inaccessible for many individuals and small businesses. Legal protection insurance helps make legal services more affordable by covering or reducing legal expenses, allowing people to access professional assistance without bearing significant costs. For example, in May 2025, according to the Australian Bureau of Statistics, an Australia-based government agency, during 2023-24, Legal Aid Commissions and Community Legal Centres provided completed legal assistance to 432,274 clients, with nearly one-third (32% or 139,193) receiving multiple services, marking a 1% (5,344) increase from 2022-23. Consequently, the growing demand for legal services is supporting the expansion of the legal protection insurance market.

Innovation in insurance offerings is enhancing market accessibility and efficiency. Companies are introducing comprehensive legal expense coverage plans to meet evolving client needs. In October 2024, Auto Logistic Solutions Ltd., a UK-based accident management firm, launched Full Circle, a legal expense insurance product for brokers. This solution allows brokers to outsource accident management, including claims handling and legal administration, while ALS covers injury claim costs. Features such as dashcam apps streamline accident reporting, improving operational efficiency and customer satisfaction.

In January 2024, ARAG SE, a Germany-based legal insurance provider, acquired DAS UK Holdings Limited. The acquisition strengthens ARAG’s legal protection insurance portfolio in Europe by leveraging DAS UK’s underwriting expertise, digital infrastructure, and customer base. This move enhances service delivery, accelerates innovation, and supports growth across existing and new markets.

Major companies operating in the legal protection insurance market are Allianz SE, AXA S.A., Swiss Re Ltd., Zurich Insurance Group AG, Chubb Limited, Covéa Group, HDI Global SE, Hiscox Ltd., ARAG SE, Clyde & Co LLP, Getsafe Insurance AG, Markel International Insurance Company Limited, ALPS Corporation, Feather Insurance Services GmbH, Kingsbridge Risk Solutions Ltd., Arc Legal Assistance Ltd., Temple Legal Protection Ltd., Adam Riese GmbH, ERGO Versicherung AG, Premierline Ltd., Legal & General Group plc, Aviva plc.

North America was the largest region in the legal protection insurance market in 2025. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the legal protection insurance market report are Asia-Pacific, South East Asia, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the legal protection insurance market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Taiwan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

The legal protection insurance market includes revenues earned by entities by providing services, such as policy customization, claim settlement and risk assessment, underwriting processes, customer support, and compliance management services. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 1-3 business days.

Table of Contents

Executive Summary

Legal Protection Insurance Market Global Report 2026 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses legal protection insurance market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase::

- Gain a truly global perspective with the most comprehensive report available on this market covering 16 geographies.

- Assess the impact of key macro factors such as geopolitical conflicts, trade policies and tariffs, inflation and interest rate fluctuations, and evolving regulatory landscapes.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on end user analysis.

- Benchmark performance against key competitors based on market share, innovation, and brand strength.

- Evaluate the total addressable market (TAM) and market attractiveness scoring to measure market potential.

- Suitable for supporting your internal and external presentations with reliable high-quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for legal protection insurance? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward, including technological disruption, regulatory shifts, and changing consumer preferences? The legal protection insurance market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, total addressable market (TAM), market attractiveness score (MAS), competitive landscape, market shares, company scoring matrix, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market. This section also examines key products and services offered in the market, evaluates brand-level differentiation, compares product features, and highlights major innovation and product development trends.

- The supply chain analysis section provides an overview of the entire value chain, including key raw materials, resources, and supplier analysis. It also provides a list competitor at each level of the supply chain.

- The updated trends and strategies section analyses the shape of the market as it evolves and highlights emerging technology trends such as digital transformation, automation, sustainability initiatives, and AI-driven innovation. It suggests how companies can leverage these advancements to strengthen their market position and achieve competitive differentiation.

- The regulatory and investment landscape section provides an overview of the key regulatory frameworks, regularity bodies, associations, and government policies influencing the market. It also examines major investment flows, incentives, and funding trends shaping industry growth and innovation.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include the technological advancements such as AI and automation, Russia-Ukraine war, trade tariffs (government-imposed import/export duties), elevated inflation and interest rates.

- The total addressable market (TAM) analysis section defines and estimates the market potential compares it with the current market size, and provides strategic insights and growth opportunities based on this evaluation.

- The market attractiveness scoring section evaluates the market based on a quantitative scoring framework that considers growth potential, competitive dynamics, strategic fit, and risk profile. It also provides interpretive insights and strategic implications for decision-makers.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth.

- Expanded geographical coverage includes Taiwan and Southeast Asia, reflecting recent supply chain realignments and manufacturing shifts in the region. This section analyzes how these markets are becoming increasingly important hubs in the global value chain.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The company scoring matrix section evaluates and ranks leading companies based on a multi-parameter framework that includes market share or revenues, product innovation, and brand recognition.

Report Scope

Markets Covered:

1) By Type of Legal Protection Insurance: Individual Legal Protection; Family Legal Protection; Business Legal Protection; Property Legal Protection2) By Customer Type: Individuals; Small and Medium Enterprises (SMEs); Large Corporations; Non-Profit Organizations; Freelancers and Contractors

3) By Coverage Scope: Legal Expenses Coverage; Court Costs Coverage; Settlement Coverage; Mediation and Arbitration Coverage; Criminal Defense Coverage

4) By Premium Payment Structure: Monthly Premiums; Annual Premiums; Pay-as-You-Go Premiums; One-Time Payment Option; Installment Payment Options

5) By Distribution Channel: Direct Sales; Online Platforms; Insurance Agents or Brokers; Affinity Groups or Associations; Partnered Services

Subsegments:

1) By Individual Legal Protection: Criminal Defense; Traffic Offenses; Employment Disputes; Tenant Legal Issues; Consumer Contract Disputes2) By Family Legal Protection: Divorce and Separation; Child Custody and Support; Inheritance Disputes; Domestic Violence Legal Aid; Family Contract Conflicts

3) By Business Legal Protection: Contract Disputes; Tax Litigation; Intellectual Property Issues; Employment Law Cases; Regulatory Compliance

4) By Property Legal Protection: Landlord-Tenant Disputes; Property Damage Claims; Boundary and Easement Conflicts; Eviction Proceedings; Homeowner Association Disputes

Companies Mentioned: Allianz SE; AXA S.a.; Swiss Re Ltd.; Zurich Insurance Group AG; Chubb Limited; Covéa Group; HDI Global SE; Hiscox Ltd.; ARAG SE; Clyde & Co LLP; Getsafe Insurance AG; Markel International Insurance Company Limited; ALPS Corporation; Feather Insurance Services GmbH; Kingsbridge Risk Solutions Ltd.; Arc Legal Assistance Ltd.; Temple Legal Protection Ltd.; Adam Riese GmbH; ERGO Versicherung AG; Premierline Ltd.; Legal & General Group plc; Aviva plc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Taiwan; Russia; South Korea; UK; USA; Canada; Italy; Spain.

Regions: Asia-Pacific; South East Asia; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: Word, PDF or Interactive Report + Excel Dashboard

Added Benefits:

- Bi-Annual Data Update

- Customisation

- Expert Consultant Support

Companies Mentioned

The companies featured in this Legal Protection Insurance market report include:- Allianz SE

- AXA S.A.

- Swiss Re Ltd.

- Zurich Insurance Group AG

- Chubb Limited

- Covéa Group

- HDI Global SE

- Hiscox Ltd.

- ARAG SE

- Clyde & Co LLP

- Getsafe Insurance AG

- Markel International Insurance Company Limited

- ALPS Corporation

- Feather Insurance Services GmbH

- Kingsbridge Risk Solutions Ltd.

- Arc Legal Assistance Ltd.

- Temple Legal Protection Ltd.

- Adam Riese GmbH

- ERGO Versicherung AG

- Premierline Ltd.

- Legal & General Group plc

- Aviva plc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | January 2026 |

| Forecast Period | 2026 - 2030 |

| Estimated Market Value ( USD | $ 18.88 Billion |

| Forecasted Market Value ( USD | $ 25.31 Billion |

| Compound Annual Growth Rate | 7.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 23 |