The growth of the industry is primarily driven by an increase in seaborne trade, ongoing advancements in vessel technology, and improvements in fuel consumption efficiency. As shipping operations strive to become more sustainable, there is a notable shift toward cleaner fuel sources, driven by tighter environmental regulations like the FuelEU Maritime regulation. These regulations are aimed at reducing carbon emissions within the shipping industry, which is increasingly focused on environmental compliance and reducing its carbon footprint. Technological innovations, such as more aerodynamic hull designs and advanced propulsion systems, also contribute to fuel efficiency and help reduce the operational costs and environmental impact of maritime transportation. Additionally, expanding offshore and onshore hydrocarbon exploration activities continue to drive demand for bunker fuel, which is essential for powering vessels and enabling port and voyage operations. With climate policies evolving and an increased emphasis on reducing emissions, the shipping industry is steadily transitioning to cleaner fuel alternatives.

In 2024, the very low sulfur fuel oil (VLSFO) segment held a 56.8% share and is expected to grow at a CAGR of 7% through 2034. This segment's growth is driven by the transition to fuels with lower sulfur emissions that cause less environmental harm. VLSFO offers shipowners the benefit of reduced sulfur oxide (SOx) emissions, contributing to improved air quality and operational efficiency. It also ensures compatibility with existing marine engines, enabling a smoother transition without the need for significant retrofitting. Ongoing investments to improve fuel efficiency and comply with stringent emissions standards are expected to bolster the VLSFO market.

The container ships segment held a 31.9% share in 2024 and is anticipated to grow at a CAGR of 5.5% from 2025 to 2034. Container ships are some of the largest fuel consumers in the maritime industry, making the demand for high-quality bunker fuel crucial. This market dominance is largely due to the continuous expansion of global trade, which drives the need for increased maritime transportation and, consequently, greater bunker fuel consumption. Shipping companies, relying heavily on bunker fuel to power large fleets, will continue to drive demand for this essential fuel source.

U.S. Bunker Fuel Market held a share of 86.5% in 2024, generating USD 5.6 billion. The country’s robust infrastructure, coupled with an increasing volume of domestic and international trade, has significantly shaped its market dynamics. Infrastructure improvements at ports and enhanced fuel distribution systems have streamlined fuel supply operations. Furthermore, stringent regulations mandating lower sulfur content in marine fuels have played a key role in reshaping the industry's landscape.

Key players operating in the Global Bunker Fuel Market include TotalEnergies, Chevron, Shell, ExxonMobil, Bunker Holding, bp, Hindustan Petroleum Corporation Limited, Gasnor, Repsol, Stena Metall, Gasum, Minerva Bunkering, Gunvor, Eagle LNG, KOREA LNG BUNKERING, Viva Energy, Bomin Bunker, Petrobras, and Innospec. To maintain a competitive edge, companies in the bunker fuel market are focusing on enhancing their global presence by diversifying their fuel offerings, particularly with cleaner, more sustainable options. Many are investing in research and development to improve fuel efficiency and meet new environmental regulations. Some companies are also forging partnerships with shipping firms to secure long-term fuel contracts and increase market share. Others are expanding their infrastructure capabilities, such as fuel storage and distribution networks, to ensure they can meet the growing demand for bunker fuel.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies profiled in this Bunker Fuel market report include:- Bomin Bunker

- BP

- Bunker Holding

- Chevron

- Minerva Bunkering

- Eagle LNG

- EVOL LNG

- ExxonMobil

- Gasnor

- Gasum

- Gunvor

- Hindustan Petroleum Corporation Limited

- Innospec

- KOREA LNG BUNKERING

- Shell

- SHV Energy

- TotalEnergies

- Petrobras

- Repsol

- Stena Metall

- Viva Energy

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 135 |

| Published | October 2025 |

| Forecast Period | 2024 - 2034 |

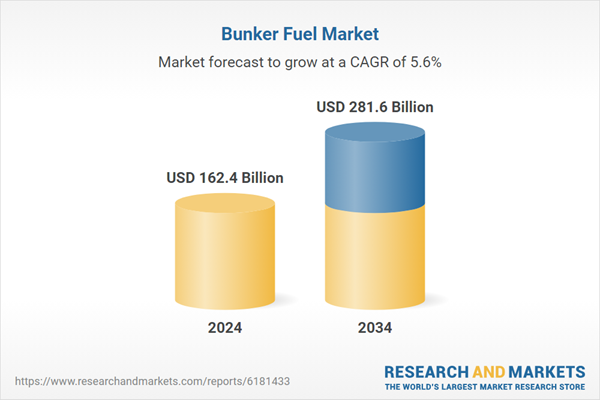

| Estimated Market Value ( USD | $ 162.4 Billion |

| Forecasted Market Value ( USD | $ 281.6 Billion |

| Compound Annual Growth Rate | 5.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 22 |