Healthcare IT Solutions Market

The Healthcare IT Solutions market spans clinical, operational, and financial systems that digitize care delivery and administration across hospitals, ambulatory networks, diagnostic centers, payers, life sciences, and public-health agencies. Core applications include electronic health records (EHR/EMR), interoperability and health information exchange, imaging IT (PACS/VNA), telehealth and virtual care, remote patient monitoring (RPM), care coordination and population health, AI-assisted clinical decision support, revenue cycle management (RCM), patient access and engagement, supply chain, cybersecurity, and cloud infrastructure/DevOps. Latest trends center on cloud-first modernization and API-first architectures, real-time interoperability (FHIR, event streaming), ambient and generative AI for documentation and triage, analytics for value-based care, enterprise imaging unification, and elevated zero-trust cybersecurity. Growth drivers include clinician productivity pressure, persistent staffing gaps, reimbursement and regulatory incentives for digital quality reporting, consumer expectations for convenient access, the shift to risk-bearing/value-based models, and the need for resilient, scalable infrastructure. The competitive landscape blends EHR platform leaders, best-of-breed point solutions, payer tech and analytics firms, cloud providers, cybersecurity specialists, and device/RPM vendors. Differentiation hinges on clinical workflow fit, measurable outcomes (throughput, denial reduction, length of stay, readmission avoidance), interoperability at scale, implementation speed, and total cost of ownership. As systems move from project-based digitization to operating-model transformation, winners pair healthcare-grade reliability with agile release cycles, integrated data platforms, embedded security, and services that accelerate adoption - linking digital initiatives directly to clinician experience, patient satisfaction, and financial sustainability.Healthcare IT Solutions Market Key Insights

- Cloud and API-first replatforming. Health systems rationalize legacy stacks onto hybrid cloud with containerized services; FHIR-based APIs and event streams unlock partner ecosystems and faster integrations across EHR, RCM, and imaging.

- Ambient & generative AI move from pilots to guardrailed scale. Documentation, coding, and patient messaging automations reduce burnout and cycle times; model governance, PHI controls, and auditability decide procurement.

- Interoperability becomes operational, not aspirational. FHIR, TEFCA/HIE participation, and longitudinal patient indices support cross-venue care, prior auth, and payer-provider collaboration - reducing duplicative tests and denials.

- Virtual and hybrid care normalize. Telehealth, hospital-at-home, and RPM integrate with scheduling, triage, and care pathways; device-agnostic platforms and reimbursement alignment sustain adoption beyond spikes.

- RCM modernization targets cash and leakage. AI-driven eligibility, prior auth, clinical documentation integrity, and denials analytics compress DNFB, improve yield, and stabilize margins amid payer policy shifts.

- Enterprise imaging consolidates. VNA/cloud archives and diagnostic viewers span radiology, cardiology, and “ology” lines; AI triage and workflow orchestration improve turnaround and throughput.

- Cybersecurity is board-level. Zero-trust, identity and access management, microsegmentation, medical device security, and immutable backups counter escalating ransomware and third-party risks.

- Population health & value-based analytics mature. Risk stratification, care gap closure, SDOH data, and contract performance dashboards align incentives across CINs/ACOs and payer partnerships.

- Patient access and experience as growth engine. Self-service scheduling, price transparency, digital intake, and omni-channel communications improve conversion and reduce no-shows; CRM/marketing automation ties to service-line growth.

- Services and change management are decisive. Clinical adoption, governance, and workflow redesign often drive more ROI than software features; outcomes-based service models gain favor.

Healthcare IT Solutions Market Reginal Analysis

North America

Focus on EHR optimization, cloud migration, and measurable ROI in RCM, staffing efficiency, and throughput. Interoperability initiatives and payer-provider data exchange accelerate prior auth and risk adjustment. Cybersecurity investments intensify. Virtual care, hospital-at-home, and RPM embed into chronic care models. Health systems favor platforms with proven integrations, analytics, and rapid implementation playbooks.Europe

National digitization programs and procurement frameworks emphasize interoperability, data protection, and vendor neutrality. Cross-border data exchange, e-prescribing, and eID support mobility of care. Cloud adoption advances with strict privacy and residency controls. Enterprise imaging and telehealth expand in regional networks; workforce shortages elevate automation, decision support, and flexible staffing tools.Asia-Pacific

Highly heterogeneous markets: mature hubs scale cloud EHR, AI imaging, and smart hospitals, while emerging systems prioritize foundational HIS/EMR and telehealth for access. Super-app ecosystems and e-pharmacy integrations grow rapidly. Government-backed health IDs and insurance digitization enable claims automation. Localization, price sensitivity, and strong channel partners shape vendor success.Middle East & Africa

Greenfield hospitals and smart-city health clusters adopt cloud-native, integrated platforms with strong cybersecurity. National health information exchanges and e-claims rails gain momentum. Telehealth addresses geographic gaps; RPM supports chronic disease programs. Procurement values rapid deployment, training, and multilingual support; data residency and sovereign cloud considerations influence architecture.South & Central America

Public/private mix drives demand for cost-effective HIS/EMR, RCM, and telehealth to expand access and manage budgets. Regulatory digitization (e-invoicing, e-prescribing) catalyzes adoption. Vendors with Spanish/Portuguese UX, local hosting options, and managed services win. Analytics for population health and fraud/waste/abuse detection rise with payer market maturation.Healthcare IT Solutions Market Segmentation

By Solution

- Interface/Integration Engines

- Medical Device Integration Software

- Media Integration Solutions

- Implementation Services

- Support and Maintenance Services

- Training Services Systems

By Application

- Hospital Integration

- Lab Integration

- Medical Device Integration

- Clinic Integration

- Radiology Integration

- Others

Key Market players

Epic Systems, Oracle Health (Cerner), MEDITECH, athenahealth, InterSystems, Dedalus Group, Altera Digital Health (Allscripts), NextGen Healthcare, eClinicalWorks, GE HealthCare, Philips Healthcare, Siemens Healthineers, Optum (Change Healthcare), Nuance (Microsoft), SAPHealthcare IT Solutions Market Analytics

The report employs rigorous tools, including Porter’s Five Forces, value chain mapping, and scenario-based modelling, to assess supply-demand dynamics. Cross-sector influences from parent, derived, and substitute markets are evaluated to identify risks and opportunities. Trade and pricing analytics provide an up-to-date view of international flows, including leading exporters, importers, and regional price trends.Macroeconomic indicators, policy frameworks such as carbon pricing and energy security strategies, and evolving consumer behaviour are considered in forecasting scenarios. Recent deal flows, partnerships, and technology innovations are incorporated to assess their impact on future market performance.

Healthcare IT Solutions Market Competitive Intelligence

The competitive landscape is mapped through proprietary frameworks, profiling leading companies with details on business models, product portfolios, financial performance, and strategic initiatives. Key developments such as mergers & acquisitions, technology collaborations, investment inflows, and regional expansions are analyzed for their competitive impact. The report also identifies emerging players and innovative startups contributing to market disruption.Regional insights highlight the most promising investment destinations, regulatory landscapes, and evolving partnerships across energy and industrial corridors.

Countries Covered

- North America - Healthcare IT Solutions market data and outlook to 2034

- United States

- Canada

- Mexico

- Europe - Healthcare IT Solutions market data and outlook to 2034

- Germany

- United Kingdom

- France

- Italy

- Spain

- BeNeLux

- Russia

- Sweden

- Asia-Pacific - Healthcare IT Solutions market data and outlook to 2034

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Vietnam

- Middle East and Africa - Healthcare IT Solutions market data and outlook to 2034

- Saudi Arabia

- South Africa

- Iran

- UAE

- Egypt

- South and Central America - Healthcare IT Solutions market data and outlook to 2034

- Brazil

- Argentina

- Chile

- Peru

Research Methodology

This study combines primary inputs from industry experts across the Healthcare IT Solutions value chain with secondary data from associations, government publications, trade databases, and company disclosures. Proprietary modeling techniques, including data triangulation, statistical correlation, and scenario planning, are applied to deliver reliable market sizing and forecasting.Key Questions Addressed

- What is the current and forecast market size of the Healthcare IT Solutions industry at global, regional, and country levels?

- Which types, applications, and technologies present the highest growth potential?

- How are supply chains adapting to geopolitical and economic shocks?

- What role do policy frameworks, trade flows, and sustainability targets play in shaping demand?

- Who are the leading players, and how are their strategies evolving in the face of global uncertainty?

- Which regional “hotspots” and customer segments will outpace the market, and what go-to-market and partnership models best support entry and expansion?

- Where are the most investable opportunities - across technology roadmaps, sustainability-linked innovation, and M&A - and what is the best segment to invest over the next 3-5 years?

Your Key Takeaways from the Healthcare IT Solutions Market Report

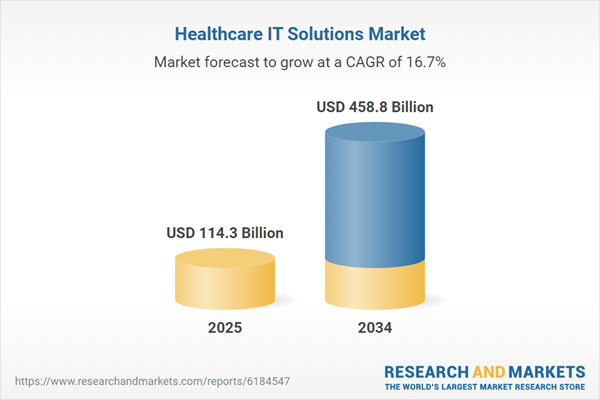

- Global Healthcare IT Solutions market size and growth projections (CAGR), 2024-2034

- Impact of Russia-Ukraine, Israel-Palestine, and Hamas conflicts on Healthcare IT Solutions trade, costs, and supply chains

- Healthcare IT Solutions market size, share, and outlook across 5 regions and 27 countries, 2023-2034

- Healthcare IT Solutions market size, CAGR, and market share of key products, applications, and end-user verticals, 2023-2034

- Short- and long-term Healthcare IT Solutions market trends, drivers, restraints, and opportunities

- Porter’s Five Forces analysis, technological developments, and Healthcare IT Solutions supply chain analysis

- Healthcare IT Solutions trade analysis, Healthcare IT Solutions market price analysis, and Healthcare IT Solutions supply/demand dynamics

- Profiles of 5 leading companies - overview, key strategies, financials, and products

- Latest Healthcare IT Solutions market news and developments

Additional Support

With the purchase of this report, you will receive:- An updated PDF report and an MS Excel data workbook containing all market tables and figures for easy analysis.

- 7-day post-sale analyst support for clarifications and in-scope supplementary data, ensuring the deliverable aligns precisely with your requirements.

- Complimentary report update to incorporate the latest available data and the impact of recent market developments.

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Epic Systems

- Oracle Health (Cerner)

- MEDITECH

- athenahealth

- InterSystems

- Dedalus Group

- Altera Digital Health (Allscripts)

- NextGen Healthcare

- eClinicalWorks

- GE HealthCare

- Philips Healthcare

- Siemens Healthineers

- Optum (Change Healthcare)

- Nuance (Microsoft)

- SAP

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 160 |

| Published | November 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 114.3 Billion |

| Forecasted Market Value ( USD | $ 458.8 Billion |

| Compound Annual Growth Rate | 16.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |