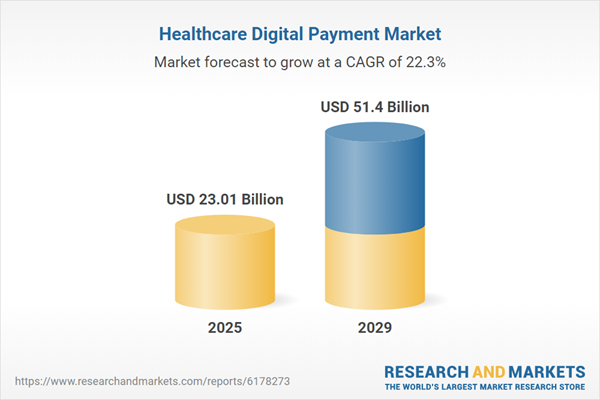

The healthcare digital payment market size is expected to see exponential growth in the next few years. It will grow to $51.4 billion in 2029 at a compound annual growth rate (CAGR) of 22.3%. The growth projected for the forecast period is driven by increasing telemedicine adoption, expansion of health insurance coverage, growing government initiatives for digital health, and rising patient preference for cashless payments. Primary trends during the forecast period include advancements in biometric authentication, enhanced integration of wearable health devices with payment systems, development of blockchain-based secure transactions, innovations in AI-powered billing solutions, and improvements in real-time cross-border healthcare payments.

The growing demand for convenient and contactless transactions is expected to support the expansion of the healthcare digital payment market. Convenient and contactless transactions are payments completed quickly and easily without the need to physically handle cash or cards. This demand is increasing as consumers seek faster and more convenient payment options that do not require physical contact or PIN entry. These transactions improve healthcare digital payment systems by providing fast and secure payment methods, making them suitable for clinics, pharmacies, and telehealth services. They reduce manual processing and wait times by enabling seamless, touch-free payments, thereby improving the experience for both patients and providers. For example, in July 2024, UK Finance reported that there were 18.3 billion contactless payments in the United Kingdom in 2023, a 7 percent rise from 17 billion in 2022. This increase is contributing to the growth of the healthcare digital payment market.

Leading companies in the healthcare digital payment market are developing advanced solutions such as mobile-first payment platforms to improve transaction efficiency, enhance security, and simplify the experience for patients and providers. Mobile-first payment platforms are digital systems designed primarily for smartphones and tablets, supporting secure and contactless transactions through integrated features such as tokenization, biometric verification, and cloud-based processing. For example, in April 2025, Alternative Payments Ltd. (trading as Judopay), a mobile payments provider based in the United Kingdom, introduced a digital payments solution for pharmacies and healthcare providers in the country. The solution aims to simplify and secure payment processes within the healthcare sector. This fully compliant and agile platform allows payments to be accepted online, through mobile applications, in person, and via payment links. It supports all major payment methods such as cards, Apple Pay, Google Pay, and contactless transactions. The platform addresses challenges in healthcare payments including data regulation compliance, fraud risk, and complex underwriting, by offering fast onboarding, fraud protection, and smooth integration with existing healthcare systems.

In May 2023, Fabrick S.p.a., an open finance company based in Italy, acquired Judopay for an undisclosed amount. Through this acquisition, Fabrick S.p.a. plans to strengthen its payment orchestration technology, optimize merchant payment processes, enhance the checkout experience, and expand its presence in the United Kingdom digital payments market. Judopay is a mobile payments provider based in the United Kingdom that delivers digital payment solutions designed for the healthcare industry.

Major players in the healthcare digital payment market are American Express Company, Visa Inc., PayPal Holdings Inc., Mastercard Incorporated, HDFC Bank Limited, Fiserv Inc., Experian Health Inc., athenahealth Inc., Adyen N.V., Nets Group A/S, Cotiviti Inc., Waystar Inc., Precisely Software Incorporated, Paymentus Holdings Inc., Zelis Healthcare LLC, Flywire Corporation, Phreesia Inc., Availity L.L.C., RevSpring Inc., Rectangle Health Inc., AccessOne MedCard Inc., ClearBalance Healthcare Inc., PayZen Inc., and PatientPay Inc.

North America was the largest region in the healthcare digital payment market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in healthcare digital payment report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East and Africa. The countries covered in the healthcare digital payment market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Note that the outlook for this market is being affected by rapid changes in trade relations and tariffs globally. The report will be updated prior to delivery to reflect the latest status, including revised forecasts and quantified impact analysis. The report’s Recommendations and Conclusions sections will be updated to give strategies for entities dealing with the fast-moving international environment.

The sudden escalation of U.S. tariffs and the consequent trade frictions in spring 2025 are severely impacting the healthcare sector, particularly in the supply of critical medical devices, diagnostic equipment, and pharmaceuticals. Hospitals and healthcare providers are facing higher costs for imported surgical instruments, imaging equipment, and consumables such as syringes and catheters, many of which have limited domestic alternatives. These increased costs are straining healthcare budgets, leading some providers to delay equipment upgrades or pass on expenses to patients. Additionally, tariffs on raw materials and components are disrupting the production of essential drugs and devices, causing supply chain bottlenecks. In response, the industry is diversifying sourcing strategies, boosting local manufacturing where possible, and advocating for tariff exemptions on life-saving medical products.

Healthcare digital payment refers to the electronic transfer of funds for medical services, treatments, and related healthcare expenses using digital platforms such as mobile apps, online portals, and payment gateways. Its primary purpose is to streamline transactions, reduce billing errors, improve payment transparency, and enhance convenience for patients and healthcare providers.

The primary types of healthcare digital payment include mobile wallets, point-of-sale (POS) systems, internet banking, mobile banking, cryptocurrencies, and others. Mobile wallets are digital applications that securely store payment details on smartphones, allowing patients to pay for healthcare services with ease. Solutions include application programming interfaces (APIs), payment gateways, payment processing, payment security and fraud management, and transaction risk management. Deployment can be cloud-based or on-premises. Technologies include near field communication (NFC), quick response (QR) code payments, blockchain, biometric authentication, and others. End users include hospitals, medical clinics, pharmacies, health insurance companies, telemedicine and remote health services, and other healthcare providers.

The healthcare digital payment market research report is one of a series of new reports that provides healthcare digital payment market statistics, including healthcare digital payment industry global market size, regional shares, competitors with a healthcare digital payment market share, detailed healthcare digital payment market segments, market trends and opportunities, and any further data you may need to thrive in the healthcare digital payment industry. This healthcare digital payment market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The healthcare digital payment market consists of revenues earned by entities by providing services such as electronic billing, electronic fund transfers, subscription-based healthcare payment services, emergency payment services, and automated claims processing. The market value includes the value of related goods sold by the service provider or included within the service offering. The healthcare digital payment market also includes sales of mobile payment applications, contactless payment cards, and quick response (QR) code payment solutions. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD unless otherwise specified).

The revenues for a specified geography are consumption values and are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Healthcare Digital Payment Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on healthcare digital payment market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as geopolitical conflicts, trade policies and tariffs, post-pandemic supply chain realignment, inflation and interest rate fluctuations, and evolving regulatory landscapes.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for healthcare digital payment? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward, including technological disruption, regulatory shifts, and changing consumer preferences? The healthcare digital payment market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: technological advancements such as AI and automation, Russia-Ukraine war, trade tariffs (government-imposed import/export duties), elevated inflation and interest rates.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Report Scope

Markets Covered:

1) By Type: Mobile Wallets; Point-Of-Sale (POS) Systems; Internet Banking; Mobile Banking; Cryptocurrencies; Other Types2) By Solution: Application Program Interface; Payment Gateway; Payment Processing; Payment Security And Fraud Management; Transaction Risk Management; Other Solutions

3) By Deployment: Cloud; On-Premise

4) By Technology: Near Field Communication (NFC); Quick Response (QR) Code Payments; Blockchain; Biometric Authentication; Other Technologies

5) By End-User: Hospitals; Medical Clinics; Pharmacies; Health Insurance Companies; Telemedicine And Remote Health Services; Other End-Users

Subsegments:

1) By Mobile Wallets: Near Field Communication Payments; Quick Response (QR) Code Payments; Mobile App Based Payments; Cloud Based Mobile Wallets; Peer To Peer Transfers2) By Point Of Sale Systems: Countertop Terminals; Mobile Point Of Sale Terminals; Smart Point Of Sale Terminals; Contactless Point Of Sale Terminals; Integrated Point Of Sale Solutions

3) By Internet Banking: Web Based Fund Transfers; Online Bill Payments; Account Management Services; Loan And Credit Services; Online Investment Services

4) By Mobile Banking: Mobile Check Deposits; Mobile Fund Transfers; Account Balance Inquiries; Bill Payments Through Apps; Personalized Financial Alerts

5) By Cryptocurrencies: Bitcoin Payments; Ethereum Payments; Stablecoin Transactions; Blockchain Based Remittances; Decentralized Finance Payments

6) By Other Types: Biometric Payment Systems; Voice Activated Payment Systems; Wearable Device Payments; Smart Card Payments; Contactless Payment Rings

Companies Mentioned: American Express Company; Visa Inc.; PayPal Holdings Inc.; Mastercard Incorporated; HDFC Bank Limited; Fiserv Inc.; Experian Health Inc.; athenahealth Inc.; Adyen N.V.; Nets Group A/S; Cotiviti Inc.; Waystar Inc.; Precisely Software Incorporated; Paymentus Holdings Inc.; Zelis Healthcare LLC; Flywire Corporation; Phreesia Inc.; Availity L.L.C.; RevSpring Inc.; Rectangle Health Inc.; AccessOne MedCard Inc.; ClearBalance Healthcare Inc.; PayZen Inc.; PatientPay Inc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The companies featured in this Healthcare Digital Payment market report include:- American Express Company

- Visa Inc.

- PayPal Holdings Inc.

- Mastercard Incorporated

- HDFC Bank Limited

- Fiserv Inc.

- Experian Health Inc.

- athenahealth Inc.

- Adyen N.V.

- Nets Group A/S

- Cotiviti Inc.

- Waystar Inc.

- Precisely Software Incorporated

- Paymentus Holdings Inc.

- Zelis Healthcare LLC

- Flywire Corporation

- Phreesia Inc.

- Availity L.L.C.

- RevSpring Inc.

- Rectangle Health Inc.

- AccessOne MedCard Inc.

- ClearBalance Healthcare Inc.

- PayZen Inc.

- PatientPay Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | October 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 23.01 Billion |

| Forecasted Market Value ( USD | $ 51.4 Billion |

| Compound Annual Growth Rate | 22.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 25 |