CV Depot Charging Market

The commercial vehicle (CV) depot charging market is scaling from pilots to multi-megawatt, multi-route operations as fleets electrify buses, medium-duty delivery vans, and heavy-duty tractors. Primary end-uses include overnight bus depots, last-mile and middle-mile distribution centers, municipal service yards, port and warehouse hubs, and rental/leasing fleets that turn vehicles quickly. Recent trends center on dedicated high-power DC architectures, liquid-cooled dispensers, smart load management across dozens to hundreds of stalls, and software-defined energy orchestration that aligns charging with duty cycles, tariffs, and grid constraints. Drivers include zero-emission mandates, fuel and maintenance savings, corporate decarbonization targets, and improved driver experience. Competitive dynamics span turnkey EPC integrators, charger OEMs, energy-as-a-service providers, CPOs, and utilities offering make-ready infrastructure; differentiation is moving toward reliability, uptime SLAs, open protocols, predictive service, and financing creativity. Technology roadmaps emphasize ISO 15118 Plug&Charge, OCPP 2.0.1, depot-scale EMS, OCPI for roaming where public access is blended, and staged readiness for pantograph and Megawatt Charging System (MCS) as heavy-duty volumes rise. Site design focuses on transformer sizing, switchgear, cable management, fire safety, and yard flow, with stationary storage for peak shaving and resilience and rooftop/ground-mount solar improving lifetime economics. As deployments expand, leaders standardize data models, automate charge scheduling from telematics and TMS inputs, and plan for mixed fleets and phased power upgrades. The medium-term playbook: start with right-sized AC/DC islands, prove uptime and TCO, and scale to campus-level microgrids with bidirectional and ancillary-service capabilities where policy and operations allow.CV Depot Charging Market Key Insights

- From pilots to platforms. Early single-route projects are giving way to standardized, repeatable depot blueprints that scale across a fleet’s network. Operators codify civil works, interconnection packages, and software stacks, shrinking time from design to commissioning. Playbooks now include contingency bays, phased conduit, and N+1 redundancy so expansion and maintenance don’t disrupt service. Success correlates with cross-functional governance spanning fleet, facilities, finance, and IT.

- Power architecture choices define lifetime cost. Centralized DC power with distributed dispensers simplifies maintenance and enables flexible stall power sharing, while fully distributed chargers can reduce single-point failures. Liquid-cooled cables and high-current connectors future-proof heavy-duty needs; AC remains viable for light/medium-duty with long dwell. Pantographs fit bus depots with tight dwell windows; MCS is planned for tractor fast-turns and opportunity charging.

- Interconnection and tariff strategy are make-or-break. Lead times for transformers and utility upgrades drive project critical paths. Early load letters, diversified feeders, and staged energization mitigate schedule risk. Tariff optimization - time-of-use alignment, demand charge mitigation, and power factor correction - pairs with EMS to clip peaks. Storage, soft limits, and staggered charging windows keep monthly bills predictable without compromising route readiness.

- Software interoperability reduces vendor lock-in. OCPP 2.0.1 and ISO 15118 enable richer diagnostics, smart charging, and Plug&Charge security. Open APIs connect chargers, EMS, telematics, and dispatch systems so charge plans reflect real-world SOC, weather, and traffic. OCPI supports semi-public access where depots monetize excess capacity. Vendors win by proving multi-brand charger control, high API uptime, and cyber-hardening aligned to enterprise standards.

- Uptime is the core KPI. Fleet commitments require charger availability, first-time plug-in success, and predictable session completion. Remote monitoring, parts kitting, and field service SLAs - with clear MTTR targets - separate leaders from laggards. Design for serviceability (modular power stages, hot-swap components, accessible filters) matters as much as nameplate power. Incident analytics feed continuous improvement across hardware, firmware, and site layout.

- Energy storage and microgrids unlock operational flexibility. BESS smooths peaks, arbitrages tariffs, and provides ride-through during grid disturbances; solar reduces daytime net load for mixed shifts. In some depots, controller orchestration prioritizes critical routes during outages and defers non-essential charging. Where rules permit, fleets test bidirectional export, backup to buildings, and participation in demand response and ancillary markets.

- Fleet integration is where value is realized. Charge scheduling now ingests route blocks, driver shifts, and yard moves to guarantee “ready-by” times. Mixed fleets (vans, rigids, tractors, buses) require charger grouping, connector diversity, and dynamic power limits tuned by SOC, battery temperature, and departure priority. Seasonal penalties are mitigated via preconditioning, heat-pump logic, and spare capacity buffers.

- Financing models accelerate adoption. Charging-as-a-service and energy-as-a-service shift capex to opex with performance guarantees. Utilities may own make-ready assets while fleets or CPOs own chargers; in some markets, full utility ownership of line-side gear de-risks early projects. Multi-year service bundles covering hardware refresh, warranties, and cyber updates stabilize lifecycle cost and ease board approvals.

- Safety, compliance, and training underpin scale. Designs follow electrical and fire codes, clear egress, bollards, and emergency stop plans. Thermal derating and enclosure IP ratings address dust, salt, and heat. Cybersecurity baselines include secure boot, certificate management, role-based access, and SIEM integration. Frontline training - cable handling, lockout/tagout, and incident reporting - reduces downtime and claim exposure.

- Future-proofing for autonomy and yard automation. Robotic connectors, automated cable reels, and standardized stall geometry anticipate autonomous yard tractors and bus movements. Consistent wayfinding, overhead charging options, and tele-ops integration reduce manual dwell time. Data retention policies and high-fidelity logs enable machine-learning improvements and support incident reconstruction as operations become more automated.

CV Depot Charging Market Reginal Analysis

North America

Scaling is propelled by zero-emission fleet rules, corridor initiatives for heavy-duty, and utility programs that offset make-ready costs. Depot designs emphasize high-power DC for tractors and mixed AC/DC islands for vans, with BESS to tame demand charges. Reliability in winter climates drives enclosure, cable, and thermal specifications. Financing leans on as-a-service models and leasebacks; data-sharing with utilities improves hosting capacity forecasts. Early MCS pilots align with port drayage, distribution hubs, and return-to-base carriers.Europe

City bus electrification experience translates into sophisticated depot layouts, pantograph readiness, and interoperable software stacks. Tight urban footprints push compact power centers, canopy-mounted dispensers, and shared depots serving multiple operators. Tariff volatility increases the value of EMS and storage, while grid operators promote flexibility markets that reward controllable loads. Cross-border standards adoption simplifies multi-country fleets. Sustainability procurement demands audited lifecycle practices and repairable hardware.Asia-Pacific

Rapid e-bus and logistics electrification, strong domestic supply chains, and frequent product refresh cycles compress costs and timelines. Industrial parks and logistics zones integrate charging with on-site solar and storage, while ports deploy high-power DC for drayage. Japan and Korea emphasize quality, cyber-hardening, and grid coordination; Australia addresses long feeder distances and substation constraints. India’s tender-driven transit programs favor standardized depot kits, shared service models, and phased power builds.Middle East & Africa

Greenfield logistics cities and smart-city districts enable purpose-built depots with abundant land and integrated microgrids. Designs prioritize extreme-heat resilience, shading, and robust cooling for chargers and batteries. Public-private partnerships anchor showcase fleets in hospitality, airports, and municipal services. In Sub-Saharan markets, reliability and power quality shape choices; hybrid solutions with solar, storage, and limited diesel backup ensure route dispatch in unstable grids.South & Central America

Bus rapid transit concessions catalyze depot electrification, often with long-term operating contracts that bundle vehicles, charging, and maintenance. Currency volatility elevates the appeal of opex-based agreements and vendor performance guarantees. Import duties and local-content rules steer assembly and component sourcing decisions. Operators blend depot charging with strategic on-route top-ups to reduce pack sizes and capex, while EMS manages tariffs and demand peaks to protect cash flow.CV Depot Charging Market Segmentation

By Vehicle

- eLCV

- eMCV

- eHCV

- eBusus

By Charger

- AC Chargers

- DC Chargers

Key Market players

ABB E-mobility, Siemens eMobility, Schneider Electric, Eaton, Delta Electronics, ChargePoint, bp pulse (AMPLY Power), Shell Recharge Solutions, Enel X Way, Kempower, Tritium, EVBox, InCharge Energy, Alfen, BTCPower, Blink Charging, EVgo, Electrify Commercial (Electrify America), TeraWatt Infrastructure, Zeem SolutionsCV Depot Charging Market Analytics

The report employs rigorous tools, including Porter’s Five Forces, value chain mapping, and scenario-based modelling, to assess supply-demand dynamics. Cross-sector influences from parent, derived, and substitute markets are evaluated to identify risks and opportunities. Trade and pricing analytics provide an up-to-date view of international flows, including leading exporters, importers, and regional price trends.Macroeconomic indicators, policy frameworks such as carbon pricing and energy security strategies, and evolving consumer behaviour are considered in forecasting scenarios. Recent deal flows, partnerships, and technology innovations are incorporated to assess their impact on future market performance.

CV Depot Charging Market Competitive Intelligence

The competitive landscape is mapped through proprietary frameworks, profiling leading companies with details on business models, product portfolios, financial performance, and strategic initiatives. Key developments such as mergers & acquisitions, technology collaborations, investment inflows, and regional expansions are analyzed for their competitive impact. The report also identifies emerging players and innovative startups contributing to market disruption.Regional insights highlight the most promising investment destinations, regulatory landscapes, and evolving partnerships across energy and industrial corridors.

Countries Covered

- North America - CV Depot Charging market data and outlook to 2034

- United States

- Canada

- Mexico

- Europe - CV Depot Charging market data and outlook to 2034

- Germany

- United Kingdom

- France

- Italy

- Spain

- BeNeLux

- Russia

- Sweden

- Asia-Pacific - CV Depot Charging market data and outlook to 2034

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Vietnam

- Middle East and Africa - CV Depot Charging market data and outlook to 2034

- Saudi Arabia

- South Africa

- Iran

- UAE

- Egypt

- South and Central America - CV Depot Charging market data and outlook to 2034

- Brazil

- Argentina

- Chile

- Peru

Research Methodology

This study combines primary inputs from industry experts across the CV Depot Charging value chain with secondary data from associations, government publications, trade databases, and company disclosures. Proprietary modeling techniques, including data triangulation, statistical correlation, and scenario planning, are applied to deliver reliable market sizing and forecasting.Key Questions Addressed

- What is the current and forecast market size of the CV Depot Charging industry at global, regional, and country levels?

- Which types, applications, and technologies present the highest growth potential?

- How are supply chains adapting to geopolitical and economic shocks?

- What role do policy frameworks, trade flows, and sustainability targets play in shaping demand?

- Who are the leading players, and how are their strategies evolving in the face of global uncertainty?

- Which regional “hotspots” and customer segments will outpace the market, and what go-to-market and partnership models best support entry and expansion?

- Where are the most investable opportunities - across technology roadmaps, sustainability-linked innovation, and M&A - and what is the best segment to invest over the next 3-5 years?

Your Key Takeaways from the CV Depot Charging Market Report

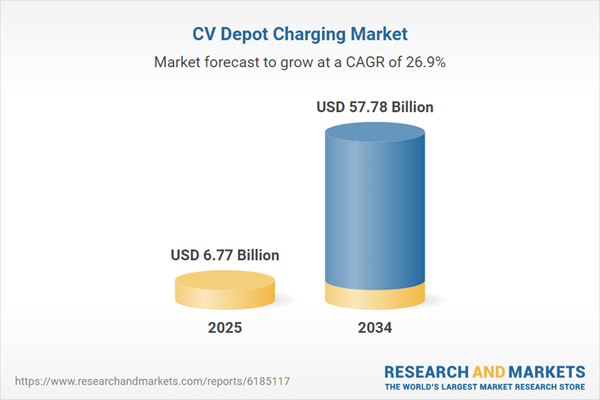

- Global CV Depot Charging market size and growth projections (CAGR), 2024-2034

- Impact of Russia-Ukraine, Israel-Palestine, and Hamas conflicts on CV Depot Charging trade, costs, and supply chains

- CV Depot Charging market size, share, and outlook across 5 regions and 27 countries, 2023-2034

- CV Depot Charging market size, CAGR, and market share of key products, applications, and end-user verticals, 2023-2034

- Short- and long-term CV Depot Charging market trends, drivers, restraints, and opportunities

- Porter’s Five Forces analysis, technological developments, and CV Depot Charging supply chain analysis

- CV Depot Charging trade analysis, CV Depot Charging market price analysis, and CV Depot Charging supply/demand dynamics

- Profiles of 5 leading companies - overview, key strategies, financials, and products

- Latest CV Depot Charging market news and developments

Additional Support

With the purchase of this report, you will receive:- An updated PDF report and an MS Excel data workbook containing all market tables and figures for easy analysis.

- 7-day post-sale analyst support for clarifications and in-scope supplementary data, ensuring the deliverable aligns precisely with your requirements.

- Complimentary report update to incorporate the latest available data and the impact of recent market developments.

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- ABB E-mobility

- Siemens eMobility

- Schneider Electric

- Eaton

- Delta Electronics

- ChargePoint

- bp pulse (AMPLY Power)

- Shell Recharge Solutions

- Enel X Way

- Kempower

- Tritium

- EVBox

- InCharge Energy

- Alfen

- BTCPower

- Blink Charging

- EVgo

- Electrify Commercial (Electrify America)

- TeraWatt Infrastructure

- Zeem Solutions

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 160 |

| Published | November 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 6.77 Billion |

| Forecasted Market Value ( USD | $ 57.78 Billion |

| Compound Annual Growth Rate | 26.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 20 |