Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Conversely, the market faces a significant obstacle due to an acute shortage of skilled technicians qualified to service increasingly complex modern vehicles. The rapid advancement of automotive technology, particularly the integration of advanced electronics, demands specialized training that the current labor supply struggles to provide. This skills gap drives up labor costs and prolongs service lead times, thereby restricting the potential expansion of service capacity throughout the industry.

Market Drivers

The rising average age of the global vehicle fleet acts as a primary catalyst for the automotive repair and maintenance sector. As vehicles remain in service for longer periods, critical components such as engines, brakes, and suspension units experience increased wear, requiring more frequent mechanical interventions and fluid replacements to ensure roadworthiness. This trend broadens the addressable market for franchise workshops and independent aftermarket providers by securing a steady baseline of demand for routine maintenance, effectively reducing the industry's vulnerability to fluctuations in new vehicle sales. According to the Auto Care Association's June 2024 '2025 Auto Care Factbook,' the average age of light vehicles in the United States hit a record 12.6 years, necessitating extended service lifecycles and directly influencing annual repair volumes.Simultaneously, the increasing technological complexity of modern vehicles drives market value through specialized labor needs and elevated service costs. The integration of Advanced Driver Assistance Systems and electrification requires calibration and diagnostic capabilities that go beyond traditional mechanical work, compelling repair facilities to invest in proprietary software and training. This shift results in higher transaction values per service visit as technicians navigate intricate electronic architectures. According to Mitchell International's October 2024 'Plugged-In: EV Collision Insights Q3 2024' report, the average claims severity for repairable electric vehicles in the U.S. was 5,560 dollars. Reflecting the financial impact of these evolving technical demands, MEMA Aftermarket Suppliers projects the United States automotive aftermarket will achieve a growth rate of 5.9 percent in 2024.

Market Challenges

The acute shortage of skilled technicians constitutes a substantial barrier to the growth of the Global Automotive Repair and Maintenance Services Market. With vehicles increasingly dependent on advanced software and electronics, the existing workforce often lacks the specialized expertise required for complex diagnostics and repairs. This disparity between the rapid evolution of automotive technology and the availability of qualified labor restricts the ability of service providers to meet rising consumer demand, causing capacity constraints that directly limit revenue potential and market expansion efforts.This widening skills gap leads to rising operational costs and extended service delays, which negatively affect customer retention. Service centers are compelled to increase wages to attract the limited pool of available talent, thereby compressing profit margins and hindering scalability. The severity of this labor deficit is highlighted by recent industry data; according to the TechForce Foundation, the automotive sector required 495,000 new entrant technicians over the five years following 2024 to address the critical workforce shortage. Without a sufficient influx of trained professionals, the market cannot fully capitalize on the opportunities presented by an aging global vehicle fleet.

Market Trends

The digitization of service booking and customer engagement platforms is fundamentally reshaping the aftermarket landscape by streamlining interactions between vehicle owners and service providers. As consumers increasingly prioritize convenience, the industry is witnessing a rapid migration toward online scheduling, digital estimates, and transparent e-commerce channels for parts procurement. This digital transformation allows service centers to capture a growing segment of tech-savvy DIY and DIFM customers while optimizing inventory management. According to the '2025 Joint E-commerce Trends and Outlook Forecast' by the Auto Care Association and MEMA Aftermarket Suppliers in November 2024, total e-commerce channel sales for aftermarket parts and accessories in the United States are projected to reach 44.6 billion dollars in 2025.Simultaneously, the integration of Artificial Intelligence for predictive maintenance is transforming vehicle care from a reactive to a proactive model. By utilizing real-time data from telematics and connected vehicle systems, repair facilities can now anticipate component failures before they occur, significantly reducing unplanned downtime for fleet and individual operators. This shift necessitates the adoption of advanced software tools capable of analyzing vast datasets to generate actionable service alerts. According to Samsara's July 2024 'State of Connected Operations Report,' 51 percent of physical operations leaders currently utilize artificial intelligence, with predictive maintenance serving as a primary application for enhancing asset reliability.

Key Players Profiled in the Automotive Repair and Maintenance Services Market

- LKQ Corporation

- Robert Bosch GmbH

- Belron International Ltd.

- Driven Brands Holdings Inc.

- Jiffy Lube International Inc.

- Goodyear Tire & Rubber Company

- Midas International LLC

- Asbury Automotive Group Inc.

- Monro, Inc.

- Sun Auto Service

Report Scope

In this report, the Global Automotive Repair and Maintenance Services Market has been segmented into the following categories:Automotive Repair and Maintenance Services Market, by Vehicle Type:

- Passenger Cars Light Commercial Vehicle

- Heavy Commercial Vehicle

Automotive Repair and Maintenance Services Market, by Services and Parts:

- Oils

- Tires

- Batteries

- Oil Filter

- Wiper Blades

- Lights

- Air Filter

- Spark Plugs

- Others

Automotive Repair and Maintenance Services Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Automotive Repair and Maintenance Services Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Automotive Repair and Maintenance Services market report include:- LKQ Corporation

- Robert Bosch GmbH

- Belron International Ltd.

- Driven Brands Holdings Inc.

- Jiffy Lube International Inc.

- Goodyear Tire & Rubber Company

- Midas International LLC

- Asbury Automotive Group Inc.

- Monro, Inc.

- Sun Auto Service

Table Information

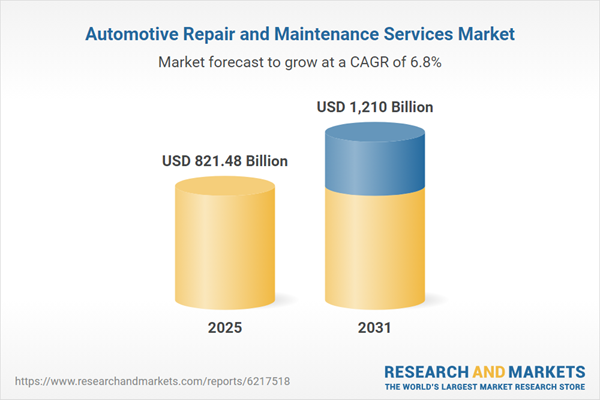

| Report Attribute | Details |

|---|---|

| No. of Pages | 182 |

| Published | January 2026 |

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 821.48 Billion |

| Forecasted Market Value ( USD | $ 1210 Billion |

| Compound Annual Growth Rate | 6.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |