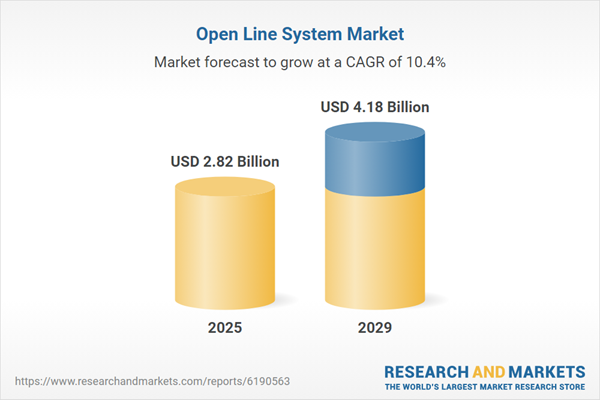

The open line system market size is expected to see rapid growth in the next few years. It will grow to $4.18 billion in 2029 at a compound annual growth rate (CAGR) of 10.4%. The growth in the forecast period is supported by greater adoption of cloud-based services, rising demand for low-latency applications, expanded deployment of fifth-generation networks, growth of smart city projects, and increased investments in hyperscale data centers. Key trends in the forecast period include advancements in hollow-core fiber, development of photonic integrated circuits, innovations in silicon photonics transceivers, progress in artificial intelligence-based network optimization, and integration of digital twinning for network management.

The increasing rollout of 5G networks is expected to drive the growth of the open-line system market. 5G networks, representing the fifth generation of mobile communication technology, offer faster data speeds, ultra-low latency, higher network reliability, and the capacity to connect a massive number of devices simultaneously. The expansion of 5G networks is primarily fueled by growing demand for high-speed mobile broadband, as consumers and enterprises require faster and more reliable connectivity for streaming, cloud computing, and smart device applications. Open-line systems support 5G networks by providing flexible, high-capacity, and low-latency optical transport infrastructure that efficiently handles massive data traffic, enables ultra-reliable low-latency communications, and facilitates seamless network slicing for diverse 5G services. For example, in July 2024, according to 5G Americas, a US-based telecommunication organization, global 5G connections reached nearly 2 billion in the first quarter of 2024, adding 185 million new subscriptions, with projections estimating 7.7 billion connections by 2028. The increasing rollout of 5G networks is therefore propelling the growth of the open-line system market.

Key companies in the open-line system market are focusing on innovations such as zero-touch provisioning to simplify deployment, reduce operational complexity, and enable rapid network scaling. Zero-touch provisioning (ZTP) automatically configures and deploys network devices without manual intervention, reducing setup time, minimizing errors, and simplifying network management. For instance, in March 2025, Adtran Inc., a US-based telecommunications company, launched the FSP 3000 IP Open Line System (OLS), a compact, plug-and-play solution designed to streamline optical networking. The platform features zero-touch provisioning, automated span equalization, full-spectrum monitoring, and fiber assurance, enabling capacity expansion from 400G to 1.6T per wavelength. By integrating automation and intelligence into a 1RU chassis, the FSP 3000 IP OLS reduces operational complexity, accelerates deployment, and allows service providers and enterprises to efficiently scale networks in response to surging AI and data center traffic while ensuring high reliability, improved network visibility, and seamless integration with existing infrastructure.

In February 2025, Nokia Corporation, a Finland-based technology company, acquired Infinera Corporation for an undisclosed amount. The acquisition allows Nokia to strengthen its position in optical networks by combining scale, advanced technology, and expertise to accelerate product development, expand in webscale and data center markets, and enhance its global customer base. This enables network operators to meet the rapidly growing demands of the AI era while improving innovation and operational efficiency. Infinera Corporation is a US-based telecommunications company specializing in open line system solutions, as well as metro, long-haul, and subsea networks.

Major players in the open line system market are Huawei Technologies Co. Ltd., Nippon Telegraph and Telephone Corporation (NTT), Cisco Systems Inc., Jabil Inc., Fujitsu Network Communications Inc., NEC Corporation, Nokia Corporation, ZTE Corporation, Corning Incorporated, Ciena Corporation, ADTRAN Inc., Ribbon Communications Inc., Tejas Networks Limited, Ekinops S.A., Smartoptics ASA, Padtec S.A., Sintai Communication Co. Ltd., Ufi Space Co. Ltd., PacketLight Networks Ltd., andshenzhen fiberroad technologies Co. Ltd.

North America was the largest region in the open line system market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in open line system report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East and Africa.

Note that the outlook for this market is being affected by rapid changes in trade relations and tariffs globally. The report will be updated prior to delivery to reflect the latest status, including revised forecasts and quantified impact analysis. The report’s Recommendations and Conclusions sections will be updated to give strategies for entities dealing with the fast-moving international environment.

The rapid escalation of U.S. tariffs and the resulting trade tensions in spring 2025 are significantly impacting the information technology sector, particularly in hardware manufacturing, data infrastructure, and software deployment. Higher duties on imported semiconductors, circuit boards, and networking equipment have raised production and operational costs for tech firms, cloud service providers, and data centers. Companies relying on globally sourced components for laptops, servers, and consumer electronics are facing longer lead times and increased pricing pressures. In parallel, tariffs on specialized software tools and retaliatory measures from key international markets have disrupted global IT supply chains and reduced overseas demand for U.S.-developed technologies. To navigate these challenges, the sector is accelerating investments in domestic chip fabrication, diversifying supplier bases, and adopting AI-driven automation to enhance operational resilience and cost efficiency.

The open line system market research report is one of a series of new reports that provides open line system market statistics, including open line system industry global market size, regional shares, competitors with the open line system market share, open line system market segments, market trends, and opportunities, and any further data you may need to thrive in the open line system industry. This open line system market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

An open-line system is a communication network in which the transmission medium is owned and managed by a single entity to provide connectivity for multiple users. It delivers the physical infrastructure, including optical fibers and repeaters, while enabling the interconnection of equipment from different providers. The system promotes flexibility, interoperability, and efficient use of long-distance transmission resources.

The primary components of open-line systems include optical line systems, amplifiers, transponders, multiplexers, and related elements. Optical line systems are high-capacity infrastructures that transmit data over long distances using optical fibers with minimal loss and high reliability. They employ fiber types such as single-mode and multi-mode and support functionalities such as real-time communication, data delivery, emergency response communication, and surveillance and monitoring. These systems are applied in personal communication, home automation, business communications, healthcare applications, and traffic management, serving end-users including commercial, residential, industrial, and institutional sectors.

The countries covered in the open line system market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

The open line system market consists of revenues earned by entities by providing services such as network design, system integration, installation and maintenance, managed services, support services, and optimization. The market value includes the value of related goods sold by the service provider or included within the service offering. The open line system market also includes sales of optical switches, wavelength routers, optical cross-connects, fiber monitoring units, dispersion compensators, and pluggable optics. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Open Line System Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on open line system market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as geopolitical conflicts, trade policies and tariffs, post-pandemic supply chain realignment, inflation and interest rate fluctuations, and evolving regulatory landscapes.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for open line system? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward, including technological disruption, regulatory shifts, and changing consumer preferences? The open line system market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the technological advancements such as AI and automation, Russia-Ukraine war, trade tariffs (government-imposed import/export duties), elevated inflation and interest rates.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Report Scope

Markets Covered:

1) By Component: Optical Line Systems; Amplifiers; Transponders; Multiplexers; Other Components2) By Fiber Type: Single-Mode; Multi-Mode

3) By Functionality: Real-Time Communication; Data Delivery Systems; Emergency Response Communication; Surveillance and Monitoring

4) By Application: Personal Communication; Home Automation; Business Communications; Healthcare Applications; Traffic Management

5) By End-User: Commercial Users; Residential Users; Industrial Users; Institutional Users

Subsegments:

1) By Optical Line Systems: Long Haul Optical Line Systems; Metro Optical Line Systems; Coherent Optical Line Systems; Wavelength Division Multiplexing Optical Line Systems2) By Amplifiers: Erbium Doped Fiber Amplifiers; Raman Amplifiers; Semiconductor Optical Amplifiers; Hybrid Amplifiers

3) By Transponders: 100 Gigabit Transponders; 400 Gigabit Transponders; Flexible Grid Transponders; Coherent Transponders

4) By Multiplexers: Dense Wavelength Division Multiplexers; Coarse Wavelength Division Multiplexers; Add-Drop Multiplexers; Reconfigurable Optical Add-Drop Multiplexers

5) By Other Components: Connectors; Optical Switches; Patch Panels; Power Supply Units

Companies Mentioned: Huawei Technologies Co. Ltd.; Nippon Telegraph and Telephone Corporation (NTT); Cisco Systems Inc.; Jabil Inc.; Fujitsu Network Communications Inc.; NEC Corporation; Nokia Corporation; ZTE Corporation; Corning Incorporated; Ciena Corporation; ADTRAN Inc.; Ribbon Communications Inc.; Tejas Networks Limited; Ekinops S.A.; Smartoptics ASA; Padtec S.A.; Sintai Communication Co. Ltd.; Ufi Space Co. Ltd.; PacketLight Networks Ltd.; Shenzhen Fiberroad Technologies.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain.

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The companies featured in this Open Line System market report include:- Huawei Technologies Co. Ltd.

- Nippon Telegraph and Telephone Corporation (NTT)

- Cisco Systems Inc.

- Jabil Inc.

- Fujitsu Network Communications Inc.

- NEC Corporation

- Nokia Corporation

- ZTE Corporation

- Corning Incorporated

- Ciena Corporation

- ADTRAN Inc.

- Ribbon Communications Inc.

- Tejas Networks Limited

- Ekinops S.A.

- Smartoptics ASA

- Padtec S.A.

- Sintai Communication Co. Ltd.

- Ufi Space Co. Ltd.

- PacketLight Networks Ltd.

- Shenzhen Fiberroad Technologies.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | November 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 2.82 Billion |

| Forecasted Market Value ( USD | $ 4.18 Billion |

| Compound Annual Growth Rate | 10.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 21 |