Baru Nuts Market

The Baru nuts market (also known as barùkas or cumbaru) centers on a nutrient-dense, wild-harvested legume seed native to Brazil’s Cerrado biome. Positioned at the crossroads of premium snacking, plant-protein, and sustainable sourcing, the category spans whole roasted nuts, flavored/snack mixes, butters/spreads, bakery and confection inclusions, and emerging alt-dairy and sports-nutrition applications. Demand is propelled by “new-to-market superfood” appeal, clean-label preferences, and biodiversity stories that resonate with wellness and eco-conscious consumers. Brand owners differentiate on roast curves and flavor development (light vs. dark roast; sweet-savory profiles), texture (crisp exterior, dense bite), allergen positioning (peanut/tree-nut alternative for some consumers - label caveats apply), and provenance claims linked to fair compensation for collector communities. Route-to-market is a blend of direct-to-consumer, natural/specialty retail, premium grocers, and chef/café collaborations, with cross-merchandising alongside nut butters, granolas, and functional snacks. Category headwinds include limited, seasonal wild supply; costs tied to hand collection and shelling; import/logistics constraints; and the need for consumer education on flavor, preparation, and origin. Strategic priorities include controlled scale-up via agroforestry and regenerative projects that protect the Cerrado, rigorous quality systems for aflatoxin and moisture control, and portfolio extensions that move beyond plain nuts to higher-margin formats (bars, spreads, RTD blends). Over the horizon, the market’s durability will hinge on credible sustainability verification, consistent sensory profiles at scale, and partnerships that stabilize supply while retaining the product’s ecological halo.Baru Nuts Market Key Insights

- Biodiversity and origin storytelling sell: Cerrado conservation, fair-trade style contracts, and community co-ops meaningfully differentiate versus commodity nuts; third-party verification and traceable batches build retailer trust.

- Roast and grind are the flavor levers: Fine control of roast profile and particle size (for butters and inclusions) determines perceived sweetness, aroma release, and spread mouthfeel - key to repeat purchase in premium sets.

- Allergen-aware positioning (with rigor): As an alternative to common nuts in some diets, brands win by clear cross-contact protocols, validated cleaning, and conservative labeling to avoid over-promising tolerance.

- Format premiumization drives margin: Chocolate-coated pieces, savory spice rubs, trail mixes, spreads, and bakery inclusions shift the category from single-ingredient snacking to versatile culinary use and giftable SKUs.

- Functional halo without hype: Naturally favorable macro and micronutrient profiles support “better-for-you” narratives; credible claims frameworks and simple front-of-pack cues outperform superfood hyperbole.

- Supply is the strategic bottleneck: Weather variability, wild-harvest constraints, and labor availability require multi-region sourcing within the Cerrado, buffer stocks, and long-term purchasing agreements.

- Quality systems protect brand equity: Moisture, shell integrity, and mycotoxin control matter; inline sorting, rapid water activity checks, and cold-chain for butters maintain freshness and flavor stability.

- Education unlocks household penetration: Usage content - recipes, pairing guides, and grind-at-home ideas - accelerates trial beyond curiosity purchases and increases basket size across breakfast and baking occasions.

- Omnichannel builds resilience: DTC storytelling plus natural/specialty retail authorizations and foodservice/CSP trials (e.g., café toppings) balance velocity and discovery; seasonal gift packs lift Q4 volumes.

- ESG as a retailer gate: Retailers increasingly require measurable impact (income for collectors, hectares protected, waste minimization); brands with audited metrics gain shelf priority and PR upside.

Baru Nuts Market Reginal Analysis

North America

Discovery-driven natural and premium grocery channels lead, with DTC education and influencer recipes driving awareness. Retailers favor clear provenance, verified sustainability, and strong sensory differentiation. Flavored snack SKUs and spreads gain traction; partnerships with cafés and boutique chocolatiers expand occasions. Distribution reliability and promotional cadence (limited editions, seasonal) are key to repeat authorizations.Europe

High scrutiny on sustainability and labeling favors brands with traceability and conservative claims. Gourmet and health-food retailers adopt early, with emphasis on culinary versatility - bakery inclusions, patisserie, and nut-butter alternatives. Clean-label, recyclable packaging, and allergen diligence are decisive. Taste profiles lean toward dark-roast, sea-salt, herb, and cocoa pairings.Asia-Pacific

Urban wellness consumers and specialty cafés drive trial; e-commerce and live-commerce formats accelerate education. Smaller pack sizes, gift boxes, and fusion flavors (sesame, yuzu, matcha, mala) localize appeal. Cost sensitivity prompts value laddering: trial sachets for discovery, premium tins for gifting. Stable supply and consistent roast are critical amid rapid trend cycles.Middle East & Africa

Premium retail and hospitality adopt baru nuts for novelty and provenance stories. Gifting formats, chocolate pairings, and date-based mixes resonate culturally. Heat-resilient packaging and oil-migration control in butters are operational priorities. Bilingual packaging and halal-compliant ingredient controls influence listings in the Gulf.South & Central America

Proximity to origin supports origin-forward branding and culinary integration. Brazil anchors supply, with domestic gourmet and tourism channels showcasing spreads, confectionery, and bakery uses. Regional export growth depends on streamlined logistics, quality control at shelling hubs, and cooperative models that stabilize collector income while scaling agroforestry plantings.Baru Nuts Market Segmentation

By Product

- Whole Baru Nuts

- Raw Baru Nuts

- Roasted Baru Nuts

- Flavored Baru Nuts

- Processed Baru Nuts

By End-User

- Food Processing

- Snacks

- Nutraceuticals

- Confectionary

- Personal Care & Cosmetics

- Otherss

Key Market players

Barùkas, Baru Baron, Baruvida, BaruNut, Terrasoul Superfoods, Sunfood Superfoods, Nuts.com, Essential Living Foods, Sprout Living, Westnut, Nutty Good, Baru Company, Fazenda Bacuri, Barùkas Brazil LTDA, AvoriaBaru Nuts Market Analytics

The report employs rigorous tools, including Porter’s Five Forces, value chain mapping, and scenario-based modelling, to assess supply-demand dynamics. Cross-sector influences from parent, derived, and substitute markets are evaluated to identify risks and opportunities. Trade and pricing analytics provide an up-to-date view of international flows, including leading exporters, importers, and regional price trends.Macroeconomic indicators, policy frameworks such as carbon pricing and energy security strategies, and evolving consumer behaviour are considered in forecasting scenarios. Recent deal flows, partnerships, and technology innovations are incorporated to assess their impact on future market performance.

Baru Nuts Market Competitive Intelligence

The competitive landscape is mapped through proprietary frameworks, profiling leading companies with details on business models, product portfolios, financial performance, and strategic initiatives. Key developments such as mergers & acquisitions, technology collaborations, investment inflows, and regional expansions are analyzed for their competitive impact. The report also identifies emerging players and innovative startups contributing to market disruption.Regional insights highlight the most promising investment destinations, regulatory landscapes, and evolving partnerships across energy and industrial corridors.

Countries Covered

- North America - Baru Nuts market data and outlook to 2034

- United States

- Canada

- Mexico

- Europe - Baru Nuts market data and outlook to 2034

- Germany

- United Kingdom

- France

- Italy

- Spain

- BeNeLux

- Russia

- Sweden

- Asia-Pacific - Baru Nuts market data and outlook to 2034

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Vietnam

- Middle East and Africa - Baru Nuts market data and outlook to 2034

- Saudi Arabia

- South Africa

- Iran

- UAE

- Egypt

- South and Central America - Baru Nuts market data and outlook to 2034

- Brazil

- Argentina

- Chile

- Peru

Research Methodology

This study combines primary inputs from industry experts across the Baru Nuts value chain with secondary data from associations, government publications, trade databases, and company disclosures. Proprietary modeling techniques, including data triangulation, statistical correlation, and scenario planning, are applied to deliver reliable market sizing and forecasting.Key Questions Addressed

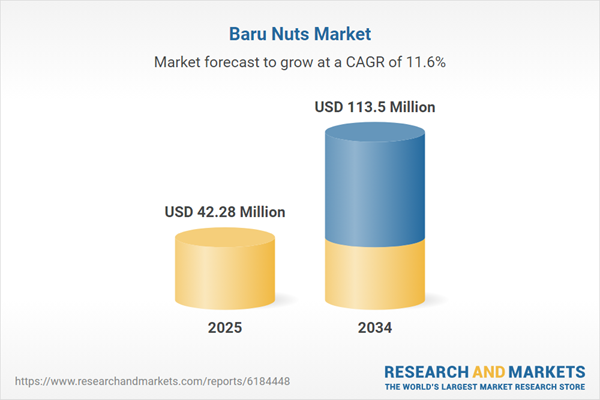

- What is the current and forecast market size of the Baru Nuts industry at global, regional, and country levels?

- Which types, applications, and technologies present the highest growth potential?

- How are supply chains adapting to geopolitical and economic shocks?

- What role do policy frameworks, trade flows, and sustainability targets play in shaping demand?

- Who are the leading players, and how are their strategies evolving in the face of global uncertainty?

- Which regional “hotspots” and customer segments will outpace the market, and what go-to-market and partnership models best support entry and expansion?

- Where are the most investable opportunities - across technology roadmaps, sustainability-linked innovation, and M&A - and what is the best segment to invest over the next 3-5 years?

Your Key Takeaways from the Baru Nuts Market Report

- Global Baru Nuts market size and growth projections (CAGR), 2024-2034

- Impact of Russia-Ukraine, Israel-Palestine, and Hamas conflicts on Baru Nuts trade, costs, and supply chains

- Baru Nuts market size, share, and outlook across 5 regions and 27 countries, 2023-2034

- Baru Nuts market size, CAGR, and market share of key products, applications, and end-user verticals, 2023-2034

- Short- and long-term Baru Nuts market trends, drivers, restraints, and opportunities

- Porter’s Five Forces analysis, technological developments, and Baru Nuts supply chain analysis

- Baru Nuts trade analysis, Baru Nuts market price analysis, and Baru Nuts supply/demand dynamics

- Profiles of 5 leading companies - overview, key strategies, financials, and products

- Latest Baru Nuts market news and developments

Additional Support

With the purchase of this report, you will receive:- An updated PDF report and an MS Excel data workbook containing all market tables and figures for easy analysis.

- 7-day post-sale analyst support for clarifications and in-scope supplementary data, ensuring the deliverable aligns precisely with your requirements.

- Complimentary report update to incorporate the latest available data and the impact of recent market developments.

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Barùkas

- Baru Baron

- Baruvida

- BaruNut

- Terrasoul Superfoods

- Sunfood Superfoods

- Nuts.com

- Essential Living Foods

- Sprout Living

- Westnut

- Nutty Good

- Baru Company

- Fazenda Bacuri

- Barùkas Brazil LTDA

- Avoria

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 160 |

| Published | November 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 42.28 Million |

| Forecasted Market Value ( USD | $ 113.5 Million |

| Compound Annual Growth Rate | 11.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |