United States Off-road Motorcycle Industry Overview

The United States off-road motorcycle industry has evolved significantly, fueled by growing enthusiasm for recreational sports and outdoor adventure activities. Off-road motorcycles are designed to handle rugged terrains, including dirt trails, hills, and unpaved tracks, making them popular among adventure seekers and motorsport enthusiasts. The rise in off-road racing events, adventure tourism, and recreational riding clubs has enhanced market visibility. Manufacturers are continuously innovating with lightweight designs, advanced suspension systems, and efficient engines to meet evolving consumer demands. Additionally, increasing consumer interest in fitness and outdoor lifestyles contributes to the growth of off-road motorcycle ownership across the country.The market is witnessing technological advancements and diversification in product offerings, including motocross, trail, and enduro models. These innovations are aimed at improving rider comfort, durability, and performance in challenging conditions. Moreover, manufacturers are integrating electronic aids, safety systems, and hybrid technology to cater to environmentally conscious consumers. The growing influence of motorsport culture and digital marketing platforms is also expanding consumer engagement and brand visibility. In addition, the emergence of youth-oriented models and training academies is helping broaden the customer base, promoting early adoption among younger riders.

Looking ahead, the U.S. off-road motorcycle industry is expected to benefit from continued innovation, lifestyle diversification, and community engagement. However, challenges such as environmental regulations, maintenance costs, and safety concerns may limit broader adoption. The industry’s future growth will depend on balancing performance and sustainability while meeting evolving regulatory standards. Despite potential constraints, increased recreational spending and the popularity of motorsport competitions position the United States as one of the most dynamic markets for off-road motorcycles globally.

Key Factors Driving the United States Off-road Motorcycle Market Growth

Rising Popularity of Outdoor Recreational Activities

Growing participation in outdoor recreational activities is a primary driver of the U.S. off-road motorcycle market. Consumers are increasingly seeking adventure and leisure experiences, with off-road biking becoming a preferred choice due to its thrill and accessibility. Organized trail networks, off-road parks, and adventure clubs across the country are encouraging participation. The rise in disposable income and lifestyle diversification has allowed more consumers to invest in recreational vehicles. Additionally, the promotion of adventure tourism and off-road racing events has enhanced public awareness and engagement. Off-road motorcycling also appeals to enthusiasts seeking fitness and stress relief through outdoor activities. The availability of training programs and beginner-friendly models further encourages entry-level riders to join the segment. These factors collectively strengthen the market’s growth outlook by integrating off-road riding into mainstream recreational culture in the United States.Technological Advancements and Product Innovation

Continuous technological innovation is driving growth in the U.S. off-road motorcycle market. Manufacturers are introducing advanced suspension systems, lightweight materials, and fuel-efficient engines to enhance performance across varied terrains. Digital instrumentation, improved braking systems, and ergonomic designs have elevated rider comfort and safety. Furthermore, the development of hybrid and electric off-road motorcycles aligns with the growing demand for environmentally sustainable solutions. These advancements not only reduce environmental impact but also attract new riders who value innovation and green technology. Connectivity features and customizable ride modes add to user experience, promoting brand differentiation. The focus on durability and low maintenance ensures higher value retention and reliability, key factors influencing purchasing decisions. As consumers increasingly prioritize innovation, manufacturers that invest in R&D and smart technology integration are well-positioned to capture greater market share in the coming years.Expanding Motorsport Events and Recreational Infrastructure

The growth of organized motorsport events and recreational infrastructure across the U.S. is a significant driver for the off-road motorcycle market. National and regional competitions, including motocross, supercross, and enduro races, have gained mainstream popularity, attracting large audiences and participants. This expansion promotes brand awareness and fosters aspirational buying behavior among younger riders. Moreover, the development of dedicated off-road trails, parks, and adventure zones provides enthusiasts with safe and accessible riding spaces. Collaborations between local governments and private organizations to improve trail networks and promote motorsport tourism further support market growth. The presence of riding schools and training programs also encourages new entrants into the sport. As motorsport culture continues to thrive, the increasing exposure, sponsorship opportunities, and media coverage will sustain long-term demand for off-road motorcycles across the United States.Challenges in the United States Off-road Motorcycle Market

Environmental Regulations and Land-use Restrictions

Stringent environmental regulations and land-use restrictions pose significant challenges for the U.S. off-road motorcycle market. Concerns regarding noise pollution, emissions, and ecological disruption have led to limitations on riding areas and organized events. Several states enforce strict environmental guidelines that restrict access to natural trails and forests, reducing opportunities for off-road activities. Moreover, the need for compliance with emission standards has increased manufacturing costs and limited product availability. Environmental advocacy groups continue to push for sustainable practices, prompting manufacturers to explore electric and hybrid alternatives. However, high costs and limited infrastructure hinder rapid adoption. Balancing environmental preservation with recreational access remains a key challenge for industry stakeholders. Addressing these concerns through eco-friendly designs, rider education, and responsible land management will be essential for ensuring long-term market sustainability.Safety Concerns and High Maintenance Costs

Safety and maintenance issues remain major barriers to market expansion. Off-road motorcycling involves navigating rough terrains, which increases the risk of injuries and accidents, especially for inexperienced riders. The absence of proper safety training and protective gear further exacerbates these risks. Additionally, regular maintenance requirements, including suspension tuning, tire replacements, and engine servicing, add to ownership costs. High repair expenses deter budget-conscious consumers from entering the market. Manufacturers and training academies are working to improve rider education and promote safety awareness through programs and certification courses. The introduction of advanced safety technologies and improved design ergonomics offers some mitigation. However, the need for continuous upkeep and safety compliance continues to influence purchasing decisions. Overcoming these challenges through education, affordability, and product reliability will be critical for sustaining growth in the U.S. off-road motorcycle industry.United States Off-road Motorcycle Market Overview by States

Regional market growth in the U.S. varies by terrain and participation levels, with western and southern states leading due to favorable landscapes, outdoor culture, and investment in off-road trails and motorsport infrastructure. The following provides a market overview by States:California Off-road Motorcycle Market

California represents one of the largest and most vibrant markets for off-road motorcycles in the United States. The state’s diverse terrain - from deserts to mountain trails - offers ideal conditions for off-road riding. A strong motorsport culture, coupled with numerous recreational parks and adventure zones, fuels consumer engagement. The presence of organized motocross and enduro events attracts enthusiasts across age groups, promoting community growth. Additionally, the state’s focus on sustainable practices encourages the adoption of electric and hybrid off-road models. California’s extensive dealership network and active rider associations support both new and experienced consumers. Government initiatives promoting outdoor recreation further strengthen market expansion. Despite regulatory constraints related to emissions and land access, the combination of favorable climate, terrain diversity, and lifestyle appeal positions California as a leading hub for off-road motorcycle activity in the U.S.Texas Off-road Motorcycle Market

Texas holds a prominent position in the U.S. off-road motorcycle market, driven by vast landscapes and a thriving motorsport culture. The state’s ranchlands, trails, and desert regions provide ideal environments for recreational and competitive riding. Increasing participation in motocross, trail, and enduro events is expanding consumer demand. Additionally, the state’s favorable climate allows year-round riding opportunities, attracting both casual riders and professionals. Supportive local organizations and off-road clubs play a key role in promoting events and safety awareness. Texas also benefits from a growing youth rider population and a strong dealership network offering diverse product options. While maintenance costs and land-use policies pose occasional challenges, rising recreational spending and community engagement continue to sustain growth. With its expanding rider base and diverse geography, Texas remains one of the fastest-growing regional markets for off-road motorcycles in the U.S.New York Off-road Motorcycle Market

New York’s off-road motorcycle market is characterized by a balance of recreational and competitive riding communities. The state’s upstate regions offer scenic trails and adventure routes that attract outdoor enthusiasts. Increasing participation in organized off-road events and growing youth interest are contributing to market expansion. Moreover, the presence of dedicated off-road parks and riding clubs supports community building and skill development. However, strict environmental regulations and urban space limitations pose challenges for riders in metropolitan areas. Manufacturers and local organizations are responding by promoting safety training programs and eco-friendly riding practices. The popularity of seasonal motorsport events and rural adventure tourism continues to support steady demand. Despite regulatory hurdles, New York’s blend of natural landscapes, active rider networks, and community engagement ensures consistent growth for the off-road motorcycle segment in the state.Florida Off-road Motorcycle Market

Florida’s off-road motorcycle market is gaining traction due to its favorable climate, recreational culture, and growing adventure tourism sector. The state’s sandy trails, forests, and designated riding parks provide ideal conditions for year-round activity. Rising interest in outdoor sports and motorsport competitions drives participation among both youth and adults. Florida’s extensive dealer network and motorsport events further enhance market accessibility. In addition, initiatives promoting eco-friendly recreation are fostering adoption of low-emission and electric models. While the flat terrain limits certain competitive formats, organized trail systems and community clubs maintain steady engagement. Seasonal tourism also contributes to higher equipment rentals and sales. Although regulatory and maintenance challenges persist, the combination of adventure tourism, family recreation, and favorable weather conditions positions Florida as a promising and expanding regional market for off-road motorcycles in the United States.Market Segmentations

Type

- Motocross Motorcycles

- Enduro Motorcycles

- Trail Motorcycles

- Track-racing Motorcycles

Application

- Commercial

- Personal

- Industrial

- Others

Engine Capacity

- Less than 500 cc

- 500 cc to 1000 cc

- More than 1000 cc

Price Range

- Low to Mid

- High

States

- California

- Texas

- New York

- Florida

- Illinois

- Pennsylvania

- Ohio

- Georgia

- New Jersey

- Washington

- North Carolina

- Massachusetts

- Virginia

- Michigan

- Maryland

- Colorado

- Tennessee

- Indiana

- Arizona

- Minnesota

- Wisconsin

- Missouri

- Connecticut

- South Carolina

- Oregon

- Louisiana

- Alabama

- Kentucky

- Rest of United States

All the Key players have been covered

- Overviews

- Key Persons

- Recent Developments

- SWOT Analysis

- Revenue Analysis

Company Analysis:

- Harley-Davidson Incorporation

- Yamaha Motor Co., Ltd.

- Ducati Motor Holding S.p.A.

- Honda Motor Co., Ltd.

- Kawasaki Heavy Industries, Ltd.

- BMW AG

- Suzuki Motor Corporation

- Hero MotoCorp Limited

- Bajaj Auto Ltd.

- TVS Motor Company

Table of Contents

Companies Mentioned

- Harley-Davidson Incorporation

- Yamaha Motor Co., Ltd.

- Ducati Motor Holding S.p.A.

- Honda Motor Co., Ltd.

- Kawasaki Heavy Industries, Ltd.

- BMW AG

- Suzuki Motor Corporation

- Hero MotoCorp Limited

- Bajaj Auto Ltd.

- TVS Motor Company

Methodology

In this report, for analyzing the future trends for the studied market during the forecast period, the publisher has incorporated rigorous statistical and econometric methods, further scrutinized by secondary, primary sources and by in-house experts, supported through their extensive data intelligence repository. The market is studied holistically from both demand and supply-side perspectives. This is carried out to analyze both end-user and producer behavior patterns, in the review period, which affects price, demand and consumption trends. As the study demands to analyze the long-term nature of the market, the identification of factors influencing the market is based on the fundamentality of the study market.

Through secondary and primary researches, which largely include interviews with industry participants, reliable statistics, and regional intelligence, are identified and are transformed to quantitative data through data extraction, and further applied for inferential purposes. The publisher's in-house industry experts play an instrumental role in designing analytic tools and models, tailored to the requirements of a particular industry segment. These analytical tools and models sanitize the data & statistics and enhance the accuracy of their recommendations and advice.

Primary Research

The primary purpose of this phase is to extract qualitative information regarding the market from the key industry leaders. The primary research efforts include reaching out to participants through mail, tele-conversations, referrals, professional networks, and face-to-face interactions. The publisher also established professional corporate relations with various companies that allow us greater flexibility for reaching out to industry participants and commentators for interviews and discussions, fulfilling the following functions:

- Validates and improves the data quality and strengthens research proceeds

- Further develop the analyst team’s market understanding and expertise

- Supplies authentic information about market size, share, growth, and forecast

The researcher's primary research interview and discussion panels are typically composed of the most experienced industry members. These participants include, however, are not limited to:

- Chief executives and VPs of leading corporations specific to the industry

- Product and sales managers or country heads; channel partners and top level distributors; banking, investment, and valuation experts

- Key opinion leaders (KOLs)

Secondary Research

The publisher refers to a broad array of industry sources for their secondary research, which typically includes, however, is not limited to:

- Company SEC filings, annual reports, company websites, broker & financial reports, and investor presentations for competitive scenario and shape of the industry

- Patent and regulatory databases for understanding of technical & legal developments

- Scientific and technical writings for product information and related preemptions

- Regional government and statistical databases for macro analysis

- Authentic new articles, webcasts, and other related releases for market evaluation

- Internal and external proprietary databases, key market indicators, and relevant press releases for market estimates and forecasts

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | September 2025 |

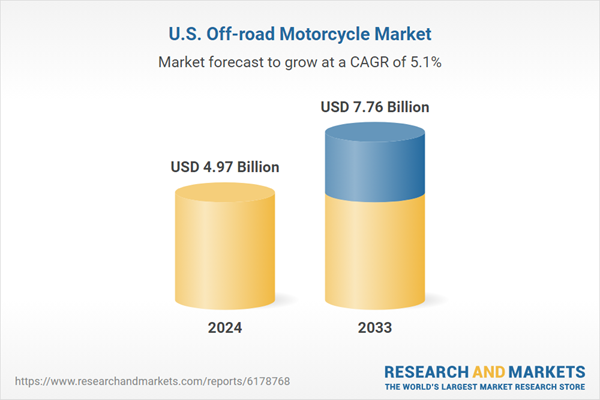

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 4.97 Billion |

| Forecasted Market Value ( USD | $ 7.76 Billion |

| Compound Annual Growth Rate | 5.0% |

| Regions Covered | United States |

| No. of Companies Mentioned | 10 |