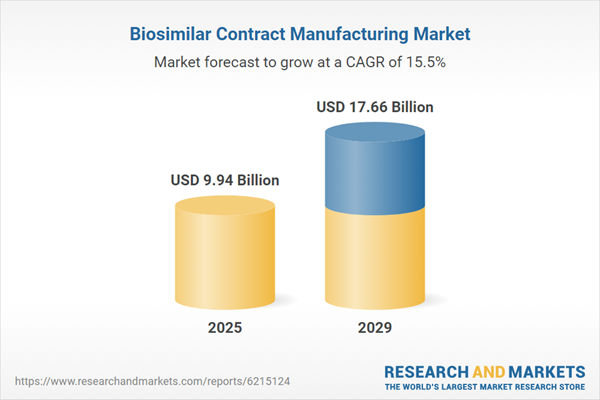

The biosimilar contract manufacturing market size is expected to see rapid growth in the next few years. It will grow to $17.66 billion in 2029 at a compound annual growth rate (CAGR) of 15.5%. Growth in the forecast period can be attributed to the continued expiration of patents for monoclonal antibodies, expansion of biosimilar development pipelines, increasing price pressures and tender-driven procurement processes, rising adoption of value-based reimbursement models, and the growing participation of small and mid-sized biopharma companies. Major trends expected in the forecast period include advancements in single-use bioreactor technologies, progress in continuous bioprocessing, wider adoption of process analytical technologies, increasing use of artificial intelligence and machine learning for bioprocess optimization, and broader implementation of quality-by-design approaches.

The growing prevalence of diabetes is expected to drive the growth of the biosimilar contract manufacturing market in the coming years. Diabetes prevalence refers to the proportion of individuals living with diabetes at any given time, reflecting the ongoing need for treatment and the demand for lifetime therapies. The rise in diabetes cases is largely attributed to increasing sedentary lifestyles and poor dietary habits, which contribute to obesity, insulin resistance, and higher rates of type 2 diabetes. Biosimilar contract manufacturing plays a key role in diabetes management by enabling large-scale, cost-effective production of biosimilar insulin and other related biologics. This process ensures consistent quality and regulatory compliance, making advanced therapies more affordable and accessible to patients worldwide. This, in turn, improves the affordability of treatment and enhances global access to essential diabetes care. For example, in June 2024, the National Health Service (NHS) in the UK reported that 3,615,330 individuals registered with a general practitioner (GP) were diagnosed with non-diabetic hyperglycemia (pre-diabetes) in 2023, marking an 18% increase from 3,065,825 cases in 2022. As a result, the growing prevalence of diabetes is fueling the growth of the biosimilar contract manufacturing market.

Leading companies in the biosimilar contract manufacturing market are focusing on developing production facilities, such as mirrored single-use plants, to accelerate tech transfer, scale-up, and ensure commercial reliability. Mirrored single-use plants are facilities designed with identical production suites that use disposable bioprocess equipment and unified digital systems, enabling rapid changeovers, consistent quality across sites, and reduced contamination risks. For instance, in September 2025, Rezon Bio, a Poland-based contract development and manufacturing organization (CDMO), launched two mirrored-capability single-use biomanufacturing sites covering cell line development through commercial GMP supply. This approach facilitates faster technology transfer and flexible scale-up for biosimilars, reducing downtime while enhancing batch-to-batch consistency through standardized suites, integrated analytics, and logistics automation. Additionally, it lowers the total cost of ownership for sponsors by minimizing cleaning validation requirements, shortening development and manufacturing timelines, and mitigating expansion risks.

In October 2023, Advent International Corporation, a US-based private equity firm, and Warburg Pincus LLC, another US-based private equity firm, acquired BioPharma Solutions' business (now Simtra BioPharma Solutions) from Baxter International Inc. for an undisclosed amount. With this acquisition, Advent and Warburg Pincus aim to strengthen their position in the biopharmaceutical manufacturing sector by leveraging BioPharma Solutions’ expertise in the contract development and manufacturing of biologics and biosimilars. This acquisition supports the growing global demand for advanced biopharma production capabilities. Baxter International Inc. is a US-based biotechnology company that provides biosimilar contract manufacturing services.

Major companies operating in the biosimilar contract manufacturing market are Thermo Fisher Scientific Inc., Biocon Limited, Lonza Group AG, Samsung Biologics Co. Ltd., WuXi Biologics (Cayman) Inc., Laboratorios Farmacéuticos Rovi S.A., Vetter Pharma-Fertigung GmbH & Co. KG, National Resilience Inc., Porton Pharma Solutions Co. Ltd., Syngene International Limited, Rentschler Biopharma SE, Boehringer Ingelheim International GmbH, Enzene Biosciences Ltd., Prestige Biologics Co. Ltd., Mabion S.A., HALIX B.V., BioConnection B.V., BioCina Pty Ltd, Mycenax Biotech Inc., Polpharma Biologics S.A.

North America was the largest region in the biosimilar contract manufacturing market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in biosimilar contract manufacturing report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East and Africa. The countries covered in the biosimilar contract manufacturing market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Note that the outlook for this market is being affected by rapid changes in trade relations and tariffs globally. The report will be updated prior to delivery to reflect the latest status, including revised forecasts and quantified impact analysis. The report’s Recommendations and Conclusions sections will be updated to give strategies for entities dealing with the fast-moving international environment.

The sudden escalation of U.S. tariffs and the consequent trade frictions in spring 2025 are severely impacting the pharmaceutical companies contend with tariffs on APIs, glass vials, and lab equipment inputs with few alternative sources. Generic drug makers, operating on razor-thin margins, are especially vulnerable, with some reducing production of low-profit medicines. Biotech firms face delays in clinical trials due to tariff-related shortages of specialized reagents. In response, the industry is expanding API production in India and Europe, increasing inventory stockpiles, and pushing for trade exemptions for essential medicines.

The biosimilar contract manufacturing market research report is one of a series of new reports that provides biosimilar contract manufacturing market statistics, including biosimilar contract manufacturing industry global market size, regional shares, competitors with a biosimilar contract manufacturing market share, detailed biosimilar contract manufacturing market segments, market trends and opportunities, and any further data you may need to thrive in the biosimilar contract manufacturing industry. This biosimilar contract manufacturing market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

Biosimilar contract manufacturing refers to the outsourcing of biosimilar drug production to specialized third-party manufacturers that possess advanced facilities, technical capabilities, and regulatory expertise. These manufacturers produce biosimilars - biologic medicines that are highly comparable to approved reference biologics in terms of safety, efficacy, and quality. This model helps biopharmaceutical companies reduce production costs, maintain regulatory compliance, and speed up time-to-market.

The key product types in biosimilar contract manufacturing include monoclonal antibodies, insulin, erythropoietin, granulocyte colony-stimulating factor, and others. Monoclonal antibodies are laboratory-engineered proteins designed to specifically recognize and bind a single antigen, enabling precise diagnostic or therapeutic activity. Contract manufacturers provide services such as process development, analytical and quality control testing, fill-and-finish operations, packaging, and more, using both mammalian and non-mammalian production systems. Applications span oncology, autoimmune diseases, blood disorders, growth hormone deficiency, and other therapeutic areas, serving end users such as pharmaceutical and biotechnology companies.

The biosimilar contract manufacturing market consists of revenues earned by entities by providing services such as cell line development, process optimization, upstream and downstream processing, formulation, fill-finish, quality control, packaging, and regulatory support. The market value includes the value of related goods sold by the service provider or included within the service offering. The biosimilar contract manufacturing market also includes sales of biosimilar drug substances, intermediates, active pharmaceutical ingredients (APIs), finished dosage forms, cell culture media, single-use bioreactors, chromatography resins, filtration systems, and other bioprocessing consumables. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Biosimilar Contract Manufacturing Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on biosimilar contract manufacturing market which is experiencing strong growth. the report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as geopolitical conflicts, trade policies and tariffs, post-pandemic supply chain realignment, inflation and interest rate fluctuations, and evolving regulatory landscapes.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for biosimilar contract manufacturing? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward, including technological disruption, regulatory shifts, and changing consumer preferences? The biosimilar contract manufacturing market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the technological advancements such as AI and automation, Russia-Ukraine war, trade tariffs (government-imposed import/export duties), elevated inflation and interest rates.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Report Scope

Markets Covered:

1) By Product Type: Monoclonal Antibodies; Insulin; Erythropoietin; Granulocyte Colony-Stimulating Factor; Other Product Types2) By Service Type: Process Development; Analytical and Quality Control; Fill and Finish Operations; Packaging; Other Service Types

3) By Source: Mammalian; Non-mammalian

4) By Application: Oncology; Autoimmune Diseases; Blood Disorders; Growth Hormone Deficiency; Other Applications

5) By End-Use: Pharmaceutical Companies; Biotech Companies

Subsegments:

1) By Monoclonal Antibodies: Chimeric Monoclonal Antibodies; Humanized Monoclonal Antibodies; Fully Human Monoclonal Antibodies; Bispecific Monoclonal Antibodies2) By Insulin: Rapid Acting Insulin; Short Acting Insulin; Intermediate Acting Insulin; Long Acting Insulin; Premixed Insulin

3) By Erythropoietin: Alpha Erythropoietin; Beta Erythropoietin; Darbepoetin Alfa; Continuous Erythropoietin Receptor Activators

4) By Granulocyte Colony-Stimulating Factor: Filgrastim; Pegfilgrastim; Lenograstim; Long Acting Granulocyte Colony-Stimulating Factor

5) By Other Product Types: Interferons; Interleukins; Fusion Proteins; Enzyme Therapeutics; Hormonal Biologics

Companies Mentioned: Thermo Fisher Scientific Inc.; Biocon Limited; Lonza Group AG; Samsung Biologics Co. Ltd.; WuXi Biologics (Cayman) Inc.; Laboratorios Farmacéuticos Rovi S.A.; Vetter Pharma-Fertigung GmbH & Co. KG; National Resilience Inc.; Porton Pharma Solutions Co. Ltd.; Syngene International Limited; Rentschler Biopharma SE; Boehringer Ingelheim International GmbH; Enzene Biosciences Ltd.; Prestige Biologics Co. Ltd.; Mabion S.A.; HALIX B.V.; BioConnection B.V.; BioCina Pty Ltd; Mycenax Biotech Inc.; Polpharma Biologics S.A.

Companies Mentioned

The companies profiled in this Biosimilar Contract Manufacturing market report include:- Thermo Fisher Scientific Inc.

- Biocon Limited

- Lonza Group AG

- Samsung Biologics Co. Ltd.

- WuXi Biologics (Cayman) Inc.

- Laboratorios Farmacéuticos Rovi S.A.

- Vetter Pharma-Fertigung GmbH & Co. KG

- National Resilience Inc.

- Porton Pharma Solutions Co. Ltd.

- Syngene International Limited

- Rentschler Biopharma SE

- Boehringer Ingelheim International GmbH

- Enzene Biosciences Ltd.

- Prestige Biologics Co. Ltd.

- Mabion S.A.

- HALIX B.V.

- BioConnection B.V.

- BioCina Pty Ltd

- Mycenax Biotech Inc.

- Polpharma Biologics S.A.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | December 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 9.94 Billion |

| Forecasted Market Value ( USD | $ 17.66 Billion |

| Compound Annual Growth Rate | 15.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 21 |