The market is experiencing rapid expansion due to the growing global demand for sustainable and ethical coffee alternatives. Consumers are becoming increasingly aware of the environmental and social impacts linked with traditional coffee farming, including deforestation, excessive water usage, and labor exploitation in developing nations. As awareness grows, the transition toward lab-grown coffee is gaining traction, offering a lower carbon footprint and a more transparent, ethical supply chain that aligns closely with global sustainability and ESG objectives. Additionally, diminishing arable land and climate-related challenges such as soil degradation, erratic weather patterns, and declining crop yields in leading coffee-producing countries have further accelerated the shift toward controlled-environment coffee production. Lab-based systems enable consistent, year-round production with reliable quality and stable output, independent of geographical and climatic limitations, making them an increasingly attractive solution for sustainable coffee production.

The cellular agriculture segment was valued at USD 3.7 million in 2024 and is estimated to grow at a CAGR of 27.9% from 2025 to 2034. This approach enables coffee cells to be cultivated in optimized laboratory environments that reproduce the authentic flavors and aroma of conventionally grown coffee. The method ensures stable production, consistency across batches, and reduced dependency on agricultural variables. Microbial biosynthesis, particularly through precision fermentation, is also gaining attention due to its ability to synthesize coffee flavor molecules and caffeine efficiently with fewer natural resources and faster turnaround times compared to traditional farming.

The ground lab-grown coffee segment reached USD 3.2 million in 2024 and is estimated to grow at a CAGR of 28.6% through 2034. The growing popularity of sustainable and convenient coffee products is driving demand for this format. Environmentally conscious consumers are increasingly adopting whole-bean and ground lab-grown coffee products, as they provide a familiar brewing experience while aligning with eco-friendly values. The availability of these products in online and specialty retail channels is contributing to their steady rise in popularity among consumers who prioritize sustainability in their purchasing decisions.

North America Lab-Grown Coffee Production Systems Market was valued at USD 3 million in 2024, driven by sustainable and ethically sourced beverages. Increasing disposable incomes and a strong interest in climate-friendly consumption are fueling the introduction of lab-grown coffee across retail, ready-to-drink, and foodservice categories. Market growth is supported by technological advancements, favorable regulatory frameworks for novel foods, and growing investments from food-tech innovators. The region’s mature e-commerce platforms and direct-to-consumer subscription models are further accelerating product accessibility. Collaborations between biotechnology firms and coffee brands are also enhancing product development and commercial scalability.

Key companies operating in the Global Lab-Grown Coffee Production Systems Market include Compound Foods, Voyage Foods, Atomo Coffee, Coffeesai (Pluri Biotech), and Northern Wonder. Companies in the Lab-Grown Coffee Production Systems Market are pursuing strategic initiatives to expand their presence and strengthen their market positions. Leading firms are investing heavily in R&D to refine cellular agriculture and fermentation technologies for scalable, cost-efficient coffee production. Strategic collaborations with biotechnology organizations, beverage brands, and retail distributors are being established to accelerate commercialization and improve market reach. Businesses are also focusing on building sustainable production models that minimize resource consumption while ensuring consistent flavor quality. Expansion into direct-to-consumer platforms, online retail, and subscription-based delivery systems is enhancing accessibility and brand visibility.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies profiled in this Lab-Grown Coffee Production Systems market report include:- Amatera

- Atomo Coffee

- Coffeesai (Pluri Biotech) - Israel

- Compound Foods

- Food Brewer

- Minus Coffee

- Northern Wonder

- Planting Costa Rica

- Prefer

- Voyage Foods

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 210 |

| Published | October 2025 |

| Forecast Period | 2024 - 2034 |

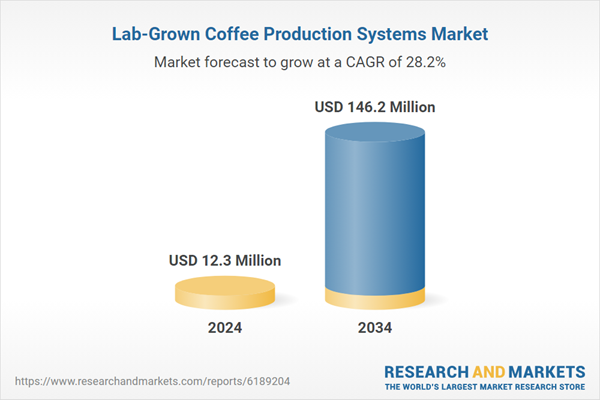

| Estimated Market Value ( USD | $ 12.3 Million |

| Forecasted Market Value ( USD | $ 146.2 Million |

| Compound Annual Growth Rate | 28.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |