Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

In 2024, EirGrid highlighted this demand by awarding contracts for new synchronous condenser projects designed to collectively provide 6,963 MVA of synchronous inertia to facilitate renewable integration across the Irish power system. Despite the strong necessity for these assets, market expansion faces a significant hurdle due to the high initial capital expenditure required for equipment procurement and necessary civil works. Furthermore, the growth of the market is impeded by the extended lead times associated with the manufacturing of these complex electromechanical assets, which complicates rapid deployment.

Market Drivers

The accelerating integration of renewable energy sources serves as the primary catalyst for market growth, necessitating new solutions for grid stability. As power systems worldwide transition away from fossil-fuel generation, the resulting loss of electromechanical inertia presents severe risks to frequency stability. Consequently, transmission system operators are commissioning synchronous condensers to replicate the kinetic energy of traditional turbines, allowing for the safe integration of intermittent solar and wind capacity without compromising reliability. For example, Siemens Energy reported in its Q4 Fiscal Year 2024 earnings call that it had secured a landmark contract with TenneT in November 2024 to supply eight synchronous condensers, marking the largest single project for this technology globally.Equally critical is the growing investment in grid modernization and upgradation projects, driven by the urgent need to reinforce aging infrastructure to meet modern load demands. Utilities are prioritizing significant capital allocations for dynamic stability assets that effectively manage short-circuit strength and voltage fluctuations. In June 2024, GE Vernova announced it had secured an order to build two turnkey synchronous condenser facilities to support National Grid's 'Upstate Upgrade' initiative in New York. The substantial financial scale of these modernization efforts was further underscored by Conrad Energy, which secured GBP 200 million in financing in April 2024 specifically to fund the construction of two synchronous condenser projects in the UK.

Market Challenges

A significant challenge impeding the growth of the Global Synchronous Condenser Market is the high initial capital expenditure required for equipment procurement and civil works, exacerbated by the long lead times associated with manufacturing these complex assets. Unlike inverter-based solutions, synchronous condensers are massive electromechanical machines that demand substantial upfront investment, not only for the hardware itself but also for the extensive engineering and site preparation required for installation. This capital intensity creates a major financial barrier for transmission system operators, often complicating the approval and financing phases of grid stability projects and slowing the overall rate of market expansion.Furthermore, the intricate manufacturing process for these heavy rotating machines results in extended delivery schedules that frequently misalign with the urgent timelines of renewable energy integration. The limited number of specialized manufacturers capable of producing such sophisticated equipment creates a supply bottleneck, further delaying critical grid reinforcement. This issue was illustrated by the Australian Energy Market Operator (AEMO) in 2024, which identified that the preferred technical option to address system strength deficits in New South Wales alone would require the deployment of 14 new synchronous condensers. This example highlights the immense scale of manufacturing capacity and capital allocation demanded to secure just one regional network, demonstrating how these logistical and financial burdens hinder the market's ability to scale rapidly.

Market Trends

Repurposing decommissioned thermal generators into synchronous condensers is rapidly emerging as a viable strategy to preserve grid inertia while minimizing construction costs and timelines. Utilities are retrofitting retired fossil-fuel power plants by decoupling the generator from the steam or gas turbine, enabling the machine to operate freely as a synchronous condenser that provides critical short-circuit strength and reactive power without associated carbon emissions. This approach allows operators to leverage existing high-voltage interconnections and civil infrastructure, significantly reducing capital expenditures compared to greenfield projects. For instance, Eaton announced in a June 2025 press release that it had commenced a project to convert the retired Bull Run Fossil Plant in Tennessee into two 605 MVAR synchronous condensers to support regional network stability.The development of dedicated Greener Grid Stability Parks represents a structural shift toward constructing standalone facilities designed exclusively for ancillary services rather than active power generation. These specialized parks utilize high-inertia synchronous condensers, often augmented with heavy flywheels, to deliver concentrated voltage control and frequency regulation in specific zones with high renewable penetration. This model enables transmission operators to strategically site stability assets at weak grid nodes independent of where power is actually generated, decoupling grid strength from energy production. Highlighting the scale of such developments, Statkraft announced in November 2025 that it had begun construction on the Necton Greener Grid Park with an investment of over £100 million; the facility will provide approximately 4 GW.s of inertia, an amount comparable to a large conventional gas-fired power station.

Key Players Profiled in the Synchronous Condenser Market

- Siemens Energy AG

- General Electric Company

- ABB Ltd.

- Mitsubishi Electric Corporation

- Eaton Corporation PLC

- Voith GmbH & Co. KGaA

- WEG S.A.

- Andritz AG

- Toshiba Energy Systems & Solutions Corporation

- Hyundai Electric & Energy Systems Co., Ltd.

Report Scope

In this report, the Global Synchronous Condenser Market has been segmented into the following categories:Synchronous Condenser Market, by Type:

- New Synchronous Condenser

- Others

Synchronous Condenser Market, by Cooling Type:

- Hydrogen-Cooled

- Others

Synchronous Condenser Market, by Starting Method:

- Static Frequency Converter

- Others

Synchronous Condenser Market, by End-User:

- Electrical Utilities

- Industries

Synchronous Condenser Market, by Reactive Power Rating:

- Up to 100 MVAR

- 00 MVAR-200 MVAR

- Above 200 MVAR

Synchronous Condenser Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Synchronous Condenser Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Synchronous Condenser market report include:- Siemens Energy AG

- General Electric Company

- ABB Ltd.

- Mitsubishi Electric Corporation

- Eaton Corporation PLC

- Voith GmbH & Co. KGaA

- WEG S.A.

- Andritz AG

- Toshiba Energy Systems & Solutions Corporation

- Hyundai Electric & Energy Systems Co., Ltd.

Table Information

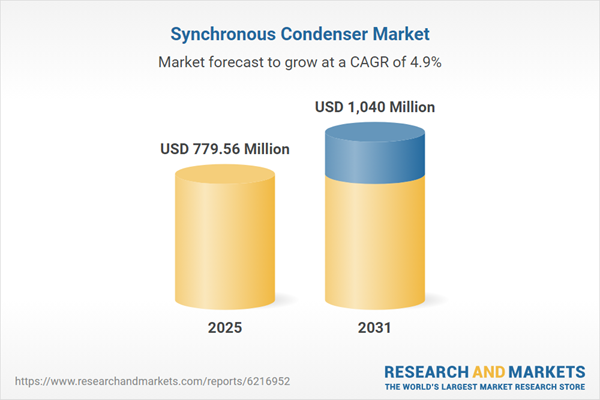

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | January 2026 |

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 779.56 Million |

| Forecasted Market Value ( USD | $ 1040 Million |

| Compound Annual Growth Rate | 4.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |