The agriculture chemical packaging market is experiencing rapid growth propelled by expanding global agrochemical trade and export activities. There is a notable shift toward sustainable packaging, with increasing adoption of recyclable bags and pouches. Demand for bioplastics and flexible formats is rising to minimize environmental impact. In India, the market is expanding steadily amid escalating fertilizer consumption and food production needs.

Growth in agrochemical trade remains a core driver, supported by efforts to extend shelf life of agrochemicals and biologicals, heightened R&D, and rising requirements from emerging economies. Technological advancements and machinery modernization are creating new avenues for innovation in packaging solutions.

Plastics dominate as the primary material for agricultural chemicals due to their lightweight, reliable, and cost-effective properties. However, sustainable alternatives like bags, pouches, bottles, and containers are gaining traction rapidly. Flexible packaging, including pouches and bags, offers superior product-to-package ratios compared to rigid formats, reducing transportation losses while lowering carbon footprints. Providers like Scholle IPN deliver pouch and bag-in-box options optimized for agrochemical protection.

Increasing demand for effective packaging solutions significantly fuels market expansion. Plastic bags and pouches are prevalent for fertilizers and pesticides, with HDPE and PET favored for jars and bottles due to moderate gas permeability, heat resistance, moisture, and oxygen barriers. Global crop protection needs drive requirements for safe storage and dispensing of pesticides and herbicides. Trends in food production, chemical fertilizer use, and bioplastics adoption present substantial opportunities. Flexible plastics enable environmentally considerate solutions, with pouches and bags increasingly preferred for agrochemicals.

Geographically, India's agriculture chemical packaging sector is forecasted for steady growth. The country ranks among leaders in agricultural output, with agrochemical production rising alongside intensified farming activities. Fertilizer sales reached 53.95 metric tons in September 2023, reflecting a 6.8% increase over the prior year according to the Department of Fertilizers. Population growth and elevated food consumption further stimulate agricultural operations, heightening demand for secure packaging of pesticides and fertilizers during storage and transport.

Local players like Hitech Corporation Ltd. bolster the market through diverse offerings, including monolayer and barrier containers in LDPE, PP, PE, and HDPE across bottles, buckets, and jerrycans. Government regulations on packaging and labeling of agrochemicals provide additional impetus for compliant, high-quality solutions.

Leading companies in the agriculture chemical packaging space include United Caps, Mauser Packaging Solutions, Greif, Inc., NNZ Group, and ProAmpac. These firms focus on durable, sustainable, and functional designs to address safety, efficiency, and environmental concerns in agrochemical handling.

Overall, the market is advancing robustly, driven by trade expansion, sustainability imperatives, and regional agricultural intensification, positioning flexible and eco-friendly packaging as central to future developments in safe agrochemical distribution.

Key Benefits of this Report:

- Insightful Analysis: Gain detailed market insights covering major as well as emerging geographical regions, focusing on customer segments, government policies and socio-economic factors, consumer preferences, industry verticals, and other sub-segments.

- Competitive Landscape: Understand the strategic maneuvers employed by key players globally to understand possible market penetration with the correct strategy.

- Market Drivers & Future Trends: Explore the dynamic factors and pivotal market trends and how they will shape future market developments.

- Actionable Recommendations: Utilize the insights to exercise strategic decisions to uncover new business streams and revenues in a dynamic environment.

- Caters to a Wide Audience: Beneficial and cost-effective for startups, research institutions, consultants, SMEs, and large enterprises.

What can this report be used for?

Industry and Market Insights, Opportunity Assessment, Product Demand Forecasting, Market Entry Strategy, Geographical Expansion, Capital Investment Decisions, Regulatory Framework & Implications, New Product Development, Competitive Intelligence.Report Coverage:

- Historical data from 2021 to 2025 & forecast data from 2026 to 2031

- Growth Opportunities, Challenges, Supply Chain Outlook, Regulatory Framework, and Trend Analysis

- Competitive Positioning, Strategies, and Market Share Analysis

- Revenue Growth and Forecast Assessment of segments and regions including countries

- Company Profiling (Strategies, Products, Financial Information, and Key Developments among others.

Agriculture Chemical Packaging Market Segmentation:

- By Product Type

- Bags and Pouches

- Bottles and Containers

- Drums and Intermediate Bulk (IBC's)

- Others

- By Material Type

- Plastic

- Metal

- Others

- By Chemical

- Fertilizer

- Pesticide

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Thailand

- Others

- North America

Table of Contents

Companies Mentioned

The companies profiled in this Agriculture Chemical Packaging market report include:- United Caps

- Mauser Packaging Solutions

- Greif, Inc

- NNZ Group

- ProAmpac

- Silgan Holdings, Inc.

- LC Packaging International BV

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 146 |

| Published | January 2026 |

| Forecast Period | 2025 - 2031 |

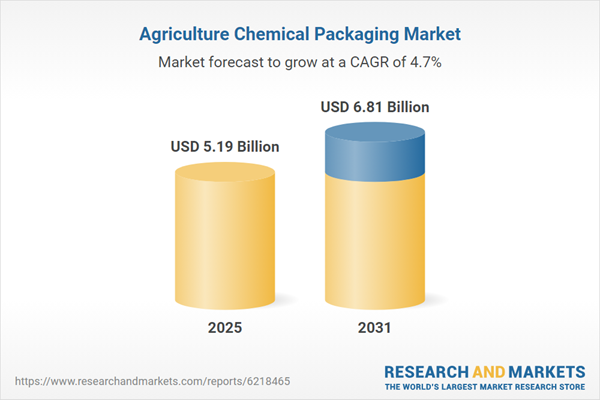

| Estimated Market Value ( USD | $ 5.19 Billion |

| Forecasted Market Value ( USD | $ 6.81 Billion |

| Compound Annual Growth Rate | 4.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 8 |