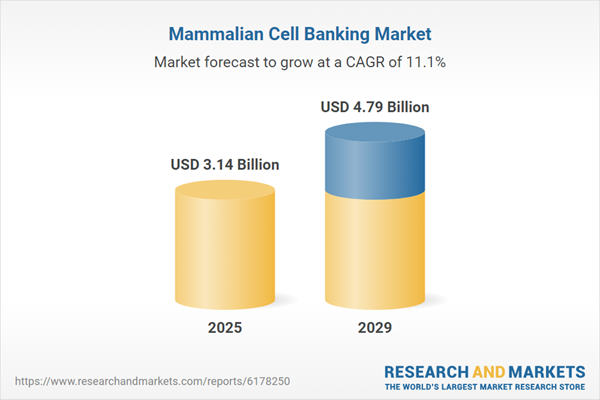

The mammalian cell banking market size is expected to see rapid growth in the next few years. It will grow to $4.79 billion in 2029 at a compound annual growth rate (CAGR) of 11.1%. The growth projected for the forecast period can be attributed to increasing demand for cell and gene therapies, wider adoption of personalized medicine, rising investment in biomanufacturing infrastructure, expansion of biosimilar and biobetter development, and strengthened pandemic preparedness and vaccine production. Key trends during the forecast period include the integration of automation and digital tracking, advancements in cell culture technologies, progress in regenerative medicine, development of serum-free and protein-free media, and improvements in cryopreservation and analytical techniques.

The growing demand for cell-based therapies is expected to significantly drive the expansion of the mammalian cell banking market. Cell-based therapies involve advanced treatments using living, often modified or engineered, cells to repair, replace, or regenerate damaged tissues and organs, offering targeted solutions for various diseases. As chronic and rare diseases become more prevalent, there is an increasing need for more effective and precise treatments. Mammalian cell banking plays a key role in supporting these therapies by providing a consistent, high-quality cell source, ensuring safety, scalability, and reliability in the development and production of regenerative treatments. For example, the American Society of Gene and Cell Therapy reported in April 2024 that the number of therapies in clinical pipelines has grown, with Phase I trials showing the strongest growth of 11% since late 2022. This surge in demand for cell-based therapies is therefore fueling the growth of the mammalian cell banking market.

The rise in chronic diseases is driving the growth of the mammalian cell banking market. Chronic diseases are long-term conditions that require ongoing management instead of a cure, and their prevalence is increasing, particularly as the global population ages. Older individuals are more prone to developing chronic conditions that demand continuous care. Mammalian cell banking aids in treating these conditions by supplying high-quality, stable cells for the creation of consistent, reliable cell-based therapies and biologics. For instance, the International Diabetes Federation reported in April 2025 that around 589 million adults aged 20 to 79 were living with diabetes in 2024, and this figure is projected to rise to 853 million by 2050. As the incidence of chronic diseases continues to grow, the demand for mammalian cell banking services is also increasing.

Companies in the mammalian cell banking market are advancing the field by developing innovative stable cell line systems that improve cell line productivity, ensure long-term genetic stability, and streamline biopharmaceutical manufacturing. Stable cell line systems are engineered mammalian cells that can consistently produce specific proteins or therapeutic molecules across generations with high genetic stability. For example, WuXi Biologics, a biopharmaceutical company based in China, introduced the WuXia293 Stable platform in August 2024. This HEK293-based stable cell line system is designed for the development and production of challenging biologic molecules. By using proprietary cell line development technology, the platform ensures stable expression, consistent quality, and scalable production, overcoming challenges typically seen with traditional CHO cell systems, such as low yields and compromised quality. The WuXia293 Stable platform provides higher protein yields, better human-like glycosylation, and more efficient production for clinical and commercial use.

Major players in the mammalian cell banking market are Merck KGaA, Thermo Fisher Scientific Inc., Lonza Group AG, Eurofins Scientific SE, Charles River Laboratories International Inc., Catalent Inc., Sartorius Stedim Biotech S.A., Samsung Biologics Co. Ltd., CMIC Holdings Co. Ltd., WuXi Biologics Inc., Fujifilm Diosynth Biotechnologies Inc., Evotec SE, AGC Biologics Inc., CordenPharma International GmbH, GenScript ProBio Co. Ltd., Syngene International Limited, KBI Biopharma Inc., Rentschler Biopharma SE, BioVectra Inc., Polpharma Biologics S.A., and Abzena plc.

North America was the largest region in the mammalian cell banking market in 2024. The regions covered in mammalian cell banking report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East and Africa. The countries covered in the mammalian cell banking market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Note that the outlook for this market is being affected by rapid changes in trade relations and tariffs globally. The report will be updated prior to delivery to reflect the latest status, including revised forecasts and quantified impact analysis. The report’s Recommendations and Conclusions sections will be updated to give strategies for entities dealing with the fast-moving international environment.

The fast surge in U.S. tariffs and the trade tensions that followed in spring 2025 are heavily affecting the medical equipment sector, particularly for imported imaging machine components, surgical-grade stainless steel, and plastic disposables. Hospitals and clinics resist price hikes, pressuring manufacturers’ margins. Regulatory hurdles compound the problem, as tariff-related supplier changes often require re-certification of devices, delaying time-to-market. Companies are mitigating risks by dual-sourcing critical parts, expanding domestic production of commoditized items, and accelerating R&D in cost-efficient materials.

Mammalian cell banking is the organized procedure of producing, preserving, and storing well-characterized mammalian cell stocks under strict conditions, typically at very low temperatures, to ensure their long-term survival, genetic consistency, and functional performance. This method maintains the cells’ uniformity, prevents contamination, and preserves their original traits over time, providing a reliable and standardized resource for future use.

The primary types of products in mammalian cell banking are master cell bank and working cell bank. A master cell bank (MCB) is a carefully prepared and extensively characterized collection of cells stored in multiple vials under controlled cryogenic conditions. It includes various cell types such as Chinese hamster ovary (CHO), baby hamster kidney (BHK), non-secreting 0 (NS0), YB2/0 and P2/0, human embryonic kidney 293 (HEK293) and derivatives, and HeLa cells. Storage methods include liquid nitrogen, controlled-rate freezing, and flash freezing. Master cell banks are used in drug development, vaccine production, gene therapy, and monoclonal antibody production, serving end users such as academic and research laboratories, biopharmaceutical companies, and contract research organizations (CROs).

The mammalian cell banking market research report is one of a series of new reports that provides mammalian cell banking market statistics, including mammalian cell banking industry global market size, regional shares, competitors with a mammalian cell banking market share, detailed mammalian cell banking market segments, market trends and opportunities, and any further data you may need to thrive in the mammalian cell banking industry. This mammalian cell banking market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The mammalian cell banking market consists of sales of cryopreservation media, cell culture reagents, storage vials, cryogenic storage equipment, and quality control kits. Values in this market are ‘factory gate’ values, that is, the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Mammalian Cell Banking Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on mammalian cell banking market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as geopolitical conflicts, trade policies and tariffs, post-pandemic supply chain realignment, inflation and interest rate fluctuations, and evolving regulatory landscapes.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for mammalian cell banking? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward, including technological disruption, regulatory shifts, and changing consumer preferences? The mammalian cell banking market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: technological advancements such as AI and automation, Russia-Ukraine war, trade tariffs (government-imposed import/export duties), elevated inflation and interest rates.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Report Scope

Markets Covered:

1) By Product Type: Master Cell Bank; Working Cell Bank2) By Cell Type: Chinese Hamster Ovary Mammalian Cell Banking (CHO); Baby Hamster Kidney (BHK); Non-Secreting 0 (NS0); YB2/0 And P2/0; Human Embryonic Kidney 293 (HEK293) And Derivatives; Henrietta Lacks (HELA)

3) By Storage Type: Liquid Nitrogen; Controlled Rate Freezer; Flash Freezing

4) By Application: Drug Development; Vaccine Production; Gene Therapy; Monoclonal Antibody Production

5) By End User: Academic And Research Laboratories; Biopharmaceutical Companies; Contract Research Organizations (CROs)

Subsegments:

1) By Master Cell Bank: Recombinant Cell Lines; Hybridoma Cell Lines; Primary Cell Lines; Genetically Engineered Cell Lines; Viral Vector Producing Cell Lines2) By Working Cell Bank: Current Good Manufacturing Practice (CGMP)-Compliant Cell Banks; Research-Grade Cell Banks; Clinical Trial Cell Banks; Commercial Production Cell Banks; Stability Testing Cell Banks

Companies Mentioned: Merck KGaA; Thermo Fisher Scientific Inc.; Lonza Group AG; Eurofins Scientific SE; Charles River Laboratories International Inc.; Catalent Inc.; Sartorius Stedim Biotech S.A.; Samsung Biologics Co. Ltd.; CMIC Holdings Co. Ltd.; WuXi Biologics Inc.; Fujifilm Diosynth Biotechnologies Inc.; Evotec SE; AGC Biologics Inc.; CordenPharma International GmbH; GenScript ProBio Co. Ltd.; Syngene International Limited; KBI Biopharma Inc.; Rentschler Biopharma SE; BioVectra Inc.; Polpharma Biologics S.A.; Abzena plc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The companies featured in this Mammalian Cell Banking market report include:- Merck KGaA

- Thermo Fisher Scientific Inc.

- Lonza Group AG

- Eurofins Scientific SE

- Charles River Laboratories International Inc.

- Catalent Inc.

- Sartorius Stedim Biotech S.A.

- Samsung Biologics Co. Ltd.

- CMIC Holdings Co. Ltd.

- WuXi Biologics Inc.

- Fujifilm Diosynth Biotechnologies Inc.

- Evotec SE

- AGC Biologics Inc.

- CordenPharma International GmbH

- GenScript ProBio Co. Ltd.

- Syngene International Limited

- KBI Biopharma Inc.

- Rentschler Biopharma SE

- BioVectra Inc.

- Polpharma Biologics S.A.

- Abzena plc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | October 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 3.14 Billion |

| Forecasted Market Value ( USD | $ 4.79 Billion |

| Compound Annual Growth Rate | 11.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 22 |