The growth is powered by the increasing global burden of musculoskeletal conditions, an aging population, and continual innovations in orthopedic technology. Orthopedic devices are becoming essential in improving mobility, reducing pain, and enhancing patients' quality of life. The industry supports healthcare providers, life sciences firms, and digital health platforms by delivering advanced solutions such as joint implants, spinal systems, trauma devices, and digital tools that elevate surgical precision and post-operative care. Growing awareness around early interventions, increased spending on healthcare, and the emergence of minimally invasive techniques have further elevated demand. In both developed and emerging markets, these devices are reshaping orthopedic care by providing faster recovery, personalized treatment, and improved clinical efficiency. Demand is also being supported by rising accident rates, sports-related injuries, and patient preference for technologically advanced procedures that reduce downtime. As hospitals and surgical centers adopt digital and robotic surgical systems, the role of orthopedic devices continues to expand across diverse care settings.

The joint reconstruction devices segment held a 37.5% share in 2024. Increasing diagnoses of degenerative joint diseases and the growing volume of hip and knee replacement surgeries, especially among older adults, are primary factors boosting this segment. These devices are essential in managing conditions that impair mobility and require surgical intervention to restore joint functionality and relieve chronic discomfort.

The spinal devices segment generated USD 11.7 billion in 2024 and is forecasted to grow at a steady CAGR of 2.8% through 2034. Market expansion in this segment is largely attributed to the growing number of people affected by spinal conditions, often driven by aging demographics and sedentary lifestyles. The preference for less invasive surgical procedures has fueled demand for advanced spine technologies. Recent innovations in motion-preserving implants, bioresorbable components, and image-guided systems are improving outcomes and helping reduce post-operative complications, making spinal procedures more accessible and effective.

North America Orthopedic Devices Market held a 55.6% share in 2024. The region's strong healthcare infrastructure, along with significant investments in new medical technologies, has supported the wide adoption of orthopedic solutions. An aging population, coupled with high incidences of arthritis, obesity, and joint-related disorders, continues to drive high demand. The region’s preference for early diagnosis and intervention, as well as the increasing rate of sports-related trauma, has further fueled the use of orthopedic implants and devices across clinical environments.

Major industry players involved in the Global Orthopedic Devices Market include Enovis, ATEC, MicroPort Scientific, DePuy Synthes (J&J), Stryker, Waldemar, Zimmer Biomet, Arthrex, TriMed, ConforMIS, Integra, CONMED, Globus Medical, aap Implantate, B. Braun, Smith & Nephew, Medtronic, and Medacta. Leading companies in the Global Orthopedic Devices Market are focused on strengthening their presence through innovation, global expansion, and strategic acquisitions. Continuous R&D investments allow them to develop next-generation implants, robotics-assisted systems, and patient-specific devices. Expanding into emerging markets through partnerships and localized manufacturing helps meet growing demand and regulatory needs. Companies are also investing in digital technologies like AI-driven surgical planning tools and remote patient monitoring to elevate clinical outcomes.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies profiled in this Orthopedic Devices market report include:- Aap Implantate

- Arthrex

- ATEC

- B. Braun

- ConforMIS

- CONMED

- DePuy Synthes (J&J)

- Enovis

- Globus Medical

- Integra

- Medacta

- Medtronic

- MicroPort Scientific

- Smith & Nephew

- Stryker

- TriMed

- Waldemar

- Zimmer Biomet

Table Information

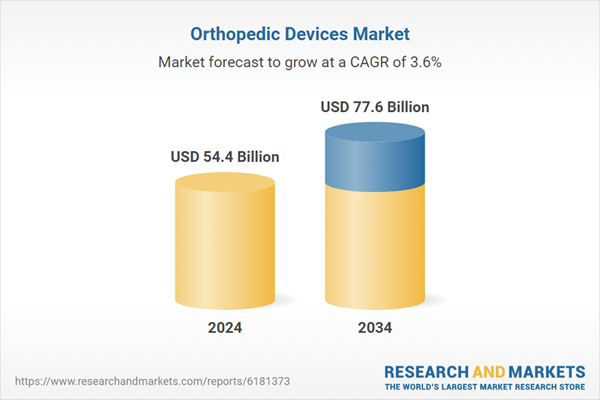

| Report Attribute | Details |

|---|---|

| No. of Pages | 160 |

| Published | October 2025 |

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 54.4 Billion |

| Forecasted Market Value ( USD | $ 77.6 Billion |

| Compound Annual Growth Rate | 3.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 19 |