Industrial Fat Fraction Market

Industrial fat fractions are tailored lipid ingredients produced through fractionation and interesterification of vegetable and specialty fats to deliver precise melting, texture, and crystallization profiles for food and allied industries. Core end-uses include confectionery coatings and fillings (cocoa butter equivalents/improvers and lauric systems), bakery shortenings and laminating fats (β′-tending plasticity), deep-frying and snack applications (oxidative stability), dairy and dairy-alternative analogs (cheese, whipping creams, frozen desserts), non-dairy creamers, and specialty nutrition. Recent trends revolve around trans-fat elimination, clean-label replacement of partially hydrogenated oils, and “deforestation-free” supply chains with heightened traceability. Technically, the market is shifting toward dry multi-stage fractionation, enzymatic interesterification, and advanced crystallization control to hit tight solid-fat-content (SFC) curves and tempering behavior while mitigating 3-MCPD and glycidyl esters formed during refining. Demand is reinforced by growth in premium chocolate, plant-based confectionery, laminated bakery, and food-service frying, alongside rising adoption of structured lipids in dairy-alt and medical nutrition. The competitive landscape spans integrated tropical-oil majors and specialist fat houses offering application-ready blends, toll fractionation, and co-development support. Differentiation is increasingly about functionality under process stress - thermal robustness, polymorph stability (β vs β′), bloom resistance, and rapid set - backed by rheology and DSC data. Strategic sourcing of palm, palm kernel, shea, illipé, sal, and high-oleic soft oils enables tailored lauric and non-lauric systems across price tiers. Key constraints include raw-material volatility, retailer sustainability requirements, and regional regulatory nuances for contaminants and claims. Overall, industrial fat fractions function as enabling building blocks for texture, sensory quality, and shelf-life across modern food systems.Industrial Fat Fraction Market Key Insights

- From commodity splits to precision functionality. The center of gravity is moving from simple olein/stearin cuts to multi-cut, narrow-range fractions with engineered SFC curves that lock in spreadability, snap, and mouth-melt. Suppliers pair DSC/PLM analytics with pilot-scale crystallization to deliver reproducibility across seasons and origins, reducing reformulation risk for bakery and confectionery lines.

- Trans-fat exit cemented enzymatic pathways. Enzymatic interesterification provides PHO-free structuring with fewer off-flavors than chemical routes and tighter control of TAG distribution. This allows butter-like β′ textures for pastries and cream fillings without hydrogenation, improving nutrition labels while preserving lamination lift and aeration performance.

- Chocolate systems diversify beyond classic CBE. Cocoa butter equivalents and improvers now include hybrid, higher-symmetry TAG blends for faster set, improved tempering latitude, and bloom resistance in warm chains. Non-lauric systems target compatibility with cocoa butter, while lauric options serve compound coatings where quick hardening and snap under cold molds are critical.

- Bakery fats optimized for robustness and machinability. Laminating and shortening fats emphasize β′ stability, plastic range, and gas retention under variable proofing and sheeting conditions. Anti-smear behavior, reduced post-bake oiling-out, and clean flavor release are prioritized for croissants, puff pastry, biscuits, and filled cookies running at industrial speeds.

- Frying oils balance stability with sensory. High-oleic and tailored mid-oleic fractions deliver oxidative resilience, low polymer formation, and light color pickup across batch and continuous fryers. Filtration compatibility and anti-foaming characteristics extend fry-life, while low-linolenic profiles reduce off-notes in snacks and QSR applications.

- Plant-based dairy and creamers need tailored crystallization. Structured fats enable spreadable plant butters, whippable toppings, and cheese analogs with sliceability and melt-stretch targets. Emphasis is on controlled crystal network build, melt onset near body temperature, and emulsion stability through UHT, HTST, and freeze-thaw cycles.

- Refining and safety are core differentiators. Gentle deodorization, selective adsorbents, and process control mitigate 3-MCPD/GE while protecting oxidative stability. Documented allergen controls, contaminant specs, and full batch traceability are now table stakes for retailer acceptance and multinational audits.

- Sustainability and deforestation-free proof points. Buyers increasingly require geospatial traceability, NDPE compliance, smallholder inclusion, and progress on Scope 1-3 emissions. Lifecycle data and regenerative sourcing pilots inform tenders, while mono-material or recycled packaging for bulk fats supports downstream ESG goals.

- Agility through multi-origin and alternative botanicals. Exposure to palm/palm kernel price swings is hedged via high-oleic soft oils, shea and other kernel fats. Blending strategies maintain functionality when origin availability shifts, backed by spec-driven equivalency models so customers can dual-source without sensory drift.

- Service model now includes line integration. Leading suppliers co-design crystallization curves with customers’ tempering, lamination, and cooling tunnels, providing start-up SOPs, temper indices, and troubleshooting playbooks. This reduces waste during changeovers and accelerates time-to-spec for new SKUs.

Industrial Fat Fraction Market Reginal Analysis

North America

Adoption is driven by PHO-free reformulation in bakery and confectionery, with strong demand for β′-tending laminating fats, compound coating systems, and stable frying fractions for QSR/snacks. Retailers emphasize clean labels and contaminant controls. High-oleic soft-oil integration is common to hedge price volatility. Co-development and toll-fractionation capacity near major co-packers reduces lead times and logistics costs.Europe

Stringent expectations on deforestation-free sourcing, contaminant mitigation, and labeling shape specifications. Chocolate and premium pastry segments require tight tempering windows, bloom control, and consistent melt curves across seasons. Private label and branded players invest in recyclable bulk packaging and documented LCA improvements. Regional manufacturers favor enzymatic interesterified systems for trans-fat compliance and sensory finesse.Asia-Pacific

APAC concentrates upstream supply (palm/palm kernel) and fast-growing downstream demand from bakery, confectionery, and dairy-alt. Large integrated processors scale dry multi-cut fractionation, serving regional hubs in China, India, Indonesia, and Malaysia. Formulations cater to warm-chain resilience, quick set in compound coatings, and cost-effective shortenings for mass bakery while premium tiers expand in metro retail.Middle East & Africa

Hot climates and extended ambient logistics require fats with higher softening points, bloom resistance, and stable frying performance. Industrial bakeries and confectioners prioritize robust plasticity and shelf-life under variable storage. Import-reliant markets value suppliers offering turnkey technical service, including tempering guidance and QA documentation tailored to retailer audits.South & Central America

Growth centers on confectionery, biscuits, and laminated bakery, with compound coatings favored for cost and processability. Regional players balance palm-based systems with locally available soft oils. Priorities include stable supply, application support for high-humidity operations, and PHO-free credentials. Investments in regional refining and fractionation shorten lead times and support private-label expansion.Industrial Fat Fraction Market Segmentation

By Type

- Solid

- Liquid

By Application

- Ba

By Nutrition Food

- Medical Industry

- Sports Industry

- Others

Key Market players

Arla Foods Ingredients Group P/S, Corman SA, Murray Goulburn Co-operative Co. Limited, Flechard SA, Ornua Co-operative Limited, Groupe Lactalis S.A., FrieslandCampina N.V., Royal VIV Buisman B.V., Land O’Lakes Inc., Dairy Crest Group plc, Glanbia PLC, Fonterra Co-operative Group Limited, Agropur Ingredients LLC, The Tatua Co-operative Dairy Company Limited, Danone S.A.Industrial Fat Fraction Market Analytics

The report employs rigorous tools, including Porter’s Five Forces, value chain mapping, and scenario-based modelling, to assess supply-demand dynamics. Cross-sector influences from parent, derived, and substitute markets are evaluated to identify risks and opportunities. Trade and pricing analytics provide an up-to-date view of international flows, including leading exporters, importers, and regional price trends.

Macroeconomic indicators, policy frameworks such as carbon pricing and energy security strategies, and evolving consumer behaviour are considered in forecasting scenarios. Recent deal flows, partnerships, and technology innovations are incorporated to assess their impact on future market performance.Industrial Fat Fraction Market Competitive Intelligence

The competitive landscape is mapped through proprietary frameworks, profiling leading companies with details on business models, product portfolios, financial performance, and strategic initiatives. Key developments such as mergers & acquisitions, technology collaborations, investment inflows, and regional expansions are analyzed for their competitive impact. The report also identifies emerging players and innovative startups contributing to market disruption.

Regional insights highlight the most promising investment destinations, regulatory landscapes, and evolving partnerships across energy and industrial corridors.Countries Covered

- North America - Industrial Fat Fraction market data and outlook to 2034

- United States

- Canada

- Mexico

- Europe - Industrial Fat Fraction market data and outlook to 2034

- Germany

- United Kingdom

- France

- Italy

- Spain

- BeNeLux

- Russia

- Sweden

- Asia-Pacific - Industrial Fat Fraction market data and outlook to 2034

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Vietnam

- Middle East and Africa - Industrial Fat Fraction market data and outlook to 2034

- Saudi Arabia

- South Africa

- Iran

- UAE

- Egypt

- South and Central America - Industrial Fat Fraction market data and outlook to 2034

- Brazil

- Argentina

- Chile

- Peru

Research Methodology

This study combines primary inputs from industry experts across the Industrial Fat Fraction value chain with secondary data from associations, government publications, trade databases, and company disclosures. Proprietary modeling techniques, including data triangulation, statistical correlation, and scenario planning, are applied to deliver reliable market sizing and forecasting.Key Questions Addressed

- What is the current and forecast market size of the Industrial Fat Fraction industry at global, regional, and country levels?

- Which types, applications, and technologies present the highest growth potential?

- How are supply chains adapting to geopolitical and economic shocks?

- What role do policy frameworks, trade flows, and sustainability targets play in shaping demand?

- Who are the leading players, and how are their strategies evolving in the face of global uncertainty?

- Which regional “hotspots” and customer segments will outpace the market, and what go-to-market and partnership models best support entry and expansion?

- Where are the most investable opportunities - across technology roadmaps, sustainability-linked innovation, and M&A - and what is the best segment to invest over the next 3-5 years?

Your Key Takeaways from the Industrial Fat Fraction Market Report

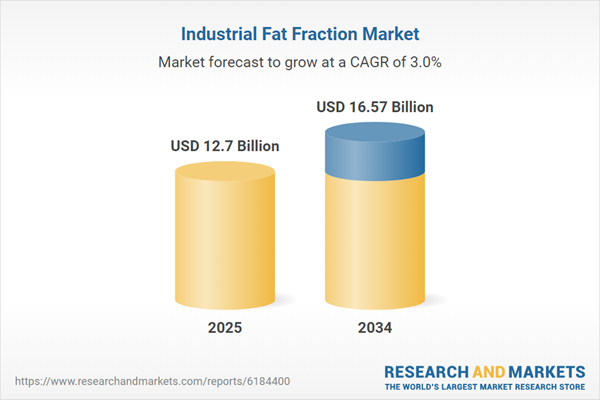

- Global Industrial Fat Fraction market size and growth projections (CAGR), 2024-2034

- Impact of Russia-Ukraine, Israel-Palestine, and Hamas conflicts on Industrial Fat Fraction trade, costs, and supply chains

- Industrial Fat Fraction market size, share, and outlook across 5 regions and 27 countries, 2023-2034

- Industrial Fat Fraction market size, CAGR, and market share of key products, applications, and end-user verticals, 2023-2034

- Short- and long-term Industrial Fat Fraction market trends, drivers, restraints, and opportunities

- Porter’s Five Forces analysis, technological developments, and Industrial Fat Fraction supply chain analysis

- Industrial Fat Fraction trade analysis, Industrial Fat Fraction market price analysis, and Industrial Fat Fraction supply/demand dynamics

- Profiles of 5 leading companies - overview, key strategies, financials, and products

- Latest Industrial Fat Fraction market news and developments

Additional Support

With the purchase of this report, you will receive:- An updated PDF report and an MS Excel data workbook containing all market tables and figures for easy analysis.

- 7-day post-sale analyst support for clarifications and in-scope supplementary data, ensuring the deliverable aligns precisely with your requirements.

- Complimentary report update to incorporate the latest available data and the impact of recent market developments.

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Arla Foods Ingredients Group P/S

- Corman SA

- Murray Goulburn Co-operative Co. Limited

- Flechard SA

- Ornua Co-operative Limited

- Groupe Lactalis S.A.

- FrieslandCampina N.V.

- Royal VIV Buisman B.V.

- Land O’Lakes Inc.

- Dairy Crest Group PLC

- Glanbia PLC

- Fonterra Co-operative Group Limited

- Agropur Ingredients LLC

- The Tatua Co-operative Dairy Company Limited

- Danone S.A.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 160 |

| Published | November 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 12.7 Billion |

| Forecasted Market Value ( USD | $ 16.57 Billion |

| Compound Annual Growth Rate | 3.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |