Refined Locust Bean Gum Market

The Refined Locust Bean Gum (LBG) market centers on high-purity galactomannan extracted from carob (Ceratonia siliqua) endosperm and refined to controlled viscosity, particle size, and microbiological profiles for food, beverage, personal care, and industrial uses. Top end-uses span frozen desserts and dairy to modulate ice crystal growth and texture; cream cheese and processed cheese for body and sliceability; bakery and gluten-free systems for moisture retention; plant-based milks and spoonables for mouthfeel; sauces/dressings for shear-thinning stability; pet nutrition and select pharmaceutical/OTC syrups; and niche paper/textile and oilfield fluids. Trends emphasize label-friendly hydrocolloid systems with fewer E-numbers; synergy optimization with xanthan, carrageenan, and gellan; tighter specs for off-flavor and allergen control; and sustainability storytelling tied to Mediterranean agroforestry and smallholder supply. Demand is propelled by the rise of plant-based dairy analogues, premiumization of textures, reformulation away from modified starches, and the need for freeze/thaw and heat stability in global cold chains. The competitive landscape includes integrated seed processors and specialty hydrocolloid formulators offering bespoke blends and application labs; differentiation rests on lot-to-lot viscosity stability, low speck/low bioburden grades, rapid hydration profiles, and technical service translating bench rheology into plant performance. Supply priorities include resilient carob pod sourcing across Mediterranean and expanding plantations, decoupling kernel price spikes via contracting, and modern refining that reduces ash and improves color while preserving functional backbone. Key challenges remain around crop cyclicality, FX and logistics exposure, competition from guar/tara or starch systems on cost-in-use, and harmonizing regulatory and label language across regions and channels.Refined Locust Bean Gum Market Key Insights

- Raw-material resilience is the strategic moat. Carob harvests are biennial-leaning and climate-sensitive, so secure LBG suppliers diversify origins, contract with farmer co-ops, and invest in pod/kibble preprocessing near groves to protect seed quality. Kernel yield, germ/skin removal efficiency, and endosperm integrity drive both cost and functionality. Multi-year supply frameworks with price-index clauses stabilize availability for volume users. Inventory smoothing and forward specs reduce shock transmission to formulators during tight crops. Traceable chain-of-custody is now a gatekeeper for multinational buyers.

- Refining sophistication separates premium from commodity. Modern dehusking, splitting, and clarification steps produce low-ash, light-color, low-speck powders with predictable hydration. Tight control of granulation narrows dusting and boosts dispersibility without fish-eyes in high-solids systems. Microbiological stewardship (low plate counts, pathogen controls) widens LBG’s reach in cold-fill beverages and infant-adjacent lines. Inline viscosity monitoring and SPC limit lot drift that would otherwise force re-dosage and QC holds at customer plants.

- Texture engineering is increasingly data-driven. Application labs map LBG’s galactomannan backbone to rheology targets - yield stress, G′/G″, and shear thinning - across pH, salt, and thermal histories. Synergy with xanthan and carrageenan enables lower total gum loads while improving cling, melt control, and cuttability. In dairy analogues, LBG contributes creaminess without waxiness; in frozen desserts, it manages recrystallization through storage abuse. Translating these curves into in-plant recipes shortens scale-up and reduces scrap.

- Plant-based dairy and hybrid beverages are the growth hinge. Almond/oat/soy matrices need LBG for body, suspension, and foam control while tolerating UHT and homogenization. Pairing with gellan or MCC stabilizes proteins and insoluble fractions through distribution. Clean-label ambitions push formulators toward shorter hydrocolloid decks; LBG’s recognizable origin supports shopper acceptance. Dose-efficiency and sensory neutrality determine brand loyalty where mouthfeel is a differentiator.

- Cost-in-use competition requires portfolio agility. Guar and tara gums challenge LBG on price cycles, while modified starches offer robust supply at lower cost. Suppliers defend LBG with dose-reduction via synergy blends, faster hydration grades that cut processing time, and performance in abuse conditions (freeze/thaw, high salt). Decision tools that simulate swap scenarios help buyers quantify the trade-off between cents per kilo and consumer-perceived quality.

- Quality governance is a procurement non-negotiable. Heavy-metal, pesticide, and allergen panels, along with EC-compliant labeling and pharmacopeia references where applicable, are baseline for tenders. Low-odor and low off-note grades expand use in delicate flavor systems. UDI-like batch traceability, rapid CAPA, and change-control communication protect listings with global retailers. Documentation packs that anticipate import checks speed customs clearance and reduce demurrage risk.

- Processing robustness wins on factory floors. Rapid, lump-free hydration in cold water, and stability under hot-fill/UHT, reduce rework. Fine-tuned particle sizes fit dust-controlled handling, while agglomerated/instantized variants improve dispersion in beverage powders. Training operators on pre-blend order and shear profiles prevents over-shearing and loss of viscosity. Suppliers who provide on-site commissioning support and SOPs raise first-time-right rates.

- Sustainability narratives influence buyer scorecards. Carob’s drought tolerance and role in Mediterranean agroforestry support credible ESG stories. Programs for smallholder inclusion, biodiversity, and regenerative practices resonate with premium brands. Energy-efficient milling/drying and recyclable sacks lower scope 1/2/3 claims. Auditable metrics - not aspirational slogans - are increasingly tied to shelf approvals and long-term contracts.

- Innovation whitespace is shifting to multifunctional systems. Co-processed LBG with starches or fibers can deliver heat-stable body at lower gum loads. In cheese and cream analogues, tailored LBG-carrageenan ratios deliver firmness without gelation. Powder beverage sticks and high-protein drinks test fast-wetting LBG grades for smooth mouthfeel. Personal-care emulsions adopt LBG for cushion in silicone-reduced systems, supporting natural-positioned claims.

- Route-to-market execution compounds advantage. Global distributors with refrigerated/ambient hubs, blended-gum capabilities, and VMI keep customers supplied during peaks. Digital portals with rheology databases, dosage calculators, and COAs reduce friction for R&D and QA teams. Private-label blends deepen customer lock-in while protecting IP. Multi-plant supply and dual-qualification lower business continuity risk for critical SKUs.

Refined Locust Bean Gum Market Reginal Analysis

North America

Demand concentrates in frozen desserts, cream cheeses, plant-based milks, spoonables, and clean-label sauces. Buyers require low-speck, low-odor grades with tight microbiological specs for cold-fill and UHT lines. Formulators favor LBG/xanthan blends for freeze/thaw resilience in national cold chains. Distributors with VMI, rapid COA access, and technical bake/freeze labs gain share. Sustainability and smallholder sourcing narratives enhance acceptance with premium retailers.Europe

A mature hydrocolloid user base with rigorous additive governance and strong Mediterranean supply linkages. Dairy and processed cheese remain core, with plant-based alternatives accelerating. Tender success hinges on RS/traceability, light color, and batch-to-batch viscosity control. Co-processed systems targeting low-E-number labels are in favor. Regional blending hubs and multilingual technical dossiers speed multi-country rollouts and retailer audits.Asia-Pacific

Growth is driven by spoonable yogurts, beverages, bakery fillings, and expanding plant-based portfolios. Humidity-resilient packaging and instantized LBG grades support powders and RTD factories. Price-sensitive users evaluate LBG against guar/tara; dose-efficient synergy blends maintain LBG relevance. Regional application centers provide pilot runs and scale-up support for UHT lines. Cold-chain expansion in emerging markets boosts demand for freeze-stable texture systems.Middle East & Africa

Adoption clusters in dairy desserts, processed cheese, and premium sauces, with growing interest from plant-based brands in urban centers. Supply reliability, halal-aligned documentation, and heat-stable performance under hot-fill conditions are critical. Distributors who provide hands-on formulation support and manage temperature/humidity in storage are preferred. ESG stories around drought-tolerant carob and smallholder programs resonate with premium retailers and foodservice.South & Central America

Use is anchored in dairy desserts, spreads, and bakery fillings, with plant-based milks and RTD smoothies gaining shelf space in metropolitan markets. Buyers prioritize consistent viscosity, clean flavor, and competitive cost-in-use versus starch/guar. Bilingual service teams, local stock positions, and co-processed blends tailored to regional recipes improve conversion. Training on hydration order and shear control reduces rework in high-throughput plants.Refined Locust Bean Gum Market Segmentation

By Type

- Food Grade

- Petfood Grade

By Application

- Bakery

- Meat

- Poultry & Seafood

- Sauces & Dressings

- Dairy & Frozen Desserts

- Petfood

- Others

Key Market players

DuPont, LBG Sicilia Ingredients, Carob S.A., INCOM A.Ş., Cargill, CP Kelco, GA Torres, Polygal AG, Industrial Farense, TIC Gums, AEP Colloids, Gumix International, GKM Co., Altrafine Gums, Ingredients Solutions, Inc.Refined Locust Bean Gum Market Analytics

The report employs rigorous tools, including Porter’s Five Forces, value chain mapping, and scenario-based modelling, to assess supply-demand dynamics. Cross-sector influences from parent, derived, and substitute markets are evaluated to identify risks and opportunities. Trade and pricing analytics provide an up-to-date view of international flows, including leading exporters, importers, and regional price trends.Macroeconomic indicators, policy frameworks such as carbon pricing and energy security strategies, and evolving consumer behaviour are considered in forecasting scenarios. Recent deal flows, partnerships, and technology innovations are incorporated to assess their impact on future market performance.

Refined Locust Bean Gum Market Competitive Intelligence

The competitive landscape is mapped through proprietary frameworks, profiling leading companies with details on business models, product portfolios, financial performance, and strategic initiatives. Key developments such as mergers & acquisitions, technology collaborations, investment inflows, and regional expansions are analyzed for their competitive impact. The report also identifies emerging players and innovative startups contributing to market disruption.Regional insights highlight the most promising investment destinations, regulatory landscapes, and evolving partnerships across energy and industrial corridors.

Countries Covered

- North America - Refined Locust Bean Gum market data and outlook to 2034

- United States

- Canada

- Mexico

- Europe - Refined Locust Bean Gum market data and outlook to 2034

- Germany

- United Kingdom

- France

- Italy

- Spain

- BeNeLux

- Russia

- Sweden

- Asia-Pacific - Refined Locust Bean Gum market data and outlook to 2034

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Vietnam

- Middle East and Africa - Refined Locust Bean Gum market data and outlook to 2034

- Saudi Arabia

- South Africa

- Iran

- UAE

- Egypt

- South and Central America - Refined Locust Bean Gum market data and outlook to 2034

- Brazil

- Argentina

- Chile

- Peru

Research Methodology

This study combines primary inputs from industry experts across the Refined Locust Bean Gum value chain with secondary data from associations, government publications, trade databases, and company disclosures. Proprietary modeling techniques, including data triangulation, statistical correlation, and scenario planning, are applied to deliver reliable market sizing and forecasting.Key Questions Addressed

- What is the current and forecast market size of the Refined Locust Bean Gum industry at global, regional, and country levels?

- Which types, applications, and technologies present the highest growth potential?

- How are supply chains adapting to geopolitical and economic shocks?

- What role do policy frameworks, trade flows, and sustainability targets play in shaping demand?

- Who are the leading players, and how are their strategies evolving in the face of global uncertainty?

- Which regional “hotspots” and customer segments will outpace the market, and what go-to-market and partnership models best support entry and expansion?

- Where are the most investable opportunities - across technology roadmaps, sustainability-linked innovation, and M&A - and what is the best segment to invest over the next 3-5 years?

Your Key Takeaways from the Refined Locust Bean Gum Market Report

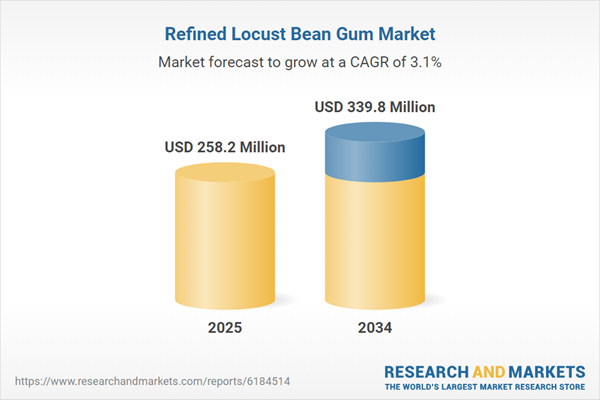

- Global Refined Locust Bean Gum market size and growth projections (CAGR), 2024-2034

- Impact of Russia-Ukraine, Israel-Palestine, and Hamas conflicts on Refined Locust Bean Gum trade, costs, and supply chains

- Refined Locust Bean Gum market size, share, and outlook across 5 regions and 27 countries, 2023-2034

- Refined Locust Bean Gum market size, CAGR, and market share of key products, applications, and end-user verticals, 2023-2034

- Short- and long-term Refined Locust Bean Gum market trends, drivers, restraints, and opportunities

- Porter’s Five Forces analysis, technological developments, and Refined Locust Bean Gum supply chain analysis

- Refined Locust Bean Gum trade analysis, Refined Locust Bean Gum market price analysis, and Refined Locust Bean Gum supply/demand dynamics

- Profiles of 5 leading companies - overview, key strategies, financials, and products

- Latest Refined Locust Bean Gum market news and developments

Additional Support

With the purchase of this report, you will receive:- An updated PDF report and an MS Excel data workbook containing all market tables and figures for easy analysis.

- 7-day post-sale analyst support for clarifications and in-scope supplementary data, ensuring the deliverable aligns precisely with your requirements.

- Complimentary report update to incorporate the latest available data and the impact of recent market developments.

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- DuPont

- LBG Sicilia Ingredients

- Carob S.A.

- INCOM A.Ş.

- Cargill

- CP Kelco

- GA Torres

- Polygal AG

- Industrial Farense

- TIC Gums

- AEP Colloids

- Gumix International

- GKM Co.

- Altrafine Gums

- Ingredients Solutions Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 160 |

| Published | November 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 258.2 Million |

| Forecasted Market Value ( USD | $ 339.8 Million |

| Compound Annual Growth Rate | 3.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |